- XRP flips and helps a number of resistance zones, and $3 at the moment serves as the important thing battlefield.

- Market analyst Matt Hughes says that if it exceeds $3, it will probably trigger parabolic motion.

- Commonplace Chartered predicts XRP will rise above 300% to $12.50.

Even because the broader crypto sentiment softens, some market watchers are assured that XRP is on the specter of a much-anticipated surge. Technical analysts level to a mature chart construction that means that the subsequent breakout section for an asset is nearer than many anticipated.

XRP reverses previous cycles to new help and builds a robust basis

Analyst Matt Hughes, for instance, outlined how XRP worth actions proceed to invert earlier resistance zones to strong help ranges. Utilizing Gunfan on the weekly chart, Hughes confirmed that the key factors of resistance for 2018 and 2021 have already damaged and are turning into a brand new basis for development.

XRP is at the moment buying and selling past its 2021 peak and above its $1.96 peak. The vary that after rounded off a transfer between $0.50 and $1 has been left for a very long time. Lately, a $3 psychological barrier has grow to be the battlefield, usually rapidly recovered after a short-lived dip beneath.

Associated: XRP surpasses crypto market forward of October’s SEC ETF resolution

For Hughes, this habits reveals resilience within the XRP construction, creating what he nonetheless calls essentially the most highly effective basis for his subsequent upward leg.

XRP Breakout Set off: Analysts say turning $3 is the “last boss”

At a worth of round $2.80, Hughes has recognized the $3 zone because the “last boss” inside the Gann fan mannequin. If XRP can convert this area into everlasting help, he claims it’ll trigger parabolic actions, much like previous bull runs.

For Hughes, the dialogue is not about whether or not XRP might be rallyed, however about when it’ll occur. This angle displays years of optimism inside the XRP group, with many anticipating a breakout run to new highs.

Raul PAL: XRP enters a brand new stage of development

Along with this outlook, Actual Imaginative and prescient CEO Raoul Pal additionally sees XRP work collectively for key strikes. PAL means that capital is starting to spin from Bitcoin to different property, with Ethereum and Solana already exhibiting power. In his view, XRP is at the moment “absolutely ported” to the subsequent stage of development.

Associated: Raoul Pal’s “Full Porting” Name for XRP

He factors to a recurring sample in XRP historical past. That is adopted by an explosive rally. PAL highlights the formation of a sequence of triangles in its weekly charts courting again to 2014, every main the huge surge.

How a lot is XRP?

Presently, XRP is forming one other bullish pennant just under the $3 mark. A breakout on high of this sample may have some predictions geared toward a $10 area, probably unlocking the rally in the direction of an all-time excessive.

Nevertheless, if help is weakened, XRP can revisit the $1.70 to $2 zone earlier than trying one other push.

Commonplace Chartered is seeing $12.50 from 300% upside as ETF catalysts method the October deadline

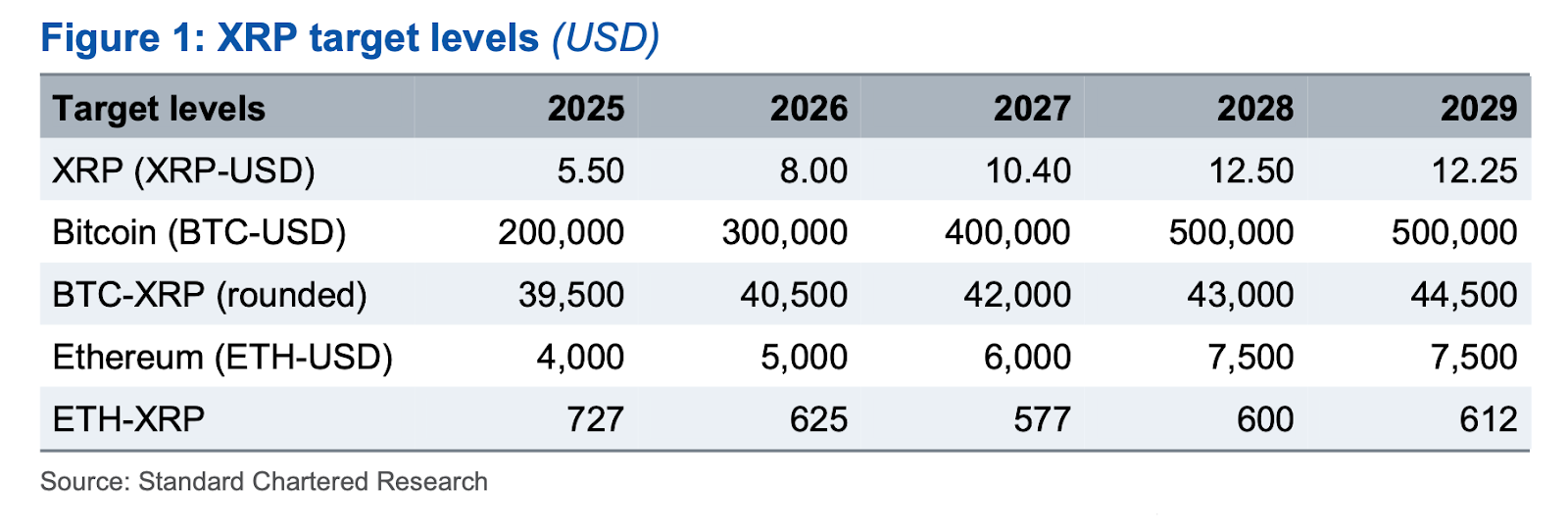

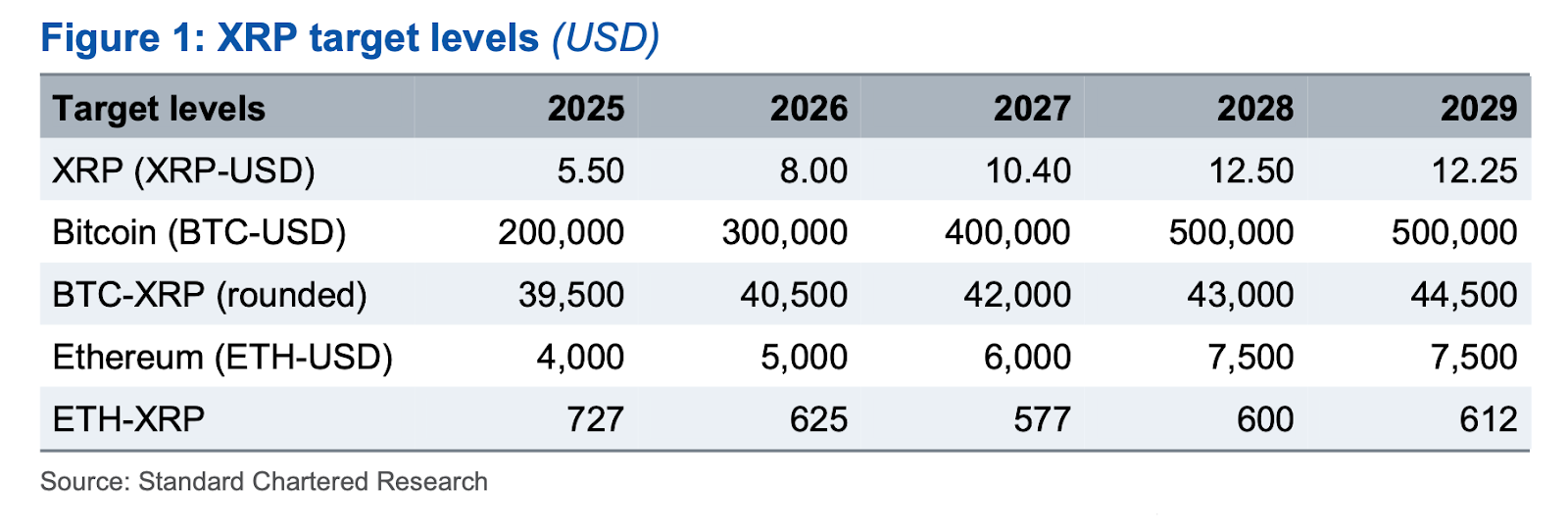

Commonplace Chartered predicts that XRP might rise above 300% to $12.50 by 2028. The financial institution’s roadmap might set worth targets at $5.50 (2025), $8 (2026), and $10.40 (2027), and problem Ethereum’s market place.

Main development drivers embrace the US Spot XRP ETF by October. Many individuals predict that the product will appeal to $4 billion to $8 billion inflows. Along with XRP’s core utility for cross-border funds, there are help elements. Ripple will transfer to Stablecoins, and tokenization might additional promote adoption.

Kendrick additionally believes that by 2029 Bitcoin might attain $50K and elevate Altcoins like XRP.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version shouldn’t be responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.