- XRP eyes a $3 goal as bullish momentum strengthens above a key EMA assist zone.

- Open curiosity soared to $4.4 billion, suggesting elevated hypothesis amid market optimism.

- Forex knowledge reveals strategic accumulation regardless of a reasonable profit-taking pattern.

After rebounding from its October 11 low close to $1.58, XRP is making an attempt to regain increased floor, exhibiting new indicators of energy. The token is step by step rising in a brand new uptrend, with consumers consolidating positions throughout key technical zones. This restoration comes amid enhancing market sentiment, indicating elevated curiosity from merchants hoping for a broader transfer into the $3 area.

Construct Momentum Past Important Help

The 4-hour chart reveals that XRP is steadily recovering, supported by rising transferring averages. The 20-EMA is above the 50-EMA, indicating rising momentum within the bulls’ favor.

Worth motion is hovering across the 200-EMA close to $2.63, an vital stage to substantiate pattern continuation. If XRP sustains a detailed above this stage, a transparent reversal might develop and point out medium-term energy.

A significant Fibonacci retracement zone between $2.16 and $2.78 types the subsequent route. The 0.618 Fib stage close to $2.52 is offering short-term assist, whereas $2.78 is appearing as a direct resistance. Above this barrier, the rally might lengthen in direction of $3.00 and $3.10. Conversely, failure to maintain $2.52 might set off a pullback to $2.34 and even $2.16.

Associated: Ethereum Worth Prediction: Derivatives Soar 69% as ETH Coil Falls Beneath Breakout Set off

Open curiosity suggests elevated speculative exercise

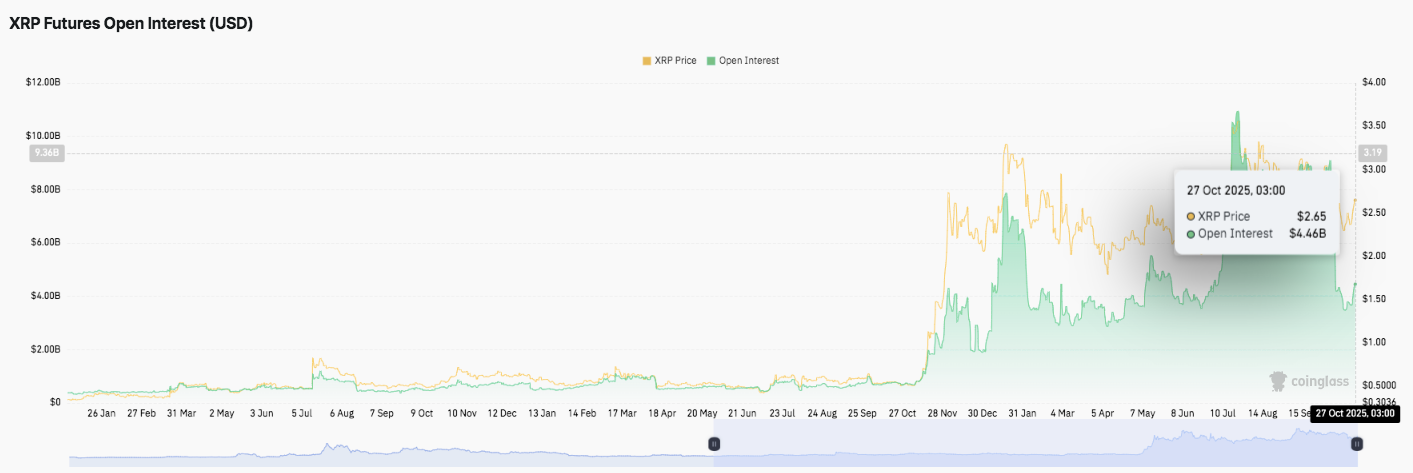

Open curiosity in XRP derivatives rose sharply, reflecting elevated speculative participation. After falling under $2 billion for a number of months, it soared to over $4.4 billion by the top of October 2025 as the worth approached $2.65.

This improve suggests merchants are bracing for volatility, in step with renewed optimism seen throughout the broader crypto market. Nonetheless, a speedy improve in open curiosity typically precedes a profit-taking section, so merchants must be cautious.

Moreover, this sustained improve highlights stronger liquidity and confidence in XRP’s continued restoration. This knowledge reveals that leveraged merchants are beginning to commerce once more after an extended interval of low exercise originally of the yr.

Spot knowledge that gives hints for cautious accumulation

The change’s influx and outflow patterns present that outflows account for many of 2025, suggesting continued promoting stress. Nonetheless, the current $21.7 million internet outflow recorded on October 27 signifies profit-taking fairly than a panic exit. This motion signifies strategic accumulation as merchants lock in income and look forward to a brand new entry level.

Associated: Bitcoin value prediction: BTC bulls regain management regardless of Mt. Gox reimbursement delay

Technical outlook for XRP value

Key ranges stay well-defined heading into November as XRP makes an attempt to regain bullish footing after rebounding from the lows of $1.58. The token trades inside a medium-term upward channel, reflecting a gradual restoration and elevated market participation.

- High stage: $2.52 and $2.57 function rapid assist for consumers, whereas the subsequent resistance hurdles are $2.78 and $3.10. If confirmed above $2.78, the rally might widen in direction of $3.00 and year-to-date highs of $3.10.

- Cheaper price stage: $2.34 and $2.16 function vital defensive zones for the bulls. A break under these ranges might expose XRP to recent promoting stress, indicating that the $2.00 psychological space might be examined once more.

- EMA resistance: The 200-EMA close to $2.63 stays a essential ceiling to take care of bullish momentum. A break above this stage would strengthen market confidence and ensure the continuation of the pattern.

The technical construction means that XRP is consolidating under the $2.78 to $2.80 resistance cluster, forming the premise for the subsequent transfer. Historic buying and selling conduct round these ranges signifies {that a} sturdy breakout is usually preceded by an accumulation section. Subsequently, a sustained shut above $2.63 might trigger elevated volatility, much like previous bull markets.

Will XRP proceed to get better?

XRP’s near-term trajectory will rely upon whether or not consumers can maintain out the $2.52 to $2.57 assist zone lengthy sufficient to problem the $2.78 resistance. A profitable breakout might pave the best way for costs above $3.00 and ensure bullish management. Nonetheless, if the assist fails to carry, there’s a danger of retracement to $2.34 and even $2.16.

Moreover, derivatives knowledge reveals rising speculative demand, with open curiosity exceeding $4.4 billion in late October. Whereas this rally displays renewed optimism, it additionally indicators the potential for extra volatility within the close to time period if sentiment adjustments. Spot capital inflows and outflows stay balanced, suggesting cautious accumulation fairly than aggressive profit-taking.

For now, XRP stays within the pivotal zone. If the 200-EMA turns to assist, momentum indicators favor a continuation. Merchants stay targeted on a definitive shut above $2.78, which might rekindle medium-term bullish momentum in direction of the $3.10 goal.

Associated: Solana value prediction: Derivatives surge forward of $225 goal, inflicting $66 million outflow

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.