- The XRP value is consolidated almost $2.99, with $2.97 serving as a key Fibonacci help for gross sales strain.

- ETF hypothesis boldly requires XRPs between $10 and $25, however the influx is modest and momentum stays unsure.

- EU regulators are pushing for tighter surveillance and maintaining a tally of XRP’s upcoming outlook regardless of the bullish narrative.

In the present day’s XRP costs are buying and selling at almost $2.99, barely above the $2.97 help zone after cooling off from final week’s rally. Sellers are pushing the 20-day EMA, whereas patrons proceed to defend the important thing Fibonacci ranges. Markets are dealing with essential testing as ETF speculations intensify and European regulators are searching for extra stringent surveillance.

XRP Costs retain Fibonacci help, however face resistance

The each day charts have consolidated XRP for $2.97 simply above the 0.236 Fibonacci retracement, with a value rejecting a $3.08 resistance alongside the retracement of 0.382. Fast help is near $2.94 and $2.82, whereas deeper safety is $2.57, a 200-day EMA.

Associated: Bitcoin (BTC) Value Prediction for September seventeenth

The trendline, which descends from its $3.66 peak in July, continues to realize momentum. A clear breakout of over $3.18 is a parabolic SAR and Fibonacci 0.618 overlap to overturn bullishness. Till then, XRP remained trapped in a contract construction with the danger of one other testing on a $2.70 base.

Momentum measurements emphasize consideration. The $2.94-$2.97 EMA cluster transforms right into a battlefield, with flat indicators suggesting indecisiveness. Pushings above $3.08 will invite momentum patrons, however failing to carry the $2.97 threat will speed up the breakdown.

ETF hypothesis triggers daring predictions

After Jake Craber stated the Paul Baron Present had a $10-13 XRP that was real looking and $20-25 may very well be made by the tip of the 12 months, the market regarded on the ETF headlines. Feedback amplified by analyst John Squire on X have fueled a wave of hypothesis about institutional inflow if US regulators cleared merchandise tied to XRP.

Whereas many merchants think about this prediction to be offensive, optimism round ETFs affords a bullish story. Traditionally, related speculations in Bitcoin and Ethereum led to a sustained breakout as soon as approval was confirmed, however the timing of XRP remained unsure.

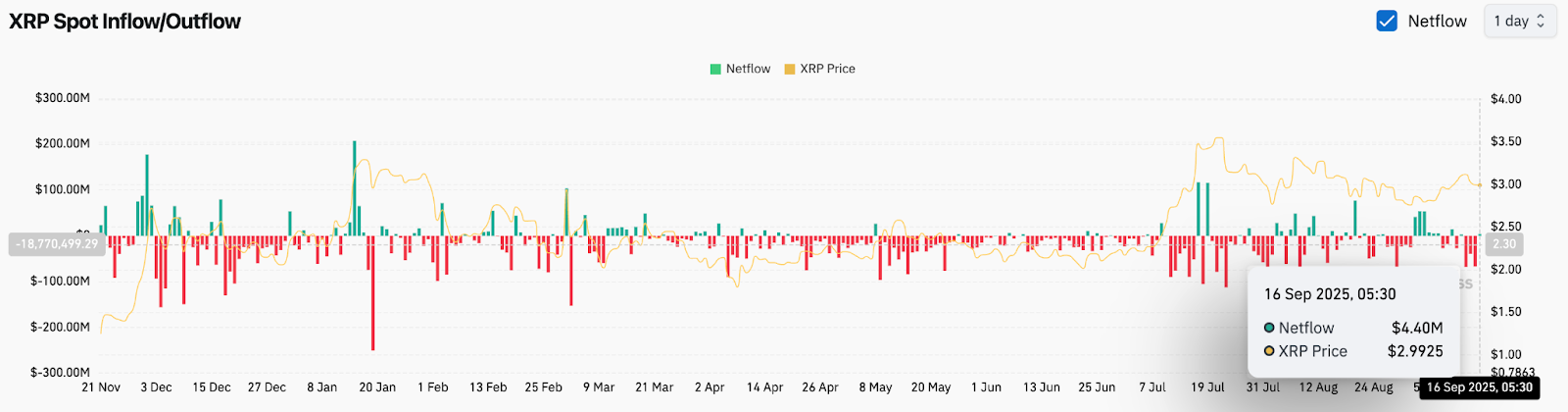

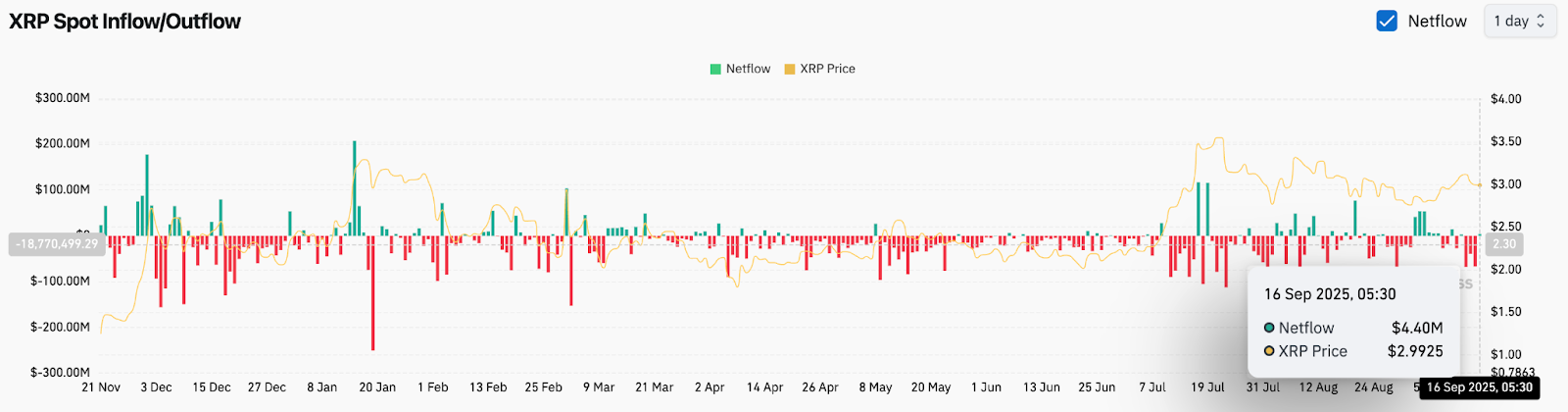

On-chain stream signifies a modest influx

Spotflow knowledge reveals a internet influx of $4.4 million to the XRP trade on September sixteenth. In comparison with historic spikes, this shift is in distinction to the sustained outflows seen previously few weeks. It suggests a cautious positioning by merchants making ready the chances of ETF improvement.

Associated: Linea (Linea) Value Forecast 2025, 2026, 2027, 2028–2030

Nevertheless, participation stays restricted. Lively addresses are stagnating in progress, and open curiosity in futures is being suppressed. XRP might wrestle to take care of breakouts past the $3.18-$3.30 zone and not using a stronger, extra constant influx.

EU regulators are pushing for tighter surveillance

Past expertise and ETF hype, the event of rules provides one other layer of uncertainty. France, Austria and Italy are urging the European Union to strengthen surveillance of the crypto market beneath MICA, calling for direct supervision of the ESMA, necessary cybersecurity audits, and stricter management on offshore platforms.

Within the case of XRP, dealing with its personal authorized scrutiny, EU enforcement might restrict entry to non-EU platforms and undermine liquidity. Nevertheless, supporters argue that stronger rules can increase long-term buyers’ belief, particularly when they’re harmonized throughout the bloc.

Technical outlook for XRP value

The important thing ranges stay nicely outlined. The benefit is that clearing $3.08 targets $3.18, adopted by $3.30, which converges the higher FIB stage. The breakout there might be prolonged to $3.46. On the draw back, shedding $2.97 is dangerous as a transfer to $2.82 and $2.70. If $2.70 fails, a 200-day EMA of $2.57 will likely be your last help.

The stability of threat relies on whether or not ETF-led optimism good points traction earlier than technical breakdown pressures overwhelm patrons.

Outlook: Will XRP go up?

XRP costs are at a crossroads immediately, with ETF hypothesis and modest inflows providing bullish counterweight towards regulatory tightening and trendline resistance. Analysts stay divided, with some projecting aggressive $10-13 targets, whereas others warning that $2.70 have to be held to stay constructive.

Associated: Shiba Inu (SHIB) value forecast for September sixteenth

So long as XRP is above $2.97, bias is leaning in the direction of integration with potential upwards. A important break above $3.18 will bolster bullish circumstances, but when they fail to maintain $2.97, they may expose XRP to a different loss earlier than the customer is restructured.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version isn’t responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.