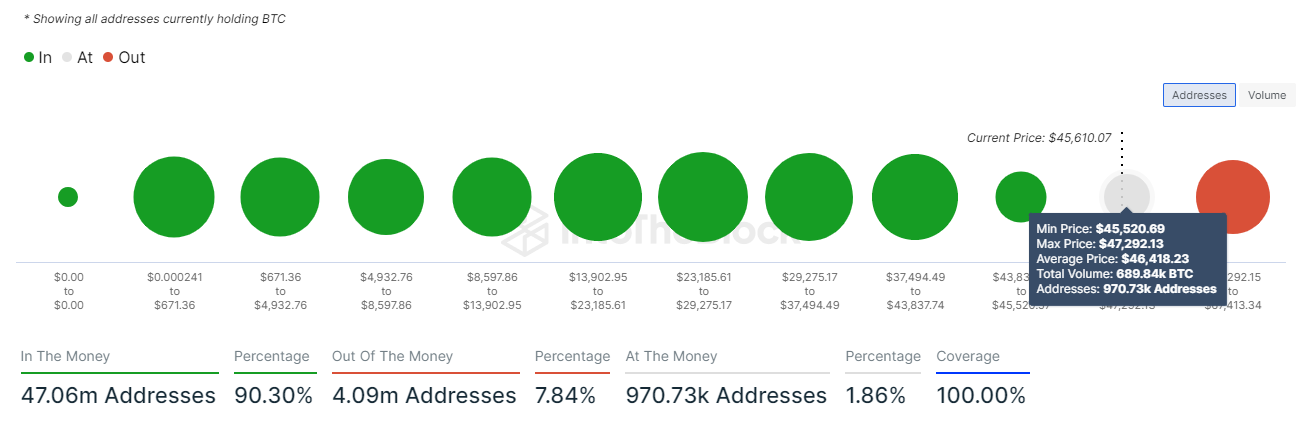

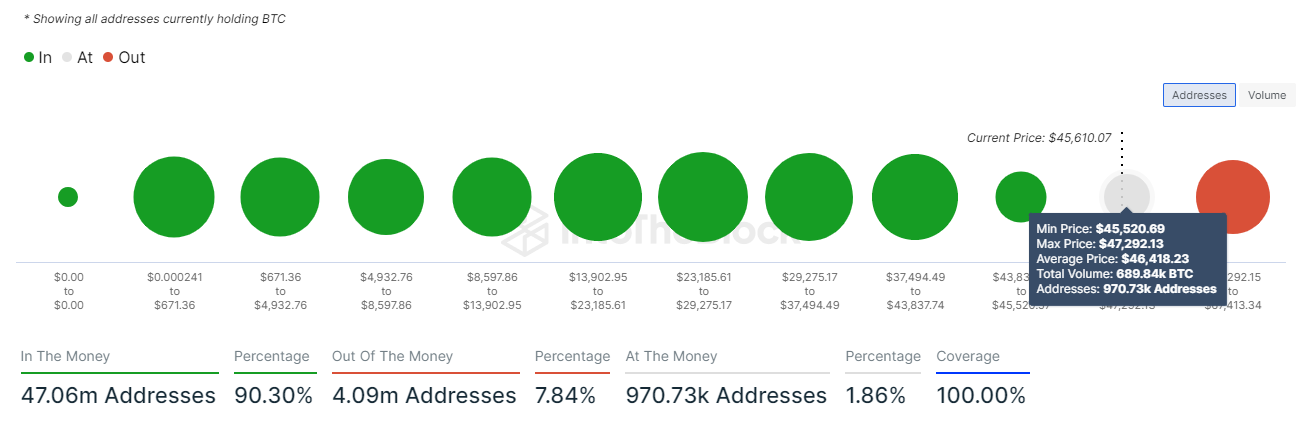

- Regardless of the market turmoil brought on by pretend Bitcoin ETF approval information, 90% of Bitcoin holders (970,000 addresses) are at present making income.

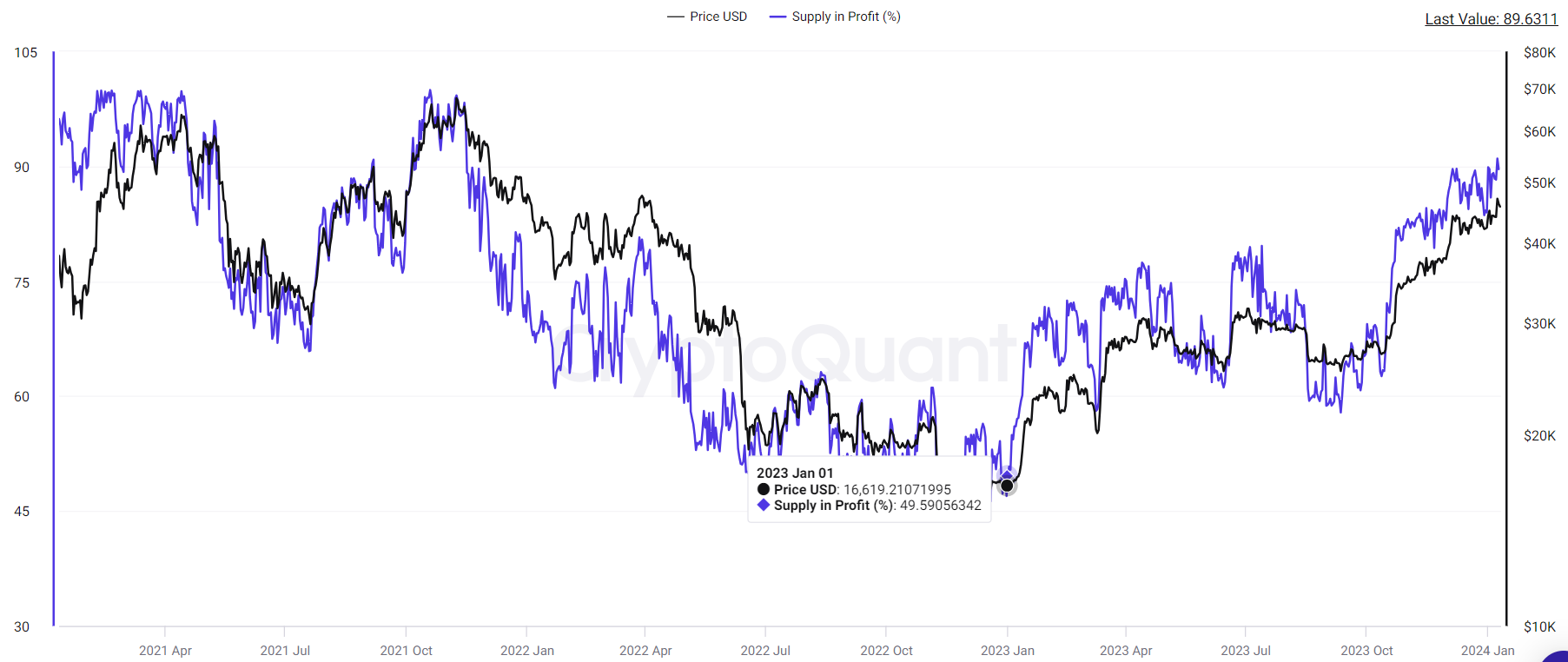

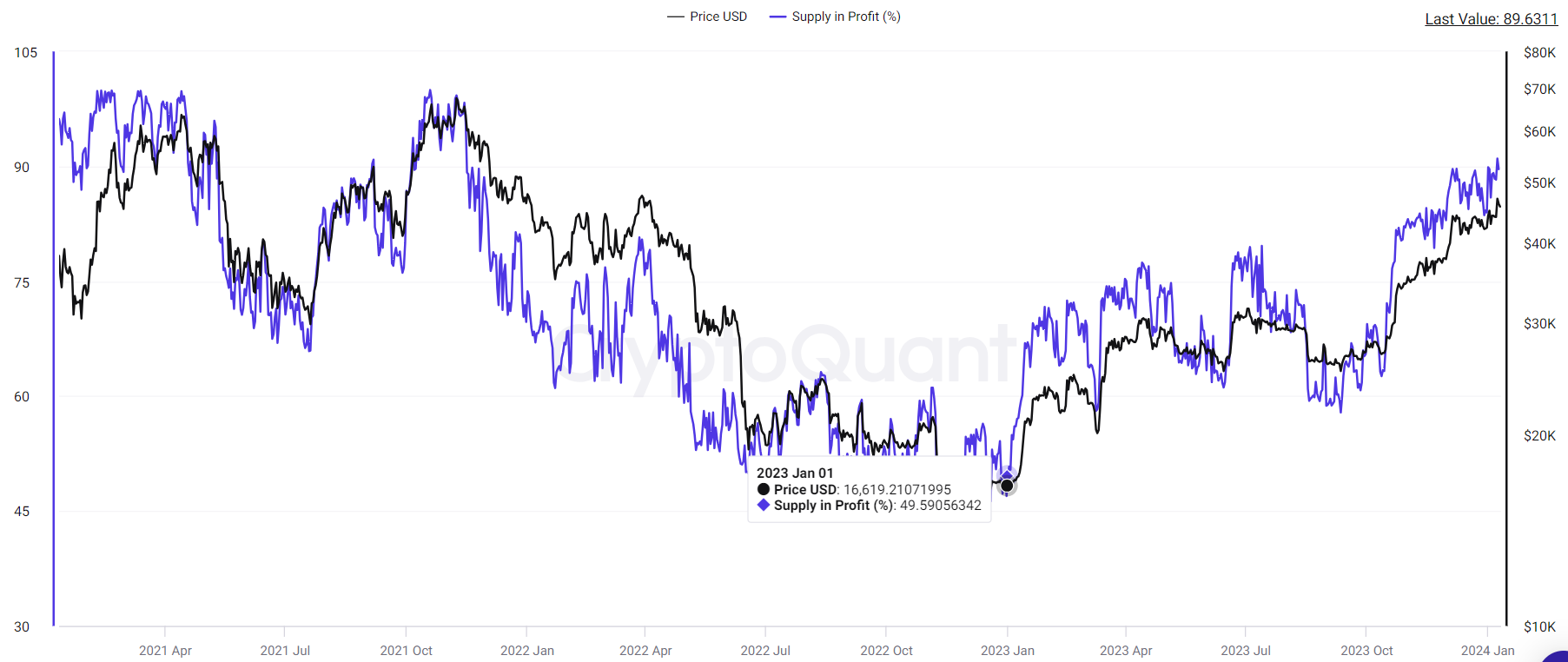

- CryptoQuant revealed that lower than half of Bitcoin holders have been worthwhile at first of 2023.

- The report warns {that a} market correction might happen if Bitcoin reaches $48,500, with help ranges at $34,000 and $30,000.

A wave of optimism has washed over the Bitcoin market, with 90% of holders sitting comfortably in revenue territory. The surge comes amid rising expectations for the approval of a spot Bitcoin exchange-traded fund (ETF) within the US, a possible catalyst for additional worth will increase.

Bitcoin costs soared to a 19-month excessive, reaching $47,900, however at one level fell to $45,100, following a false report posted on a hacked U.S. SEC Twitter account concerning the approval of a Spot Bitcoin ETF. It fell to the greenback. Regardless of this non permanent market disruption, over 970,000 addresses are at present worthwhile, with BTC buying and selling at round $45,600 on the time of writing.

Notably, CryptoQuant's knowledge reveals a dramatic shift in investor sentiment in comparison with the start of 2023, when lower than half of Bitcoin holders have been within the black. Bitcoin’s worth enhance of round 160% in 2023 and 50% previously six months has successfully put many long-term traders (HODLers) into worthwhile positions.

Nevertheless, amid all the joy, CryptoQuant analysts have issued a warning. Their current report highlights the potential risks related to the focus of unrealized positive aspects for Bitcoin holders. Sturdy demand and elevated buying and selling quantity for Grayscale Bitcoin Belief (GBTC) creates fertile floor for a pointy worth correction, even because the outlook for ETF approval factors to optimism , they declare.

One state of affairs outlined by CryptoQuant is {that a} market correction might happen if Bitcoin costs attain $48,500, the common worth for holders with a two- to three-year funding horizon. If such an occasion happens, the potential help ranges are between $34,000 and $30,000, which might result in a 10-20% decline.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.