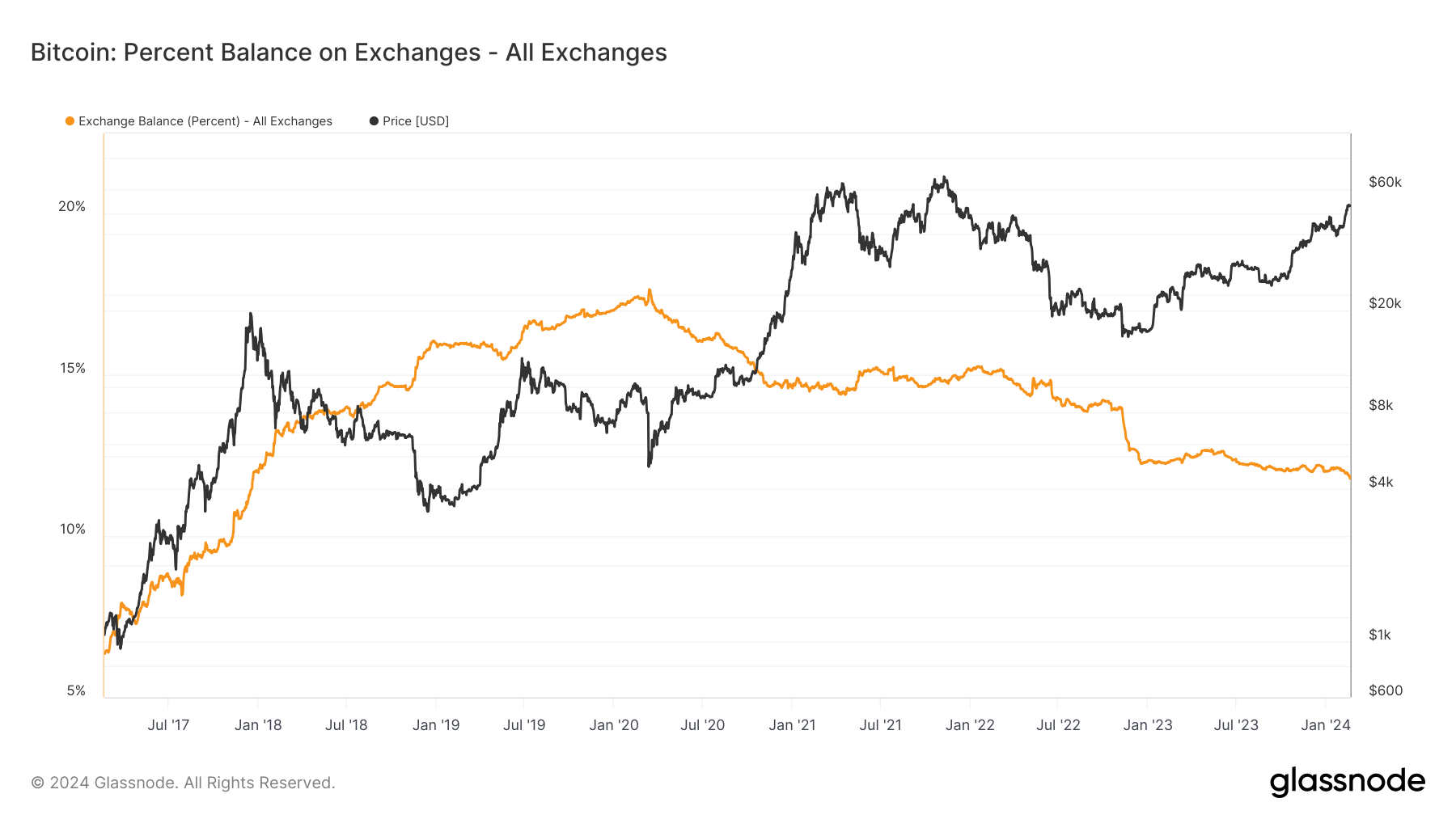

Since mid-March 2020, there was a noticeable decline within the quantity of Bitcoin saved in change wallets, indicating a big change in investor habits.

On the time, greater than 17% of the full Bitcoin provide was saved on exchanges, an all-time excessive. This development of declining change balances has continued unabated by means of the 2021 Bitcoin bull market, when the worth peaked at $69,000 in November of the identical 12 months.

This orbit can be prolonged till 2024. crypto slate Evaluation of Glassnode information reveals a continued decline in Bitcoin holdings on exchanges.

From January 1st to February nineteenth, the quantity of Bitcoin in change wallets decreased from 2.356 million BTC to 2.314 million BTC, the bottom stage since April 2018. In the meantime, the proportion of Bitcoin provide in change wallets decreased from 12.03% to 11.79%.

Bitcoin’s declining presence on exchanges means that holders are more and more transferring their belongings away from these platforms. This transfer may point out a broader strategic shift in direction of long-term holdings, or a response to basic market situations.

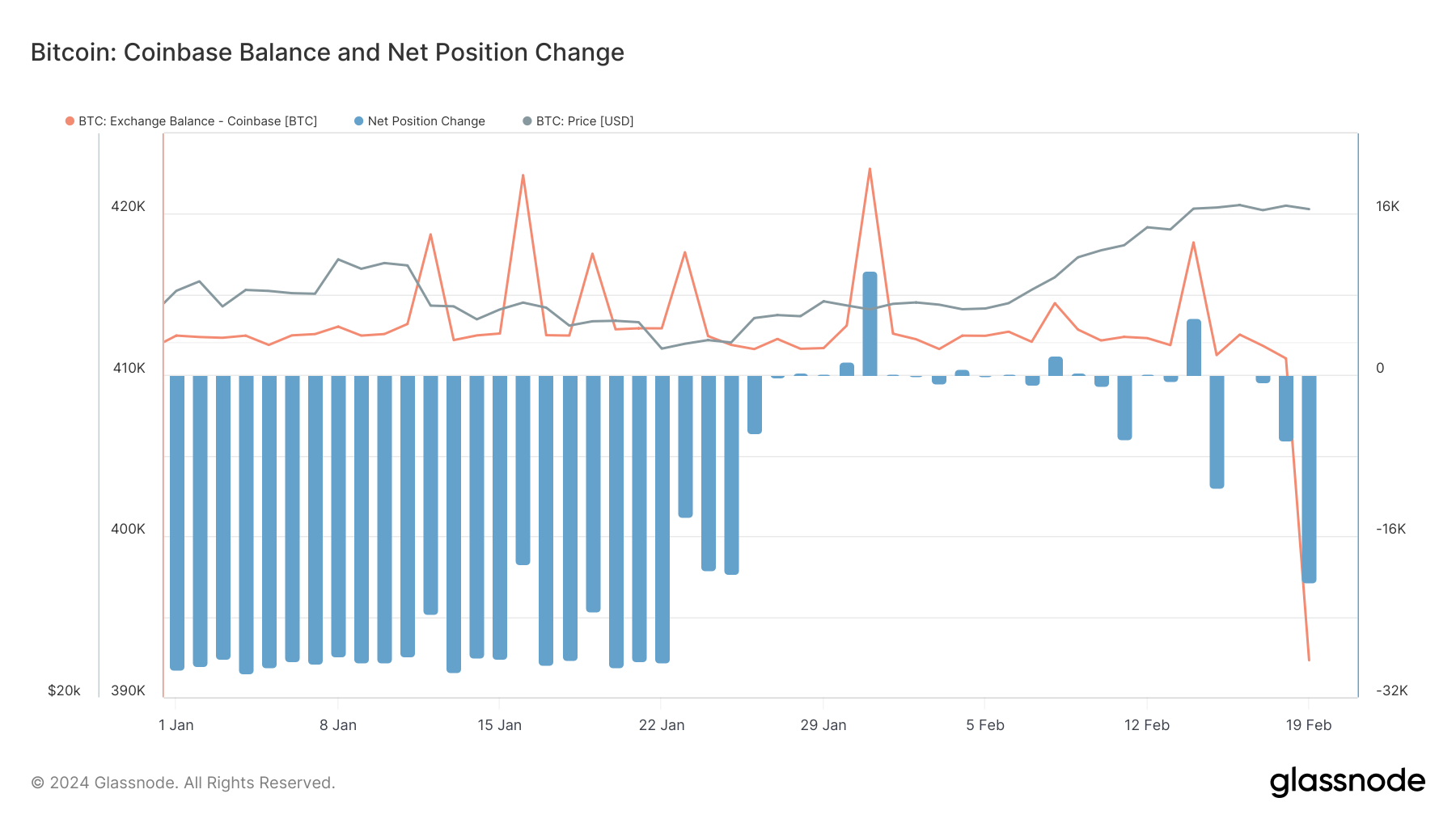

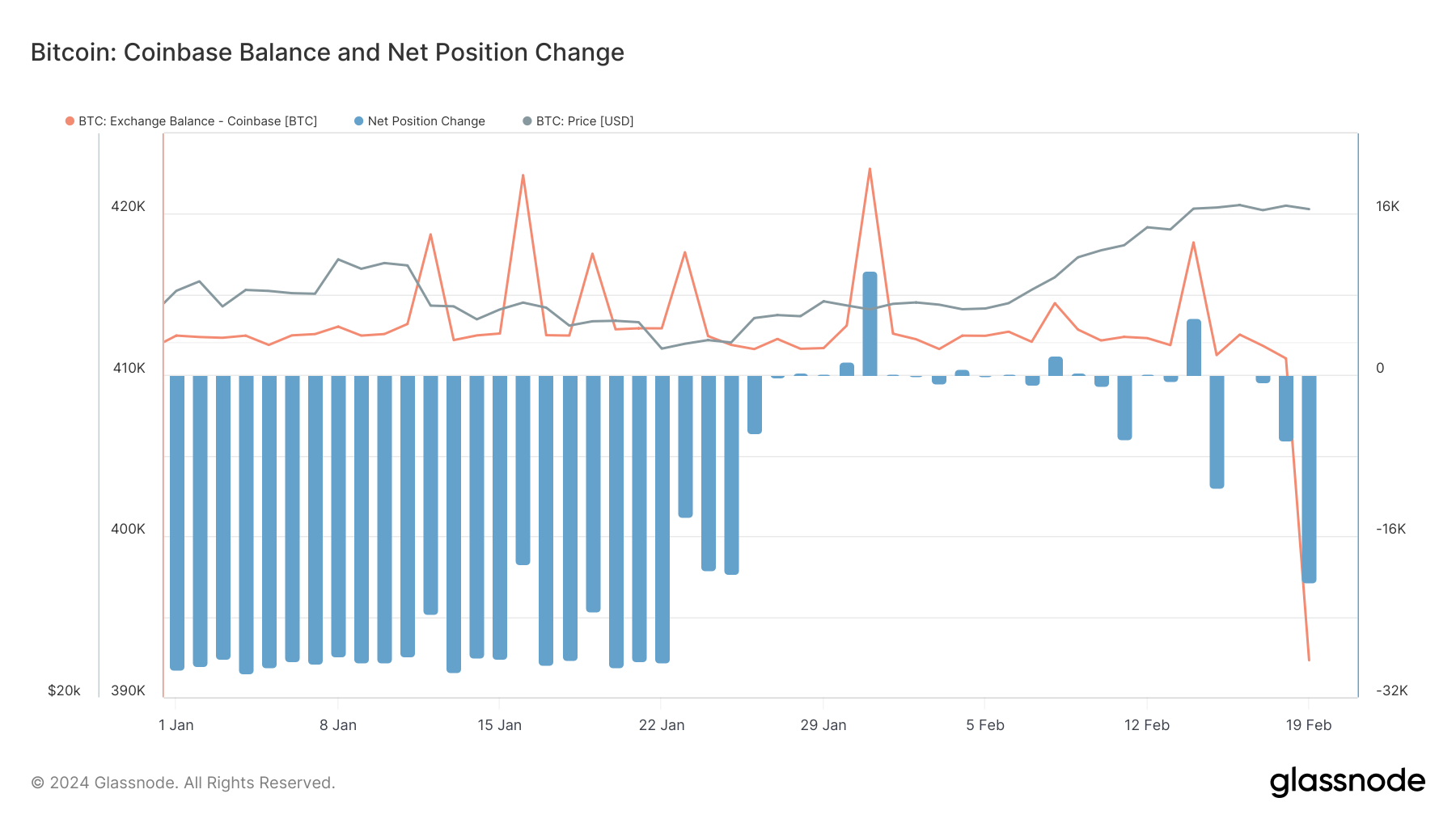

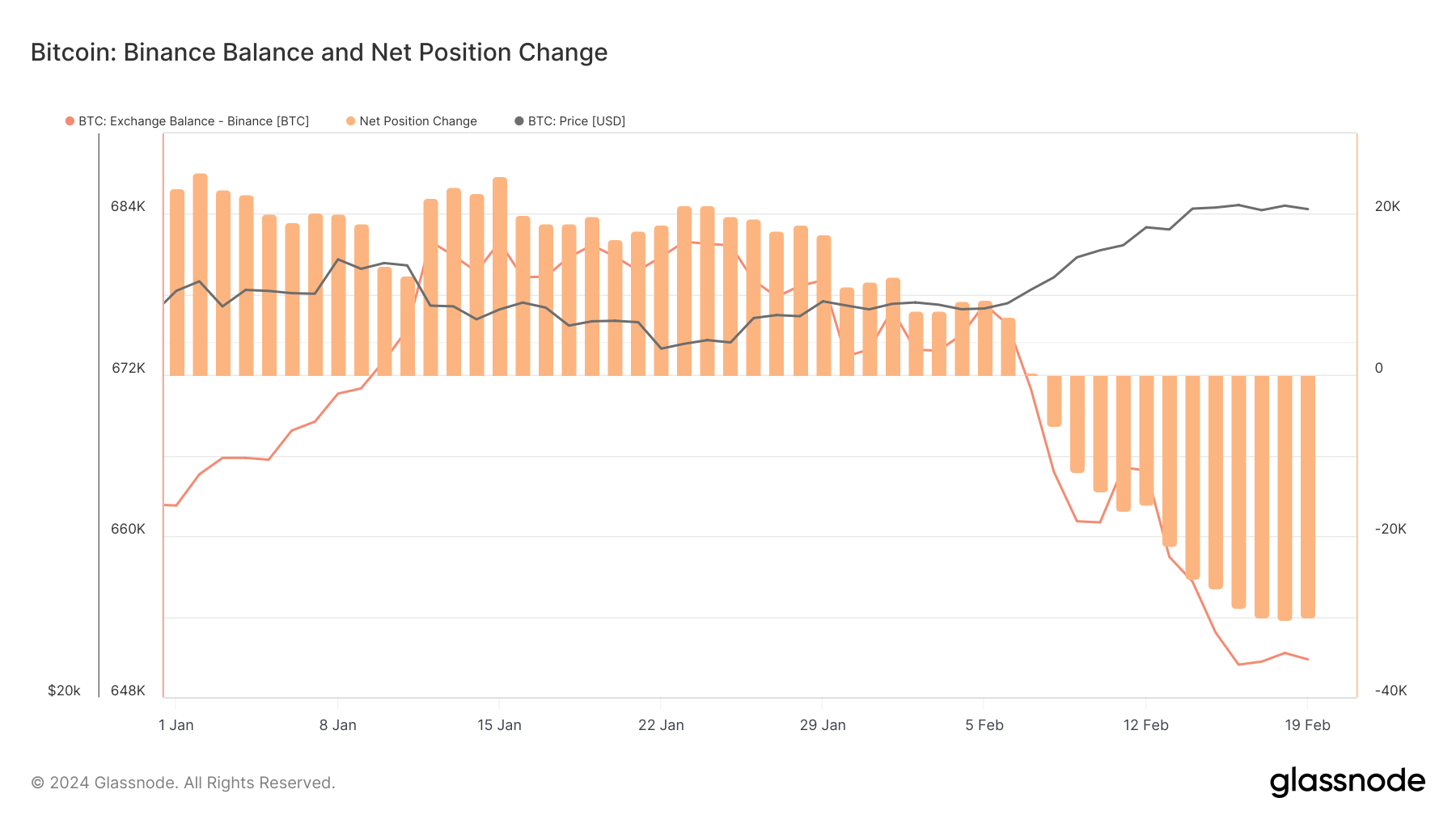

Inspecting particular exchanges reveals delicate tendencies and exceptions inside this broad sample.

Coinbase has skilled a big decline in Bitcoin balances, dropping by over 20,000 BTC from January 1st to February nineteenth, with constant internet outflows for the reason that finish of January.

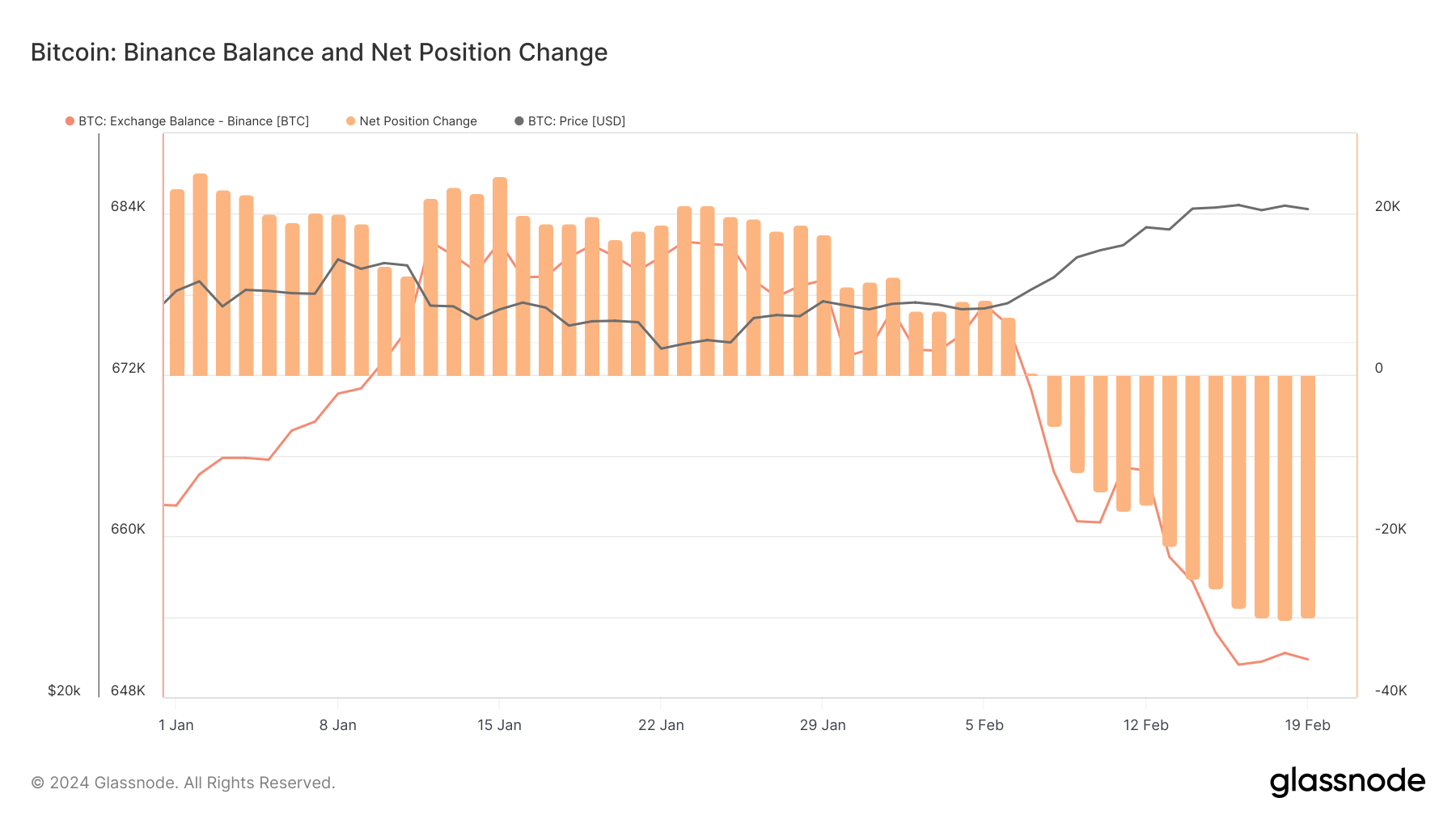

Binance has additionally seen a big decline in its Bitcoin stability this 12 months. The change's stability initially elevated till January 26, however then started to say no and internet outflows started on February 8.

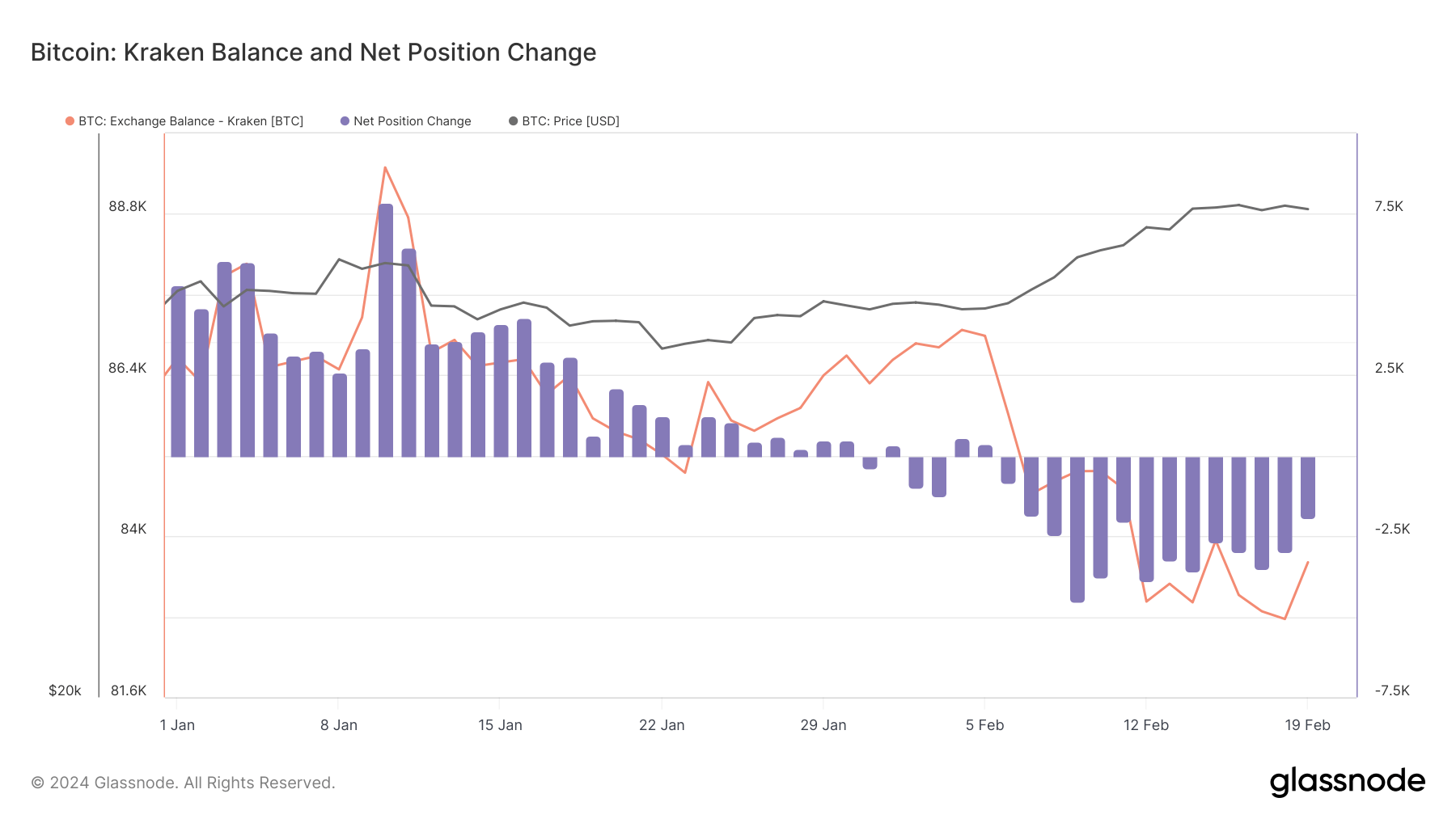

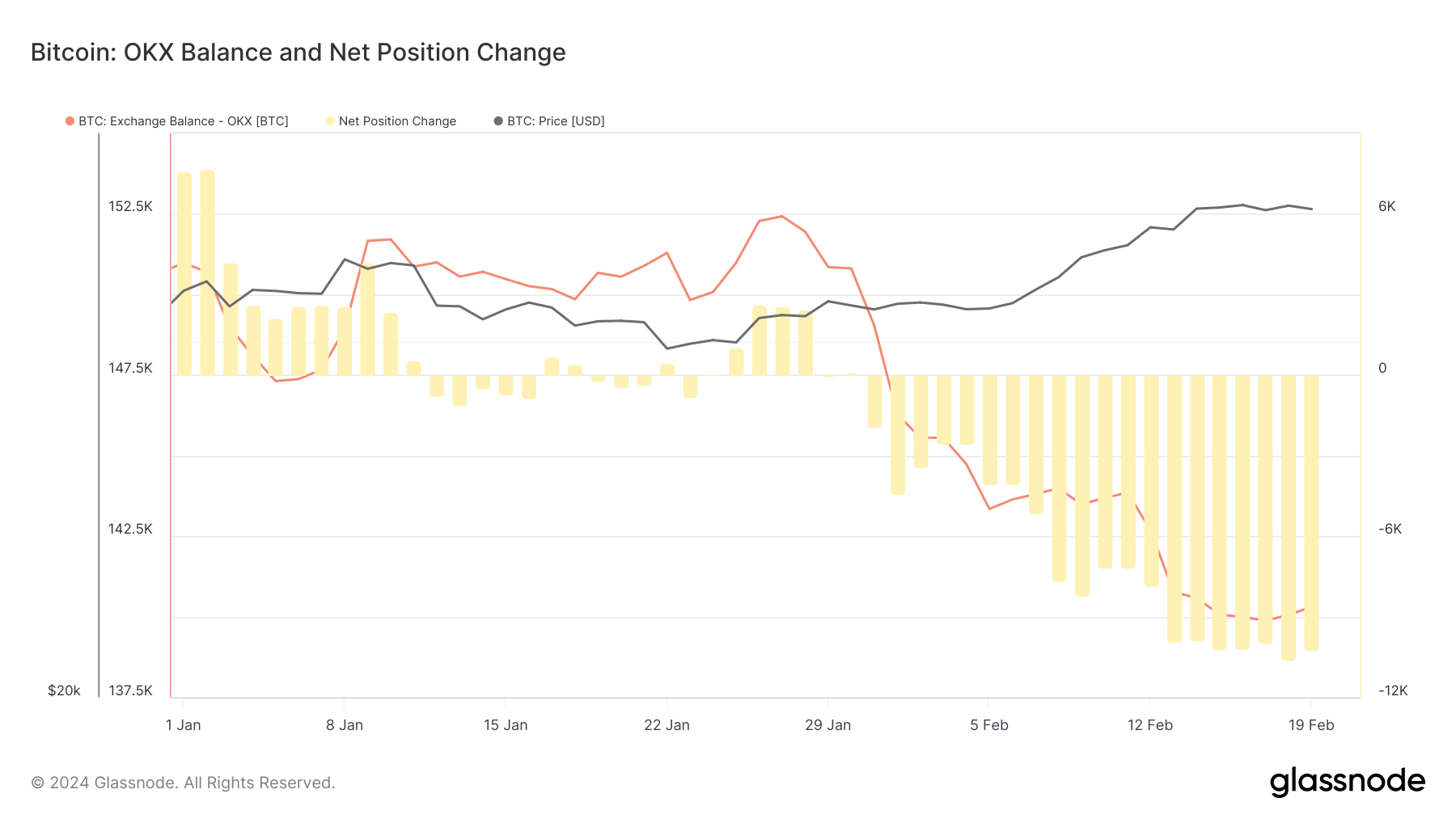

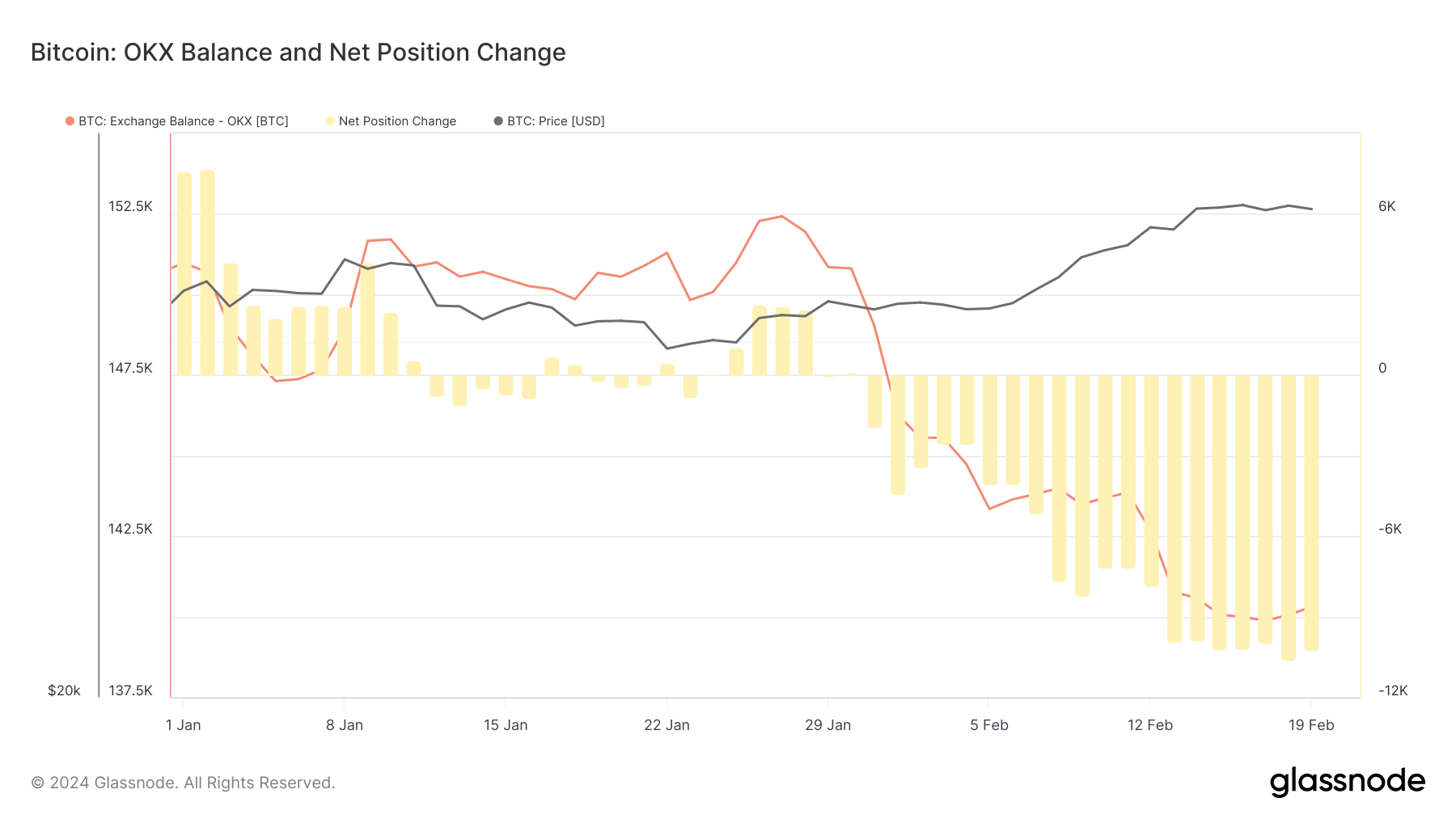

Kraken and OKX matched this development, recording important declines in internet outflows and Bitcoin balances.

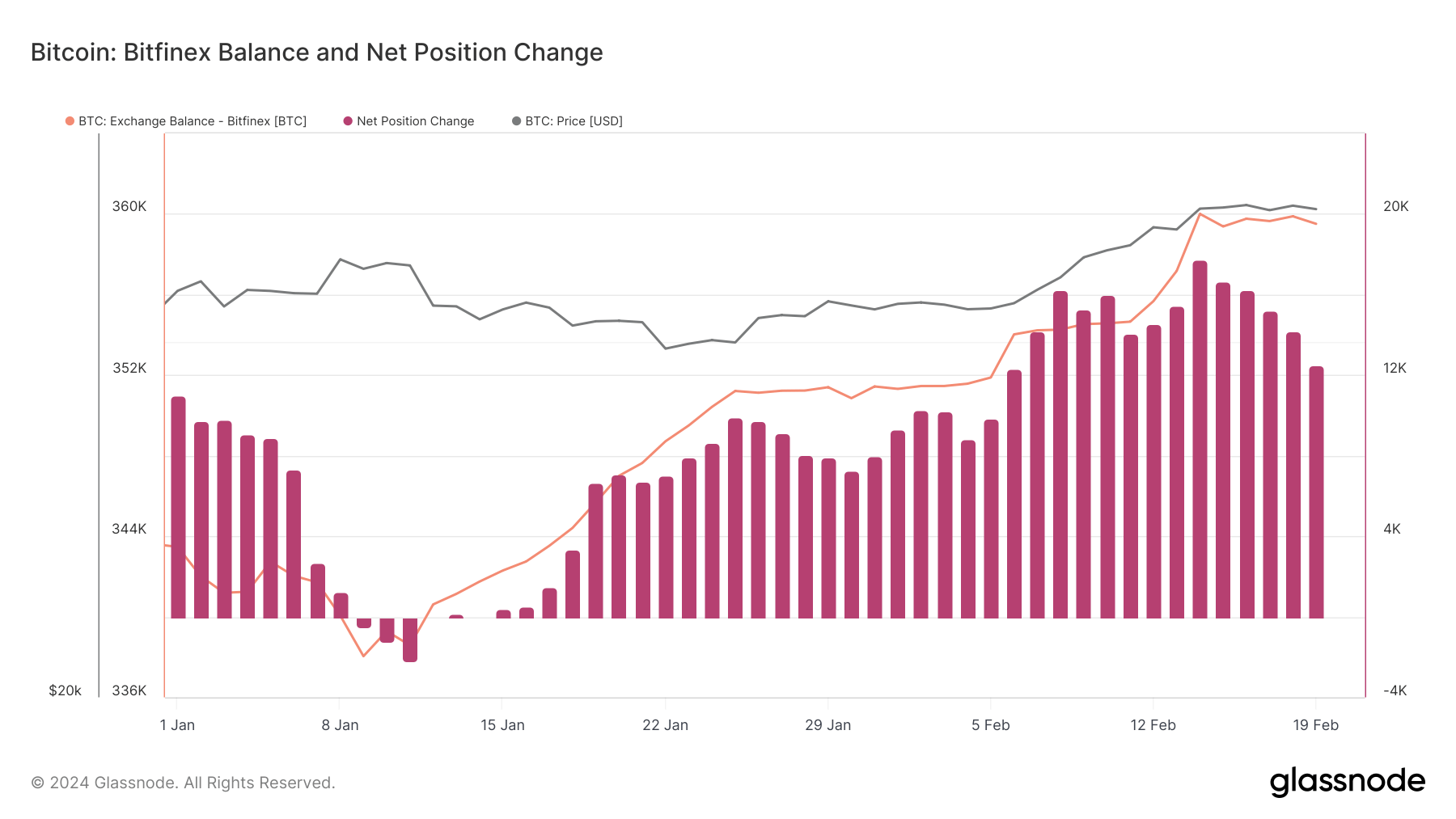

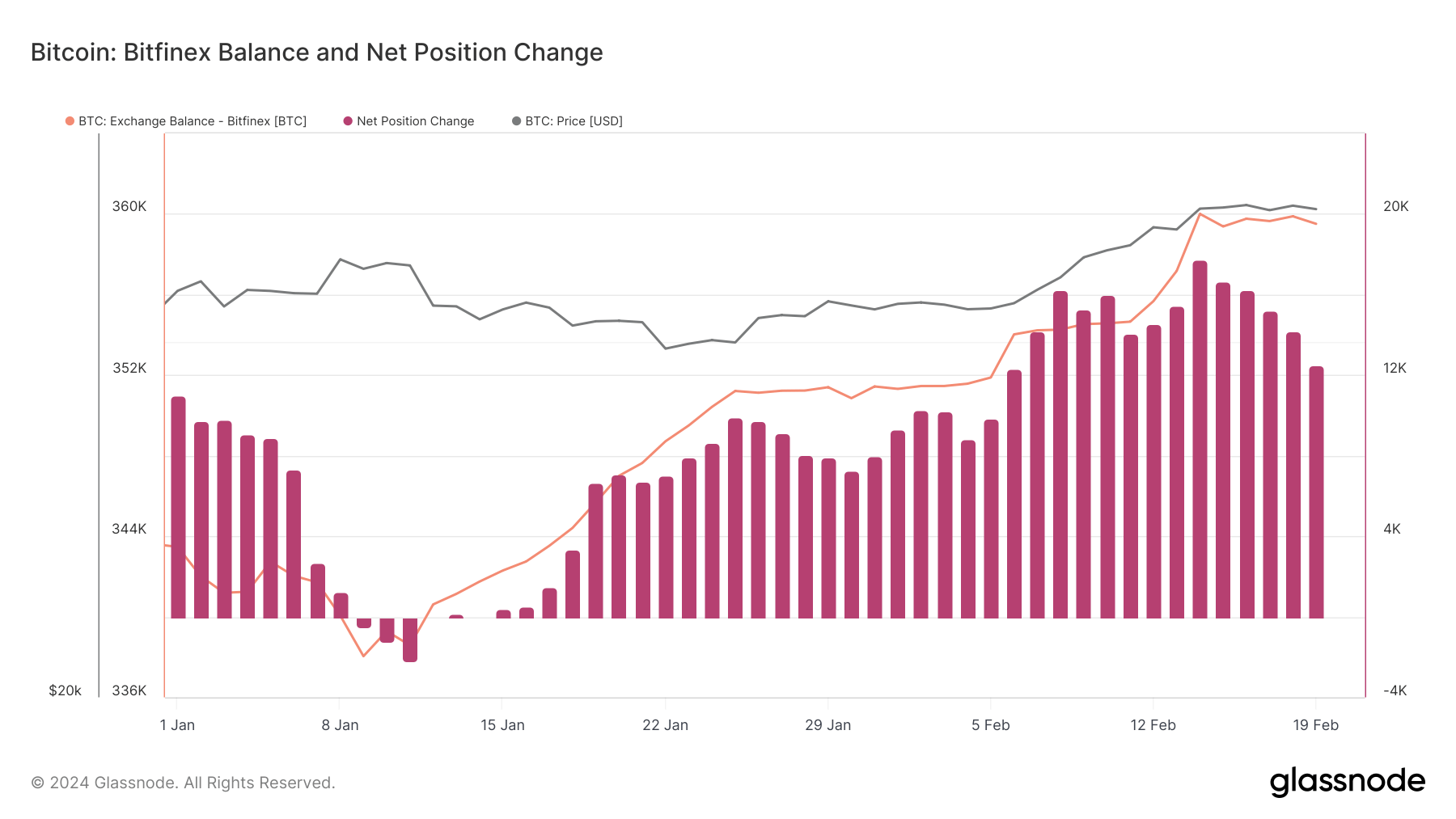

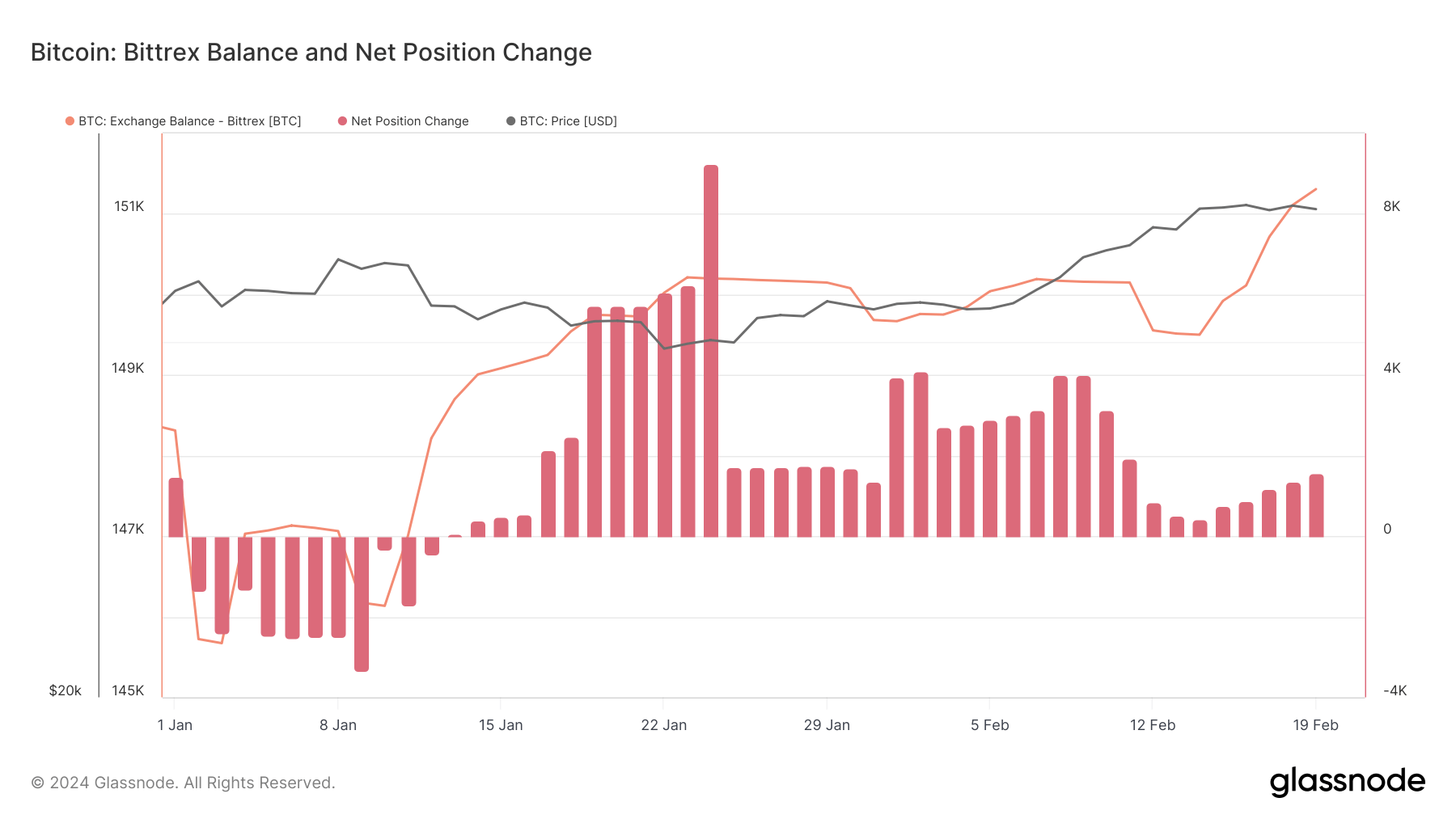

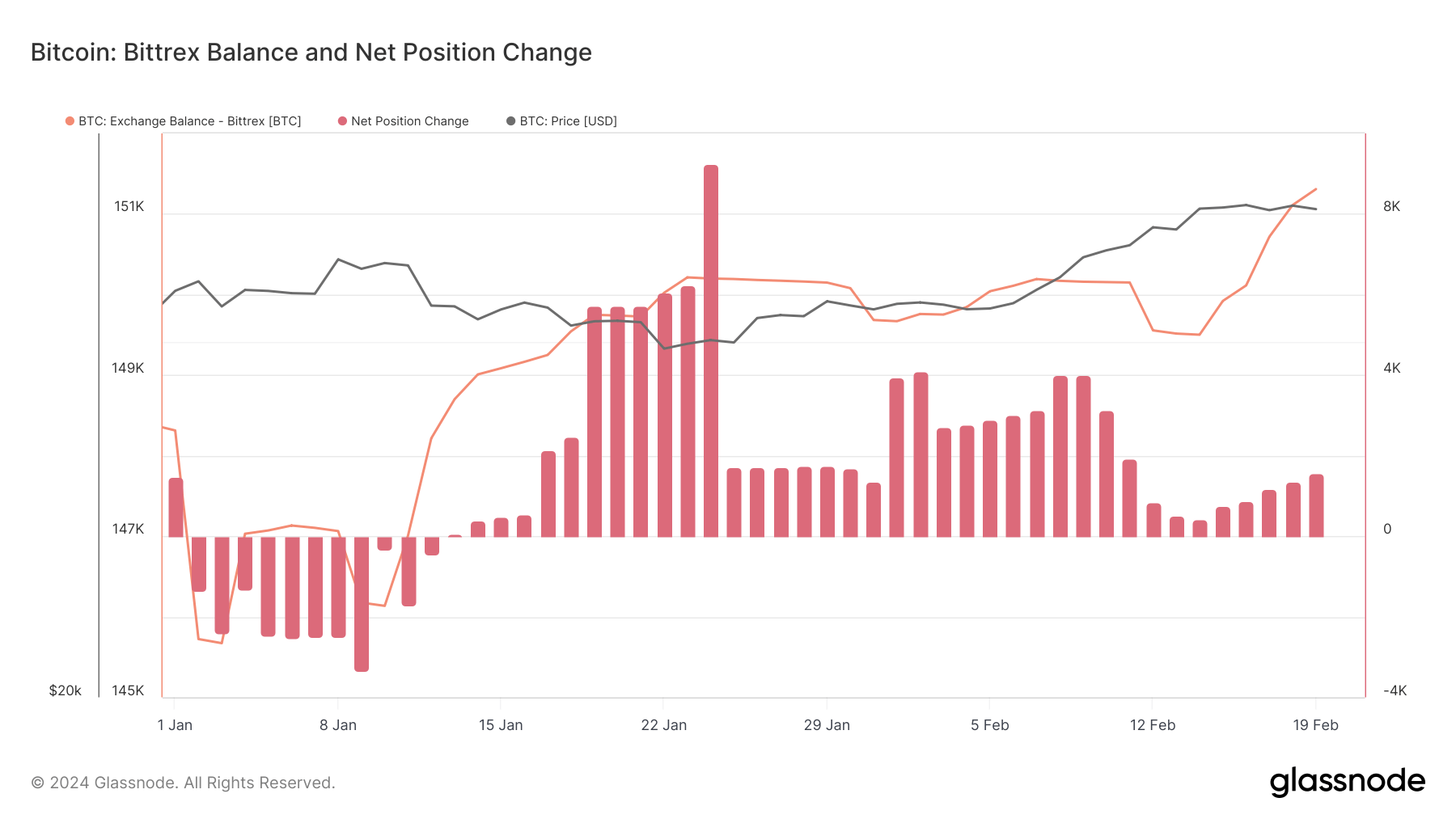

Opposite to the final development, Bitfinex and Bittrex have seen internet inflows since mid-January.

Bitfinex has added over 16,000 BTC to its Bitcoin stability for the reason that starting of the 12 months, helped by constant internet inflows since January fifteenth.

Bittrex additionally skilled a spike in balances, however this time it was a modest improve of three,000 BTC since January 1st. The change has additionally seen constant internet inflows since his January 14th.

A basic decline in Bitcoin balances on exchanges correlates with bullish market sentiment. Buyers can withdraw Bitcoin to their private wallets and maintain it for the long run, lowering promoting strain on exchanges. This technique is supported by the truth that, regardless of a pointy decline in mid-January, the worth of Bitcoin soared from $44,152 on January 1st to $52,000 by February nineteenth.

Whereas the launch of spot Bitcoin ETFs within the US doubtless influenced these tendencies, different vital components additionally play a pivotal function. The anticipation and introduction of those ETFs might have boosted market sentiment and contributed to the rebound and additional rise in Bitcoin costs in February.

Moreover, Bitcoin's migration away from exchanges might be as a result of widespread acceptance and rising optimism amongst buyers who anticipate funding in Bitcoin to additional drive costs larger. there may be.

Nonetheless, the collapse of FTX and Celsius and authorized challenges to Binance have been main catalysts, prompting customers to withdraw their funds from exchanges as a result of safety and regulatory compliance considerations.

These occasions have elevated consciousness of the dangers related to storing belongings on exchanges, resulting in a shift to non-public wallets for added management and security.

If Bitcoin is faraway from an change, it might end in lowered liquidity and elevated worth volatility. Nonetheless, the transfer exhibits agency perception amongst buyers to carry and doubtlessly units the stage for extra sustained worth appreciation as obtainable provide turns into more and more constrained.

(Tag Translation) Bitcoin

“Impressive!”

“Keep it up!”

“Bravo!”