- Zcash maintains bullish momentum as value construction kinds highs and lows

- Rising open curiosity signifies dealer confidence and alerts potential value motion

- On-chain inflows and decline in change withdrawals verify the buildup of recent traders

Zcash (ZEC) continues to draw market consideration because it maintains a robust bullish setup, supported by each technical indicators and elevated investor exercise. The cryptocurrency has maintained an upward trajectory since rebounding from the $120 space, exhibiting a constant sample of highs and lows. This technical formation means that the bullish pattern stays intact, and merchants shall be watching to see if ZEC can clear the following resistance zone round $375 to verify additional upside.

Value construction and technical outlook

ZEC is at the moment buying and selling round $356 and stays above necessary short-term help. The 20-EMA is round $331 and the 50-EMA is round $305, each of which act as dependable dynamic help zones.

Moreover, the Fibonacci retracement drawn from the $122 low to the current $375 peak highlights key demand areas at $278, $249, and $219. These ranges are in step with historic accumulation areas and recommend sturdy shopping for curiosity ought to costs reverse.

Because of this, analysts word that the 20, 50, 100, and 200 EMAs stay positively stacked, supporting bullish momentum. A sustained shut above $375 might pave the way in which for the $400-$420 vary. Conversely, a decline beneath $331 might set off a short-term rebound to $305 or $278, the place recent shopping for strain might reappear.

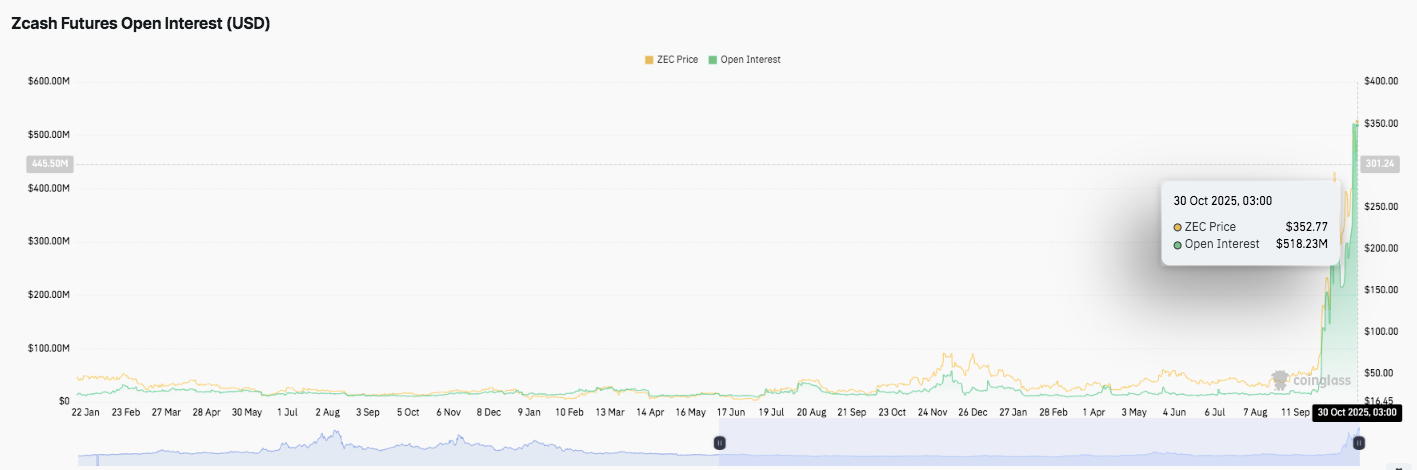

Market sentiment strengthens as open curiosity rises

Investor optimism seems to be growing, reflecting the sharp rise in Zcash futures open curiosity. As of October 30, open curiosity stood at roughly $518 million, the best stage in additional than a yr.

Associated: Cardano value prediction: ADA threat breakdown as $25 million outflow collides with Laios milestone

This soar represents a five-fold improve over ranges at first of 2025, when exercise remained beneath $100 million. This pattern signifies a brand new inflow of leveraged positions and elevated speculative participation, typically previous giant value actions.

Subsequently, this surge in derivatives publicity means that merchants are bracing for potential volatility and sustained upside value motion, reinforcing bullish sentiment throughout the ZEC market.

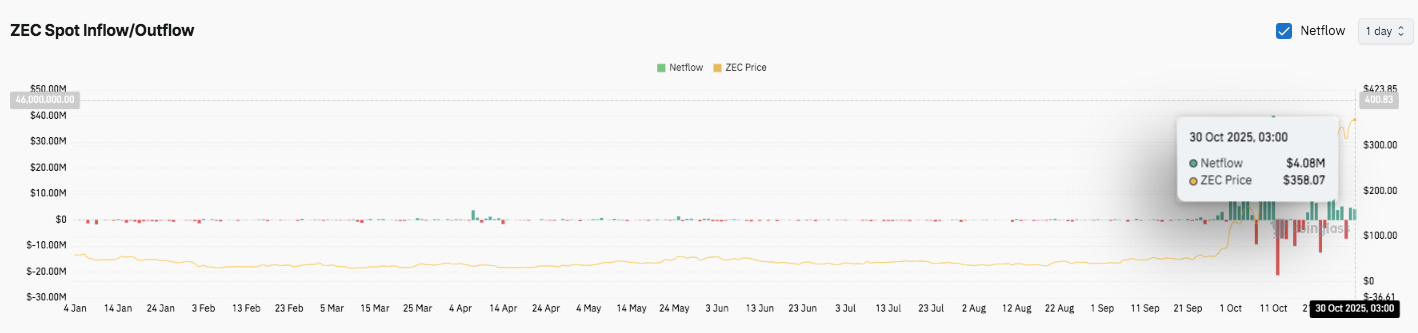

On-chain flows present new accumulation

Along with derivatives exercise, Zcash’s on-chain metrics additionally mirror an upturn in investor habits. On October 30, internet inflows exceeded $4 million, marking a decisive change from the extended interval of outflows seen from September to mid-October. Moreover, forex withdrawals have slowed, suggesting traders are holding positions in anticipation of continued positive aspects.

Zcash (ZEC) technical outlook: key ranges stay necessary heading into November

- High stage: $375, $400, and $420 function instant resistance zones. A break above $420 might open the door to $465 or $500.

- Cheaper price stage: Preliminary help is positioned close to $331 (20-EMA), adopted by $305 (50-EMA) and $278 (Fib 0.618 retracement). If the state of affairs stays beneath $278, it might result in additional decline to $249 or $219.

- Higher restrict of resistance: $375 stays a key stage for medium-term bullish continuation. If the worth closes above this zone, it would show the energy of the brand new upside.

The broader chart construction reveals that ZEC stays stable throughout the ascending channel that has shaped for the reason that $120 base in early 2025. The EMA (20 > 50 > 100 > 200) stays optimistic, reinforcing the prevailing uptrend. Momentum indicators recommend that we’re in a gentle cooling part after the current highs, however the construction stays intact.

Will Zcash proceed to rise?

Zcash’s value motion heading into November will rely upon whether or not the bulls can shield the $331-$305 vary whereas sustaining sturdy derivatives participation. Sustained inflows and rising open curiosity point out that momentum might rapidly rebuild as soon as $375 is cleared. A decisive break above this zone might ship ZEC in direction of $420 and even $465 within the coming weeks.

Associated: Solana Value Prediction: SEC ETF Approval Units Up for $225 Breakout

Conversely, if it fails to maintain above $305, the asset may very well be uncovered to a extra extreme correction close to $278 and even $249, which might result in re-entry by long-term consumers. Total, ZEC stays in a bullish construction and its subsequent transfer will rely upon how nicely it consolidates earlier than the following stage of volatility enlargement.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.