Bitcoin’s worth premium has re-emerged because the current bullish frenzy dominates the market.

kimchi premium

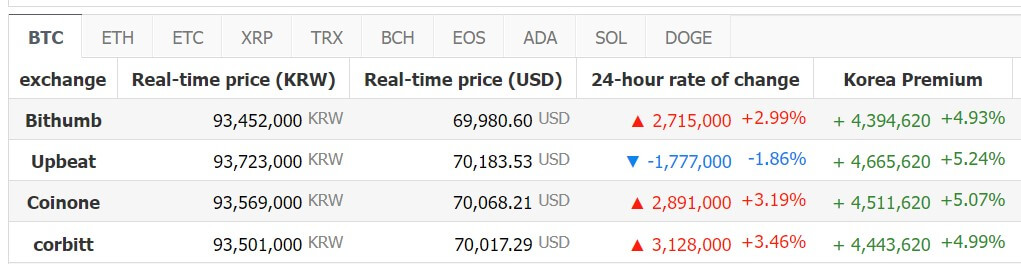

Knowledge reveals that BTC is buying and selling at a $4,000 premium in South Korea in comparison with different markets. On the time of writing, Bitcoin was priced at $66,893 on Binance, whereas it was priced at round $70,000 on Korean platforms reminiscent of Upbit, Coinone, and Bithumb.

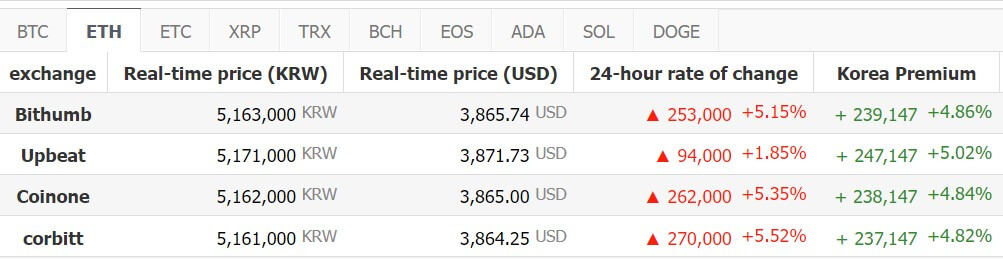

This premium pattern extends to Ethereum, the second-largest cryptocurrency by market capitalization. ETH is buying and selling round $3,900 on Korean platforms, whereas it hovers round $3,600 on different exchanges.

A kimchi premium refers to a state of affairs during which digital asset costs are considerably greater on Korean exchanges than on US or European markets, creating arbitrage alternatives for merchants with entry to each markets.

Sometimes thought of a bullish indicator, the kimchi premium alerts elevated purchaser exercise within the Korean market. This premium can be used to estimate the robust involvement in digital belongings in South Korea.

Ki Younger Ju, CEO of CryptoQuant, lately highlighted Institutional demand for BTC is powerful in South Korea, with platforms like Upbit seeing widespread adoption amongst older populations.

Whereas the present resurgence in premiums just isn’t unprecedented, it particularly happens throughout bull cycles just like the one in 2021 when BTC commanded considerably greater costs on South Korean exchanges than Coinbase and different main platforms. It displays previous occasions.

CME Premium

Equally, a number of market observers confirmed that BTC is buying and selling at a premium of over $69,000 on Chicago Mercantile Change (CME) futures, a brand new all-time excessive.

They defined that this reveals that merchants are keen to pay a premium for CME as a result of they imagine the worth of BTC will proceed to rise regardless.

On-chain analytics platform CoinGlass information reveals CME’s BTC open curiosity has reached close to all-time highs 10 billion up to now day, and the overall open curiosity of the flagship asset reached an all-time excessive of $32.36 billion.

(Tag translation) Bitcoin