Bitcoin's Realization Cap is a nuanced and modern metric for assessing Bitcoin's valuation, and is considerably totally different from conventional market capitalization.

In contrast to market capitalization, which merely multiplies Bitcoin's present market value by the whole variety of cash in circulation, the realized cap offers extra detailed and economically significant perception into the Bitcoin market.

That is carried out by aggregating the worth of all Bitcoins at their final moved value slightly than their present value. This strategy offers a extra steady view of market valuation and is much less inclined to volatility related to speculative buying and selling and short-term market actions.

To calculate the belief cap, we have to take the worth of the final time every Bitcoin moved and sum these particular person values throughout all Bitcoins. Which means that if a Bitcoin was final moved when its worth was $10,000, that specific Bitcoin will contribute $10,000 to the cap, whatever the present market value.

The realized cap reveals issues concerning the Bitcoin market that aren’t instantly apparent from the market capitalization.

First, it could actually present perception into the funding conduct of Bitcoin holders. For instance, a rise within the realization cap means that Bitcoin's value is rising, indicating optimistic sentiment amongst buyers. Conversely, if the belief cap is steady or lowering, it might point out that the majority Bitcoins usually are not altering arms, and might be as a result of holder conviction or excessive value ranges. might point out a scarcity of latest funding.

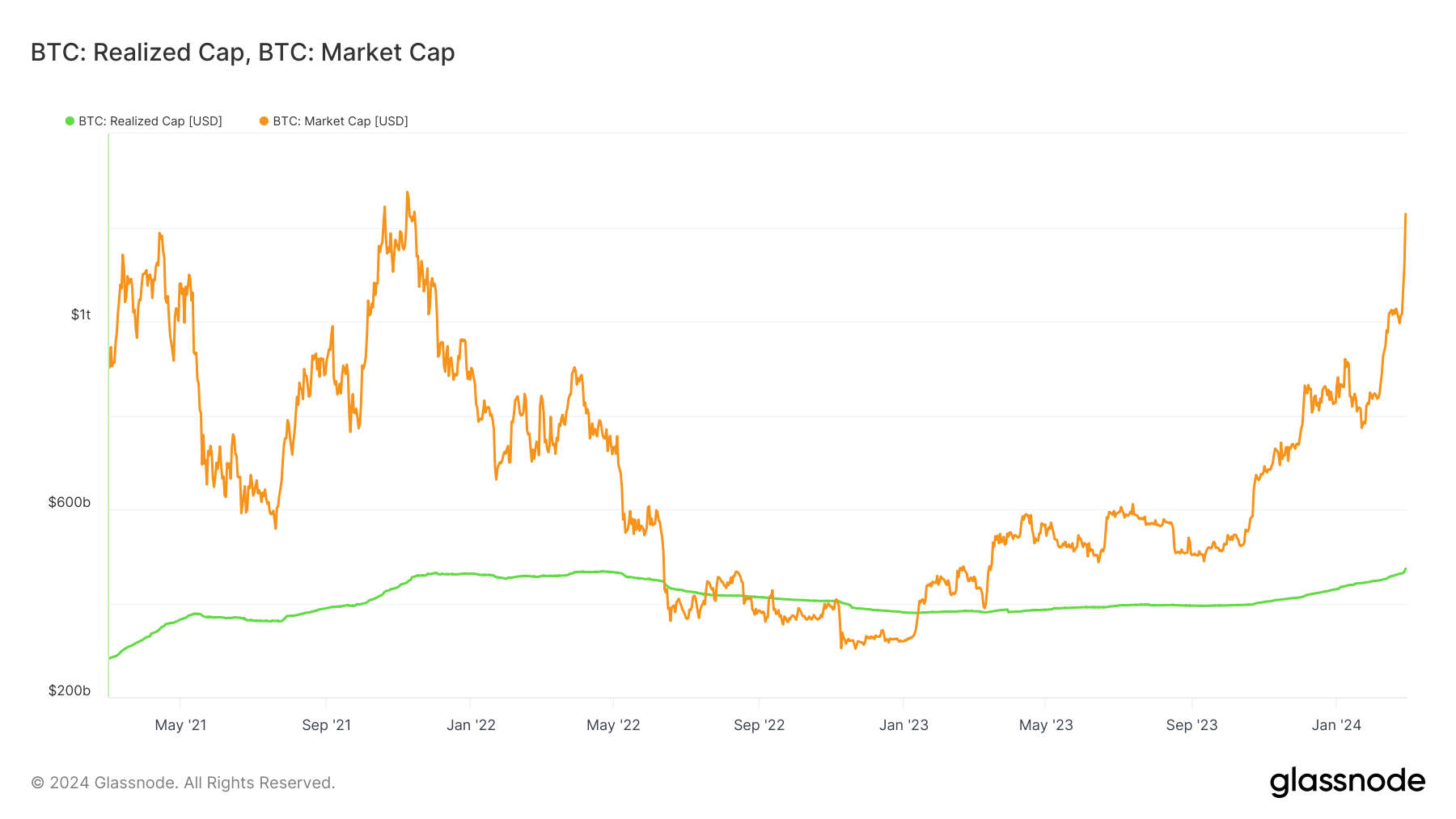

Moreover, it could actually function a proxy for invested capital, which is much less inclined to speculative fluctuations. During times of excessive volatility, market capitalization can fluctuate broadly, however as seen within the graph beneath, realized caps have a tendency to maneuver extra easily and supply a extra grounded view of the worth of the Bitcoin market. It displays the analysis. This stability makes it a beneficial instrument for buyers who need to look past the noise of each day value actions and assess the underlying well being of the market.

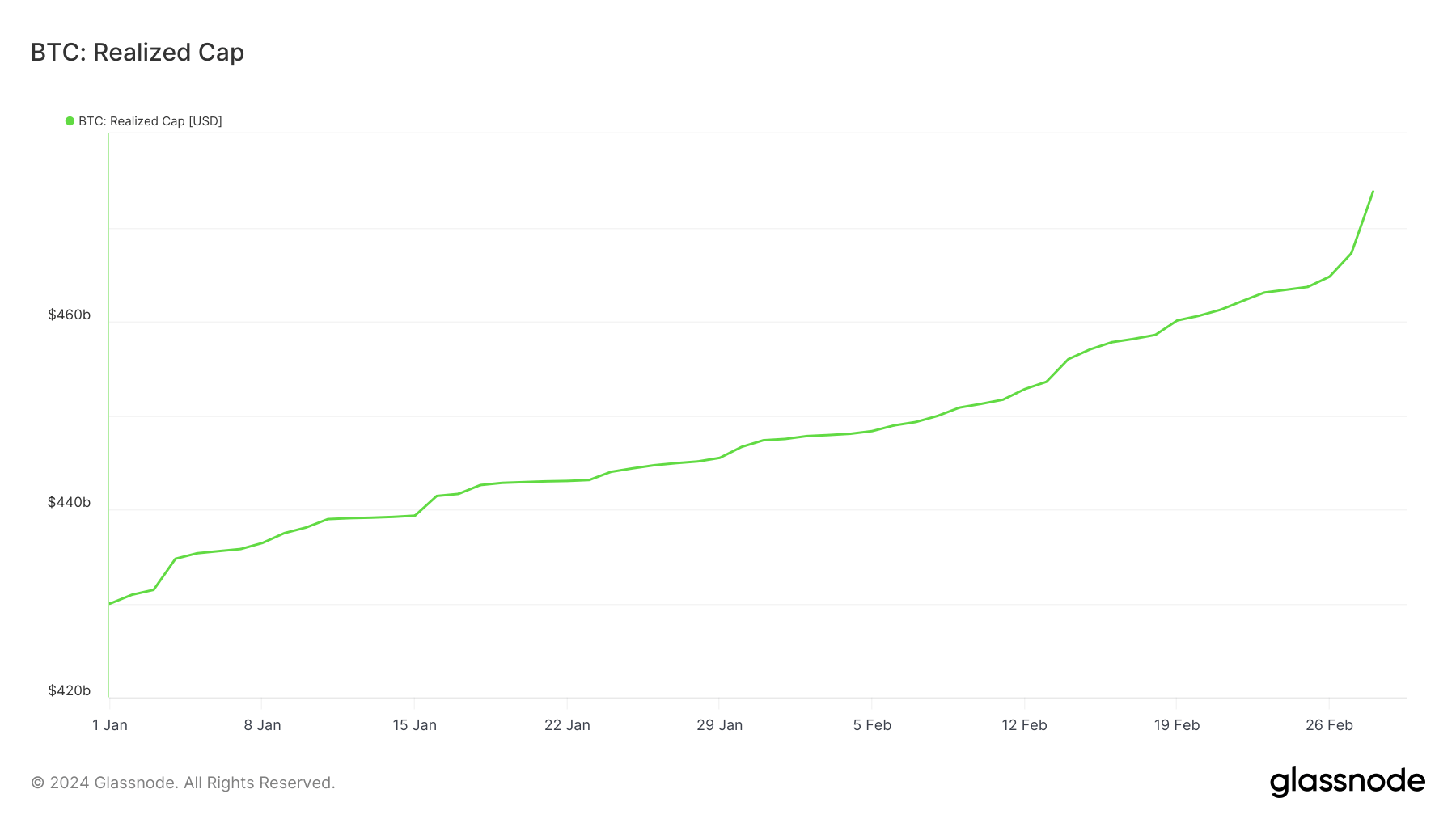

Bitcoin's most realization reached an all-time excessive on February twenty eighth, exceeding $473.8 billion. Which means that, on common, the Bitcoin community and its individuals weren’t investing in his BTC as economically as they’re now, primarily based on the worth at which most Bitcoins final traded.

Reaching the realized higher restrict ATH signifies that the market base is widening and deepening.

In contrast to market capitalization, which might rapidly inflate as a result of speculative fervor, the actual cap will increase on account of actual wealth transfers and, in flip, transactions that mirror a extra lasting perception in Bitcoin's worth. Subsequently, this ATH might be seen as a extra significant indicator of Bitcoin's acceptance and integration into broader investor monetary portfolios.

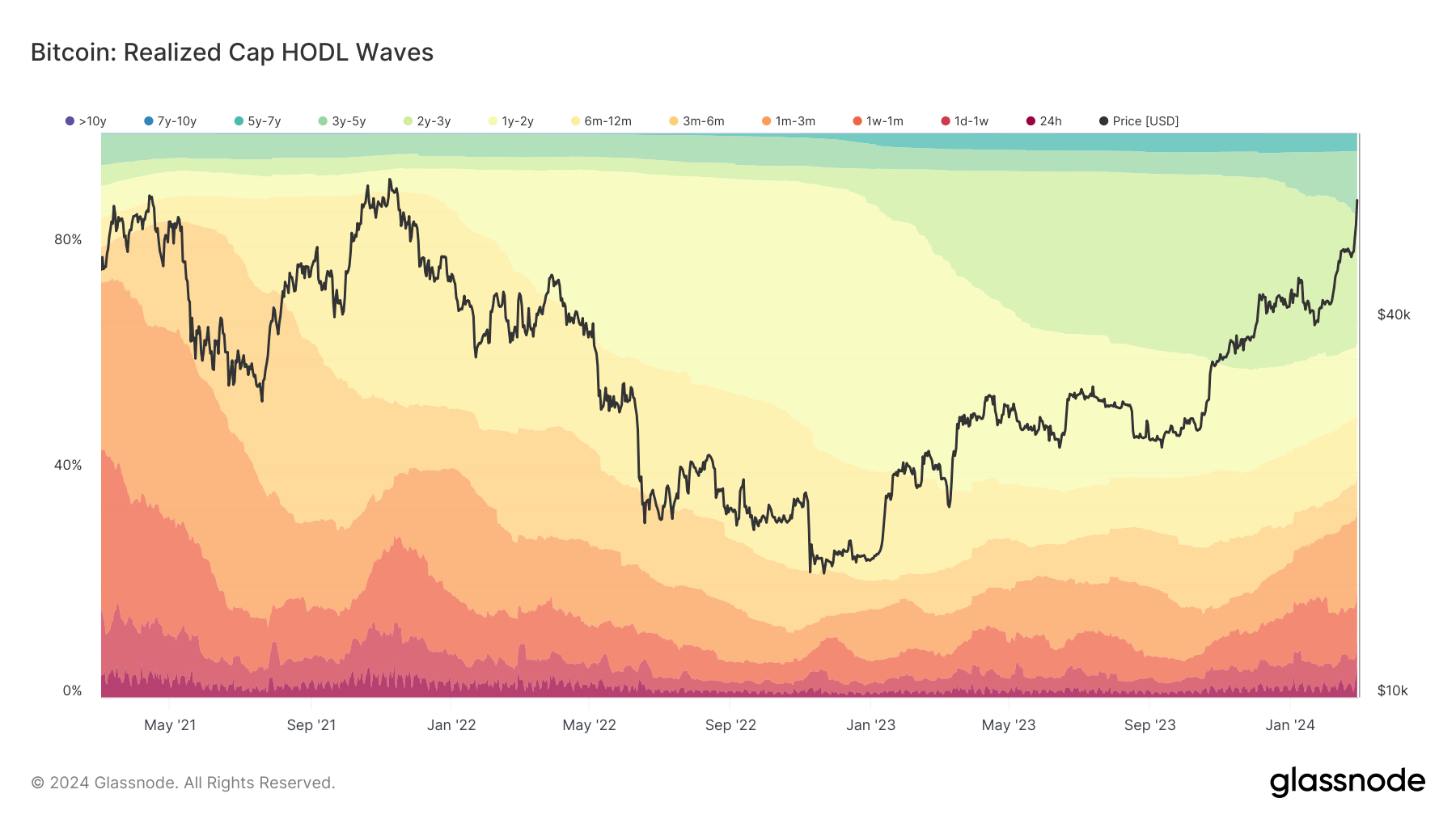

Realized Cap HODL Waves knowledge offers fascinating insights into the conduct of Bitcoin holders and their contribution to the realized cap enhance. By analyzing the modifications within the distribution of Bitcoin holdings throughout totally different holding cohorts over the previous three days, we are able to decide which teams are essentially the most energetic and the way their actions have affected the realized cap. Masu.

The distribution on February twenty fifth was as follows.

- Bitcoins held for lower than 24 hours accounted for 0.856% of the realized cap.

- The contribution of Bitcoin held from the first to the first week was 5.8%.

- The 1 week to 1 month cohort accounted for 15.571%.

- Bitcoin held for 3-6 months accounted for six.318%.

- The 6 months to 1 12 months group accounted for 11.818%.

- Lastly, the contribution of Bitcoin held for 1-2 years was 12.438%.

By February twenty eighth, there had been a noticeable change.

- The share of Bitcoin held for lower than 24 hours jumped to five.828%.

- The holding ratio from the first to the first week decreased to 4.851%.

- The 1 week to 1 month cohort confirmed a big lower of 8.543%.

- The speed for the 3-6 month group decreased barely to six.209%.

- Six-month to one-year bonds fell to 11.338%.

- The 1- to 2-year cohort decreased to 11.975%.

From this knowledge, essentially the most vital change occurred within the <24 hour cohort, which elevated dramatically from 0.856% to five.828%. This means that there was a big inflow of latest funding and buying and selling exercise, and huge quantities of Bitcoin had been traded quickly and certain offered or transferred at excessive costs, contributing to the rise within the realization cap. Masu. Such short-term holdings symbolize speculative buying and selling or quick reactions to market circumstances.

The lower in percentages for the 1 day to 1 week and 1 week to 1 month cohorts, together with a slight lower within the long-term holding class, suggests a consolidation of those teams or a transition to both ultra-short time period . Holding by buying and selling or long-term holding not specified right here (<24 hours). This may occasionally point out a reallocation of property throughout the market, with some short- to medium-term holders deciding to take income or reallocate their investments, contributing to the belief of the cap enhance.

Subsequently, the rise in realized caps seems to be pushed extra by short-term market exercise and buying and selling slightly than long-term holding methods, as evidenced by the dramatic enhance within the sub-24-hour cohort. Whereas we see exercise throughout all cohorts, the primary contributor to the rise in realized caps throughout this era is from these making short-term trades.

This conduct displays a market the place value fluctuations and quick buying and selling alternatives affect realization limits greater than the buildup methods of long-term buyers.

The put up File Realization Cap Alerts Unprecedented Financial Funding in Bitcoin appeared first on currencyjournals.