- XRP is buying and selling close to $1.91 because the token hits the underside of a multi-month descending channel and retests key help.

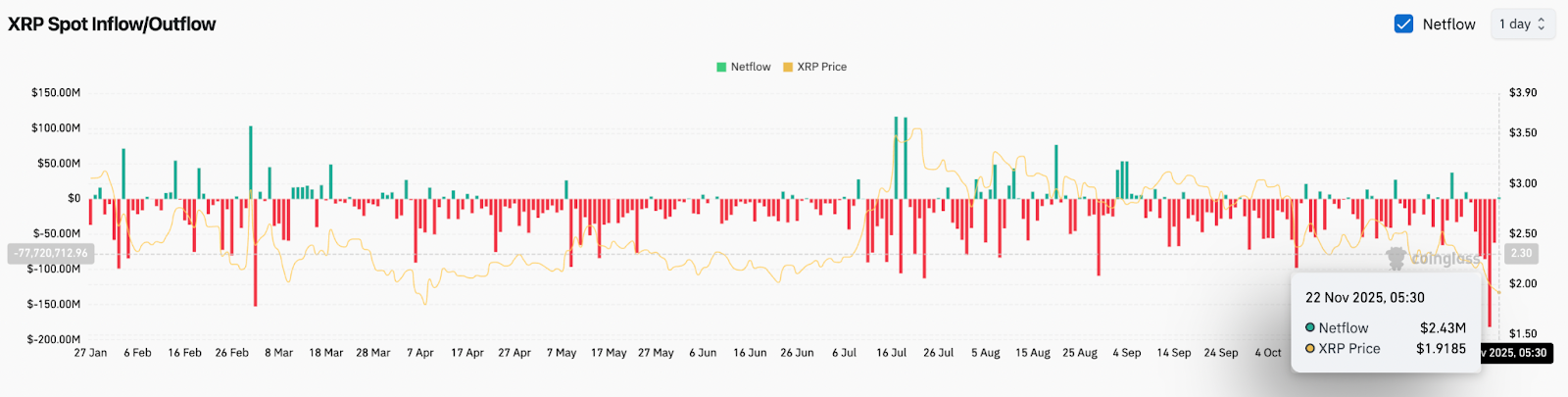

- Spot flows remained adverse with outflows of $2.4 million, including to the variety of months dominated by deficits, together with outflows of $181.5 million.

- Ripple’s long-term Apex story fuels optimism, however short-term bias stays bearish because of weak EMAs, channel strain, and deal with declines.

XRP is buying and selling close to $1.91 after falling to the underside of a multi-month descending channel. This transfer places patrons in an necessary place because the token assessments the identical help zone that it held a number of occasions earlier this 12 months. Spot flows proceed to point out weak point and sellers stay lively regardless of Ripple’s aggressive long-term imaginative and prescient outlined throughout the Apex convention.

Patrons withdraw as spot outflows improve

CoinGlass knowledge exhibits one other adverse spot move, with XRP recording an outflow of roughly $2.4 million on November twenty second.

This follows a string of darkish pink days all through the month, together with the 12 months’s steepest single-day commerce of $181.5 million. Continued outflows point out that sellers are returning cash to exchanges slightly than locking in positions for upside.

Trendline break confirms continued weak point

The every day chart exhibits that XRP has been locked inside a well-defined descending channel since July. Every rally is proscribed by the higher trendline, however decrease highs proceed to type. The worth is presently buying and selling effectively beneath the 20-day, 50-day, 100-day, and 200-day EMA. All 4 slope downwards and act as a multi-layered resistance ceiling.

The 20-day EMA is in a rejected space for the primary time in nearly a month. Sellers defended that degree once more this week, reinforcing the bearish construction. The supertrend stays within the pink, confirming draw back strain, however the channel help now has an imminent danger of breaking down in direction of the following liquidity zone at $1.75 to $1.70.

Momentum indicators are bearish. XRP has not made a significant new low since September, and the chart continues to point out depletion after every short-term rally. Till the value regains the 20-day EMA, the market will deal with every rise as a response slightly than a development reversal.

Daytime habits exhibits unstable stability

The 30-minute chart exhibits XRP attempting to construct across the $1.91 space. The parabolic SAR dot remains to be above worth, indicating that sellers are nonetheless in management. The $1.94 VWAP resistance is limiting intraday momentum, and makes an attempt to interrupt above it have repeatedly failed.

Quick-term merchants need to keep a slim worth vary between $1.90 and $1.94. A clear break above $1.95 would sign the primary indicators of intraday reduction, however that transfer may shortly fizzle out if quantity doesn’t enhance. So long as the EMA overhead is stacked to the draw back, the broader development will nonetheless decide course.

Failure to carry $1.90 opens the door to a retest of $1.85. That is positioned slightly below the channel boundary and marks the following pocket of liquidity from early Q2.

Ripple story brings long-term optimism, however no short-term upside

Ripple CEO Brad Garlinghouse’s feedback on the 2025 XRPL Apex Convention injected long-term optimism into the ecosystem. His declare that XRPL may seize as much as 14 p.c of SWIFT’s annual buying and selling quantity inside 5 years sparked a brand new debate about its future utility. Ripple’s ODL providers processed $1.3 trillion within the second quarter alone, highlighting real-world adoption in sure areas.

Nevertheless, short-term situations nonetheless dominate worth traits. This 12 months, XRP lively addresses have plummeted from 105,000 to six,000, indicating restricted retail exercise. Competitors from stablecoins, CBDCs, and personal fee networks stays fierce. Even when the long-term imaginative and prescient is engaging, short-term flows and technical buildings will proceed to dictate market course.

Will XRP go up?

The following transfer will rely on whether or not patrons can defend the $1.88 to $1.94 help band. The world has served as a springboard many occasions since early spring, however is now being examined below stronger outflow strain.

- Bullish case: XRP must regain $2.21 and shut above the 20-day EMA on elevated quantity. If this occurs, the present downtrend might be damaged, paving the best way for $2.41 and $2.55. A break above the channel higher restrict confirms a development reversal.

- Bearish case: The present decline will flip right into a definitive breakdown if the day closes beneath $1.88. This reveals the following demand zone at $1.75 after which $1.70. A lack of $1.70 will transfer the broader construction right into a deeper correction section.

If the patrons defend the help and regain the 20-day EMA, the momentum may change. A breakdown to $1.88 retains sellers in full management and magnifies the transfer into decrease liquidity pockets.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.