essential level

- Bitcoin Dominance measures the ratio of Bitcoin market capitalization to the cumulative market capitalization of the cryptocurrency sector.

- It’s now at 58%, the best stage since April 2021.

- Market dynamics are altering as monetary establishments look to Bitcoin, whereas the remainder of the cryptocurrency markets are nonetheless struggling in a tricky financial coverage surroundings.

- Bitcoin seems to be carving out its personal area of interest whereas regulatory crackdown declares many tokens as securities

The Bitcoin market isn’t boring.

That stated, 2023 will not (at the least for now) be disrupted on the size we have seen in earlier years. In 2022, because the world transitioned to tighter financial coverage, bitcoin plummeted as scandals such because the collapse of Terra and the gorgeous FTX deception got here to mild. That is within the aftermath of the 2020 and 2021 pandemics, with cryptocurrencies quickly penetrating mainstream consciousness, Bitcoin bringing dizzying earnings, and the world questioning what this mysterious web cash is. impressed a dialog on the dinner desk.

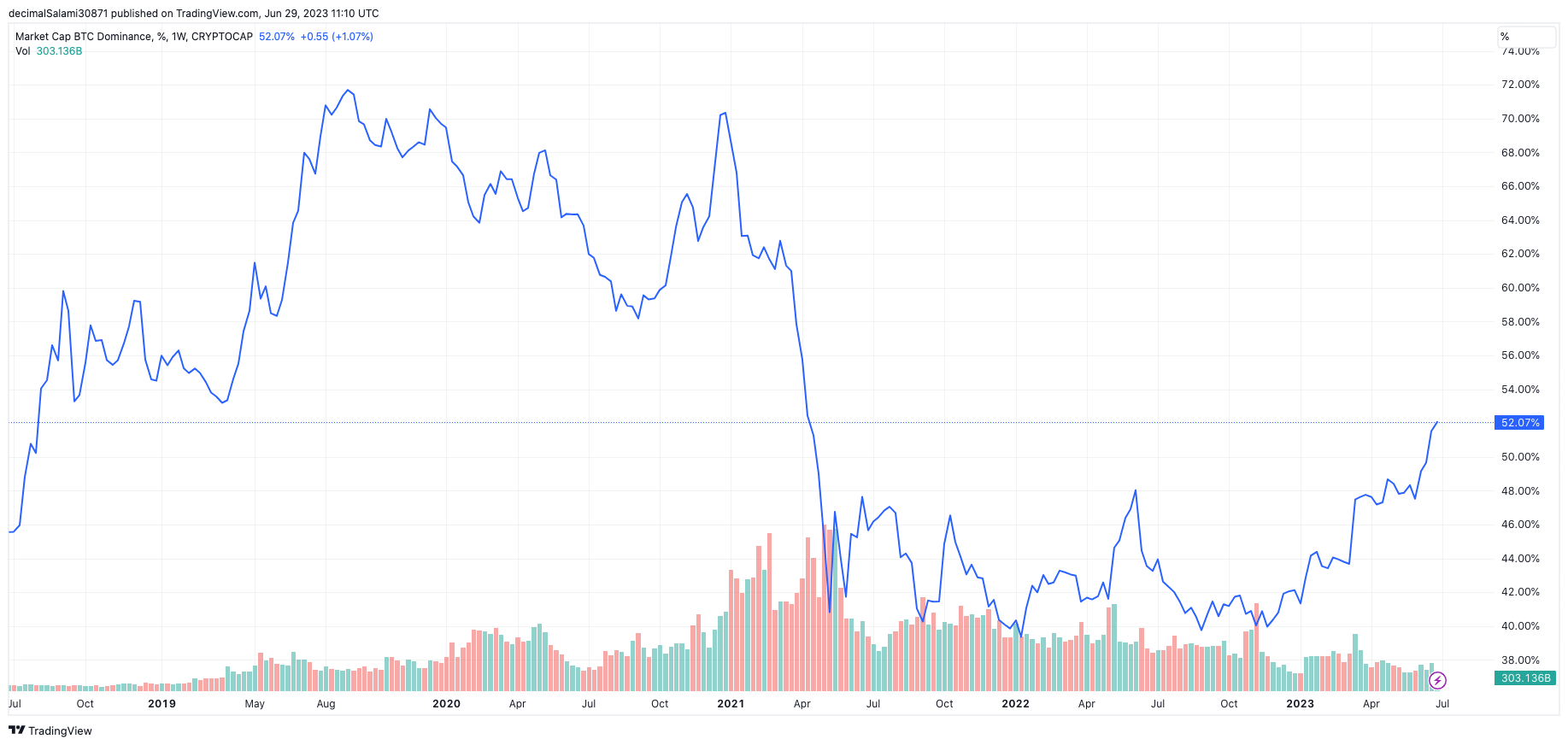

So 2023 cannot match the size of that drama. Nonetheless, there’s something very attention-grabbing happening with Bitcoin’s market dynamics, at the least in comparison with different cryptocurrencies. Bitcoin dominance, which measures the ratio of Bitcoin market capitalization to the cumulative market capitalization of all cryptocurrencies, stands at 52%, the best stage in additional than two years. In different phrases, 52% of the present $1.18 trillion cryptocurrency market capitalization is Bitcoin.

Declining dominance in 2020 and 2021

Declining dominance in 2020 and 2021

The chart above exhibits that Bitcoin began 2020 with a dominance of round 70%. Over the course of his subsequent twelve months, the inventory fluctuated a bit, dropping to the excessive $50s. Nonetheless, Bitcoin actually began to maneuver within the remaining quarter of 2020, rising from $10,000 to $28,000. Over this era, the domination ratio elevated from 59% to 70%, ending the yr at about the identical stage because it was 12 months in the past.

In 2021, altcoins will catch up. Bitcoin’s dominance plummeted like a stone, falling sooner than ever earlier than. The broader cryptocurrency market exploded as financial stimulus checks, lockdown Robinhood offers and underground rates of interest flooded all issues remotely related to blockchain with capital.

Cryptocurrency market cap will attain $3 trillion in November 2021, whereas Bitcoin market cap peaked at $1.28 trillion. Thus, Bitcoin’s dominance has dropped to 43%. However the worst inflation disaster because the Seventies has despatched central banks into the quickest fee hike cycle in current reminiscence after years of zero (and typically unfavorable) rates of interest.

For danger property, this created an issue. And arguably, the cryptocurrency market as a complete is effectively exterior the realm of danger. Capital has flowed out of house as rates of interest proceed to rise, inflation heats up additional and a number of other nefarious scandals hit the cryptocurrency sector (Do Kwon, Sam Bankman Freed , see Mr. Alex Mashinsky).

That brings us to now. Inflation peaked within the fourth quarter of final yr, however the macro surroundings stays unsure. Jobs are tight, the financial system remains to be scorching, and inflation is falling, however effectively beneath the Federal Reserve’s 2% goal. In Europe, inflation is much more intense (I do not even must ask concerning the UK if it could actually nonetheless be known as Europe).

However one thing is altering with cryptocurrencies. Bitcoin’s dominance has elevated and seems to be trending upwards once more. It’s now at 58%, the best since April 2021. On the one hand, this can be a typical phenomenon that we now have seen up to now: after a protracted interval of tectonic change (2022), funds begin to movement into Bitcoin, and finally altcoins acquire the higher hand. It will get filtered and rises earlier than the remainder of the market catches up.

Nonetheless, there are two factors of rivalry as to why this time may be totally different, and those that assume altcoins will proceed this time might have slightly extra to consider. The primary is, after all. Previous cycles are usually not indicative of future cycles, and that is very true for Bitcoin.

The asset was solely established in 2009 and has solely traded within the final 5 years with any affordable liquidity (though nonetheless skinny). So it will be foolish to place an excessive amount of emphasis on the previous few years, particularly provided that its whole existence up till final yr was coinciding with the notable bull market throughout the financial system. This was the primary rodeo for Bitcoin, and cryptocurrencies, in a excessive rate of interest surroundings, and all bets had been off.

However aside from that blindingly apparent warning, there might have been a structural shift concerning the market up to now six months, or one thing that would have modified the prevailing development going ahead. There’s additional proof suggestive of intercourse. I am referring to regulation and, extra not too long ago, institutional actions.

The regulatory crackdown within the US has been brutal for the cryptocurrency sector, with many tokens together with Solana, Polygon, Cosmos, BNB and Cardano not too long ago being authorized as securities by the SEC. Bitcoin, alternatively, appears to be carving out its personal area of interest. Or, as Coinbase CEO Brian Armstrong stated when discussing the SEC’s lawsuit towards his change, “We have heard from his SEC that the truth is the whole lot however Bitcoin is a safety. I’ve acquired info that

It due to this fact feels silly to declare this rise in dominance over the previous few months to be momentary. Reasonably, plainly Ether, the most important non-Bitcoin token, has to this point evaded the dreaded safety label, regardless that lots of this regulatory points might have already been factored in. , it’s stunning that costs haven’t risen additional.

However there are additionally realities which have been occurring institutionally in current weeks. BlackRock and Constancy, the world’s largest asset managers, have each utilized for spot ETFs. These are Bitcoin ETFs, not crypto ETFs.

In a sector the place regulation is so obscure and the intimidation of really shopping for bodily bitcoin is so excessive (irrespective of how tempting the promise of self-custody could also be, wallets and seed phrases are a brand new person and The truth is that it isn’t preferrred for institutional traders ) ), and this will have a staggering impact on liquidity. This is without doubt one of the main elements presently holding again Bitcoin’s motion. It could additionally allay considerations concerning the lack of transparency and credibility of centralized exchanges. As a result of monetary establishments can bypass entities like Binance and go straight to the (regulated) Bitcoin ETF. After all, these ETFs are usually not but authorized, however they’re much nearer to Bitcoin ETFs than different sorts of crypto ETFs.

The macro image remains to be unsure. Inflation might have peaked however remains to be rising, and with financial coverage notoriously sluggish to function, the complete ache of Fed charges above 5% has but to be felt. Many challenges stay. Whereas the regulatory crackdown might get even worse, who is aware of what is going on on behind the scenes at a few of these crypto corporations. However whereas issues are unhealthy for cryptocurrencies, there isn’t a denying that Bitcoin has head and shoulders above the remainder of the group.

Contemplating all this, the rise in dominance is smart. I do not know what occurs subsequent (in any case, cipher turns into cipher), there’s definitely nothing that may persuade us that Bitcoin’s dominance, presently at a two-year excessive, should inevitably recede anytime quickly.

(Tag Translation) Analysis

Comments are closed.