- ZEC’s sustained uptrend and robust assist maintain patrons firmly in management this month.

- Rising futures open curiosity signifies intense hypothesis and elevated volatility threat.

- New institutional accumulation will increase confidence in ZEC’s long-term privateness imaginative and prescient.

Zcash is as soon as once more gaining market consideration as merchants ramp up exercise throughout spot and derivatives markets. The asset continues to point out strong power on the 4-hour chart, even after a short pullback earlier this week.

Along with staying above key assist ranges, ZEC additionally receives robust assist from institutional traders, reinforcing confidence in its long-term story. The mixture of chart stability, futures growth, and new accumulation makes ZEC one of many hottest privateness belongings heading into late November.

Market construction that helps additional upside

ZEC maintains a constant upward pattern that began in early October. The market continues to make highs and lows, exhibiting that patrons are nonetheless in management.

Worth fell across the 1.618 extension close to $717, however remained above native pattern assist. Moreover, short-term assist close to $647 continues to restrict draw back strain, whereas structural assist close to $620 reinforces the broader pattern.

Instant resistance stays between $683 and $690, with space merchants expecting a continuation. A sustained transfer above this zone might pave the best way for an extension to $717. Subsequently, ZEC might take a look at a brand new cycle degree if patrons defend the present assist degree.

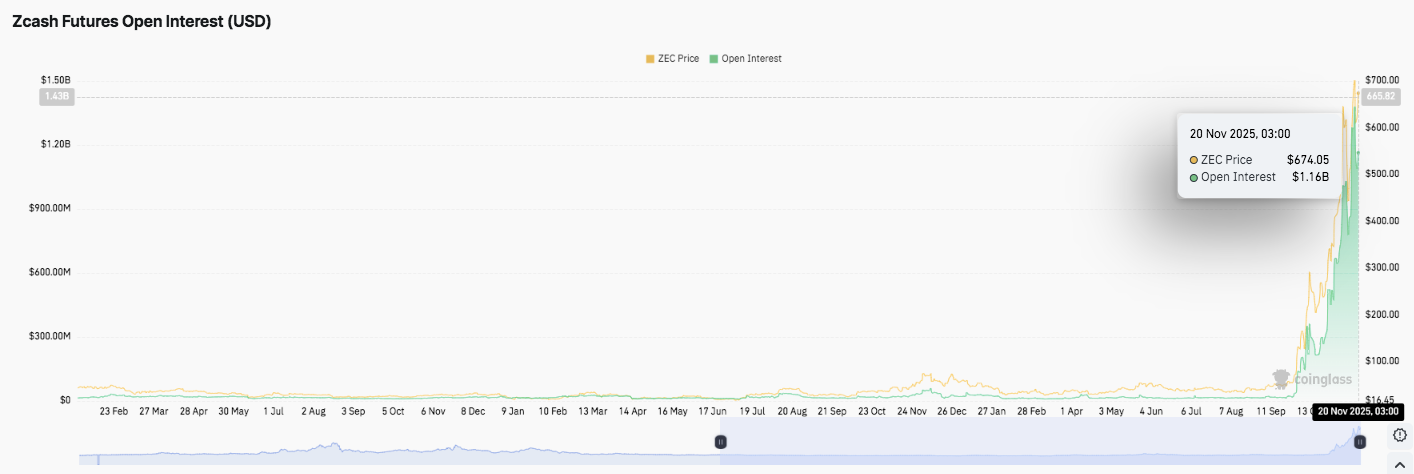

Derivatives buying and selling indicators elevated hypothesis

Open curiosity in ZEC futures soared in November. It rose to $1.16 billion by Nov. 20 as merchants elevated their publicity. This enhance coincided with ZEC surging in direction of the $670 space. Subsequently, leverage seems to be rising throughout the board, indicating stronger conviction and better volatility threat.

The latest progress means that merchants expect continued worth motion following ZEC’s fast worth growth. Moreover, this sharp enhance signifies that each lengthy and brief positions are being aggressively constructed, making the market extra delicate to surges in liquidations.

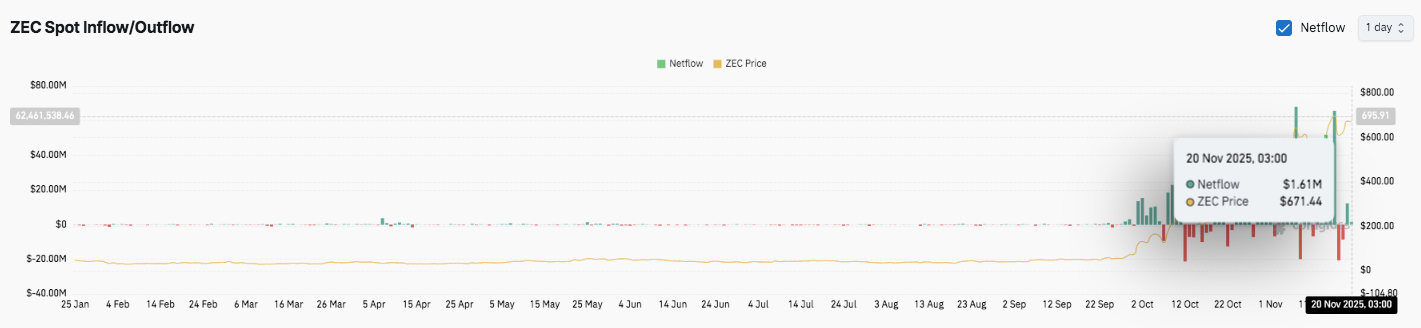

Spot flows reveal energetic rotation

Spot influx and outflow traits have change into extra erratic in latest weeks. Exercise remained quiet all year long, however abruptly modified in late October. Giant inflows have been seen throughout worth declines, suggesting merchants have been altering positions in the course of the correction.

Nonetheless, some robust outflows additionally occurred, indicating continued accumulation. The latest web influx of $1.61 million on November 20 displays this elevated rotation.

Institutional accumulation provides new catalysts

Cypherpunk Applied sciences has elevated its ZEC holdings after buying practically 30,000 extra tokens. The corporate presently controls over 1.43% of the community provide.

Moreover, new leaders have joined the board, demonstrating a broader dedication to the privateness house. The corporate views ZEC as a strategic asset that aligns with rising issues about digital privateness.

Technical outlook for Zcash (ZEC) worth

As Zcash strikes deeper into the present pattern cycle, key ranges stay properly outlined.

- Prime degree: The Fibonacci extension zone of $683-690 after which $717-720 is the following huge hurdle. A breakout above this space might prolong in direction of a better pattern prediction and point out new momentum.

- Cheaper price degree: $647-650 serves as rapid short-term assist, with $620 indicating stronger structural fundamentals. The $555 space is in line with deeper retracement assist and can lock in a broader bullish construction if volatility widens.

Technical situations counsel that ZEC is compressing between the $650 assist band and the $690 resistance shelf. This vary discount usually precedes a decisive growth section, particularly as open curiosity will increase or influx patterns change quickly. Merchants at the moment are eyeing a strong break above $690 to substantiate a continuation in direction of the $720 resistance.

Will Zcash rise additional?

ZEC’s near-term path relies on patrons having the ability to keep the $647-$650 zone throughout continued consolidation. If this degree holds, the value might retest the $683-$690 cluster and the breakout might revisit the $717-$720 extension. Previous pattern traits and up to date derivatives progress counsel greater volatility sooner or later.

If momentum builds with recent capital inflows, ZEC might try a transfer in direction of a brand new cycle excessive above $720. Nonetheless, if the value is unable to guard itself at $620, there’s a threat of a deeper retrace to $555, the place robust demand has appeared previously. For the time being, ZEC is buying and selling in a pivotal zone as market confidence and construction affirmation form its subsequent route.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.