- XRP is dealing with robust resistance between $2.39 and $2.64, limiting any near-term upside makes an attempt.

- For now, help stays close to $2.16, with the potential for a deeper decline in the direction of $1.94.

- Rising open curiosity and $15 million inflows counsel new prospects for speculative accumulation.

XRP continues to commerce below promoting stress as technical indicators counsel restricted near-term rebound momentum. The token is hovering round $2.28 on the 4-hour chart, beneath the foremost exponential transferring common.

Regardless of the restoration try, sellers stay in management close to the foremost retracement zone. Analysts notice that the present construction signifies a correction sample, with resistance ranges persevering with to constrain any upside makes an attempt.

Resistance Degree Defines XRP’s Close to-Time period Path

The $2.39 degree stays the primary main resistance degree and coincides with the 20-day EMA and 0.5 Fibonacci retracement zone. Above that, the $2.51-$2.64 vary varieties a robust resistance cluster combining the 50, 100, and 200 EMAs.

This zone has traditionally attracted profit-takers and has usually halted short-lived bull markets. A definitive shut above $2.64 might change the market construction and pave the way in which for $2.77 and $3.10. However till that occurs, the general pattern for XRP is down.

On the draw back, speedy help lies round $2.16, which corresponds to the 0.382 Fibonacci degree. If this degree can’t be maintained, XRP might fall additional in the direction of $1.94 and $1.58, each of which point out vital liquidity pockets. Sustaining energy above $2.16 is important for the bulls to aim a brand new restoration section.

Associated: Solana worth prediction: Uniswap integration fails to stop outflow, SOL plummets

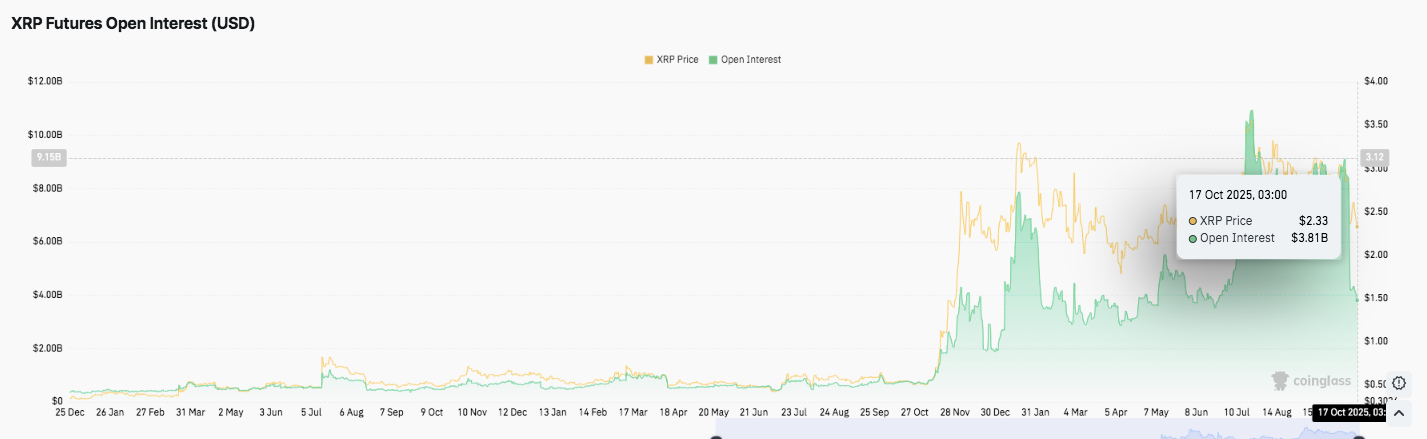

Improve in open curiosity is an indication of speculative exercise

In line with market information, XRP’s open curiosity will improve quickly by 2025, reaching greater than $9 billion in April. Though exercise has subsided, the present degree of roughly $3.81 billion stays excessive.

This implies that merchants are bracing for volatility as XRP consolidates. The correlation between worth stagnation and excessive open curiosity displays elevated leverage buying and selling and speculative positioning previous to giant worth actions.

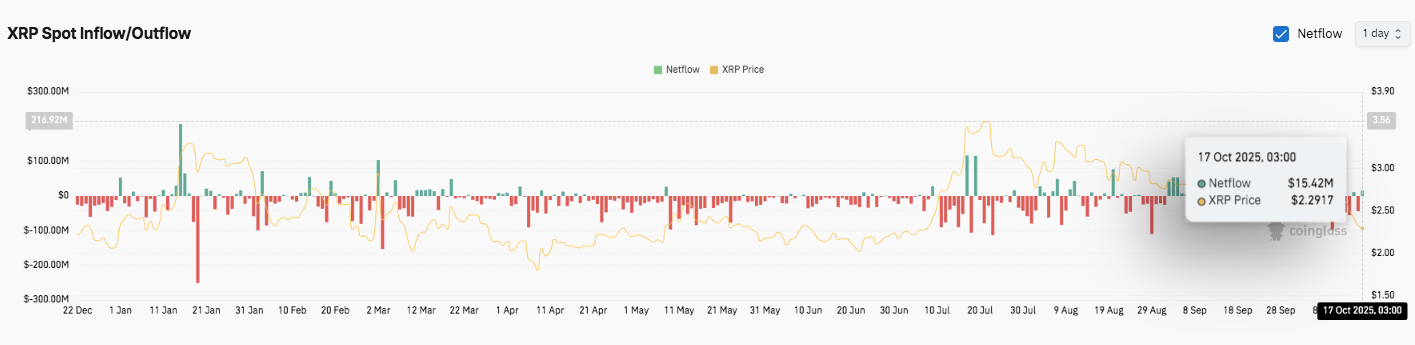

Influx signifies new accumulation

In line with CoinGlass information, internet inflows as of October 17 have been $15.42 million, marking a shift after constant outflows in current months. This influx happens when the worth is stabilizing round $2.29, suggesting potential accumulation close to the help zone. Traditionally, such surges in inflows have preceded short-term recoveries, particularly when supported by broad market sentiment.

ETF expectations modify following regulatory delays

As reported by Coin Version, hypothesis surrounding the XRP ETF has subsided after receiving clarification from authorized consultants. The Oct. 19b-4 submitting didn’t present a begin date however outlined the steps within the SEC’s evaluation course of.

As soon as the federal government reopens, functions might resume and ETF issuance might start shortly thereafter. Consequently, traders proceed to observe regulatory developments and put together for potential adjustments in liquidity as approvals transfer ahead.

Associated: Ethereum Worth Prediction: BlackRock’s $46.9M ETH Buy Eyes Assist

Technical outlook for XRP worth

Key ranges stay effectively outlined heading into late October, with XRP stabilizing across the $2.28 mark. Upside resistance is positioned at $2.39 (EMA 20 and Fibonacci 0.5 degree) after which at $2.51 (EMA 50 and 0.618 Fibonacci). A break above these thresholds might pave the way in which for retests of $2.64 (100 EMA) and $2.77 (200 EMA cluster). The $2.77 space stays the important thing higher certain for medium-term bullish affirmation.

On the draw back, help lies at $2.16 (0.382 Fib), an vital defensive zone for bulls. A break beneath this might expose $1.94 and former swing lows round $1.58, the place liquidity stays concentrated. These ranges outline the decrease bounds of the continuing correction vary.

The technical construction exhibits that XRP is compressing between converging EMAs, hinting on the potential for elevated volatility if a definitive breakout happens. Momentum indicators nonetheless favor promoting, however the market’s open curiosity has risen to over $3.8 billion, indicating robust dealer engagement.

Will XRP maintain $2.16?

The near-term path of XRP will rely upon whether or not patrons can maintain the help at $2.16 lengthy sufficient to get better between $2.51 and $2.64. If inflows proceed and the worth closes above $2.64, it might sign a structural reversal and set the stage for a rally towards $2.77 and probably $3.10.

Nevertheless, if the present help can’t be sustained, a correction might deepen additional and XRP might head in the direction of $1.94 or $1.58. For now, XRP stays in a pivotal consolidation zone the place confidence and liquidity flows will decide the subsequent breakout section.

Associated: Shiba Inu Worth Prediction: SHIB falls as key help faces new promoting stress

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not answerable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.