- The XRP value is built-in at practically $3.03, with a triangular resistance of $3.20, with a concentrate on assist of $2.85.

- The SEC will assessment a number of XRP ETF filings beginning October 18th and use publishers that embody Grayscale and Prohares.

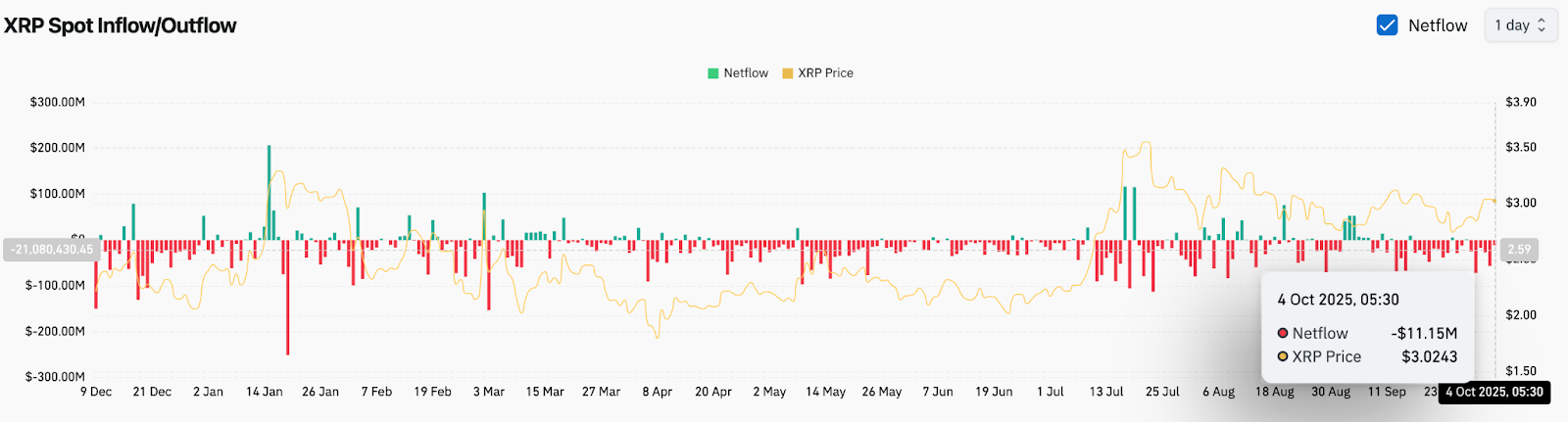

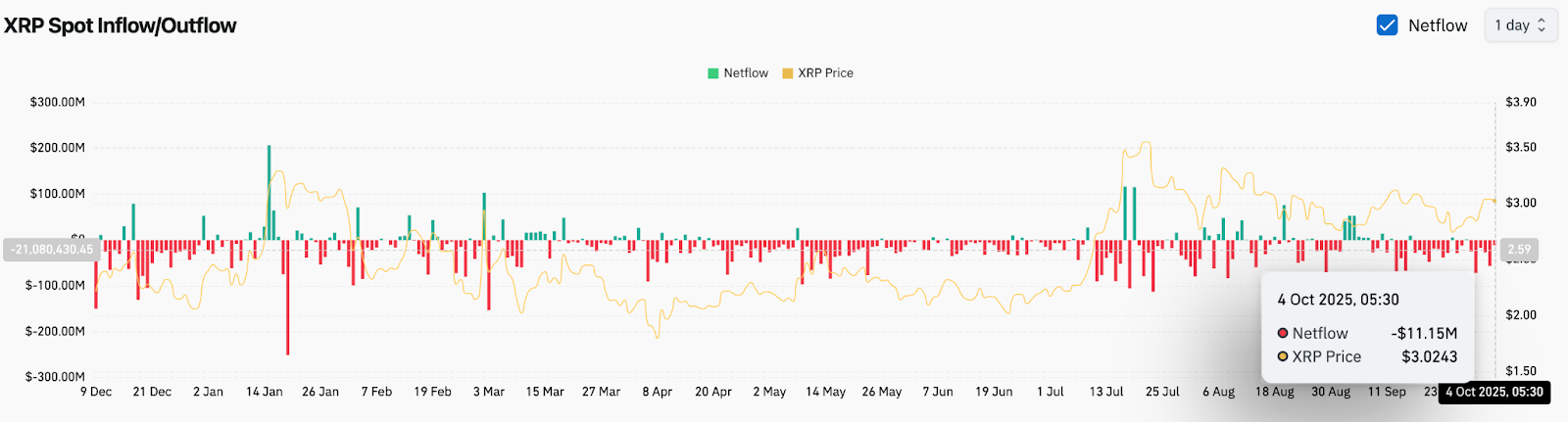

- On-chain information reveals outflows of $11.1 million, whereas a gradual shift to impartial flows signifies early accumulation.

XRP (Crypto:XRP) costs are buying and selling practically $3.03 right now, consolidating after a unstable week when tokens all of the sudden rebound from $2.85 assist. Merchants are trying carefully as SEC prepares to assessment a number of XRP ETF purposes beginning October 18th.

XRP Costs retain assist for main triangles

On the each day charts, the XRP strikes the tightening symmetrical triangle with resistance near $3.15-3.20 and assist mounted at $2.85. The $2.94 20-day EMA and $2.93 50-day EMA proceed to supply technical flooring, whereas the $2.62 200-day EMA protects the broader uptrend construction.

The RSI is in about 56th place, reflecting the reasonable bullish momentum after recovering from territory bought in late September. This sample means that merchants are accumulating inside compression ranges and are ready for a crucial breakout.

A sustained transfer above $3.20 can affirm bullish breakouts focusing on $3.35-3.60, however a rejection beneath $2.85 dangers a pullback to the $2.62-2.65 zone.

Institutional momentum is constructed previous to ETF choices

Market sentiment has been strengthened after analyst Cryptoking emphasised that it’s going to start reviewing XRP ETF filings from October 18th. The submitting lists main publishers equivalent to Grayscale, Proshares, Wisdomtree, 21 Shares, and Franklin Templeton.

If even considered one of these funds is accepted, analysts anticipate a big inflow of institutional capital into the XRP market. The historic patterns of Bitcoin and Ethereum ETFs present that the approval part is usually per important value volatility and sustained accumulation levels.

This background has made XRP one of the crucial fastidiously seen belongings heading into the mid-October resolution window.

On-chain move displays cautious positioning

Coinglass’ on-chain information reveals XRP recorded a web spill of $11.1 million on October 4, reflecting short-term earnings since final week’s rebound. However, the general sample since late September reveals a gradual shift from intense outflows to impartial Netflows, suggesting early indicators of accumulation.

The inflow-to-external ratio stays restrained. In different phrases, merchants are nonetheless cautious about committing massive capital previous to SEC critiques. Analysts notice {that a} sequence of optimistic Netflows, over $50 million, might mark the beginning of an up to date institutional accumulation.

Outlook: Will XRP improve sharply?

Quick-term XRP value forecasts stay cautiously bullish. Whereas ETF predictions function a strong narrative driver, technical setups nonetheless require affirmation. So long as the XRP value exceeds $2.85, this construction will probably be doubtlessly most well-liked by $3.35-$3.60 earlier than the $3.20 retest, SEC assessment window.

The breakdown beneath $2.85 will revert focus to $2.62 assist, delaying bullish outlook. Analysts consider the subsequent 10 buying and selling days will decide whether or not XRP will enter a brand new part of its regime-driven momentum or stay restricted to the mixing.

Technical forecast overview

| indicator | sign | Key degree |

| Help degree | The above bullish bias | $2.85, $2.62 |

| Resistance degree | I am watching a breakout on | $3.20, $3.35, $3.60 |

| RSI (14) | Impartial Brish | 56 |

| On-Chain Internet Move | Gentle spill | – $11.1m |

| 20/50/100/200 EMA | Development Help is undamaged | $2.94/$2.93/$2.85/$2.62 |

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version isn’t answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.