- BNB futures soared to a five-month excessive regardless of falling costs, signaling a market reversal.

- Resilient BNB rebounded from 90-day lows, sparking renewed curiosity.

- Elevated buying and selling quantity has fueled optimism about BNB’s future.

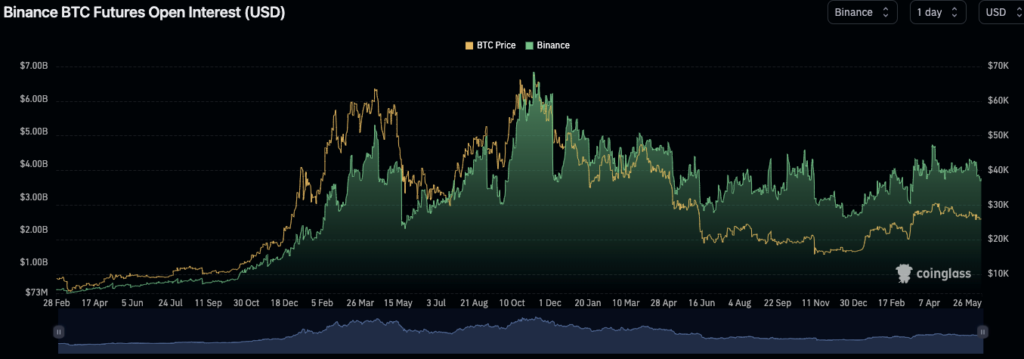

Earlier as we speak, Binance (BNB) token witnessed an surprising flip in its monetary narrative. Open curiosity in futures soared to a five-month excessive at the same time as costs fell. Coinglass tracked this rise in open curiosity, the sum of energetic and unsettled futures contracts, revealing a staggering 27% improve inside every week, and an 8% improve prior to now day alone. grew to become.

Binance’s native token, BNB, was hit laborious early Monday morning, with its market value plummeting to $221. This largely mirrors the token’s low on July 13, 2022, marking an enormous 25% drop for the reason that US SEC introduced its lawsuit in opposition to Binance on June 5, 2023.

Nonetheless, in a downward spiral, BNB managed to recuperate from a 90-day low of $222.07 after dropping from a 24-hour excessive of $238.49. The market noticed the bulls take the lead because the token discovered assist at this stage and bounced again to $236.74 on the time of writing. This speedy restoration displays BNB’s resilience within the face of robust bearish sentiment.

BNB’s market capitalization fell 0.38% to $36,795,635,711. In the meantime, the 24-hour buying and selling quantity surged 78.87% to $847,447,451, signaling renewed investor curiosity. This surge in buying and selling quantity could point out that many individuals, particularly those that have long-term belief in Binance and its ecosystem, see the latest plunge as an funding alternative.

BNB/USD Technical Evaluation

A Relative Power Index ranking of 37.89 and an upside indicator means that the market is presently on a modest upward pattern.

The transfer reveals that BNB’s unfavorable momentum is waning and will reverse within the close to future.

Along with the optimistic outlook, the Chaikin Cash Move (CMF) has began to rise and is about to enter optimistic territory at -0.20. The transfer indicators growing shopping for strain, which may change the temper out there.

In conclusion, regardless of the latest value drop, BNB futures open curiosity rose to a five-month excessive, signaling elevated investor curiosity and a doable reversal in market sentiment.

Disclaimer: The views, opinions and knowledge shared on this value forecast are revealed in good religion. Readers ought to do their analysis and due diligence. Readers are strictly accountable for their very own actions. Coin Version and its associates usually are not accountable for any direct or oblique damages or losses.

… [Trackback]

[…] Find More Info here on that Topic: currencyjournals.com/bnb-worth-rebounds-from-90-day-lows-as-open-curiosity-surges/ […]

You have brought up a very great points, appreciate it for the post.

… [Trackback]

[…] Find More on that Topic: currencyjournals.com/bnb-worth-rebounds-from-90-day-lows-as-open-curiosity-surges/ […]

… [Trackback]

[…] Read More on on that Topic: currencyjournals.com/bnb-worth-rebounds-from-90-day-lows-as-open-curiosity-surges/ […]

… [Trackback]

[…] Read More Information here to that Topic: currencyjournals.com/bnb-worth-rebounds-from-90-day-lows-as-open-curiosity-surges/ […]

… [Trackback]

[…] Information to that Topic: currencyjournals.com/bnb-worth-rebounds-from-90-day-lows-as-open-curiosity-surges/ […]