- Zcash has risen 900% since September, topping $500 for the primary time since 2018.

- Greater than 30 % of ZEC’s provide is at present held in shielded swimming pools, tightening change liquidity and amplifying value volatility.

- Value is effectively above the important thing EMA, indicating sturdy pattern momentum, however growing the chance of short-term consolidation.

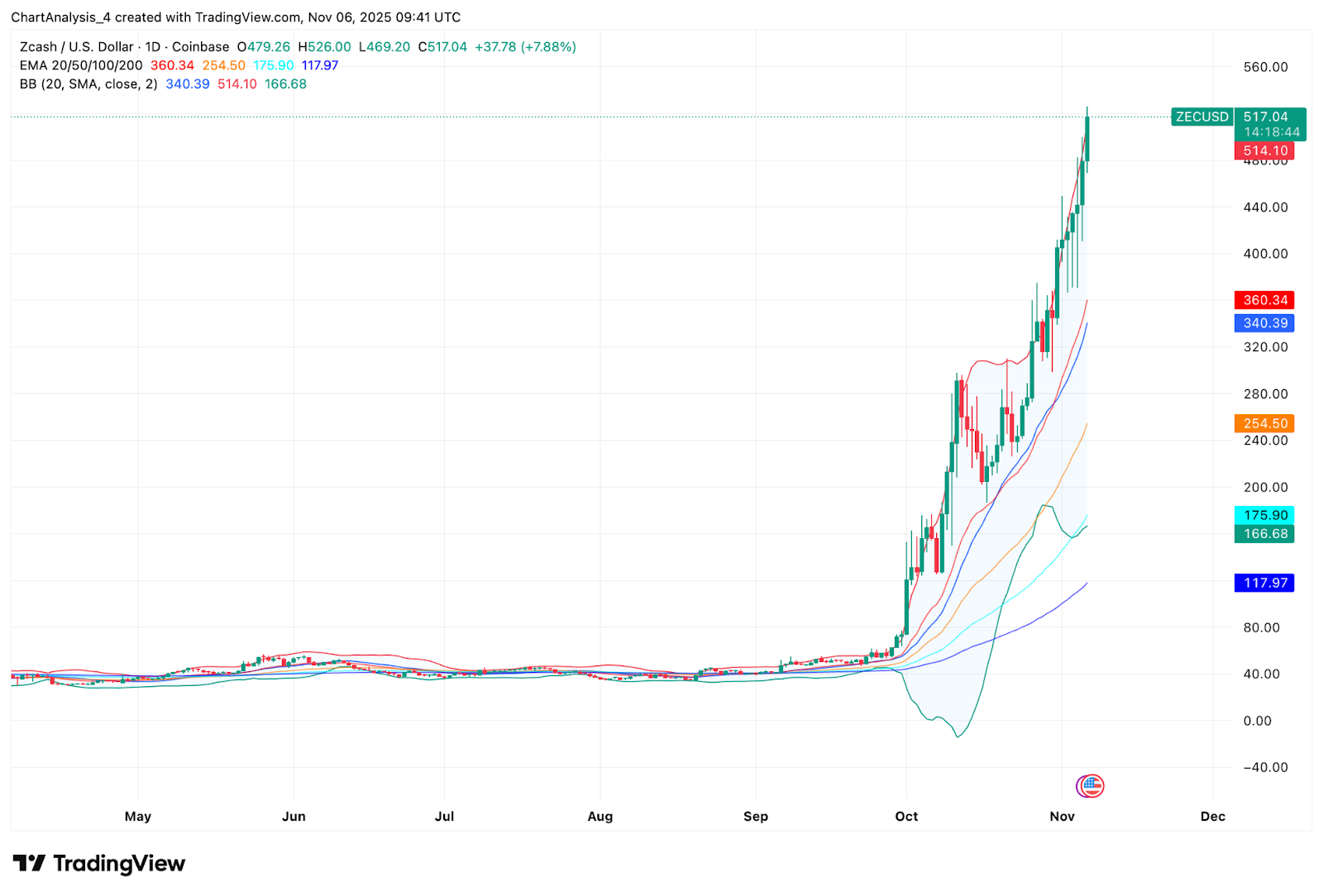

Zcash value is buying and selling round $517 at this time after breaking above the psychological $500 degree for the primary time since 2018. This surge follows a 900% rally since early September, marking one of many strongest strikes amongst large-cap tokens this quarter. The present rally is placing stress on patrons to carry excessive because the market checks whether or not momentum can prolong into the $550-$600 space.

This breakout isn’t speculative noise. That is pushed by structural upgrades to Zcash’s privateness structure, a surge in demand for anonymity on account of elevated regulatory oversight, and a brief squeeze throughout derivatives markets. Greater than 30 % of whole provide is at present held in shielded swimming pools, decreasing seen circulating float and tightening liquidity on exchanges. The lower in float has amplified the worth elasticity, and up to date flows point out that patrons are exiting the coin moderately than making a robust promote.

Parabolic construction extending away from the EMA

The each day chart reveals that Zcash is buying and selling at an excessive vertical angle. The 20-day EMA is close to $360, the 50-day EMA is close to $254, and the 100-day EMA is close to $175. Value stays over 40 % above the closest EMA and practically thrice the gap from the 100-day EMA. Such a separation reveals purchaser confidence and in addition signifies that the market is nearing some extent the place a pause will assist reset momentum.

Bollinger bands spotlight related imbalances. Value is driving on the higher band with none significant retracement. This conduct happens throughout sturdy breakout phases, however the longer the chart is caught in a band, the extra doubtless a cooling part or consolidation is. The mid-band value is at present near $340. An in depth beneath the mid-band represents a transition from a breakout to a breakout.

The present candlestick reveals a clear excessive round $526. There are not any technical weaknesses but, solely vertical acceleration. To validate a continuation, the worth wants to remain above the current excessive moderately than forming a decrease excessive.

Patrons withdraw when short-term charts settle down

The 30-minute chart reveals the primary indicators of moderation. After hitting $526, the worth retreated in the direction of session VWAP and is now close to $499. All through the session, every contact of VWAP attracted new bids. This motion signifies lively help from intraday merchants moderately than speculative monitoring.

RSI is close to 61. It has cooled down with out collapsing from the earlier peak. A decline in RSI throughout an uptrend suggests wholesome rotation moderately than fatigue.

This construction will stay in place so long as the worth stays above VWAP and continues to make new lows. If the worth drops beneath VWAP on account of elevated quantity, it is going to be the primary sign that short-term merchants are taking income moderately than accumulating.

Alternate flows present accumulation as a substitute of distribution

Spot movement information reinforces this trend-driven rally. In line with Coinglass, greater than $15 million in internet inflows entered Zcash on November sixth. This marks one of many largest buy-side flows of tokens in recent times. Throughout the identical interval, the worth soared to $516.

The heavy inflows in the course of the breakout point out that patrons are transferring their cash to personal wallets moderately than promoting on energy. Coupled with the truth that over 30% of the availability is at present held in shielded swimming pools, the liquidity accessible on exchanges stays tight. A lower in free float typically results in a sharper value response to further purchases.

outlook. Will Zcash go up?

If Zcash outperforms VWAP round $499 and closes each day above $520, patrons may attempt to push it in the direction of $550 and even $600. A break above $600 will affirm the continuation of the parabolic construction and prolong the bull market into the worth discovery zone.

If the worth falls by $499 and fails to maintain above $480, the transfer will transfer from a managed consolidation to a correction construction. A deeper pullback will goal the 20-day EMA close to $360, the place the credibility of the pattern might be examined for the primary time.

The pattern stays bullish, however after rising 90% in two months, the worth may see some consolidation earlier than the following leg.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.