Plans to liquidate altcoins held by bankrupt financier Celsius into Bitcoin (BTC) and Ethereum (ETH) will additional strain the cryptocurrency market, in keeping with a July 10 report from blockchain analytics agency Kyco. It’s mentioned that there’s a chance of making use of

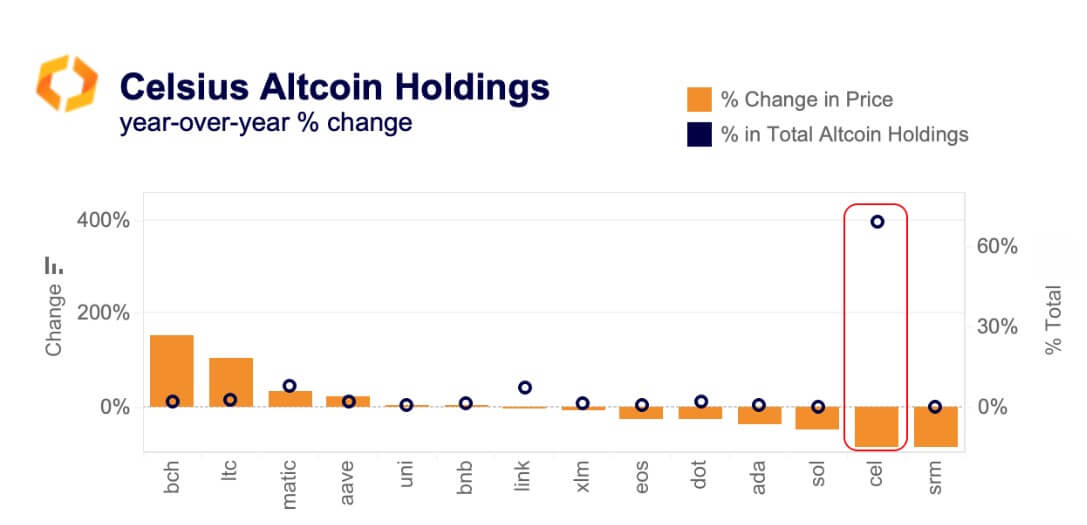

Kaiko famous that the liquidity of many of the altcoins held by Celsius has registered a big decline over the previous yr, starting from 6% to as excessive as 84%.

“The entire market depth of Celsius altcoin holdings has fallen by 40% since 2022, with a complete of round $90 million in early July.”

In line with the graph beneath, solely Litecoin (LTC), Bitcoin Money (BCH), Polygon (MATIC), and Aave (AAVE) have seen a noticeable change of their liquidity state of affairs over the previous yr. Others nearly decreased.

BCH and LTC, specifically, noticed a surge in liquidity circumstances after conventional monetary institution-backed cryptocurrency change EDX enabled help in June.

The corporate additionally famous that Celsius has over $90 million in complete altcoin holdings, “which suggests will probably be troublesome for the corporate to liquidate with out experiencing vital worth slippage.” . He additional added:

“Over 60% of the altcoin market depth is targeting Binance and different offshore exchanges, with 30% on US exchanges.”

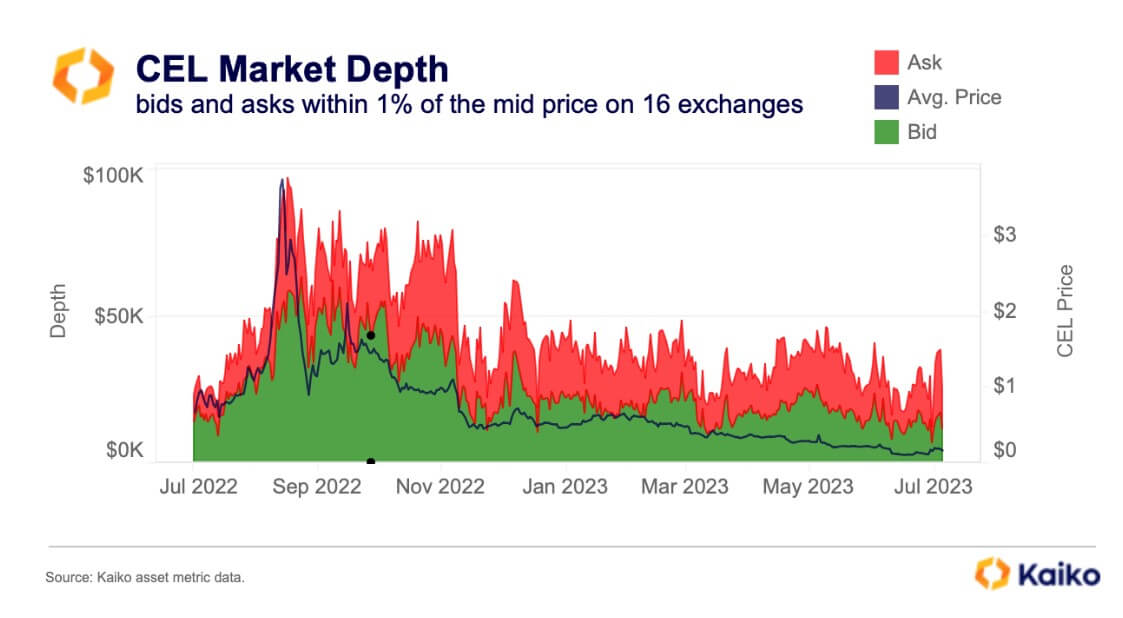

CEL token liquidity is nearly non-existent

Kaiko mentioned Celsior is going through issues because of the lack of liquidity in its most essential altcoin holding, CEL.

CEL is the native token of Celsius and accounts for practically 65% of the bankrupt firm’s complete altcoin holdings.

“There’s just about no liquidity in CEL when it comes to market depth, largely concentrated in OKX and Bybit, and the market depth has collapsed to only $30,000.”

Since Celsius filed for chapter, curiosity within the firm’s native token has waned, with its worth peaking above $8 in 2021 earlier than dropping to lower than $1, the paper mentioned. . of crypto slate knowledge.

Celsius’ post-bankruptcy liquidation plans might put strain on the complete crypto market: Kaiko makes his first look on currencyjournals.

(Tag Translation) Bitcoin

Comments are closed.