- XRP stays under the most important EMA, confirming that short-term bearish momentum continues.

- Overhead resistance close to $2.10 is hampering any restoration and sustaining the sellers’ benefit.

- The decline in bodily outflows and futures exposures suggests cautious sentiment amongst merchants.

XRP worth motion on the 4-hour chart displays the market struggling to regain momentum after repeated failed recoveries. The token is buying and selling close to $1.90, with promoting strain persevering with to outweigh short-term shopping for curiosity.

XRP 4H chart suggests continuation of bearish management

XRP continues to commerce under the most important exponential shifting common on the 4-hour chart. The 20, 50, 100, and 200 EMAs slope downward and stay tightly stacked.

This correction displays sustained intraday promoting strain. Furthermore, the value development continues to type highs and lows, confirming the final downtrend.

Repeated declines across the $2.10 to $2.20 vary spotlight persistent overhead provide. Sellers repeatedly intervene at these ranges, hampering restoration makes an attempt.

Moreover, the supertrend indicator stays in promote mode, reinforcing the bearish momentum. So long as XRP stays under the $2.00 threshold, sellers are prone to keep management.

Associated: Ethereum Worth Prediction: ETF Outflows Maintain ETH Pegged Close to…

Assist is presently positioned close to the $1.90 to $1.88 zone the place the value is presently fluctuating. Failure to keep up this area might speed up the sell-off. Subsequently, merchants are intently monitoring $1.85 as a breakdown set off. The $1.82 to $1.80 space under represents a key demand zone from earlier worth motion.

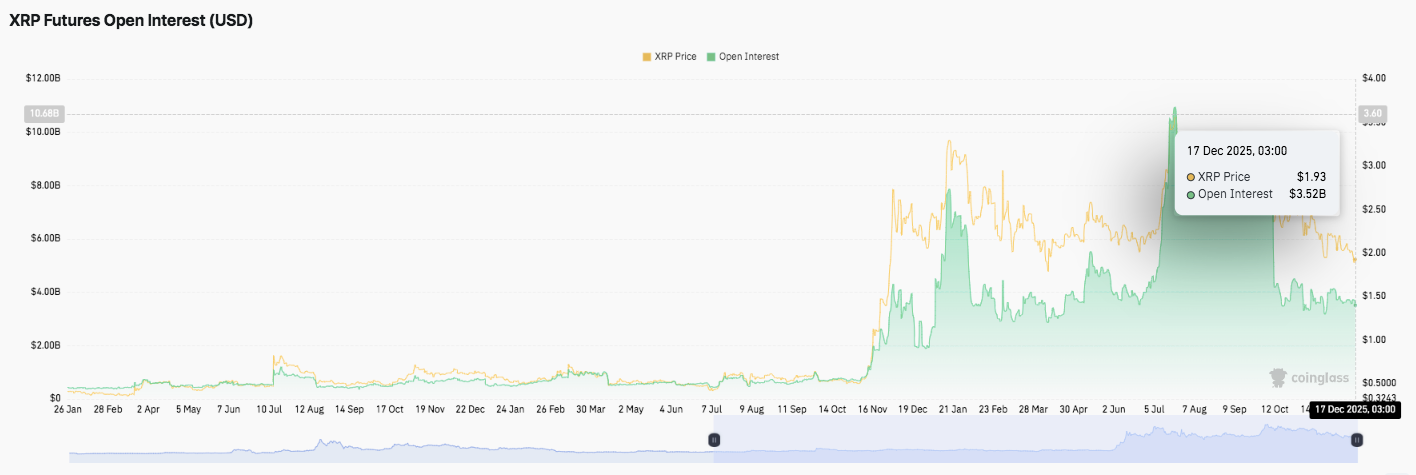

Futures Positioning Present Leverage Reset

XRP futures open curiosity offers perception into dealer conduct throughout current volatility. Open curiosity rose sharply as the value approached $2.00, peaking at almost $3.5 billion. This rally reveals that aggressive leverage is getting into the market amidst bullish momentum.

Nonetheless, open curiosity subsequently declined as costs fell. This transfer suggests a protracted interval of liquidation and shutting of positions. In consequence, speculative publicity cooled after the rally failed. Though open curiosity stays traditionally excessive, the contraction displays a extra cautious stance. It seems that merchants are presently ready for affirmation earlier than re-leveraging.

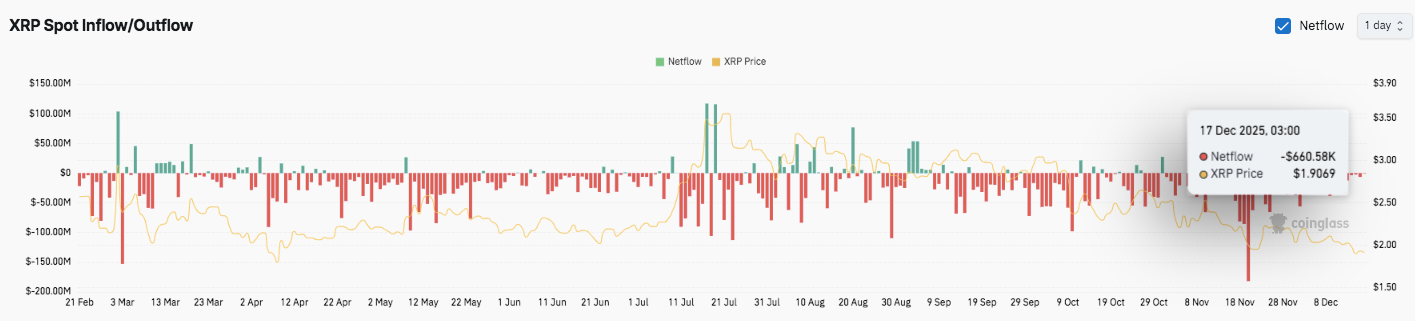

Spot flows replicate cautious market sentiment

Spot influx and outflow information additional helps the cautious outlook. XRP has proven frequent fluctuations between optimistic and damaging web flows all year long. Optimistic inflows typically coincided with worth energy, whereas outflows had been accompanied by declines.

Associated: Mantle Worth Prediction: Can MNT maintain its upward development above $1.23?

Importantly, current information reveals a pointy damaging web circulate close to the top of December. With XRP buying and selling round $1.91, the online outflow amounted to roughly $660,000. This exercise suggests dispersal relatively than accumulation at present ranges. Moreover, the info reveals that spot purchaser confidence is declining.

Technical outlook for XRP worth

XRP’s key ranges stay well-defined as the value trades close to key inflection factors.

On the upside, near-term resistance lies between $1.98 and $2.00, adopted by the near-term EMA cluster at $2.05 and $2.08. A stronger breakout might lengthen to $2.18-$2.20, with $2.30 appearing as the principle resistance close to the 200 EMA.

On the draw back, $1.90-$1.88 stays the primary help space. A failure there would expose $1.85, adopted by a broader demand zone between $1.82 and $1.80.

The technical construction means that XRP is in a short-term downtrend characterised by decrease highs and decrease lows. Worth compression under the most important shifting averages signifies potential for elevated volatility.

Will XRP go up?

XRP’s near-term course depends upon whether or not patrons can defend $1.88 and get better $2.05. If the value is confirmed to maneuver above $2.10, the momentum will additional improve.

Nonetheless, if it falls under $1.88, there’s a threat that the losses will widen in direction of $1.80. For now, XRP is buying and selling in a pivotal vary the place affirmation will decide the subsequent transfer.

Associated: Bitcoin Worth Prediction: BTC Extends Susceptible Part as Technical Pressures, Flows and Macro Indicators Converge

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.