- XRP is going through robust resistance at $2.62, which is vital to regaining bullish momentum.

- Futures open curiosity of over $4 billion signifies continued speculative involvement and volatility.

- ETF approval, anticipated on Nov. 13, may spur institutional inflows and value appreciation.

XRP is buying and selling close to $2.49 as merchants think about their subsequent transfer forward of the upcoming ETF launch. After a unstable correction from a excessive of $3.10, the asset is now attempting to regain momentum. Market knowledge suggests cautious optimism as patrons look to defend key Fibonacci assist zones whereas anticipating a possible breakout triggered by institutional catalysts.

Worth construction and foremost ranges

The token not too long ago rebounded from its $1.58 base and reached the 0.5 Fibonacci degree at $2.34. Nevertheless, the rally continued after that, with costs staying between $2.16 and $2.62. The 50, 100, and 200 EMA clusters proceed to weigh on momentum, indicating that the bear market stays dominant within the quick time period.

Rapid resistance lies at $2.52, the place the earlier assist has reversed to the ceiling. A profitable transfer above this level may pave the way in which for $2.79 and an eventual retest of the $3.10 peak. Conversely, a lack of assist at $2.34 may push the token again in the direction of $2.16 and even $1.94.

Moreover, the $2.62 resistance stays a serious take a look at for patrons. If the value sustains above that degree, bullish merchants might attempt to regain the benefit. A failure may as an alternative verify ongoing consolidation, suggesting that XRP will proceed to fluctuate inside its present buying and selling hall.

Derivatives and market participation

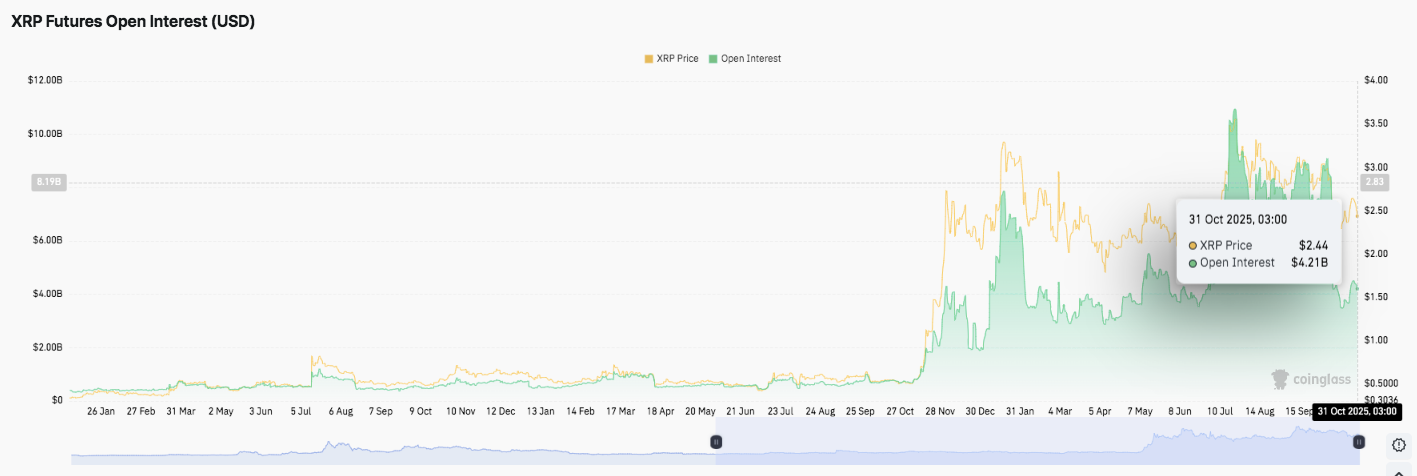

Open curiosity in XRP futures surged to greater than $8 billion earlier this yr and stabilized at $4.21 billion in late October. This enhance highlights excessive speculative exercise and signifies that merchants are taking positions in the direction of larger volatility.

Associated: Bitcoin Worth Prediction: BTC Stays Robust Amid Market Breakout

Because of this, open curiosity has cooled, however stays above its early 2025 common, reflecting constant engagement. If the token fails to take care of a key assist zone, liquidations might enhance and short-term market volatility might speed up.

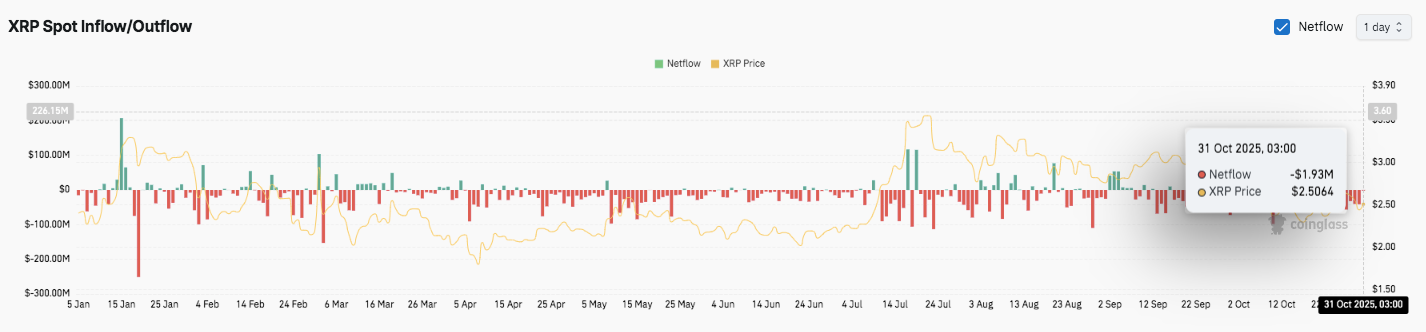

Furthermore, knowledge on inflows and outflows recommend that traders alternate between taking earnings and accumulating. Web flows turned damaging in October, indicating sluggish capital outflows regardless of steady costs. This cautious sentiment suggests merchants are ready for brand spanking new catalysts earlier than committing to bigger positions.

ETF outlook and market sentiment

The anticipated approval of the XRP ETF on November thirteenth may reshape market expectations. Canary Capital’s S-1 modification has cleared the ultimate hurdle for automated activation, pending Nasdaq approval. Due to this fact, this growth may encourage institutional investor participation and broaden the liquidity of the token.

Associated: Solana Worth Prediction: Bears intention for main assist ranges as momentum weakens

Technical outlook for XRP value

XRP value motion stays tightly spiraled because the token trades round $2.49, displaying indicators of vary compression forward of a possible breakout. Key ranges stay clearly outlined heading into November.

- High degree: $2.52 (Fib 0.618), $2.79 (Fib 0.786), and $3.10 stay the primary hurdles. A break above $2.79 may pave the way in which for $3.10 and make sure new bullish momentum. A sustained shut above this zone may lengthen the upside goal additional to $3.50, relying on market participation and ETF-driven sentiment.

- Cheaper price degree: $2.34 (Fib 0.5) acts as fast assist, adopted by $2.16 (Fib 0.382) and $1.94 as deeper fallback zones. A decisive drop under $2.16 may speed up promoting stress and expose the start of the final main rebound at $1.58.

- Higher restrict of resistance: The $2.62 degree stays a short-term barrier and must be regained by XRP to return management to patrons. This coincides with the 50, 100, and 200 EMA clusters and represents an vital inflection level.

Will XRP rise additional?

Technical settings recommend that XRP is fluctuating between main Fibonacci ranges, rising stress for a bigger transfer. Open curiosity and derivatives knowledge exhibits elevated positioning, suggesting extra volatility is on the horizon. If patrons defend $2.34 and transfer above $2.62, XRP may retest $2.79 and $3.10 as bullish momentum builds in the direction of the ETF launch.

Nevertheless, repeated rejections round $2.52 may result in recent promoting, sending the token again to $2.16 earlier than any significant restoration is seen. The approaching weeks might determine whether or not XRP strikes right into a sustained uptrend or extends its consolidation part. For now, defending $2.34 stays vital to take care of bullish expectations.

Associated: Chainlink value prediction: $3.6 million influx and Ondo buying and selling increase confidence

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.