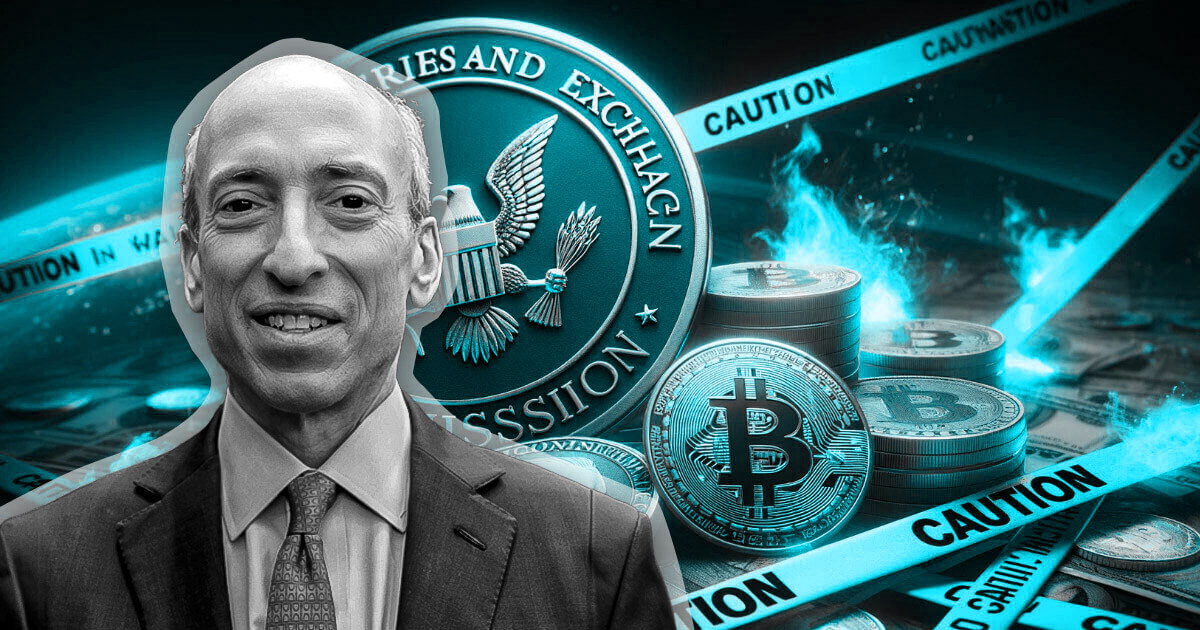

SEC Chairman Gary Gensler stated it's ironic that persons are calling the approval of the Spot Bitcoin ETF a historic second, given the spot-focused nature of Bitcoin ETFs, and that Satoshi Nakamoto's He stated it was the precise reverse of his imaginative and prescient.

He stated:

“Consider the irony of those that say this can be a historic week. This (approval) was about centralization and conventional technique of financing.”

Gensler made this assertion in a Jan. 12 interview on CNBC's “Squawk Field,” during which he delved into the reasoning behind the SEC's approval and addressed a few of the issues raised by Sen. Elizabeth Warren.

respect the court docket

Gensler stated the SEC has permitted 11 spot Bitcoin ETFs following the latest court docket ruling within the regulator's case towards Grayscale. The court docket dominated that there was no good purpose to reject the Spot Bitcoin ETF as a result of the SEC had permitted a product primarily based on futures for a number one cryptocurrency.

Mr. Gensler stated the SEC has the very best respect for the regulation and can at all times observe court docket directives relating to rules. He added that the ETF's approval will not be an endorsement of Bitcoin and stated he stays vital of the asset.

The SEC Chairman stated:

“We don’t approve or assist Bitcoin itself. It’s a product referred to as an exchange-traded product that enables traders to spend money on the underlying non-securities commodity asset.”

He added that Bitcoin stays a “risky retailer of worth” and isn’t used for reputable funds. However he acknowledged that the underlying expertise has promise and that ETF approval is “essentially the most sustainable path ahead.”

Gensler additionally made it clear that Bitcoin is the one cryptocurrency he considers to be a non-secure commodity, evaluating it to gold- and silver-based merchandise. He added that regulators preserve the view that almost all of crypto tokens are securities.

Reply to Warren

Gensler's remarks additionally touched on Warren's criticism of the choice. The senator has been a vocal critic of the cryptocurrency market, arguing that the SEC's approval was each a authorized and coverage error.

In response to those issues, Mr. Gensler expressed respect for differing opinions, however reaffirmed his dedication to observe authorized and court docket directives. he stated:

“Whereas we perceive and respect the issues raised by Sen. Warren, our determination is predicated on a rigorous evaluate of the authorized framework and present fiscal realities.”

Regardless of the controversy surrounding the SEC’s determination, the approval of those Bitcoin ETFs alerts a possible new period for cryptocurrencies in mainstream monetary markets.

The primary buying and selling session after approval noticed vital motion, demonstrating robust investor curiosity and doubtlessly paving the way in which for wider acceptance of digital property.