- XRP’s rebound from $1.58 alerts early stabilization as market confidence improves

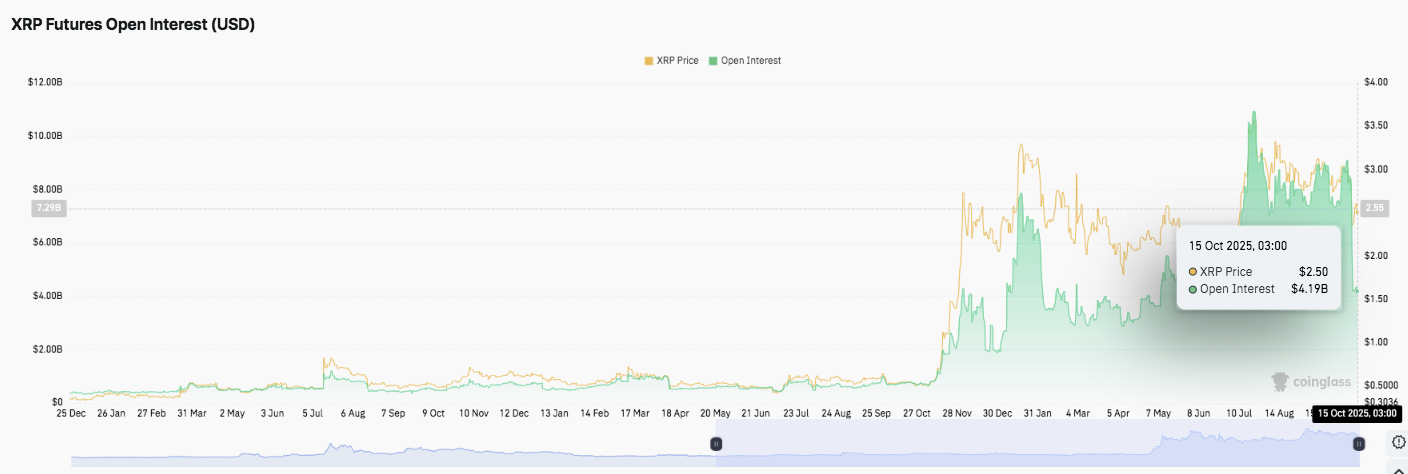

- Enhance in open curiosity of over $4.19 billion suggests resumption of exercise by speculative and institutional traders

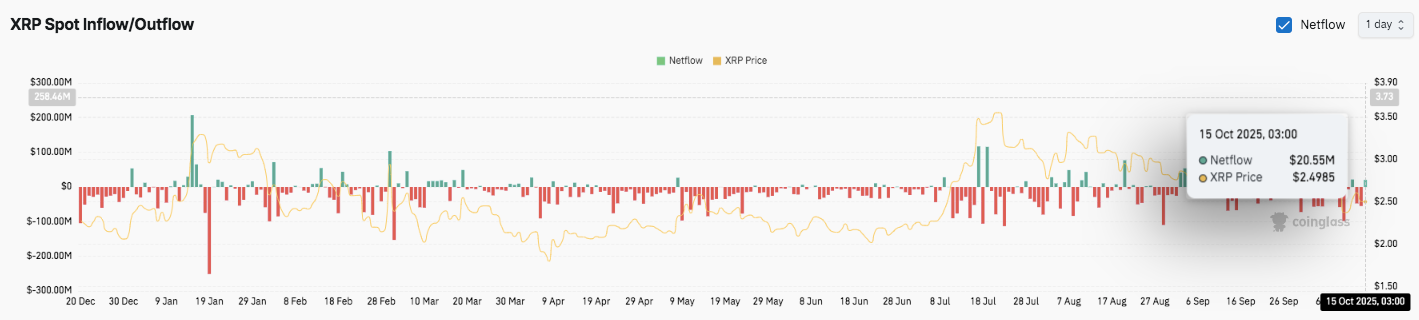

- Constructive web flows of $20.55 million point out cautious accumulation and strengthening investor sentiment

XRP is exhibiting early indicators of stabilizing after a pointy correction that erased almost half of its current good points. The cryptocurrency, which beforehand peaked at round $3.10, has since rebounded from lows round $1.58 and is at present buying and selling round $2.50.

This restoration means that consumers are cautiously re-entering the market regardless of widespread weak point in momentum indicators. The continuing rebound has coincided with elevated curiosity in futures and new capital inflows, indicating improved danger urge for food amongst merchants.

Worth construction signifies gradual restoration efforts

XRP’s newest worth construction reveals a managed restoration part supported by a stable protection across the $2.34 zone. This stage corresponds to the 0.5 Fibonacci retracement and stays an necessary short-term anchor.

Furthermore, the pushback from the area suggests the presence of aggressive consumers looking for to reestablish management. Nevertheless, XRP continues to commerce beneath the most important exponential transferring averages (20-EMA to 200-EMA), indicating that momentum stays restricted.

Importantly, the subsequent cluster of resistance lies between $2.52 and $2.56, the place each the 20-EMA and 50-EMA converge. A break above this zone may sign new energy and pave the way in which to $2.73.

Associated: Shiba Inu worth prediction: SHIB restoration stalls as momentum weakens

This stage coincides with the 100-EMA and the 0.786 Fibonacci retracement, which regularly attracts profit-taking. In consequence, a restoration of the 200-EMA close to $2.81 would affirm a structural restoration and revive the prospect of a retest of $3.10.

Derivatives markets replicate renewed speculative confidence

Moreover, it reveals a notable improve in participation within the XRP futures market. Open curiosity has elevated quickly since mid-2025, rising from lower than $1 billion to greater than $4.19 billion by mid-October.

This constant progress displays the current worth restoration and confirms merchants’ renewed confidence. The rise in open curiosity additionally alerts a rise in speculative positions, particularly as volatility returns to the broader crypto market.

Due to this fact, this transfer means that institutional and retail traders have gotten extra aggressive, utilizing leverage to reap the benefits of short-term strikes. Continued progress in open curiosity might help liquidity and worth stability within the quick time period.

Associated: Ethereum Worth Prediction: ETH Makes an attempt to Get well as Open Curiosity Hits $46.8 Billion

Influx information reveals cautious accumulation

Moreover, XRP netflow information highlights a balanced however bettering sentiment. Giant outflows accounted for a lot of the final quarter as traders booked earnings. Nevertheless, the current surge in inflows has proven new inflows across the $2.50 mark. On October fifteenth, XRP recorded constructive web flows of $20.55 million, reflecting elevated shopping for curiosity.

Technical outlook for XRP worth

As XRP enters the mid-October buying and selling part, key ranges stay properly outlined. The token is buying and selling close to $2.50 and holds short-term help above the 0.5 Fibonacci retracement at $2.34. This stage has served as an necessary pivot in current buying and selling, with consumers defending it to keep up market stability.

- Prime stage: $2.56 (20-EMA/50-EMA confluence), $2.73 (100-EMA and 0.786 Fibonacci), and $2.81 (200-EMA) characterize the most important resistance zones to look at. A transparent break above $2.73 may pave the way in which for a peak at $3.10, indicating new bullish energy.

- Cheaper price stage: Fast help lies at $2.34, adopted by $2.16 (0.382 Fibonacci) and $1.94 (0.236 Fibonacci). A break above these may expose XRP to a major drop to $1.58, the extent that confirmed its earlier robust rally.

- Higher restrict of resistance: The 200-EMA close to $2.81 stays the important thing stage for medium-term bullish continuation. A sequence of closes above this threshold signifies that consumers have regained management of the pattern.

Technical situations recommend that XRP stays agency inside a mid-range compression sample, and tightening momentum may precede a breakout in both course. Open curiosity information helps this situation, with derivatives publicity growing sharply since July, indicating energetic speculative participation.

Will XRP rebound in the direction of $3?

XRP’s worth outlook will rely upon how lengthy it may defend the $2.34 help whereas consumers attempt to claw again $2.73. If momentum builds attributable to elevated capital inflows and energetic futures buying and selling, XRP may retest the $3.10 resistance stage and prolong towards new highs later within the quarter. Nevertheless, failure to keep up help close to $2.34 will possible result in renewed promoting strain, pushing the value again in the direction of $2.16 and $1.94.

For now, XRP continues to be in a pivotal stage. Whereas a stabilization above $2.34 will hold near-term sentiment constructive, a decisive transfer above $2.73 can be essential to verify the breakout and re-establish the broader bullish construction.

Associated: Dogecoin Worth Prediction: Institutional Investor Consolidation Fuels Bullish Momentum

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.