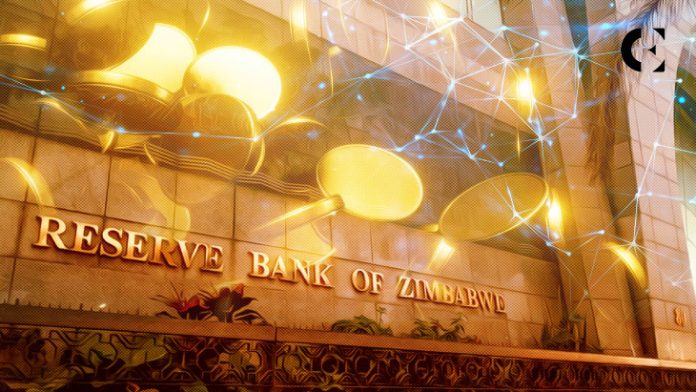

- Zimbabwean banks are contemplating gold-backed digital tokens as collateral.

- The nation plans to ascertain a digital foreign money that can be utilized for on a regular basis transactions.

- A number of the international locations which have began CBDCs are Singapore, India and Nigeria.

As a part of an effort to modernize the monetary system and develop lending choices, Zimbabwean banks are contemplating utilizing newly launched gold-backed digital tokens as collateral for loans.

The transfer comes because the nation’s central financial institution seeks to ascertain a digital foreign money that can be utilized for on a regular basis transactions, and monetary establishments search to adapt their techniques to accommodate this revolutionary type of cost. was damaged

In a latest e mail reply to Bloomberg, the Zimbabwe Bankers Affiliation expressed help for the adoption of gold-backed digital tokens. Lenders might want to incorporate a 3rd foreign money into current techniques to facilitate acceptance of those tokens as a method of compensation, the affiliation stated.

The affiliation additionally stated in a press release:

Because the steadiness of gold-backed digital tokens buying and selling currencies grows, it’s attainable that banks will supply all of their merchandise supplied in Zimbabwe {dollars} and US {dollars}.

Final week, the Central Financial institution of Zimbabwe acquired 135 functions to buy the newly launched token. This equates to a complete of 14 billion Zimbabwean {dollars}, equal to US$11 million.

Moreover, the token is backed by the nationwide gold reserve, which at present stands at 140 kilograms or £309. Greater than 71 kilograms of gold value of tokens had been offered at an public sale held afterward Thursday.

Notably, the Bahamas, Singapore, India and Nigeria have already launched digital currencies backed by their respective central banks. In the meantime, the UK is looking for public enter on its central financial institution digital foreign money (CBDC).

(Translate tags) Market information

Comments are closed.