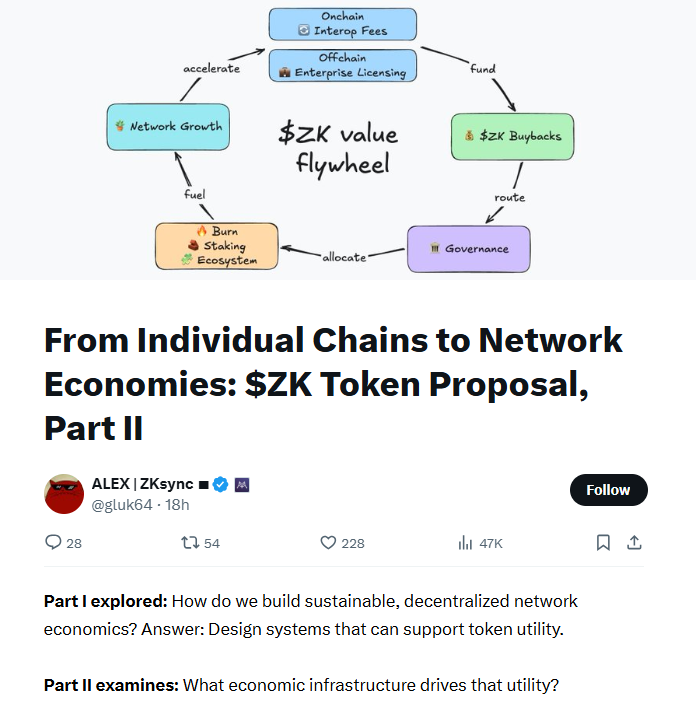

- Backside line: Founder Alex Gluchowski proposed transferring $ZK from a governance to a fee-collecting utility token.

- Mannequin: Revenues from cross-chain messaging and enterprise licenses fund token buybacks.

- Purpose: To monetize “ZK Gateway” as an built-in cost layer for institutional finance.

ZKsync founder Alex Gluchowski has proposed a brand new utility token mannequin for modern Ethereum-based protocols. In his newest publish on X, the famend innovator highlighted varied points of digital finance that he believes should be improved, whereas outlining proposed options to these wants.

Glukowski pointed to coordination issues within the monetary sector, notably the incompatible messaging networks on which international finance operates.

He mentioned the messages that drive monetary transactions world wide are trapped in incompatible silos, requiring the companies of costly trusted intermediaries.

Associated: US authorities shutdown settlement restores cryptocurrency liquidity, ZKsync, Starknet, Linea soar

“ZK Gateway” revenue mannequin

After outlining the varied levels of the messaging course of and their related prices, Glukowski determined that he might unlock super financial worth by streamlining monetary messaging. He mentioned the shortage of a verifiable shared coordination layer requires knowledge to be reconciled throughout many techniques, growing operational prices, dangers and delays. These are the issues he’s making an attempt to resolve by the newly proposed ZK token utility mannequin.

Gluchowski’s newest proposal, ZK Interop, goals to grow to be the idea for direct connections between organizations. Famend innovators describe this as a game-changer with implications far past funds. For instance, the answer can synchronize a number of financial institution directions and Treasury confirmations, and symbolize authorization and cost messages to card networks as verifiable receipts.

In response to Gluchowski, ZK Interop can break down the expensive multi-step post-trade affirmation and settlement course of when coping with securities into verifiable cross-chain, near-atomic occasions, orchestrate ISO-20022 messages, and finally allow PvP settlement of cross-border funds.

Business validation

In the meantime, Circle CEO Jeremy Allaire mentioned the pace of cash motion scales with the pace of knowledge, whereas explaining the significance of messaging within the monetary business. He believes that financial throughput scales nonlinearly as quickly as message coordination between techniques approaches near-zero delay.

Gluchowski’s purpose is to make use of the proposed innovation to eradicate company latency and rework the present fragmented and gradual message chain into prompt, verifiable coordination.

Associated: ZKsync Value Prediction: Merchants flip bullish as sentiment rises on Tokenomics proposal

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.