At present’s XRP costs are buying and selling round $2.85, transferring inside a decent, symmetrical triangle that has been holding value fluctuations within the first place since July. The token continues to have help round $2.83-$2.80, in line with the 100-day EMA, however resistance continues to be outlined by a downtrendline round $2.95-$3.00.

XRP value coil inside symmetrical triangle

The every day chart highlights the diminished construction, with XRP approaching the height of a multi-month triangular sample. Costs bounce off the uplifting help development line, with patrons confirmed defenses round $2.80, coinciding with $2.85 for the 50-day EMA and $2.63 for the 100-day EMA.

Momentum indicators stay impartial. The RSI of 44.5 exhibits calm power, suggesting that merchants are ready for affirmation earlier than re-entering their place. Over $3.00 is a bullish breakout and will goal $3.20-3.40, however if you cannot keep it above $2.80, your token could possibly be topic to much more critical fixes in direction of $2.63.

Associated: Cardano Worth Forecast: Open curiosity reaches $1.57 billion, ADA consolidated

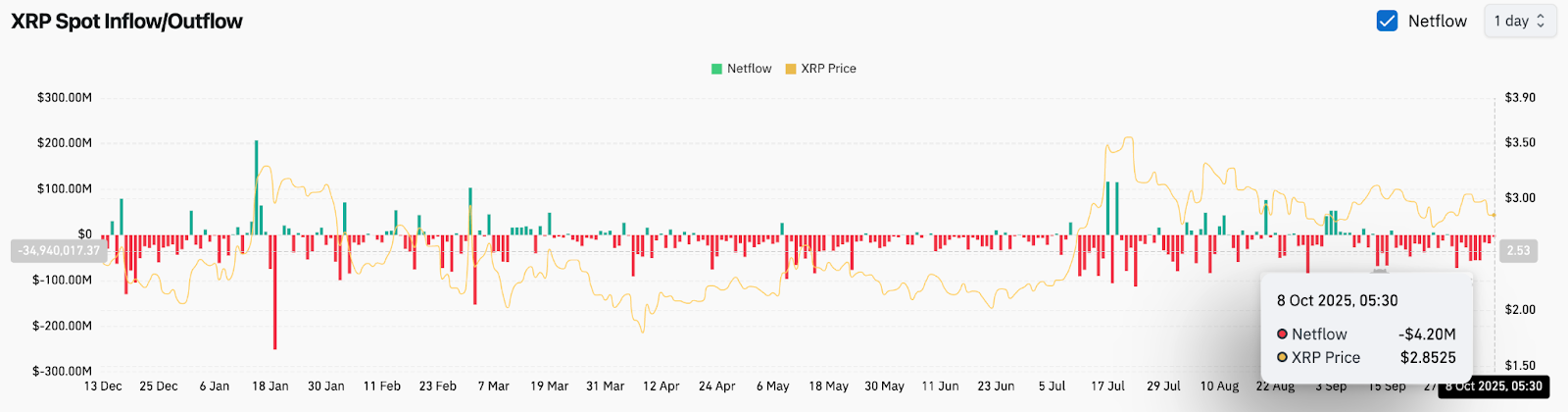

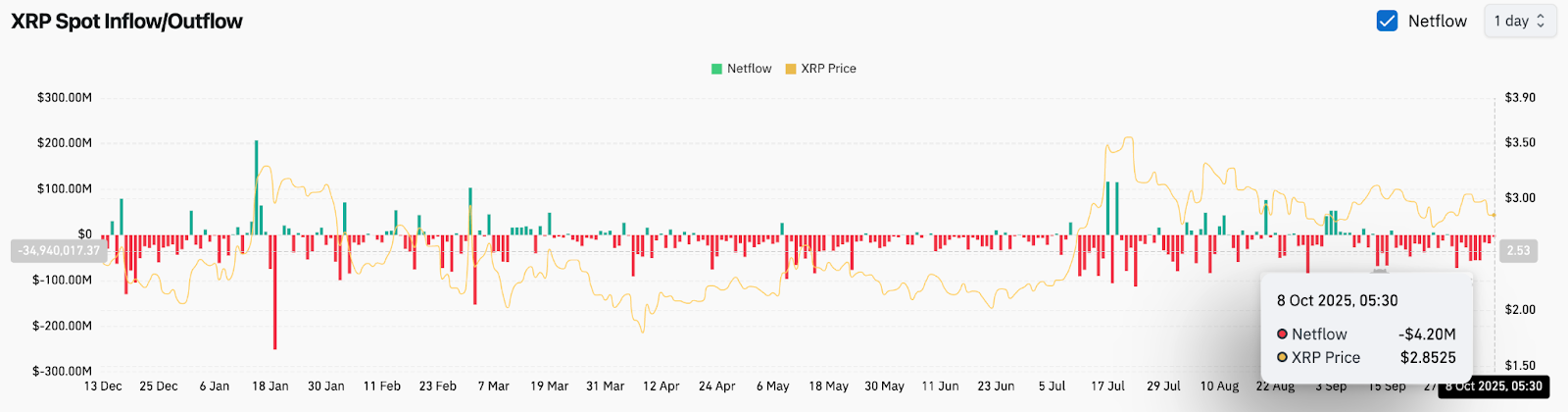

On-chain circulation displays steady accumulation

Coinglass foreign money knowledge exhibits the online outflow on October 8 was modest at $4.2 million, suggesting a gradual accumulation amid low volatility. This development displays a cautious build-up quite than a large promoting, and continues a sequence of restrained outflows till early October.

Traditionally, sustained outflows in the course of the compression part precede directional actions, suggesting that market contributors could also be positioned earlier than potential breakouts. Analysts level out that if capital inflows improve with out value deterioration, new buy enthusiasm may improve.

Assist for establishments that incite optimism

Market sentiment has turned optimistic when Teucrium CEO Sal Gilbertie publicly acknowledged that XRP is “actual usefulness” and is the coin with probably the most highly effective use case within the cryptocurrency discipline. His remarks sparked a brand new optimism concerning the company’s notion of XRP’s position in cross-border cost methods.

The help comes after S&P International introduced plans to launch the S&P Digital Market 50 index, which mixes cryptocurrency and cryptocurrency linked shares right into a single benchmark. Such developments spotlight XRP’s elevated collaboration with institutional-level publicity frameworks, growing reliability amongst conventional traders.

Associated: Ethereum Worth Forecast: Jack Mah’s ETH Preparation Report boosts market sentiment

Technical outlook for XRP value

Brief-term XRP value forecasts deal with breakout ranges in compression zones.

- Higher goal: If a breakout is achieved, it could be $3.00, $3.20, $3.40.

- Decrease worth help materials: 2.80, 2.63 and a couple of.55 key defensive zones.

- Development primarily based: $2.40 for long-term structural help.

A day’s closing value above $3.00 confirms bullish continuity, whereas a lack of $2.80 suggests a chapter, probably delaying the upside goal.

Outlook: Will XRP rise?

XRP stays at a essential stage as merchants await a decision from the stress within the love triangle. Market sentiment has been cautious however bullish after being rated by institutional traders similar to Sal Gilvati and S&P International’s upcoming cryptocurrency index.

So long as the present XRP value is above $2.80, this setting is prone to in the end escape in direction of the $3.20-$3.40 vary. A essential transfer above $3.00 will strengthen bullish confidence, however dropping $2.80 may result in a brief decline earlier than a brand new build-up.

Associated: Monero Worth Forecast: Bullseye will attain $343 as market curiosity recovers

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t accountable for any losses that come up because of your use of the content material, services or products described. We encourage our readers to take nice care earlier than taking any motion associated to us.