- ZKsync regains bullish momentum after reclaiming key Fibonacci retracement degree

- Rising derivatives exercise suggests rising dealer confidence in ZKsync restoration

- Tokenomics’ shift to earnings-linked share buybacks improves long-term prospects for utilities

ZKsync has entered a powerful restoration section after months of downward strain, and technical alerts recommend that the upward momentum continues. The token has not too long ago rebounded from October lows round $0.012, surpassing a number of key Fibonacci ranges and displaying renewed curiosity from merchants throughout main exchanges. A mix of technological restoration, elevated derivatives exercise and an evolving utility roadmap look like rising confidence in ZKsync’s medium-term outlook.

Sturdy rebound above key Fibonacci ranges

The 4-hour chart reveals that ZKsync efficiently retraced the 0.618 Fibonacci retracement at $0.05 and superior above the 0.786 degree at $0.07. The value is at present buying and selling round $0.073 after rising 2.56% throughout the day.

Rapid help is concentrated between $0.063 and $0.060, the place the 20-EMA and 50-EMA traces intersect. Sustaining this vary is crucial to take care of the bullish construction. The breakdown is that it might take a look at $0.046 concurrently the 100-EMA. Nonetheless, if it continues to commerce above $0.06, it might lay the groundwork for additional upside.

Resistance stays between $0.081 and $0.084, coinciding with the higher Bollinger Bands. A confirmed 4-hour shut above $0.084 might push the token in direction of $0.10, marking a full Fibonacci restoration from the October drop.

Derivatives surge displays rising market confidence

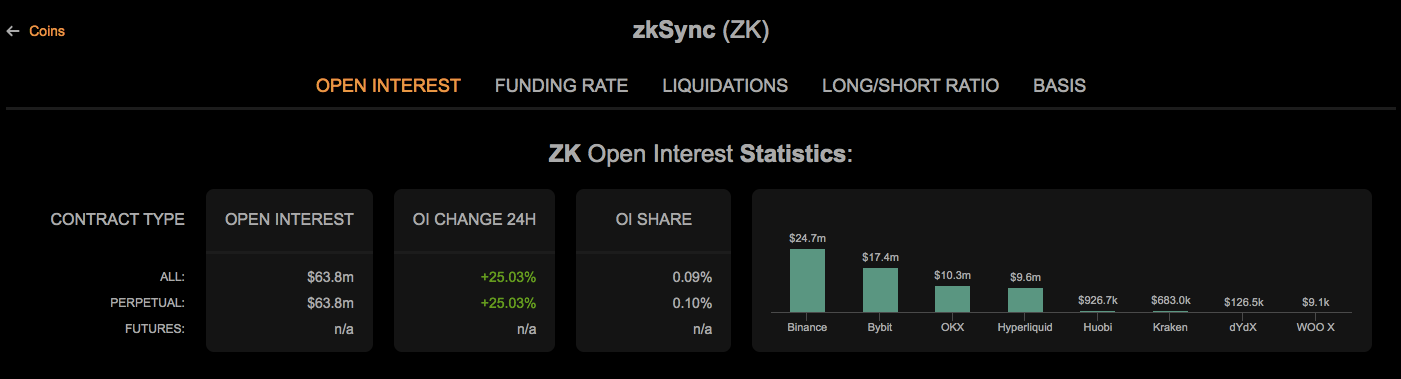

ZKsync’s open curiosity elevated by 25% to $63.8 million prior to now 24 hours, suggesting elevated speculative exercise. At the moment, Binance leads the record with $24.7 million in open positions, adopted by Bybit and OKX. The majority of this buying and selling quantity got here from perpetual contracts, reflecting merchants’ elevated confidence in near-term worth motion.

This improve in open curiosity corresponds to widespread optimism concerning ZKsync’s community improve and token utility transition. zkSync’s derivatives market share at present accounts for about 0.1% of complete cryptocurrency open curiosity, indicating sluggish however regular adoption amongst leveraged merchants.

The evolution of tokenomics: from governance to utility

Past market efficiency, zkSync’s subsequent section of progress is more likely to depend upon its altering tokenomics mannequin. Matter Labs CEO Alex Gluchowski not too long ago introduced a framework geared toward immediately linking community income to the ZK token financial system. Underneath this plan, proceeds from interoperability charges and institutional licenses will probably be used to purchase again ZK tokens.

Because of this, these repurchased tokens will probably be allotted to burn, staking rewards, and developer grants. Moreover, the not too long ago authorized TPP-12 proposal paves the best way for a pilot staking program, permitting holders to earn rewards for community participation. This marks a shift from a governance-driven mannequin to at least one targeted on sustainable financial utility.

ZKsync worth technical outlook

Key ranges stay clearly outlined heading into November. On the upside, ZKsync faces speedy resistance at $0.081 and $0.084, marking the higher Bollinger Bands and up to date native tops. A decisive breakout and a sustained shut above $0.084 might verify new bullish momentum and lengthen the rally in direction of the psychological zone of $0.095-$0.10.

On the draw back, preliminary help lies between $0.063 and $0.060, coinciding with the EMA 20 and 50 cluster. A lack of this degree might expose the 0.5 Fibonacci retracement round $0.046, the place the 100 EMA is at present matching. Additional weak spot might result in the value retesting the earlier breakout zone round $0.036-$0.04.

ZKsync’s technical scenario means that the token is consolidating after a powerful rebound and forming a possible continuation sample inside the ascending channel. The shifting averages are step by step turning greater, suggesting a near-term bullish bias. Nonetheless, momentum across the $0.08 degree seems to be stalling, leaving room for a short-term correction earlier than a sustained rally.

Will ZKsync broaden its rise?

ZKsync’s worth outlook will depend on whether or not the bulls can preserve management above the structurally linchpin vary of $0.06-$0.063. If this zone holds, the restoration path might stay intact and set the stage for a retest of the $0.084 and finally $0.10 ranges.

If shopping for strain will increase with future staking developments, volatility might improve within the bulls’ favor. Nonetheless, a decline beneath $0.05 would invalidate the bullish construction and return sentiment to a impartial correction stage. For now, ZKsync remains to be within the vital zone, the place confidence from merchants and affirmation from the technical degree will decide the following large transfer.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.