Bitcoin has plummeted to beneath $64,000, its lowest stage since mid-Might, as a result of rising promoting stress out there.

BTC has been buying and selling largely down or sideways since surpassing the $70,000 mark earlier this month, with the flagship asset shedding over 10% of the positive factors it revamped that interval.

Why is BTC falling?

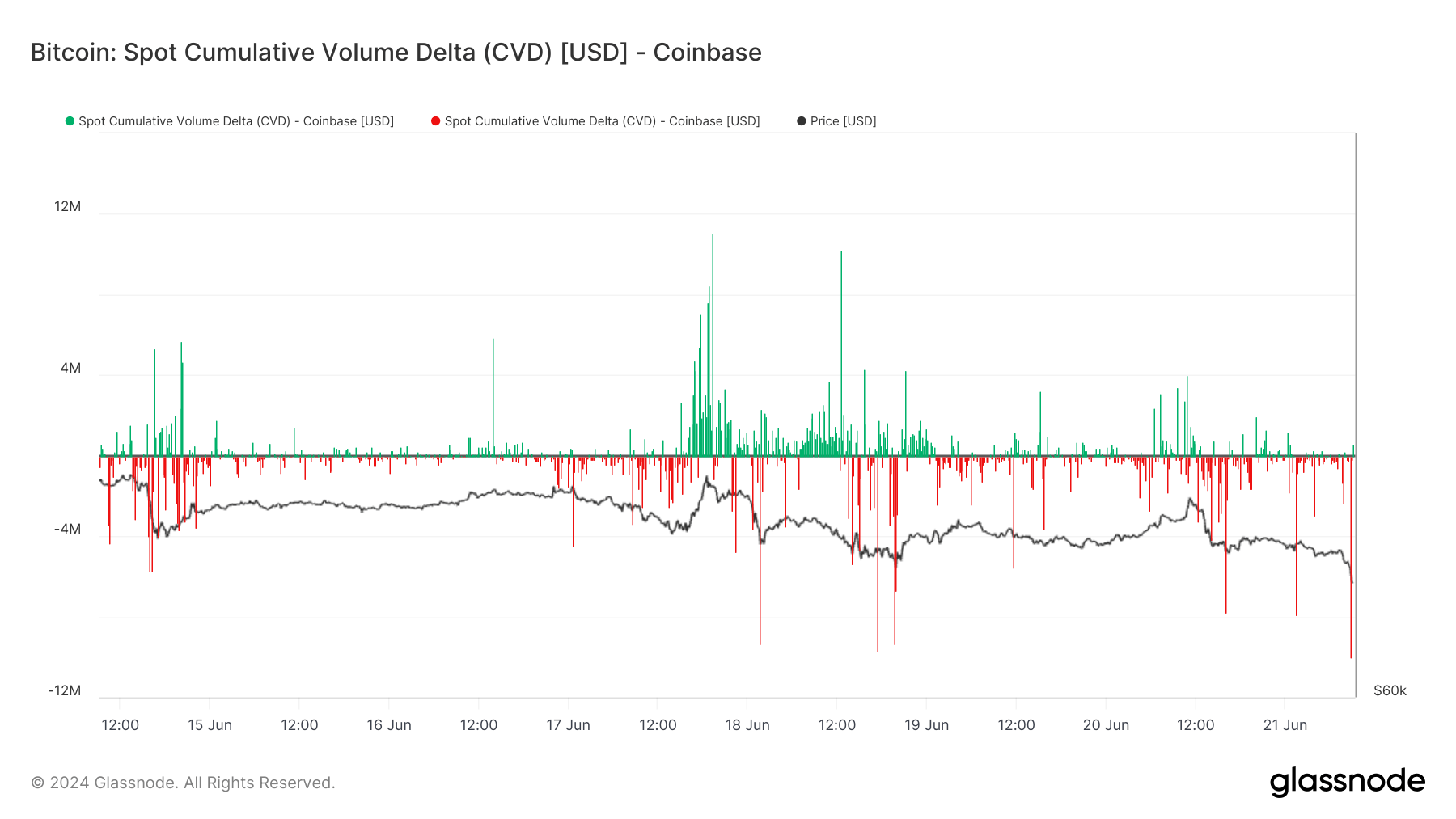

A few of the latest promoting stress has come from Coinbase, the biggest crypto alternate within the U.S., in keeping with on-chain information. The platform noticed $10 million in spot promoting, the biggest in a 10-minute interval in per week, in keeping with Glassnode information.

Notably, the German authorities has additionally joined the present promoting stress, shifting $600 million price of BTC on June 19, with $195 million of that going to 4 alternate addresses, together with Kraken, Bitstamp, and Coinbase.

Market consultants attribute BTC’s present value decline to elevated outflows from U.S.-based spot Bitcoin exchange-traded funds (ETFs). Rising curiosity in these ETFs since their approval in January has led to inflows of over $53 billion, however final week noticed internet outflows exceed $900 million.

Moreover, BTC miners are promoting off their holdings as a result of monetary pressures introduced on by the latest halving occasion, with Bitcoin analyst Willy Woo saying that BTC's value will solely get better “when the weak miners die and the hash fee recovers.”

$20 million cleared in a single hour

The market drop led to the liquidation of roughly $20 million in cryptocurrency positions up to now hour, bringing the full to $150 million up to now 24 hours, in keeping with information from Coinglass.

A more in-depth have a look at the liquidations reveals that lengthy merchants who guess on costs to rise suffered the most important losses, shedding $106 million. In distinction, brief merchants with a extra bearish outlook have been liquidated for $44 million.

Bitcoin merchants suffered the most important losses, totalling $42 million, with $26 million from lengthy positions and $16 million from brief positions, adopted by Ethereum merchants with round $28 million in liquidations.

Essentially the most important single liquidation occurred on Bybit, involving $8.09 million price of BTCUSD trades.