- In keeping with Kaiko, the destabilization of the USDT peg could have been brought on by manipulation.

- Promoting exercise began a number of days earlier than USDT fell to $0.995.

- Binance’s USDT-USDC pair noticed a major sell-off in USDT.

Kaiko, a cryptocurrency information supplier, has revealed an perception into the latest volatility surrounding Tether (USDT), the world’s largest stablecoin. The corporate’s evaluation means that the destabilization of USDT’s US greenback peg could have been brought on by manipulation forward of the discharge of key paperwork revealing the corporate’s banking relationships and business paper publicity.

A wave of promoting started days earlier than USDT fell to $0.995 on centralized and decentralized exchanges. Kaiko stated some holders could also be extremely educated concerning the imminent launch of the paperwork.

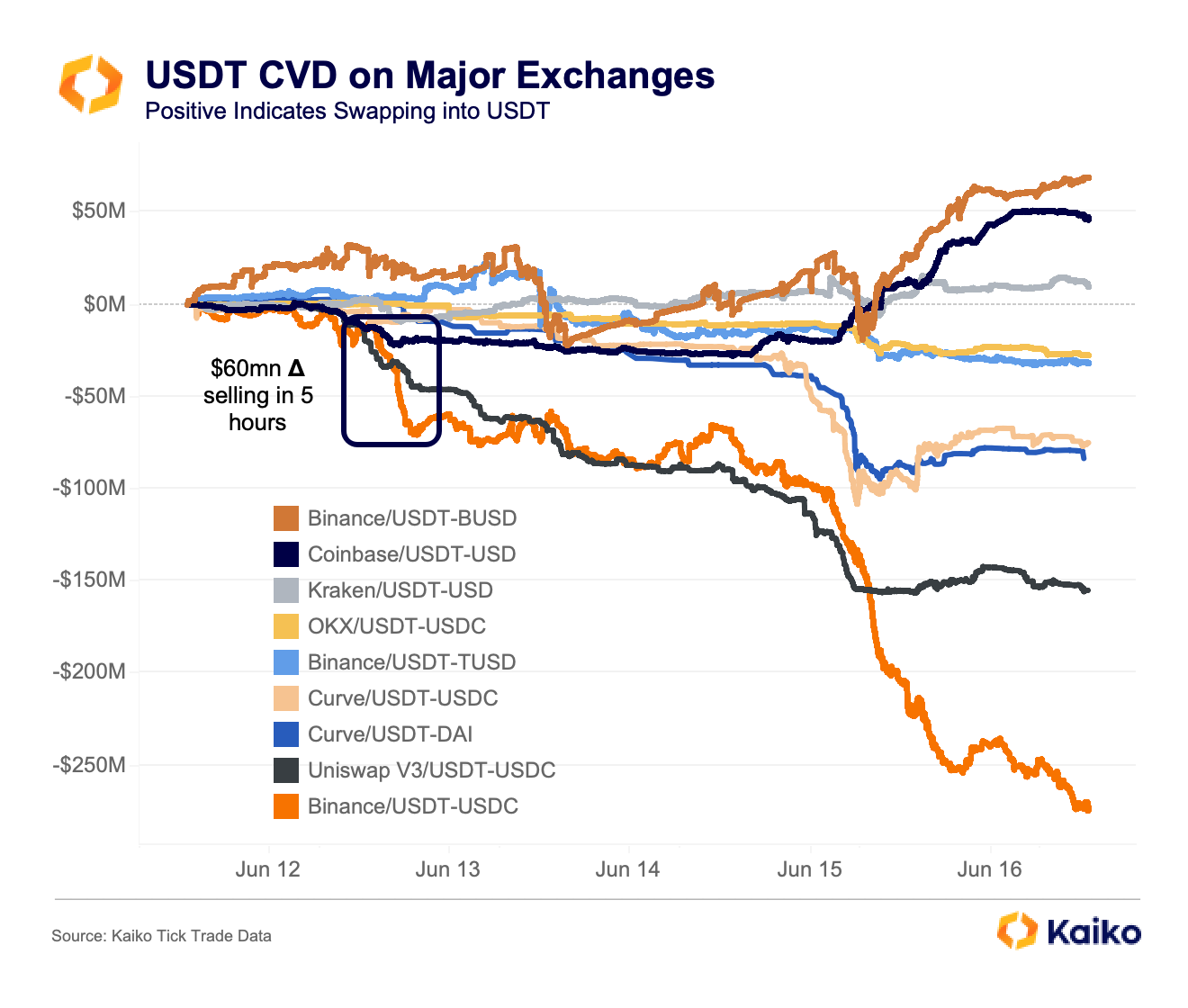

One indicator that gives beneficial perception into market dynamics is the Cumulative Quantity Delta (CVD) indicator, which represents the buy-sell pattern of a selected buying and selling pair. On this context, a constructive CVD worth signifies a desire for swaps to USDT, whereas a adverse worth signifies a USDT promote.

Binance’s USDT-USDC pair confirmed essentially the most USDT promoting exercise, posting a adverse CVD of $250 million from Monday to Friday. Uniswap V3 adopted carefully with a adverse CVD of $150 million.

Conversely, Coinbase and Kraken’s USDT-USD markets present constructive CVD values, indicating the willingness of merchants to trade their fiat forex for barely discounted USDT. Furthermore, his USDT-BUSD pair on Binance exhibits his CVD in constructive, suggesting merchants’ propensity to grab the chance to unload BUSD.

Additional evaluation reveals that Curb, the main decentralized marketplace for stablecoin swaps, has witnessed important promoting strain on USDT, primarily inside swimming pools involving DAI and USDC. This buying and selling pair confirmed his CVD of minus $150 million, highlighting the magnitude of promoting exercise throughout the decentralized ecosystem.

Curiously, the biggest order recorded throughout the unpegging occasion amounted to round $12 million value swapped from USDC to USDT. The deal exhibits that some astute merchants have tried to capitalize on the worth distinction between the 2 stablecoins with the goal of benefiting from prevailing market circumstances.

I’ve been surfing online more than three hours nowadays, yet I never found any fascinating article like yours. It?¦s beautiful price sufficient for me. Personally, if all site owners and bloggers made excellent content as you probably did, the net might be a lot more helpful than ever before.

Pretty portion of content. I just stumbled upon your web site

and in accession capital to claim that I get actually loved account your blog posts.

Anyway I will be subscribing to your augment and even I success you access consistently rapidly.

My partner and I absolutely love your blog

and find a lot of your post’s to be what precisely I’m looking for.

Would you offer guest writers to write content in your case?

I wouldn’t mind composing a post or elaborating on many of the subjects you write in relation to here.

Again, awesome site!