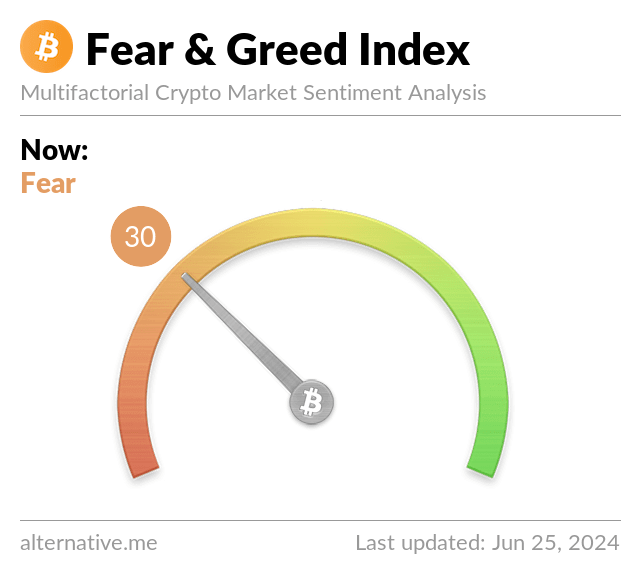

- The Cryptocurrency Worry and Greed Index is presently within the “worry” zone with a rating of 30.

- That is the bottom sentiment indicator for Bitcoin (BTC) in practically 18 months.

The Crypto Worry and Greed Index, a gauge of market sentiment in direction of Bitcoin (BTC) and the broader cryptocurrency market, fell to 30, its lowest rating in a 12 months and a half.

BTC is buying and selling decrease within the present market cycle, with the Crypto Worry & Greed Index dropping into the “worry” zone for the primary time since January of final 12 months.

Crypto Worry and Greed Index Drops to 30

On Monday, June 24, the worth of Bitcoin fell beneath $60,000, inflicting the index rating to plummet by greater than 20 factors, dropping into the “worry” zone.

The drop signifies that the Bitcoin Worry-Greed Index is presently hovering at ranges final seen in January 2023. On the time, the worth of Bitcoin was buying and selling at round $17,000 following the market's response to probably the most stunning collapse within the trade's historical past – that of the FTX cryptocurrency trade.

In Might of this 12 months, Bitcoin's worth fell to a low of $56,500, inflicting the index's rating to drop from Impartial to Worry.

The value rebound led to a big enchancment in sentiment, with the Worry and Greed index rising to 74. Greed dominated as Bitcoin surpassed $71,000, however its rating turned impartial, reaching the 30 stage inside hours on June 24.

Mt. Gox reimbursement and German authorities sale

The catalyst for the current decline contains information concerning Mt. Gox's reimbursement.

Based on a discover on Monday, the trade will start refunding clients who’ve been ready for the reason that hack in 2014. Mt. Gox clients will obtain their bitcoin and bitcoin money.

$8.5 billion price of BTC is in receivership on the trade. In April, analysts at K33 Analysis warned that Mt. Gox's Bitcoin repayments might have an effect on costs.

The German authorities's Bitcoin selloff has additionally drawn unfavourable sentiment. After sending 1,700 BTC to exchanges together with Coinbase and Kraken final week, Germany is promoting off Bitcoin once more.

On Tuesday, LookOnChain shared on-chain knowledge monitoring wallets linked to the German authorities's seizure of fifty,000 BTC earlier this 12 months, with particulars displaying an extra 400 BTC deposited at CEX.