- Analysis exhibits that positive aspects within the first and fourth quarters will enhance the cryptocurrency sector's valuation by 109% in 2023.

- The amount of non-fungible tokens has rebounded, producing $1.7 billion in December.

- In 2023, 1,173 tasks secured $9 billion in funding, with infrastructure tasks accounting for the most important share.

Main crypto trade Binance has launched a analysis report on the crypto market, specializing in the evolutionary enhance recorded in 2023 and the market forecast for 2024.

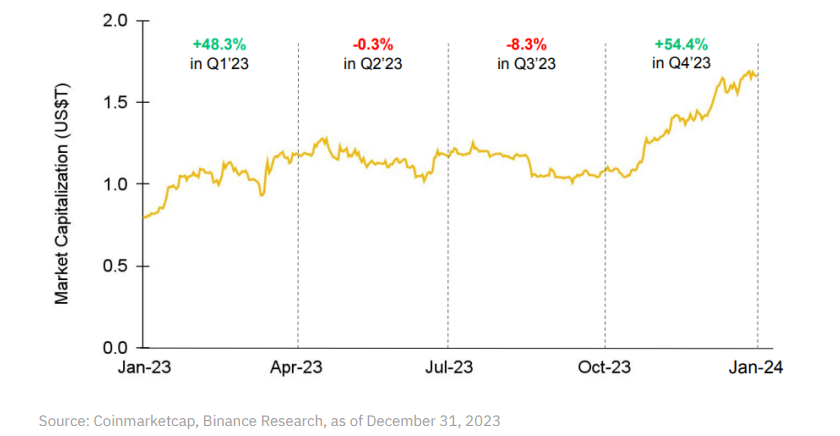

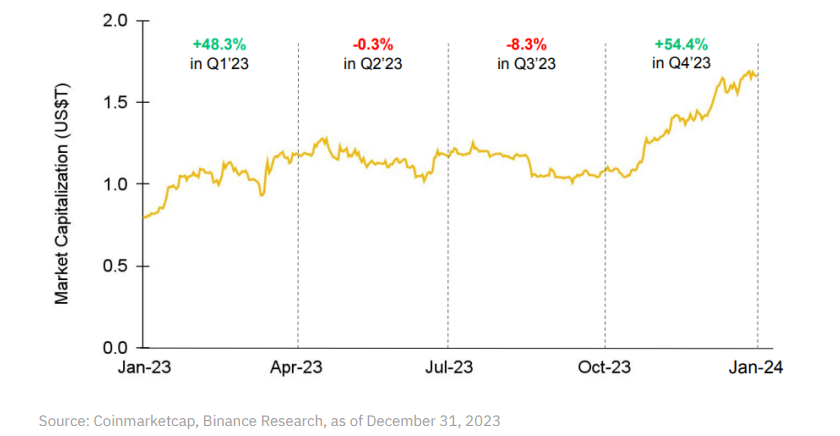

In line with the research, the valuation of the cryptocurrency sector elevated by 109%, with important positive aspects recorded within the first and fourth quarters of 2023. The report attributes the fourth-quarter rally to the at the moment authorised Bitcoin Spot ETF and optimism surrounding Bitcoin going ahead. Diminished by half.

The report famous that the positive aspects recorded at first and finish of 2023 contrasted sharply with values in 2022, when the market skilled a decline of round 64%. This decline was accelerated by a sequence of risky occasions, together with the depegging of TerraUSD (UST), the chapter of assorted monetary establishments, and the fallout from FTX.

Moreover, the report highlighted that 2023 turned out to be a really eventful 12 months for Bitcoin. This was marked by essential developments such because the introduction of ordinal numbers, inscriptions, and the BRC-20 token. In line with the research, this growth helped Bitcoin enhance its market energy from 40.4% to 50.2%, as soon as once more securing greater than half of the overall cryptocurrency market.

The report additionally states that 2023 was an equally eventful 12 months for layer 2 crypto tasks. This was characterised by a big 321.3% enhance in whole locked worth and a 77.2% enhance in L2 dominance.

In the meantime, it was revealed that regardless of the rebound in October 2023, the worldwide stablecoin market capitalization decreased by 5.2%. Centralized stablecoins have elevated their general market management to 92%, and Tether’s USDT management has elevated to 70.6%.

Additionally, within the fourth quarter of 2023, the amount of non-fungible tokens (NFTs) recovered, producing $1.7 billion in December. Apparently, Bitcoin ordinal contributed essentially the most to general NFT buying and selling quantity.

As well as, the Web3 undertaking secured 1,173 investments in 2023, producing a complete of $9 billion in capital. Roughly 36.5% of the overall quantity was invested in infrastructure tasks. Different sectors reminiscent of CeFi and DeFi gained 13.3% and eight.6% respectively.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t answerable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.