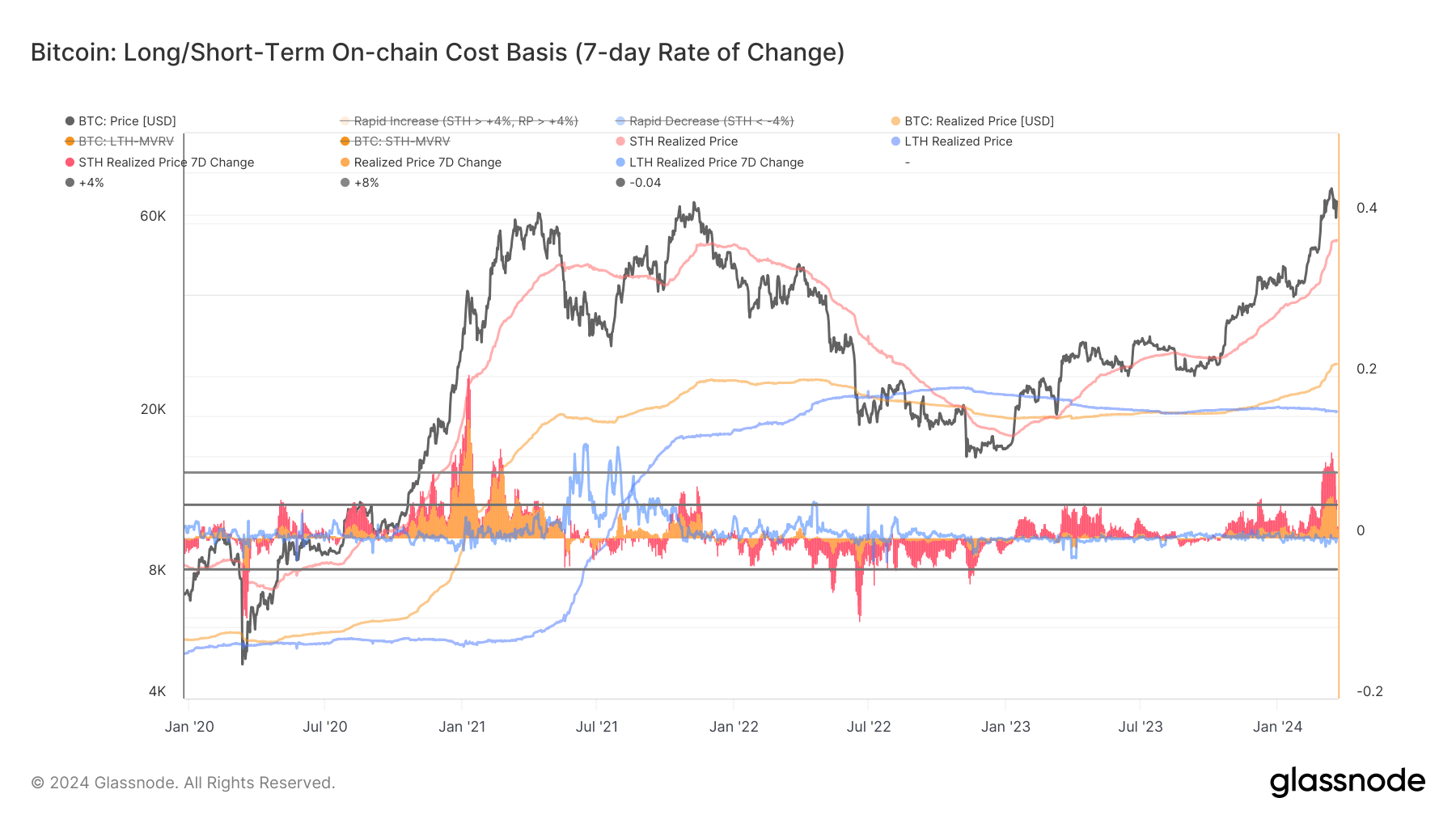

The realized Bitcoin value represents the typical price of acquisition on the chain. This can be a helpful indicator as a result of it completely measures the market's valuation baseline at any given time limit. Analyzing it by the lens of short-term and long-term holders gives perception into the funding scope of the cohort and its profound impression on Bitcoin value.

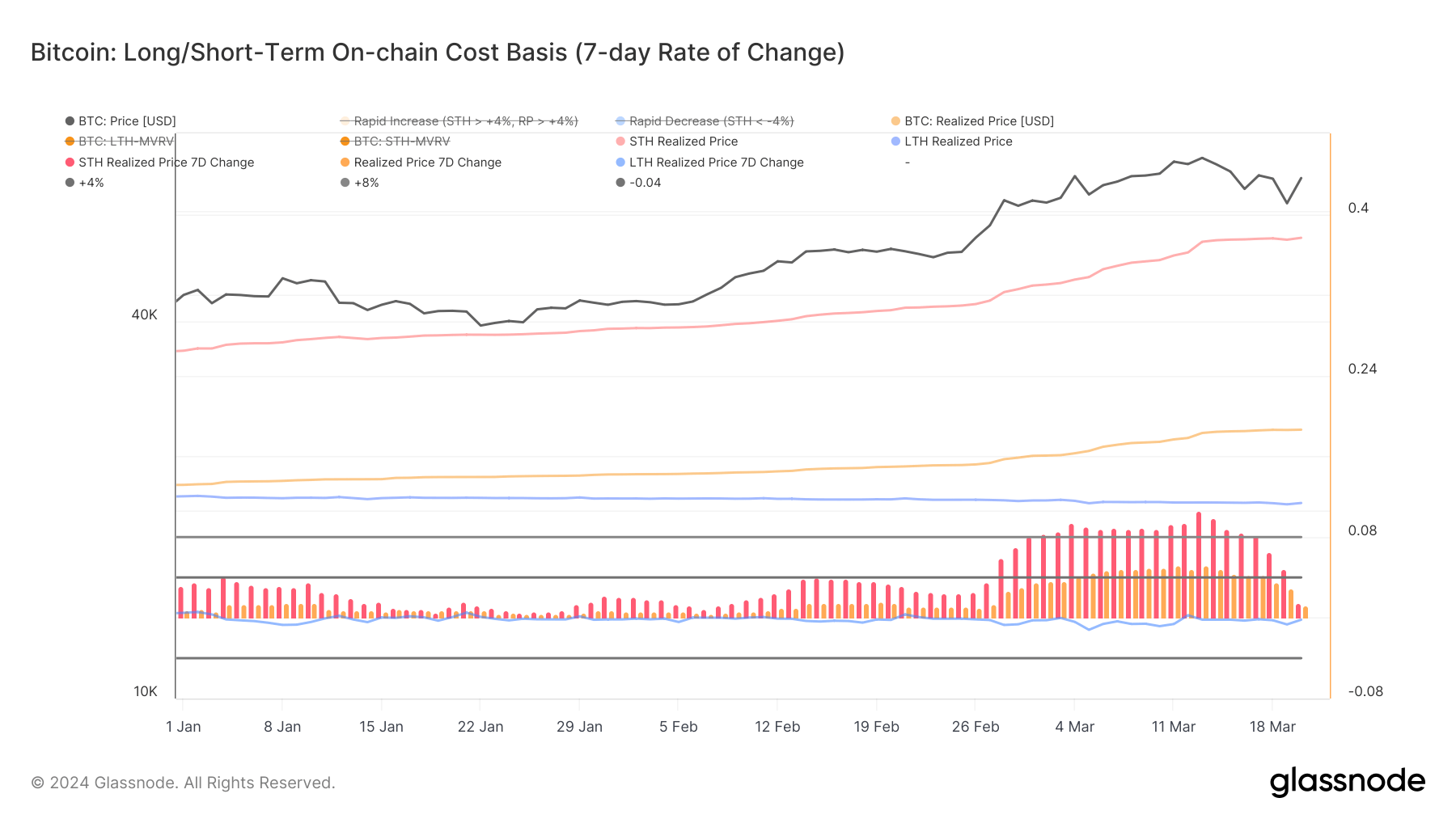

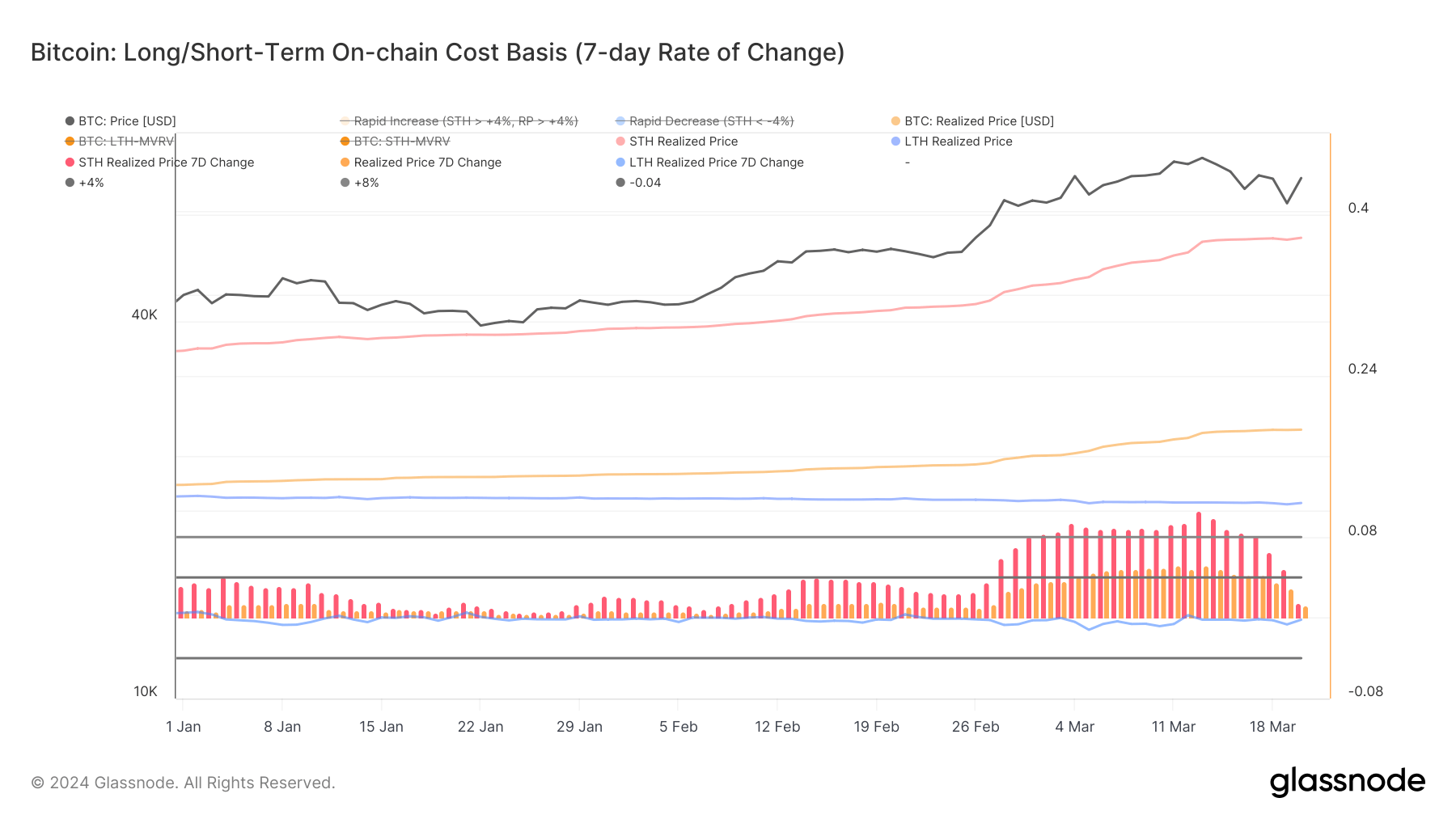

The 7-day change in realized costs for these cohorts gives a greater visualization of the indicator. The 7-day change in realized value for short-term holders reached a three-year excessive of 10.62% on March thirteenth. The 7-day change in realized value for long-term holders on the identical day was -0.183%, a slight lower from the earlier week.

This divergence between the realized costs of STH and LTH suggests a big inflow of short-term speculative curiosity into the market. From March sixth to March thirteenth, new market contributors entered the market at larger value ranges than long-term holders, rising the realized costs for the cohort. The rise in STH realized costs culminated on March thirteenth, when Bitcoin costs peaked above $73,100, however this was as a result of massive investments have been made at or close to peak costs. It signifies that.

Monitoring modifications within the realized costs of each LTH and STH is essential as it may point out modifications in market sentiment and potential stress factors. For instance, a rise in STH realized costs, notably for Bitcoin, could point out elevated optimism and speculative demand as new entrants reveal a willingness to speculate at larger value ranges. A comparatively secure or declining LTH realized value suggests that there’s a maintain sentiment amongst long-term buyers, who could not transfer their holdings regardless of value fluctuations, and the elemental worth of the market. Mounted recognition.

Glassnode's information confirmed the market at a possible inflection level. The dramatic rise in STH realized costs, parallel to the numerous rise in Bitcoin costs, signifies short-term bullish sentiment pushed by speculative buying and selling and new entrants drawn to the momentum. However a pointy spike just like the one we noticed on March thirteenth not often follows a big correction for quite a lot of weeks, and that's precisely what occurred final week.

The seven-day change in short-term holders noticed Bitcoin fall by 1.469% by March 20 because it fell to $61,000 after which recovered to $68,000. This sharp decline signifies that the speculative fever has cooled and the market has entered a correction part. The information reveals that the shopping for momentum and optimism that brought on STH to rise considerably led to realized costs, which in flip weakened Bitcoin costs and made market sentiment extra cautious.

A number of interpretations might be drawn from this information level. First, a decline within the price of change in STH realized costs could point out that new capital inflows at larger valuation ranges are slowing. The simultaneous decline in each the STH realized value change and the Bitcoin market value may point out a discount in sell-side stress from short-term holders.

Sometimes, massive fluctuations in STH realized costs, particularly after they set information like these on March 13, point out an elevated chance of promoting exercise by short-term holders trying to revenue. There’s a chance. Nonetheless, as soon as this stress subsides, costs could stabilize, albeit under latest highs, because the market absorbs the results of earlier speculative buying and selling.

Wanting forward, this readjustment interval might pave the way in which for resistance to type at this value degree because the market permits itself to digest latest positive aspects. Moreover, the habits of long-term holders will proceed to be an necessary issue to watch, as the steadiness of long-term holders typically underpins market stability amidst volatility.

(Tag translation) Bitcoin