- Patrons are defending the $1.98-$2.00 zone, with the draw back slowing after the volatility in late December.

- Sustained foreign exchange inflows point out continued circulation, leaving the rally susceptible beneath key EMAs.

- Regular ETF inflows of over $1.18 billion are the ground, however a $2.22 restoration in XRP is required to alter momentum.

XRP value is buying and selling round $2.01 at this time, stabilizing above a key short-term help zone after a unstable begin heading into 2026. The token is trying to construct on a long-term downtrend, with patrons pushing into the $1.90-$2.00 area, even because the broader crypto market stays range-bound. There’s presently a pressure between enhancing ETF-led demand and continued forex inflows that proceed to dampen upside momentum.

Patrons stay agency for long-term demand

On the every day chart, XRP continues to respect a broad demand zone starting from round $1.65 to $1.80, an space that has attracted patrons a number of occasions since October. Costs haven’t revisited the decrease finish of that zone this week, suggesting promoting strain has eased after the late December crash.

Nevertheless, the construction stays fragile. XRP remains to be buying and selling beneath the downtrend line drawn from its July peak, and the worth stays constrained beneath the stacked 20-day, 50-day, 100-day, and 200-day EMAs between $1.92 and $2.35. This EMA cluster has repeatedly rejected makes an attempt to maneuver larger since November, and the broader pattern stays corrective fairly than constructive.

The every day Supertrend indicator stays bearish above the worth round $2.05, confirming that the rally remains to be promoting fairly than following.

Quick-term charts present cooling momentum

Decrease time frames paint a extra nuanced image. On the 30-minute chart, XRP rebounded sharply into the $2.06 to $2.08 space earlier than falling again in the direction of $2.00. Parabolic SAR reversed through the rally, however is beginning to converge once more as momentum weakens.

The RSI on the intraday chart has returned to a impartial course after briefly pushing into overbought territory. This alteration means that the pullback was pushed by quick protecting or tactical shopping for fairly than participation in a brand new pattern. Patrons are lively, however not chasing larger costs.

For XRP to regain near-term management, the worth must maintain above $1.98-$2.00 and break by means of $2.05 with a follow-through. In any other case, we threat one other sluggish decline in the direction of mid-$1.90.

Alternate stream stationary sign distribution

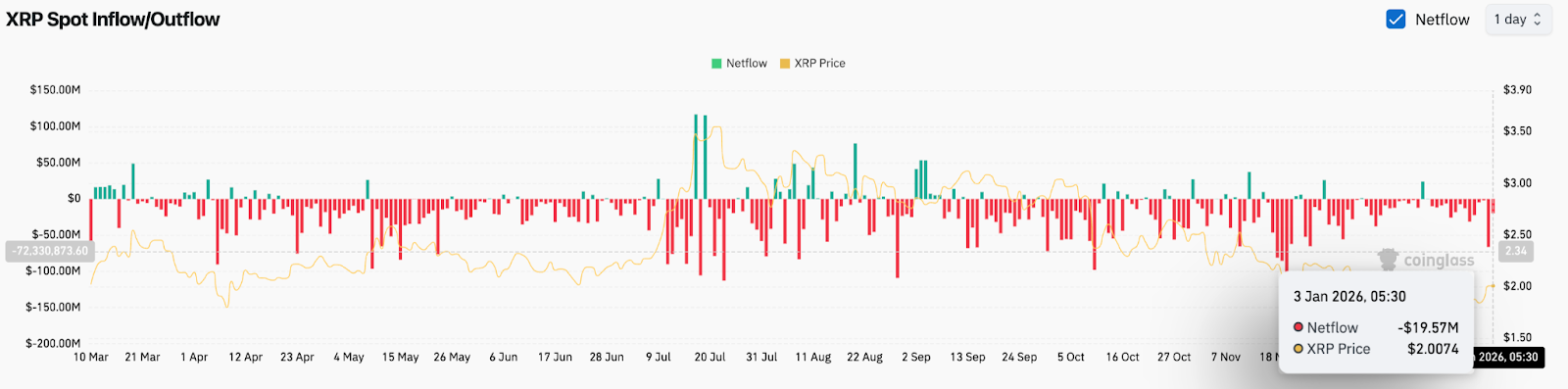

Spot stream information stays a headwind. XRP has recorded constant internet inflows to the alternate throughout latest classes, together with internet flows of -$19.5 million on January third.

This sample signifies that holders are nonetheless sending their tokens to exchanges, which is often an indication that provide is making ready to promote fairly than accumulate.

ETF inflows function a counterweight

This provide strain is partially offset by continued institutional demand. In response to SoSoValue information, the U.S. Spot XRP ETF recorded inflows of $13.59 million on January 2, bringing the overall inflows since launch to $1.18 billion.

Though modest on a day-to-day foundation, regular demand for ETFs absorbs a few of the provide flowing into the market.

Regulatory and coverage narratives heighten feelings

Past flows, sentiment has been supported by adjustments within the regulatory panorama. Merchants level to the resignation of SEC Commissioner Caroline Crenshaw, who has been a vocal critic of crypto spot ETFs, as a possible turning level. His departure has been interpreted by some market contributors as a weakening of resistance to a extra accommodative coverage stance.

Hypothesis over doable will increase within the Market Construction Invoice on January 15 additionally retains coverage expectations excessive into the primary quarter. This story helped XRP outperform at a time when the general market was struggling to generate momentum.

outlook. Will XRP go up?

Quick-term traits stay correction-neutral, however draw back strain has eased.

- Bullish case: XRP maintains above $1.98 and regains $2.22 on the every day shut, reversing the EMA cluster and rising room in the direction of $2.60.

- Bearish case: A detailed of the day beneath $1.90 signifies distribution has resumed, revealing the $1.75 demand zone.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t chargeable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to carry out due diligence earlier than taking any motion associated to our firm.