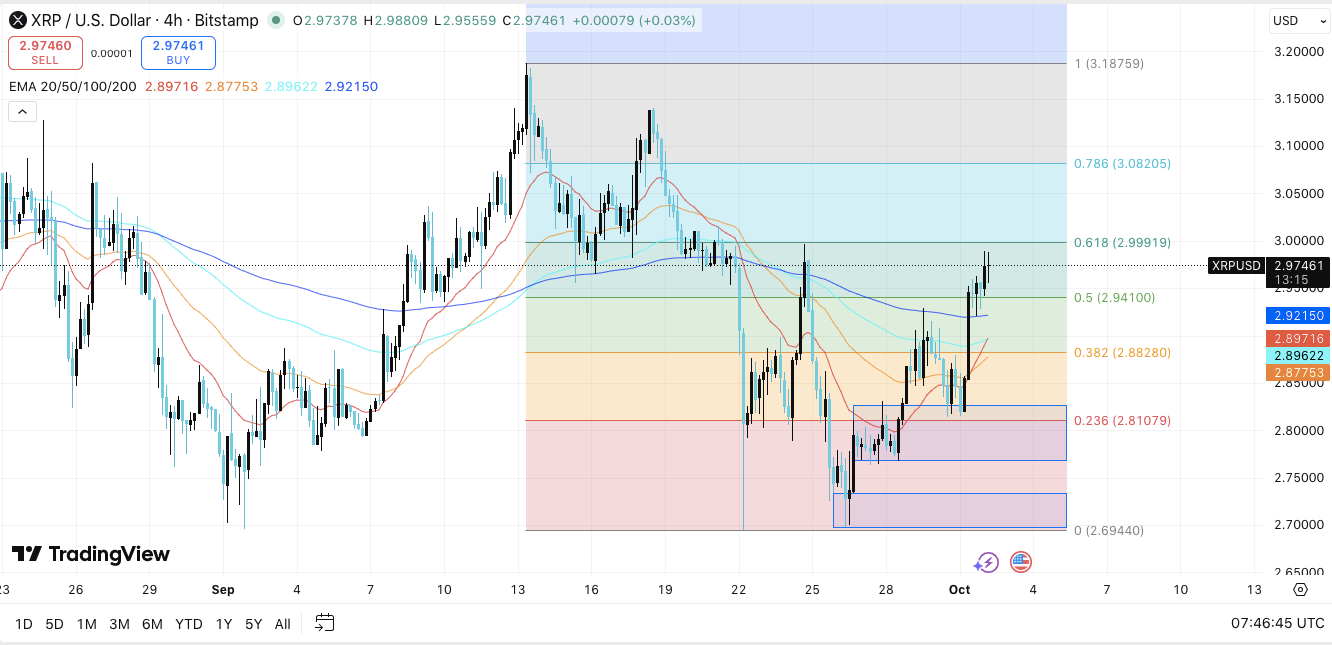

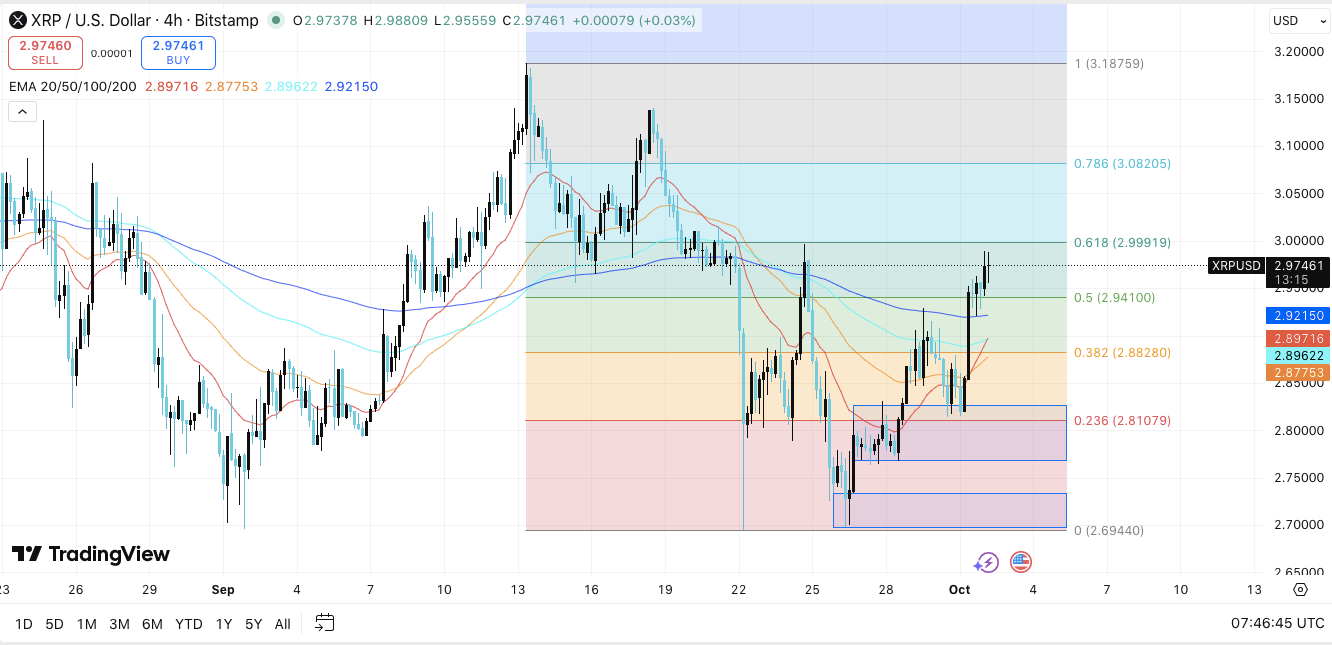

- The XRP approaches a $2.999 Fibonacci resistance, indicating the potential of bullish continuation.

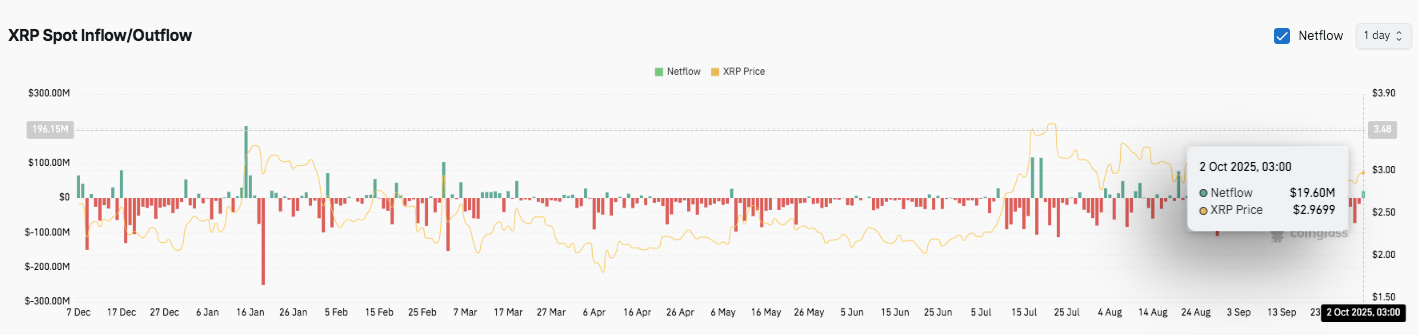

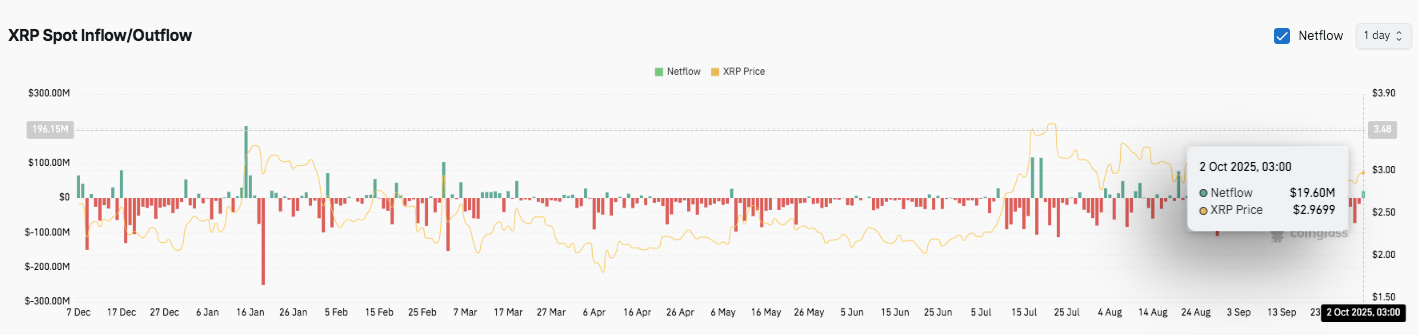

- An up to date $19.6 million influx has been up to date, growing the buildup of open curiosity gasoline traders.

- Holding assist between $2.94 and $2.88 is crucial for XRP pushing past $3.18.

XRP/USDT just lately demonstrated a outstanding rebound, reflecting elevated investor confidence and elevated market exercise. The four-hour chart highlights a sturdy restoration, with cryptocurrency at the moment buying and selling almost $2.97.

This stage serves as a crucial barrier of resistance at $2.999 slightly below the crucial 61.8% Fibonacci retracement. If XRP decisively destroys this stage, it may pave the best way for a 78.6% retracement at $3.08, adopted by the earlier Swing Excessive, near $3.18.

Technical momentum helps the upward potential

The short-term momentum stays bullish and is supported by shifting averages. XRP at the moment trades for 20 EMA for $2.89, 50 EMA for $2.87 and 200 EMA for $2.92. This alignment enhances the strengthening development and exhibits that the client is in good management. On the draw back, fast assist exists on the $2.94 50% Fibonacci stage.

If this stage fails, a 38.2% retracement is $2.88, and a 23.6% stage of $2.81 will present further cushioning. The deeper pullback exams the latest lows at almost $2.69. Because of this, the value construction means that XRP has stable, short-term assist whereas sustaining a transparent upward goal.

Associated: Ripple locks 200 million XRP to Escrow, XRP worth approaches breakout

Inflow, Outflow, and Futures Actions

Investor exercise at XRP has modified, particularly in latest months. Between Might and August, sustained outflows created gross sales strain and curbed costs.

Nonetheless, inflows returned to late August and September, and the buildup was up to date. On October 2, 2025, internet influx reached $19.6 million, matching XRP with a push of almost $2.97. This sample means that recent demand can assist much more upward momentum.

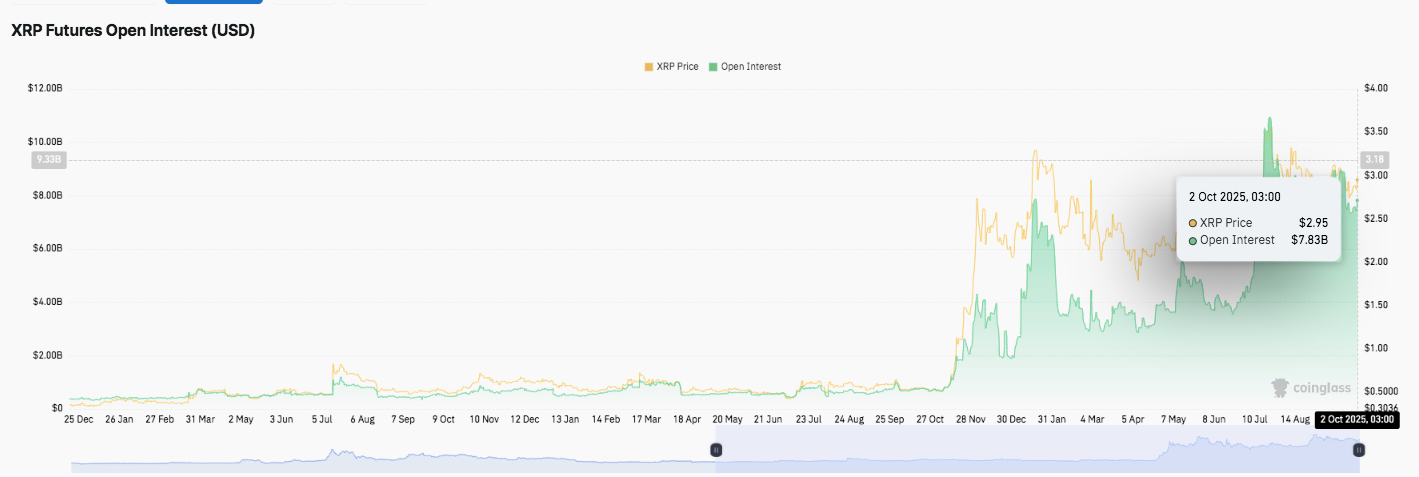

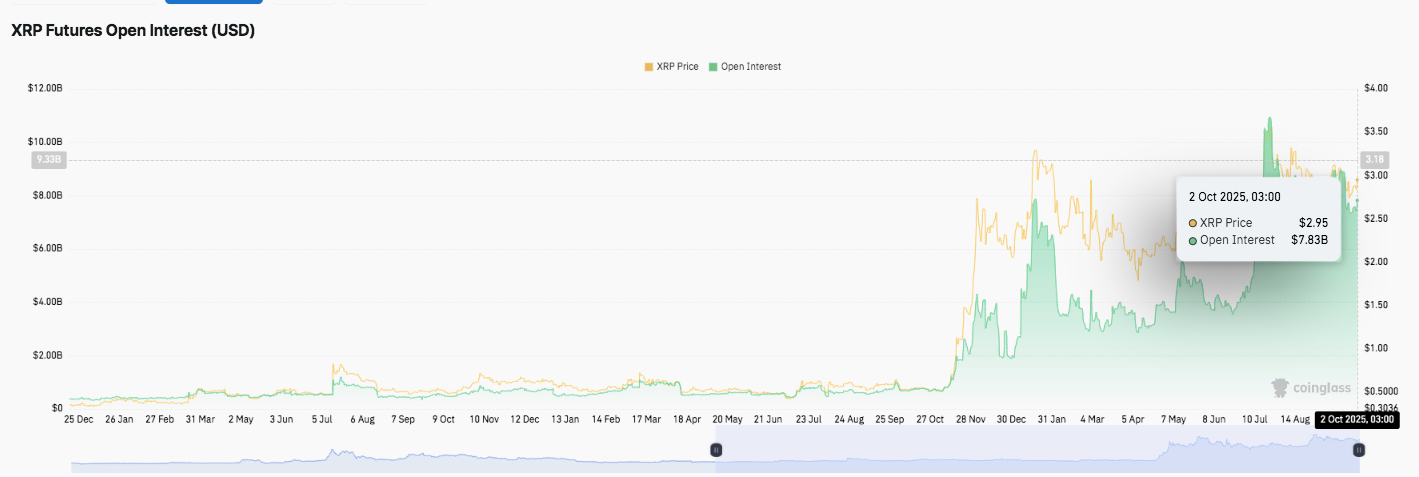

Moreover, the futures market displays the rising exercise of merchants. Public curiosity rose to $7.83 billion, highlighting speculative participation as costs rose.

Frequent spikes in flows and outflows point out aggressive revenue acquisition and leverage buying and selling strain. Because of this, sustained inflows can enhance costs, whereas massive outflows may cause short-term corrections or liquidation occasions.

Technical outlook for XRP worth: Main ranges in the direction of October

- Upside Degree: $3.00, $3.08 and $3.18 function fast resistance hurdles. A decisive break above $3.18 may pave the best way for $3.30 and $3.45.

- Drawback stage: The $2.94 trendline assist is the primary line of protection, adopted by $2.88 and $2.81. Violations at these ranges may check latest lows of almost $2.69.

- Ceiling of resistance: The 61.8% Fibonacci retracement at $2.999 is a crucial stage to flip by way of sustained mid-term bullish momentum.

The technical state of affairs means that XRP integrates past the necessary shifting common, creating bullish consistency throughout short- and medium-term time frames. A worth compression of almost $2.97 signifies that breakouts in both path may cause main actions.

Associated: Will XRP escape? Basic chart patterns match ETF deadline surges

Does XRP proceed upward?

XRP’s October trajectory will rely upon whether or not the client can maintain a zone between $2.94-$2.88 at $3.00-$3.08 lengthy sufficient to problem resistance. Whereas constructive inflow and progress of future actions recommend potential upside-downs, historic patterns recommend that volatility can enhance as capital accumulates.

If bullish momentum is strengthened, XRP may retest $3.18 and intention for $3.30-3.45. Conversely, in the event you do not preserve $2.88-$2.94, you possibly can set off a deeper pullback to $2.81 and $2.69.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version shouldn’t be responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.