- XRP is struggling beneath all EMAs, confirming sustained near-term bearish management.

- Futures open curiosity reached $3.72 billion, suggesting elevated volatility threat attributable to leverage.

- Spot flows are displaying cautious accumulation and holding assist throughout the XRP vary close to $2.00.

XRP value motion exhibits sustained weak point on the 4-hour chart, reflecting cautious sentiment throughout spot and derivatives markets. As of mid-December 2025, XRP is buying and selling round $2.00 on Bitstamp, with patrons and sellers nonetheless trapped in a slim vary.

Regardless of the interval of demand, sellers proceed to regulate short-term momentum. Collectively, the technical construction, futures positioning, and on-chain flows recommend elevated volatility threat going ahead.

XRP’s technical construction stays weak

On the 4-hour timeframe, XRP continues to commerce beneath all main exponential shifting averages. Worth motion stays restricted beneath the 20, 50, 100, and 200 EMA ranges. This coincidence confirms the persistence of bearish management within the quick time period. Furthermore, repeated failures close to dynamic resistance strengthen sellers’ benefit throughout intraday bounces.

The $2.02 to $2.06 vary acts as an preliminary restoration barrier. This zone coincides with short-term EMA resistance and a bearish supertrend construction. Due to this fact, the value rejection right here limits upside follow-through. Past that, the $2.07 to $2.10 space represents the earlier breakdown space. Bulls have to regain this vary to vary their short-term bias.

Associated: Bitcoin Worth Prediction: BTC Stabilizes Close to $90,000 As Merchants Wait…

Nonetheless, the 200 EMA close to $2.14 stays on the heart of the broader development. Until this stage is regained, draw back threat stays. On the draw back, patrons proceed to carry onto the psychological stage of $2.00. Due to this fact, losses on this space are uncovered to the following assist band at $1.96 to $1.98.

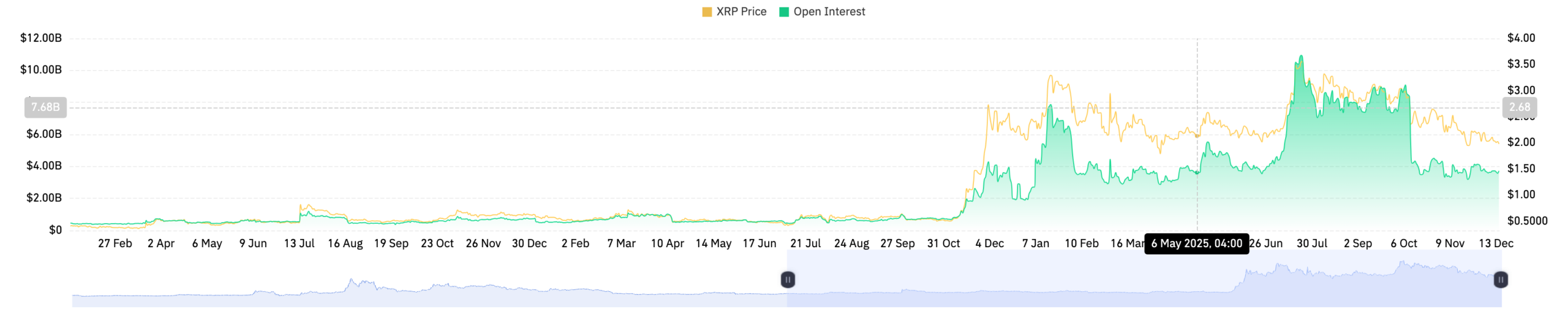

Futures open curiosity factors to elevated threat

Importantly, XRP futures open curiosity has expanded quickly over the previous 12 months. Based on the info, open curiosity has elevated from lower than $500 million in mid-2024 to $3.72 billion by December 15, 2025. This enlargement displays elevated dealer participation and speculative publicity.

The surge in open curiosity coincided with historic value will increase from late 2024 to early 2025. Moreover, sustained rising ranges recommend that monetary establishments stay energetic regardless of current value weak point. Excessive open curiosity across the $2.00 zone will increase the probability of a pointy directional transfer. Consequently, leverage-induced volatility stays an vital threat issue.

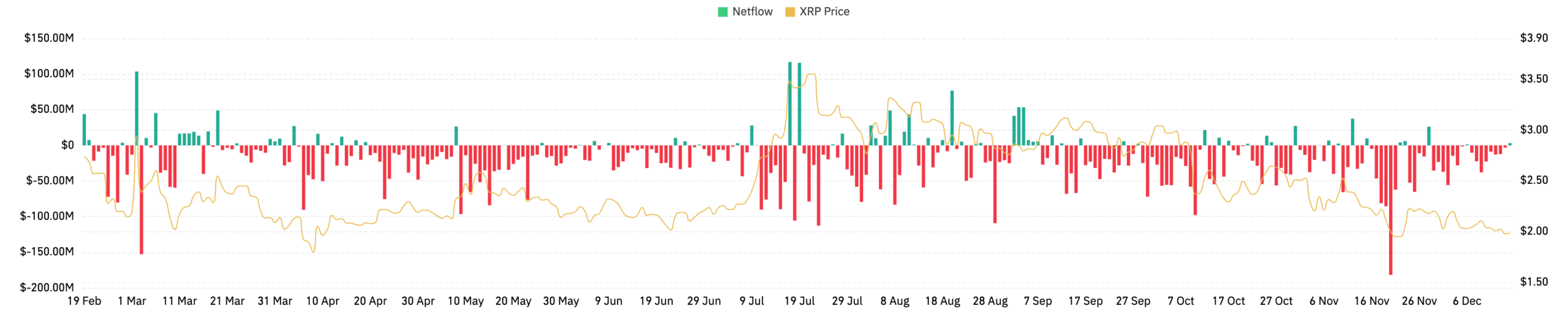

Spot movement developments mirror cautious participation

Spot movement information exhibits constant web withdrawals over most of 2025. Crimson outflow intervals dominate, indicating that extra tokens are leaving the trade than coming in. We do see occasional spikes in influx, however they continue to be comparatively small. Moreover, the intensification of outflows in November coincided with a decline in costs.

Associated: Solana Worth Prediction: SOL trades in a decent vary as merchants reassess threat

By mid-December, web flows had turned barely constructive at practically $1.72 million. Nonetheless, this modification didn’t trigger a sustained value breakout. Due to this fact, the info suggests cautious accumulation somewhat than aggressive shopping for. XRP value is prone to stay range-bound till inflows strengthen considerably.

Technical outlook for XRP value

XRP’s key ranges stay well-defined as the value trades close to key inflection factors. On the upside, the instant resistance is between $2.02 and $2.06, the place the short-term EMA and development indicators converge. A confirmed breakout above this band may enable for a transfer towards $2.10, adopted by a take a look at of $2.14-$2.15, which might coincide with the 200 EMA and broader development resistance.

On the draw back, $2.00 stays vital psychological and structural assist. Patrons have defended this stage many occasions, however momentum stays fragile. If the value fails to carry at $2.00, the following assist zone could possibly be between $1.98 and $1.96. Beneath that, draw back dangers widen to $1.90-$1.92, the place ahead demand had beforehand appeared.

The technical construction means that XRP continues to report decrease highs on the 4-hour chart. Costs additionally stay beneath the foremost shifting averages, suggesting continued bearish strain. Nonetheless, compression across the $2.00 stage signifies potential volatility enlargement.

Will XRP rise?

The course of XRP value will rely upon whether or not patrons can reclaim the $2.06-$2.10 resistance cluster with sturdy follow-through. A profitable restoration may shift near-term momentum and open room for $2.15.

Alternatively, if the unfavorable response is repeated and the value falls beneath $2.00, the bearish construction will probably be maintained and the draw back potential will improve. For now, XRP stays in a pivotal zone the place confidence and quantity decide the following decisive transfer.

Associated: Cardano Worth Prediction: ADA Stays Supported With out Clear Bullish Conviction

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not answerable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.