Bitcoin mining is the cornerstone of the cryptocurrency business and crypto market. Basically, mining profitability comes all the way down to a single key metric: the price of producing every Bitcoin.

This price turns into much more essential in the case of publicly traded Bitcoin mining firms. It is because primarily this price is what retains the corporate working and, in the end, worthwhile. On this report, currencyjournals will deal with two of the most important public Bitcoin miners: Marathon Digital and Riot Blockchain.

Marathon Digital (MARA) and Riot Platform (RIOT) are two of the most important publicly traded Bitcoin mining firms by market capitalization. Their operational capabilities and monetary standing present essential perception into the state of Bitcoin mining on the highest and most organized stage.

All public Bitcoin mining firms, together with Marathon and Riot, present information on mining prices, however there’s typically extra to their printed numbers than that. Some firms use totally different accounting therapies for digital belongings, which impacts e book worth. Some firms have a number of mining websites in several geographic areas, every with totally different electrical energy costs and mining capability.

To higher perceive the typical price of mining one Bitcoin, currencyjournals took a special strategy. It takes every firm's whole price of income and divides it by the variety of Bitcoins it produces. Though this methodology is extra speculative, it guarantees to extra precisely replicate precise mining prices.

Divide the full price of income by the variety of Bitcoins generated to get a complete image of the prices incurred within the mining course of. This strategy goes past simply energy and working prices to incorporate all direct and oblique prices related to mining, reminiscent of tools depreciation, upkeep, labor, and administrative prices.

This methodology reveals how a lot it truly prices an organization to mine every Bitcoin by aggregating these prices. It precisely displays financial actuality and captures each expense that impacts your backside line. It helps perceive the effectivity and profitability of Bitcoin mining operations and is a helpful instrument for analysts and traders trying to perceive the monetary well being and operational effectivity of mining firms.

Marathon Digital (MARA)

Marathon loved nice success in 2023, increasing its operational capabilities via acquisitions and new mining tools. The corporate additionally introduced that the acquisition diminished working prices by as much as 30%, considerably impacting profitability.

Nonetheless, there’s little concrete info instantly out there from Marathon concerning the corporate's mining prices. September evaluation The Motley Idiot estimates that it prices Marathon to mine 1 BTC at slightly below $19,000.Firm's newest month-to-month replace For December 2023, solely technical particulars about hash fee capability will increase and mining efficiency are included, and no details about mining prices is included.

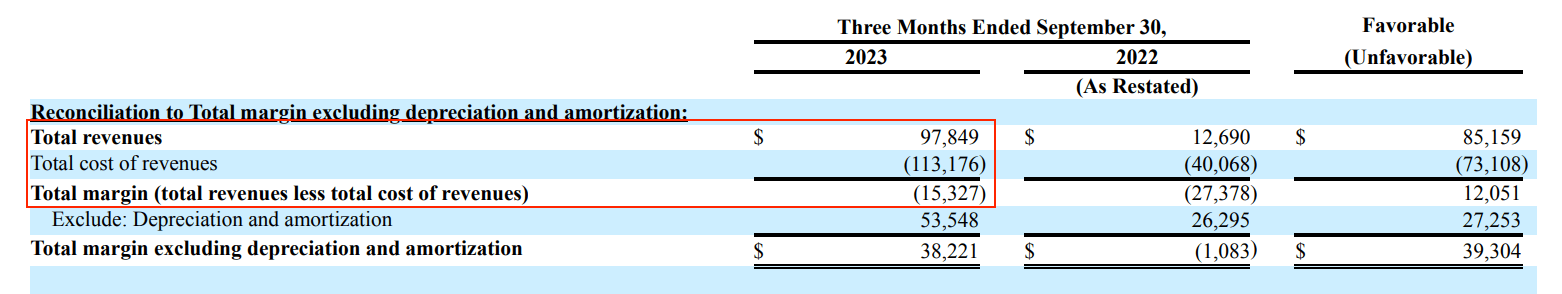

Our main information supply is from the corporate 10-Q report To find out the typical price of mining 1 BTC, we use another methodology that divides the full income price by the variety of Bitcoins generated within the three months ending September 30, 2023. The overall price of income will likely be $113,176,000, in keeping with the report. Subtracting gross revenue from price of income leads to $97,849,000.

The corporate produced 3,490 BTC throughout the quarter, so dividing the price of income by the variety of Bitcoins produced yields a mining price of roughly $28,036.96.

Riot Platform (RIOT)

Riot has spent a lot of 2023 implementing a long-term strategic plan to make sure the corporate stays worthwhile after the Bitcoin halving in April 2024. In its Q3 2023 replace, the corporate's CEO mentioned the corporate's energy technique enabled the margin discount. The year-to-date price of mining is now $5,537 per Bitcoin.

This extraordinarily low price could be attributed to Riot's particular enterprise technique, which incorporates acquiring electrical energy credit from the Electrical Reliability Council of Texas (ERCOT). Riot participates in ERCOT's demand response program, which reduces electrical energy consumption throughout peak demand intervals in change for electrical energy credit. These credit cut back Riot's electrical energy invoice, which is a serious element of Bitcoin mining prices.

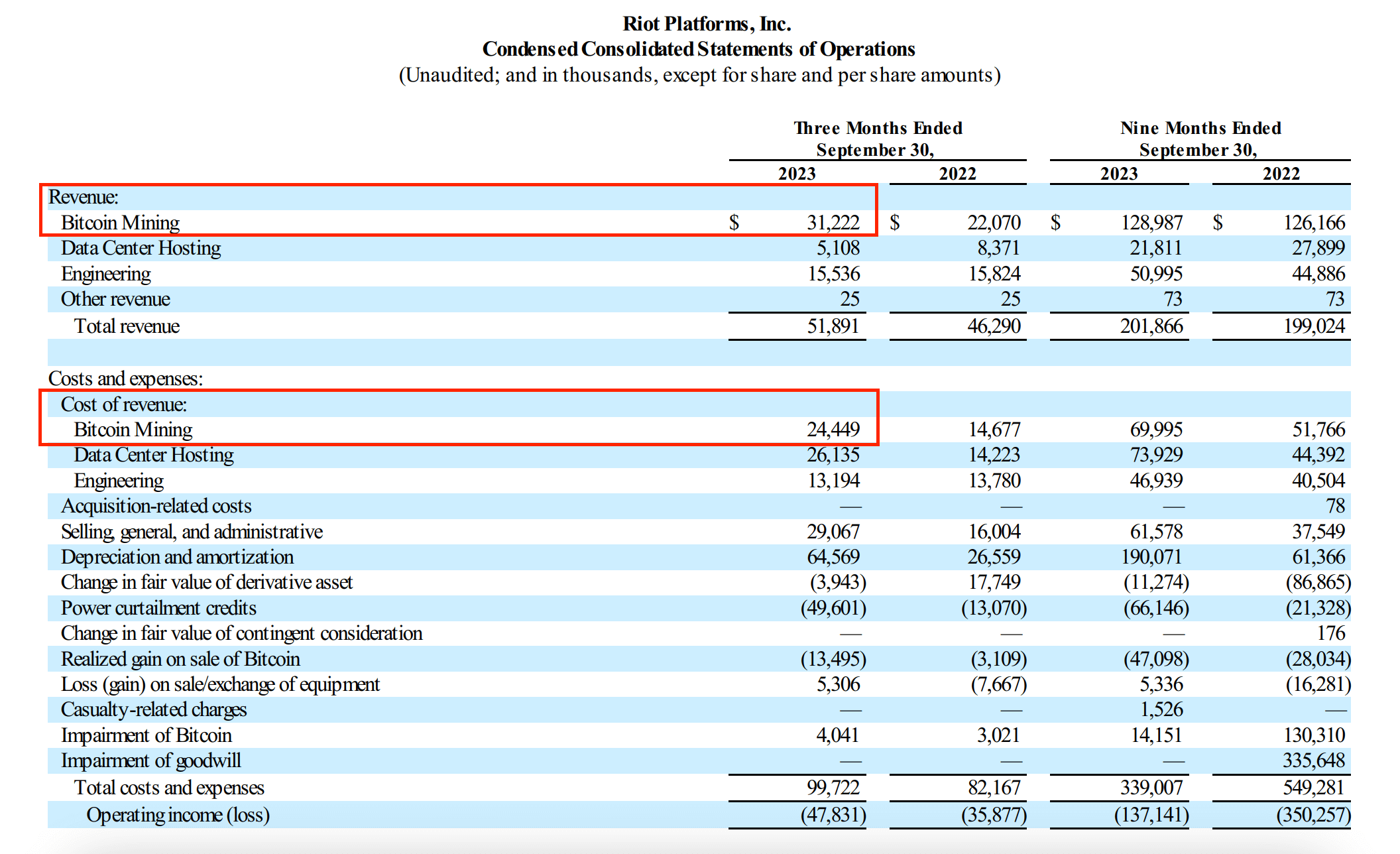

To acquire Riot's common price of mining 1 Bitcoin, apply the identical methodology to Marathon. In different phrases, divide the price of income by the variety of Bitcoins mined in a given interval. In line with Riot's Q3-10 2023 submitting, Riot's price of income from Bitcoin mining was $24,449,000. Throughout this era, Riot mined his 1,106 BTC.

If we divide the full price of income particular to Bitcoin mining by the variety of BTC mined, we discover that Riot's common price to mine one Bitcoin in Q3 was roughly $22,105.78.

This brings Riot's mining price nearer to Marathon's $28,036.96. Nonetheless, a key factor of Riot's operational technique is its engagement with ERCOT. Within the third quarter of final 12 months, Riot obtained about $49.6 million in energy discount credit from his ERCOT.

In line with the tenth quarter submitting, if the $49.6 million in energy curtailment credit for the quarter have been allotted on to Bitcoin mining income prices primarily based on proportional energy consumption, they might be diminished by $31.2 million. On this case, the adjusted price of income can be a destructive worth of -$6.751 million, indicating that the credit offset Riot's unique prices.

Contemplating this information, the typical price to mine 1 Bitcoin is roughly -$6,105.78. Though this can be a extremely unlikely situation, it does illustrate how massive an impression energy curtailment credit might have on Riot's mining operations and the way a lot it might contribute to general profitability. I’m.

The publish Marathon vs Riot: An Evaluation of the True Value of Mining 1 Bitcoin appeared first on currencyjournals.