vital level

- Our head of analysis, Dan Ashmore, delves into the connection between Bitcoin and shares

- Bitcoin-Nasdaq Correlation At Lowest Degree Since 2018

- The Nasdaq rose 10% final month as shares surged on a weak outlook for rates of interest and the macro surroundings.

- Bitcoin plunged 9% over the identical interval, with a US regulatory crackdown sparking home fears about the way forward for cryptocurrencies.

- Ashmore writes that this breakdown in correlation goes past what was seen in November 2022 in the course of the FTX collapse.Right now, Bitcoin fell to $15,000, however the inventory rose from the optimistic inflation indicator.

After 10 consecutive price hikes, the US Federal Reserve suspended its price hike coverage this week. The transfer was virtually unanimously anticipated by the market, and the transfer after the assembly was comparatively mild.

Nonetheless, over the previous month, the market has fluctuated considerably. The S&P 500 is now simply 8.8% away from all-time highs, regardless that he is up 6% over the previous 30 days and fell 27% beneath the October mark. The Nasdaq is up 10% over the identical interval. That is 15% beneath its excessive since November 2021, however a outstanding comeback given {that a} third of its worth fell in 2022.

Nonetheless, one thing is omitted, and that’s Bitcoin.

Bitcoin is presently buying and selling beneath $25,000 for the primary time in three months.I attempted to summarize deep dive In March, we analyzed the underlying worth actions to indicate how intently the corporate trades with the inventory market. It was proper across the time that Bitcoin was on the rise and banks have been reeling from the Silicon Valley financial institution debacle. Abruptly, it turned trendy to declare Bitcoin indifferent from the inventory market. Because it seems, it wasn’t true. However final month one thing very fascinating occurred.

First, let’s check out how the Nasdaq and Bitcoin have progressed since early 2022. This roughly coincides with the beginning of a bear market.

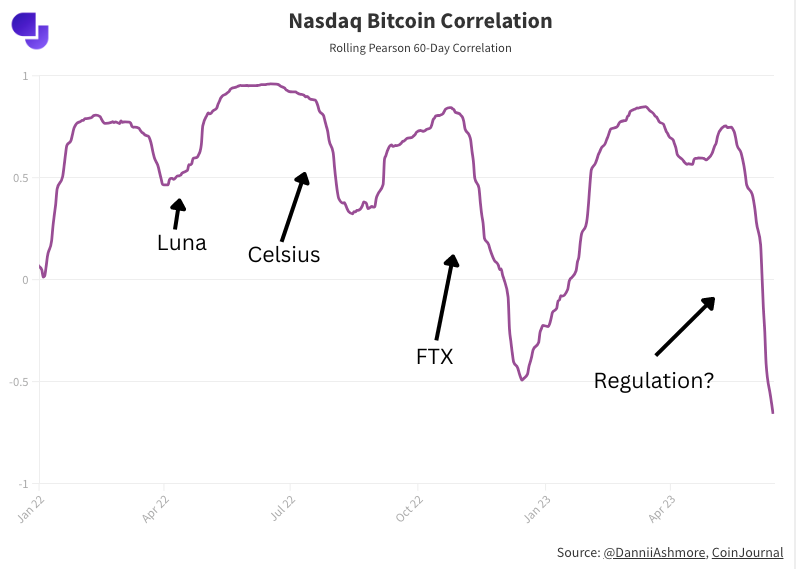

Clearly, the 2 are shifting in step. However two episodes leap out. The primary episode is his November 2022 when Bitcoin fell and the Nasdaq surged. The second was final month. We mentioned final month’s 10% rise within the Nasdaq. Nonetheless, Bitcoin fell 9% over the identical time-frame. That is clearly not what we anticipated. Plotting the correlation (utilizing 60-day Pearson) reveals this extra straight.

We talked about November 2022 above, and you’ll see the speedy drop in correlation on the chart. This was when FTX collapsed and the cryptocurrency market was in turmoil. On the similar time, nonetheless, softening inflation responded to decrease expectations concerning the future path of rates of interest, and shares soared.

April and Might 2022 and June and July 2022 additionally noticed a much less dramatic (however equally short-term) decoupling of Bitcoin and equities. Within the graph beneath, I’ve penciled within the incidents that occurred throughout these durations.

The truth is, the distinction between November (FTX) and at present is that the Nasdaq rises on the similar time that Bitcoin falls. The Luna and Celsius scandals did loads of harm to cryptocurrencies, however they occurred at a time when inventory costs have been additionally sluggish, so the impression was much less dramatic when it comes to the breakdown of correlations (nonetheless seen on charts). (though there may be).

The truth is, the distinction between November (FTX) and at present is that the Nasdaq rises on the similar time that Bitcoin falls. The Luna and Celsius scandals did loads of harm to cryptocurrencies, however they occurred at a time when inventory costs have been additionally sluggish, so the impression was much less dramatic when it comes to the breakdown of correlations (nonetheless seen on charts). (though there may be).

However at present we see the most important shift in correlation traits up to now few years, even surpassing FTX. The 60-day Pearson is presently at -0.66, whereas the bottom recorded in the course of the FTX disaster was -0.49.

Regulatory crackdown retains costs down

The reason being clear. A significant regulatory crackdown within the US is disrupting markets, and for good motive. Binance and Coinbase, the 2 largest cryptocurrency corporations on the planet, have been each sued final week.

Crypto.com has suspended its institutional trade, citing weak demand because of regulatory woes. eToro and Robinhood have withdrawn giant quantities of tokens from their platforms after confirming that the SEC considers them securities.liquidity is fall like a stone.

I wrote extensively concerning the post-announcement considerations of the Coinbase lawsuit final week, so I will not rehash it right here (that evaluation is right here). Whereas I consider Bitcoin ought to be capable to climate this storm in the long run, the image appears to be like a lot bleaker for different cryptocurrencies.

Do not get me flawed, the cryptocurrency trade faces the next issues. Massive scale So long as lawmakers preserve turning the screws, the issue will proceed. We really feel that this disaster could be very vital for a lot of cryptocurrency markets.

As for Bitcoin, lovers dream of a day when Bitcoin might be remoted and claimed as a de-correlated hedging asset, a gold-like retailer of worth. I’ve completed loads of work on what that hypothetical future may appear to be and what may lead the market to that time. However for now that is: hypothetical. As a result of whereas the correlation is at its lowest stage in 5 years, it’s going to inevitably spike once more as it isn’t pushed by fundamentals. That is nothing greater than the market reacting to a really bearish improvement round US regulation.

It’s totally different from the decoupling that traders have been anticipating. But when anybody doubts the market’s concern of regulatory woes, or wonders why bitcoin hasn’t tumbled additional, the breakdown in correlations means that Gary Gensler’s recreation is digital. You’ll be able to see very clearly how detrimental it was to the foreign money trade.

The truth is, it is secure to say that that is essentially the most anomalous correlation so far for Bitcoin being traded as a mainstream monetary asset. As a result of when it final occurred in 2018, Bitcoin was buying and selling with little or no liquidity, so its worth motion was largely irrelevant to attract conclusions going ahead.

(Tag Translation) Analysis

Comments are closed.