Funding charges are an usually ignored however essential facet of the cryptocurrency market. These charges are important in perpetual futures contracts, that are monetary devices that permit merchants to guess on the worth of Bitcoin with out an expiration date.

The funding charge helps align the worth of those contracts with the precise market value of Bitcoin via common funds between patrons and sellers. When rates of interest are optimistic, patrons pay sellers, indicating a bullish temper available in the market. Conversely, destructive rates of interest point out bearish sentiment as sellers pay patrons.

Funding ratios point out the course of market leverage and general sentiment. A excessive funding charge suggests sturdy bullish sentiment, with merchants prepared to pay extra to keep up a guess that the worth will rise. Alternatively, low or destructive rates of interest recommend a bearish outlook, tilting expectations towards decrease costs.

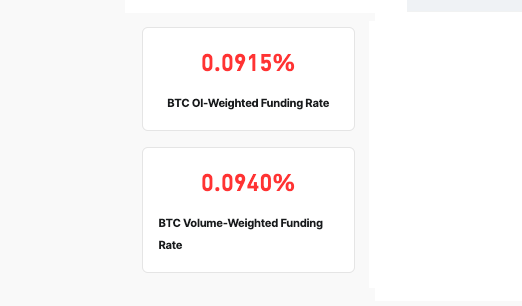

Earlier than the March 5 correction, Bitcoin's open interest-weighted funding ratio of 0.0921% and volume-weighted funding ratio of 0.0942% point out excessive prices for merchants holding lengthy positions in perpetual futures, based on CoinGlass information. Ta. The small variations between these charges end result from the distribution of open curiosity and quantity over totally different value ranges or occasions, indicating small variations in market sentiment and leverage.

The excessive value of holding this lengthy place signifies that a big portion of the market anticipated costs to rise additional within the close to future. That is particularly essential as BTC was struggling to regain its $69,000 ATH. Bitcoin briefly topped $69,000 on a number of exchanges on March 5, however a fast correction noticed the worth drop again right down to $59,500 after which round $67,000.

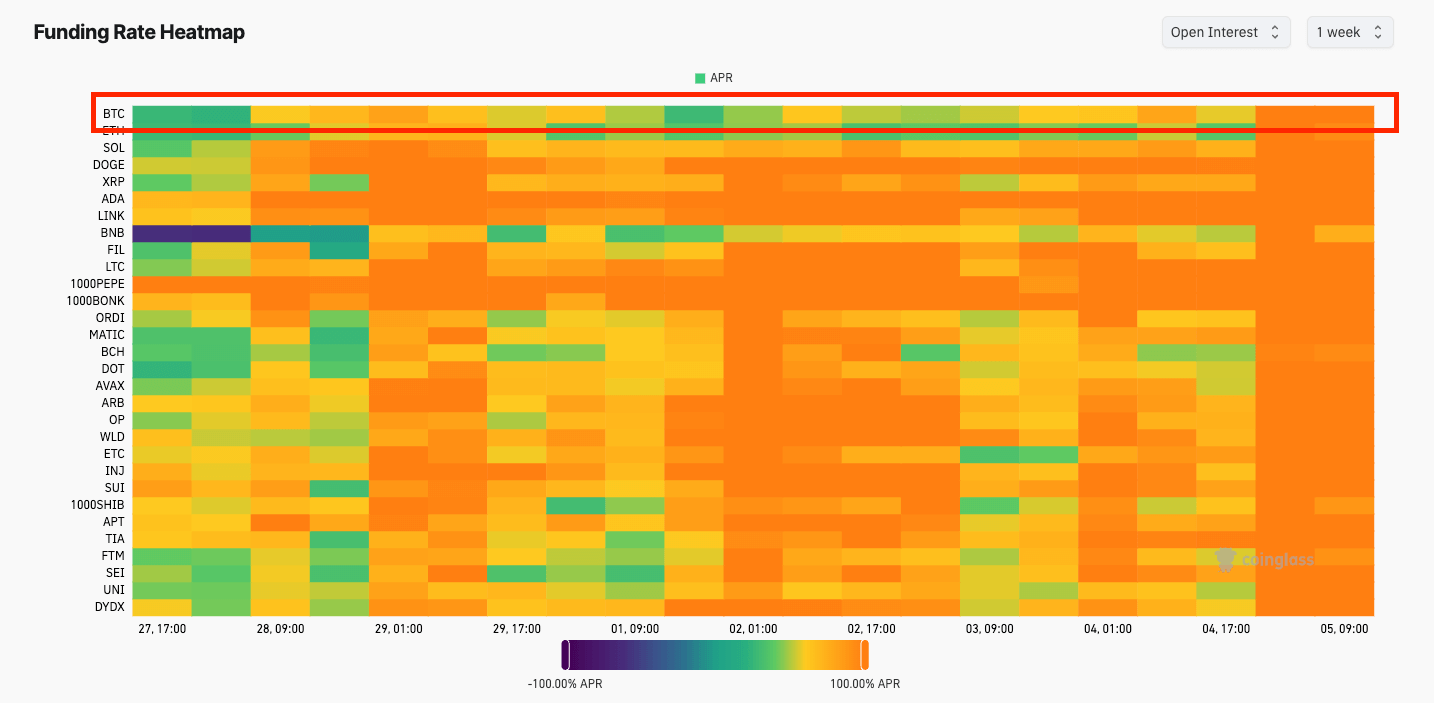

The bullish sentiment was mirrored within the dramatic rise in Bitcoin APR. On March 1st, the worth of Bitcoin was $61,480 and the funding charge APR was 27.72%. Additionally, whereas the rise in APR was seen in his previous couple of days of February, it wasn't till early March that he gained momentum. The sharp rise from an annualized charge of 27.72% on March 1st to 117.52% by the morning of March fifth adopted an increase in Bitcoin value from $61,480 to $68,296 over the identical interval.

The rise in annual funding charges, particularly the sharp rise noticed on March fifth, signifies a rising bullish sentiment amongst merchants. Markets are more and more prepared to pay increased premiums to carry lengthy positions in anticipation of additional value will increase.

The speedy rise in APR from March 1st to March fifth, particularly the hourly rise from 01:00 to 09:00 on March fifth, was an indication of latent progress as merchants rushed to benefit from the bullish development. It represents the climax of the speculative fever attributable to FOMO. This state of affairs usually results in a extremely leveraged market, the place the price of sustaining lengthy positions turns into unusually excessive, mirrored in excessive APRs. Because of the value adjustment on March fifth, the open interest-weighted funding ratio has dropped to 0.0504% on the time of writing as a result of $309 million in BTC liquidations previously 24 hours.

This case will increase the market's vulnerability to volatility and corrections. Overleveraged markets are inclined to sudden value declines, and even a small sale can set off a sequence of liquidations of leveraged positions, resulting in sharp value corrections. Traditionally, corrections have generally been preceded by massive will increase in costs or funding charges.

Earlier than the correction first appeared on currencyjournals, post-funding charges skyrocketed as merchants guess large on Bitcoin's future rise.