An evaluation carried out by CoinShares has revealed that the cryptocurrency market noticed a fifth consecutive week of outflows, with whole losses this week reaching $32.1 million.

CoinShares sourced information from digital asset funding suppliers similar to Grayscale and ProShares that cater to institutional and accredited traders.

Head of Analysis at CoinShares, James Butterfillcommented that this was as a result of “”.Poor sentiment centered on BTC. “

Cryptocurrency market suffers fifth consecutive week of capital outflows

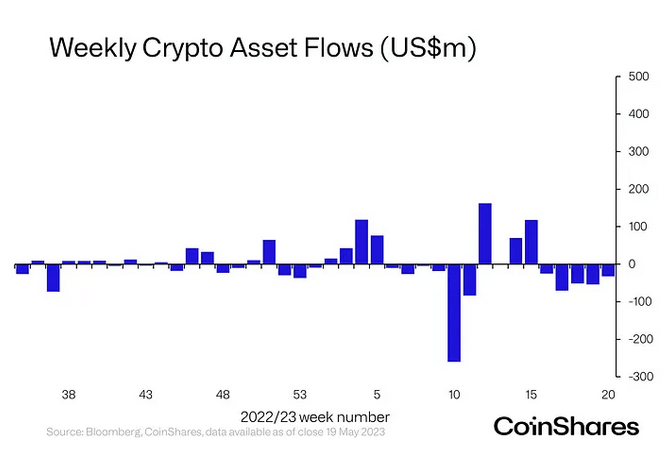

The graph under reveals consecutive cryptocurrency outflows from week 16. Complete outflows throughout this era amounted to $232 million.

2023 has seen extra outflow weeks than influx weeks, with week 10 (beginning Monday, March 6) being the yr’s most vital weekly outflow, practically $270 million throughout this era exceeded.

Early March was marked by financial institution failures, with Silvergate, Signature Financial institution and Silicon Valley Financial institution failing within the present excessive rate of interest surroundings.

After that interval, Bitcoin’s value recovered, rebounding from a low of $22,390, ending the week beginning March 13 at $28,140, and surpassing $31,000 a month later. Analysts consider this is because of adjustments in market sentiment on laborious property.

Most just lately, experiences of U.S. regulator hostility and uncertainty over the U.S. debt ceiling debate have hit cryptocurrency typically.

Germany had the best outflow

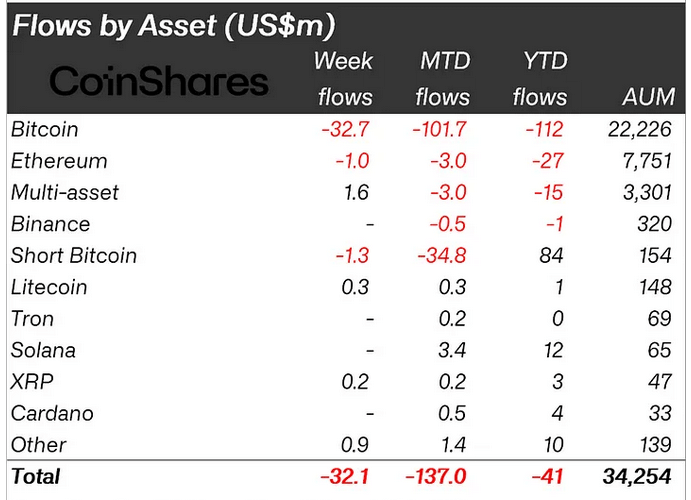

When it comes to flows by asset, bitcoin accounted for the most important loss, with $32.7 million within the twentieth week. Ethereum and quick bitcoin additionally suffered losses, however their charges have been considerably decrease at $1 million and $1.3 million respectively.

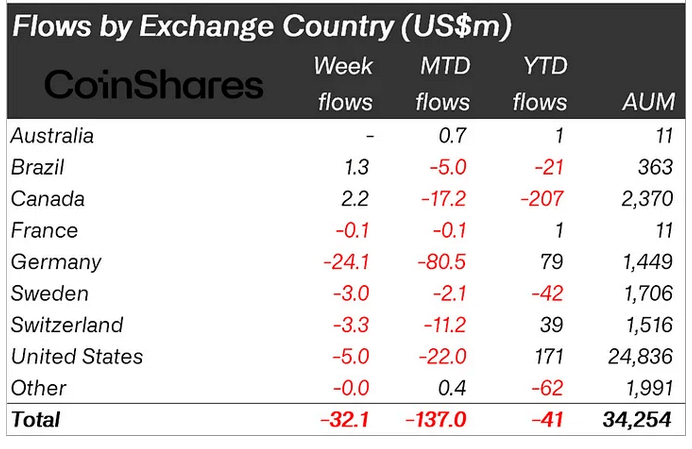

Additional evaluation by nation revealed that Germany induced essentially the most outflows, accounting for 75% of the weekly outflows. America adopted with $5 million and Switzerland with $3.3 million.

CoinShares mentioned the outflow pattern is expounded to a big drop in buying and selling quantity in each the institutional and spot markets.

“Quantity for the week totaled $900 million, 40% under the typical for the yr. Broad market quantity on trusted exchanges reached $20 billion for the week, the bottom degree for the reason that finish of 2020. .”

An article titled “5 Weeks of Outflows Counsel Cryptocurrency Market Vulnerability” was first revealed on currencyjournals.

Comments are closed.