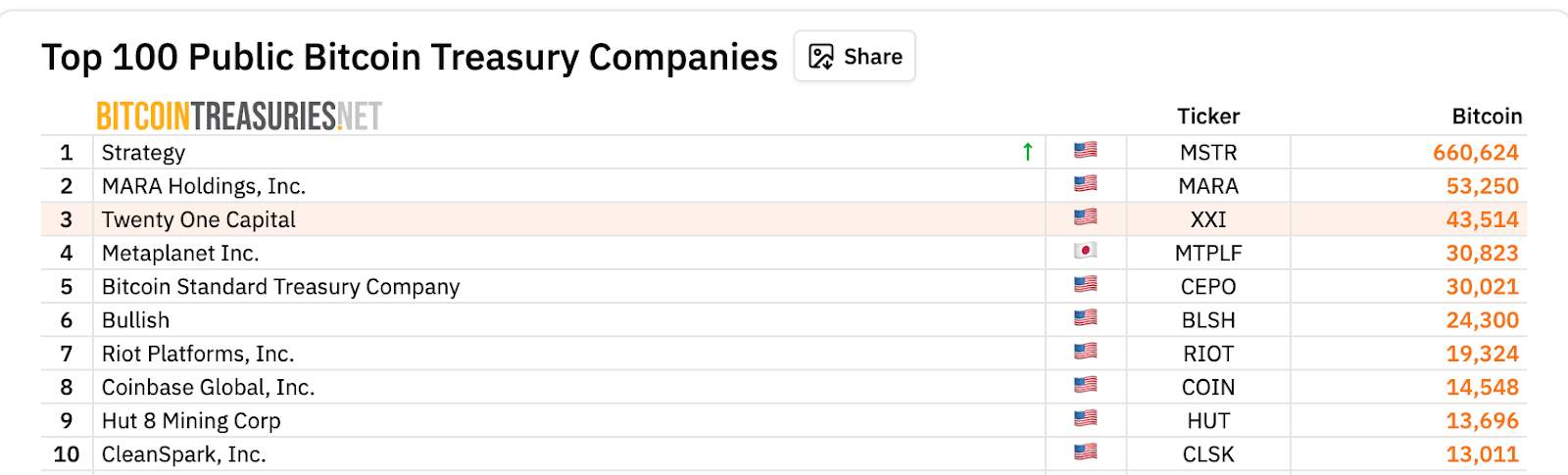

- Twenty One Capital is listed on the NYSE with 43,514 BTC and $3.9 billion in Bitcoin treasury.

- Jack Mallers stated the corporate will purchase “as a lot Bitcoin as attainable” underneath ticker XXI.

- Backers embrace Tether, Bitfinex, Cantor Fitzgerald, and SoftBank, and it has raised over $850 million.

Twenty One Capital, the Bitcoin firm co-founded by Jack Mallards, is listed on the New York Inventory Trade underneath the ticker XXI.

The transfer immediately places Twenty One Capital among the many world’s largest public-sector Bitcoin holders.

third largest public Bitcoin holder on day one

The itemizing follows a enterprise mixture with Cantor Fairness Companions, which launched the corporate with 43,514 BTC value roughly $3.9 billion.

This immediately makes Twenty One Capital the third largest publicly traded Bitcoin holder behind MicroStrategy and Marathon.

Mallars stated stay on CNBC that his mission was to “purchase as a lot Bitcoin as attainable.” Nevertheless, he emphasised that TwentyOne isn’t just a method of holding BTC.

The corporate plans to construct a complete Bitcoin-focused monetary ecosystem, together with capital markets advisory, lending fashions, and Bitcoin instructional media.

“Bitcoin is trustworthy cash,” Mallards stated, including that the corporate’s purpose is to provide bitcoin “the place it deserves within the world market.”

institutional assist

The NYSE debut is supported by quite a few institutional companions together with Tether, Bitfinex, Cantor Fitzgerald, and SoftBank.

Twenty One’s PIPE financing contains $486.5 million in convertible senior notes and roughly $365 million in widespread fairness commitments.

Mitchell Askew, head of Blockware Intelligence, described the launch as a brand new template for Bitcoin-native publicly traded corporations. He famous that TwentyOne’s institutional community has the potential to make it a “main participant, not simply in Bitcoin, however within the grand arc of monetary historical past.”

Mixture of Bitcoin finance and operational enterprise

The corporate says its worth proposition extends past its BTC holdings. Twenty One plans to mix its personal funds with a revenue-generating operational enterprise constructed round Bitcoin infrastructure. Shareholders can even have entry to on-chain verification for full transparency of their holdings.

Mallars emphasised that the corporate’s long-term worth will come from each Bitcoin and the money circulate generated by the enterprise constructed on high of it.

XXI’s inventory worth began with some volatility, initially falling greater than 23% to $10.97, a transfer analysts described as typical for an preliminary public providing. The inventory worth then stabilized as buying and selling continued.

Bitcoin is cash

The NYSE debut comes amid Mallars’ continued message that Bitcoin’s final goal is to perform as cash, not only a speculative asset.

Mallars, who beforehand spoke at Bitcoin Amsterdam, criticized conventional finance and argued that BTC already acts as actual cash for many who select to save lots of and commerce BTC.

“Folks have difficult the idea of cash to learn themselves,” he says. “What I used as cash was Bitcoin, as a result of I exchanged the work I used to be doing for Bitcoin after which exchanged it for issues I wished.”

Associated: Selling Bitcoin Transparency: Jacques Mallards’ Twenty One Capital Releases Ledger with Proof of Reserves

Mallars acknowledged strain from the media and influential figures to melt his message. He recalled that his advisers instructed him, “Do not say that on CNBC,” however he refused to compromise.

With the launch of the NYSE and plans to construct a big monetary and operational ecosystem, Twenty One Capital goals to develop into a number one Bitcoin custodian in addition to a builder of Bitcoin-native monetary infrastructure.

In accordance with Mallers, its mission is rooted in honesty, transparency, and the assumption that Bitcoin is “trustworthy cash” and deserves a central place in future world markets.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t answerable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.