The volatility Bitcoin skilled this week had a very fascinating impact on the derivatives market. Between June 23 and June 27, BTC misplaced the comparatively secure help above $64,000 and dropped to $60,000, earlier than briefly dropping again under $60,000 on June 25.

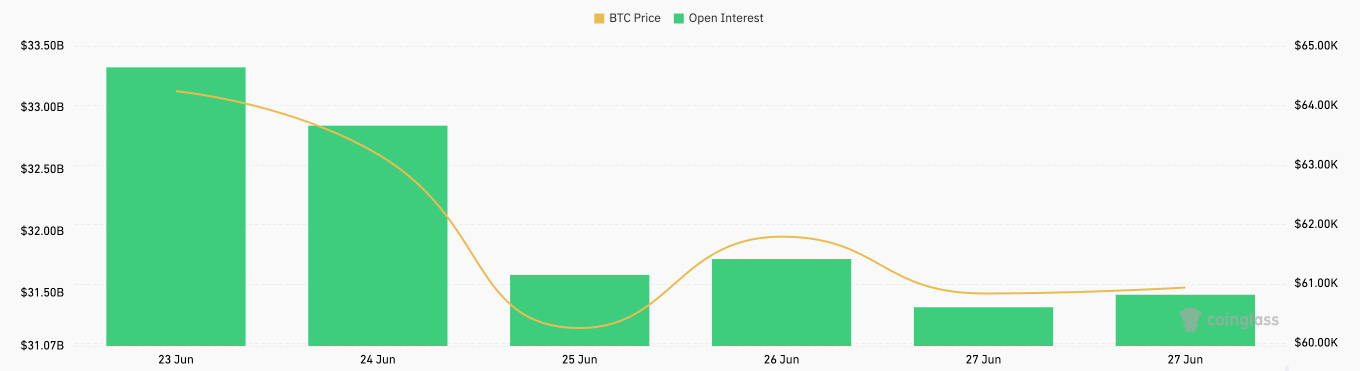

Whereas worth drops might not appear vital when long-term worth actions, a drop under $60,000 is a crucial psychological milestone for merchants. Because of this the 6% drop had a noticeable influence on derivatives. Bitcoin futures open stability fell from $33.33 billion on June 23 to $31.39 billion on June 27, reaching the bottom stage since Might 17.

The principle purpose for this decline was pressured liquidations. As costs fell sharply, many merchants with leveraged lengthy positions seemingly confronted margin calls. These calls weren’t met in time and their positions have been liquidated, rising promoting stress and sure resulting in an extra decline in open curiosity.

This creates a suggestions loop, the place liquidations typically induce additional promoting, exacerbating the value decline. Moreover, the value decline might have made merchants extra threat averse: elevated volatility and uncertainty might have discouraged merchants from opening new futures contracts, selecting to scale back their publicity till the market stabilized.

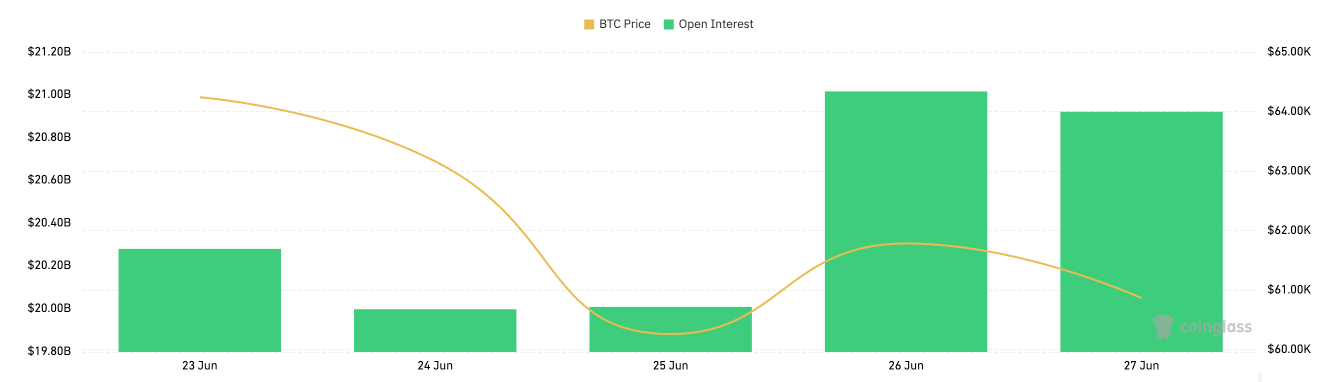

Whereas the futures market contracted, the choices market expanded. Bitcoin choices open curiosity fell to $20 billion on June 25, however rose from $20.28 billion on June 23 to $21 billion on June 26.

The rise in choices OI throughout this era signifies that merchants turned to choices as a hedge in opposition to potential worth fluctuations. Choices are a versatile device for threat administration, permitting merchants to guard positions and speculate on worth actions with out the identical dangers related to futures. The rise in OI, particularly throughout a interval of declining costs, signifies that merchants have been trying to cut back threat and put together for larger volatility.

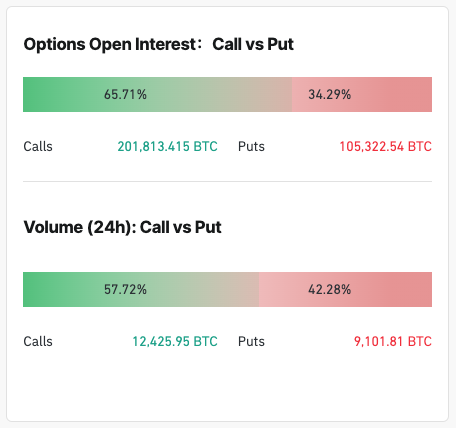

Based on knowledge from CoinGlass, most merchants are getting ready for elevated volatility. As of June 27, 65.71% of choices open curiosity was made up of name choices, with calls accounting for 57.72% of 24-hour buying and selling quantity. The clear dominance of name choices signifies bullish sentiment is prevailing, with merchants positioning for a worth restoration or concentrating on worth declines whereas limiting draw back threat.

Arbitrage alternatives between spot, futures and choices markets might have led to elevated choices buying and selling exercise. Institutional traders' use of choices for threat administration and portfolio changes seemingly contributed to the rise in choices open curiosity.

Volatility buying and selling, wherein merchants revenue from anticipated adjustments in market volatility, additionally sparked sturdy exercise in choices markets throughout this era of elevated worth motion.

Adjustments in futures and choices open curiosity point out that merchants are adopting totally different threat administration methods in response to the value decline: futures merchants seem to have lowered their publicity on account of liquidation and elevated threat aversion, whereas choices merchants elevated their publicity for hedging and hypothesis.

This text Bitcoin Volatility Sinks Futures, Surges Choices Open Curiosity First appeared on currencyjournals