LQWD Applied sciences, liquidity supplier for the Bitcoin Lightning Community, has partnered with Ambos Applied sciences to additional set up institutional liquidity on Lightning. This partnership will enable LQWD to offer liquidity to the Ambos market, permitting LQWD to satisfy market demand for Lightning Community liquidity whereas producing yield on its Bitcoin holdings.

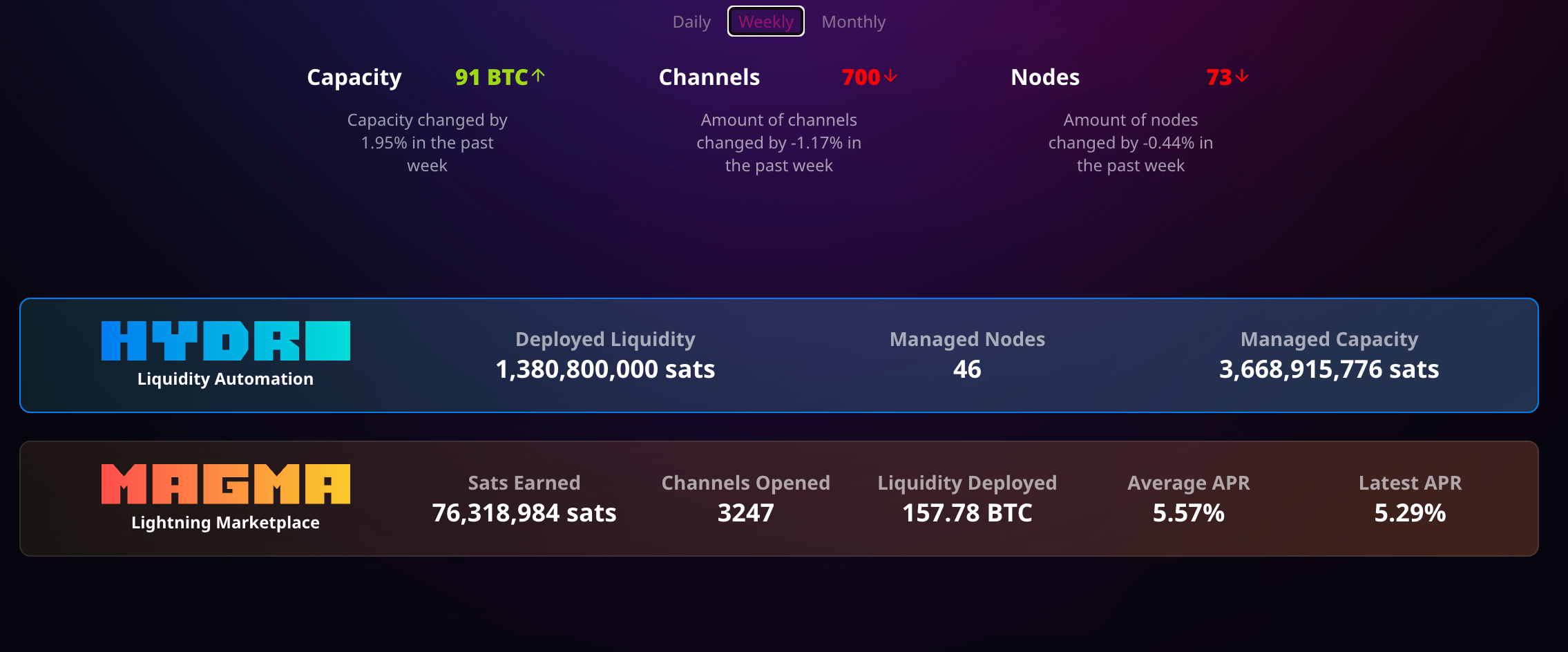

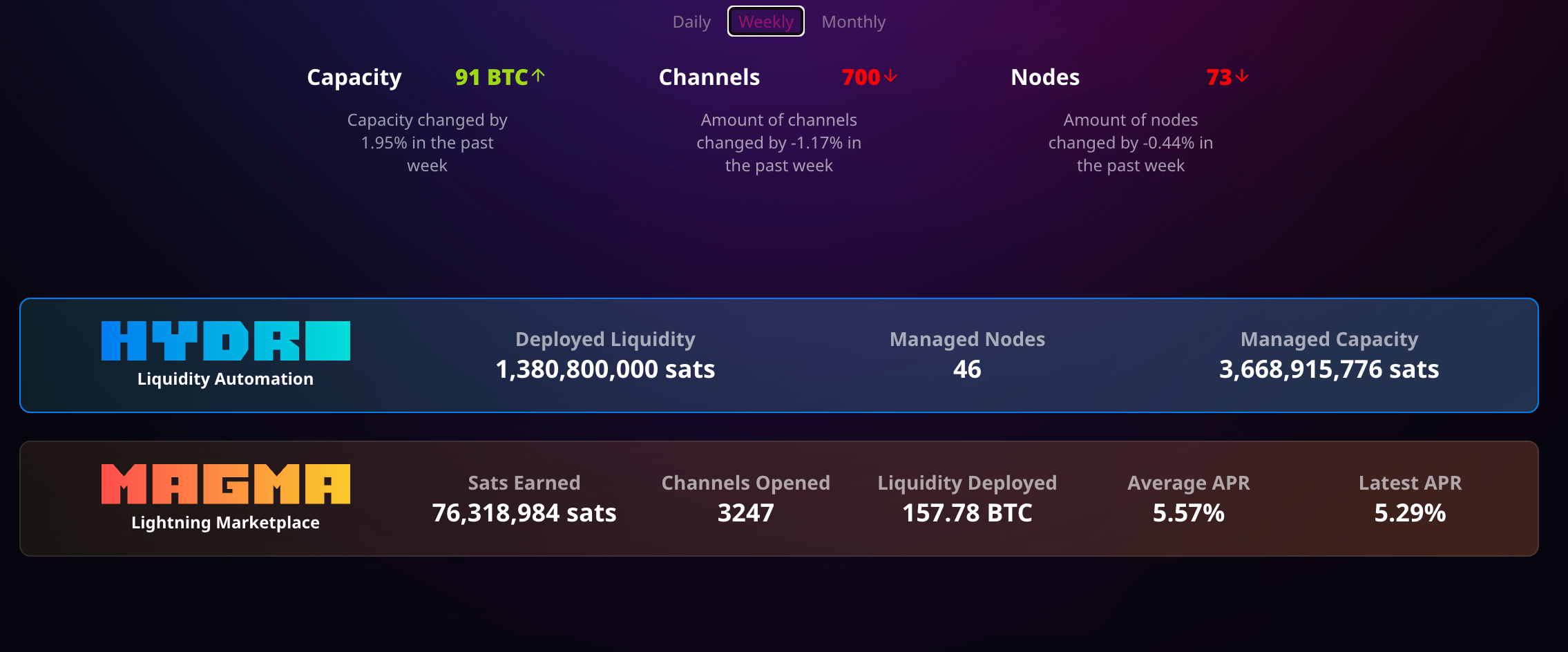

Amboss, a supplier of knowledge analytics options and funds operations in Lightning, provides specialised merchandise akin to Magma, a liquidity market, and Hydro, a complicated liquidity automation device. These merchandise are meant to create an orderly market and facilitate funds on the Lightning Community. As a liquidity supplier, LQWD has launched an preliminary tranche of Bitcoin to Amboss and plans to deploy further Bitcoin by the partnership.

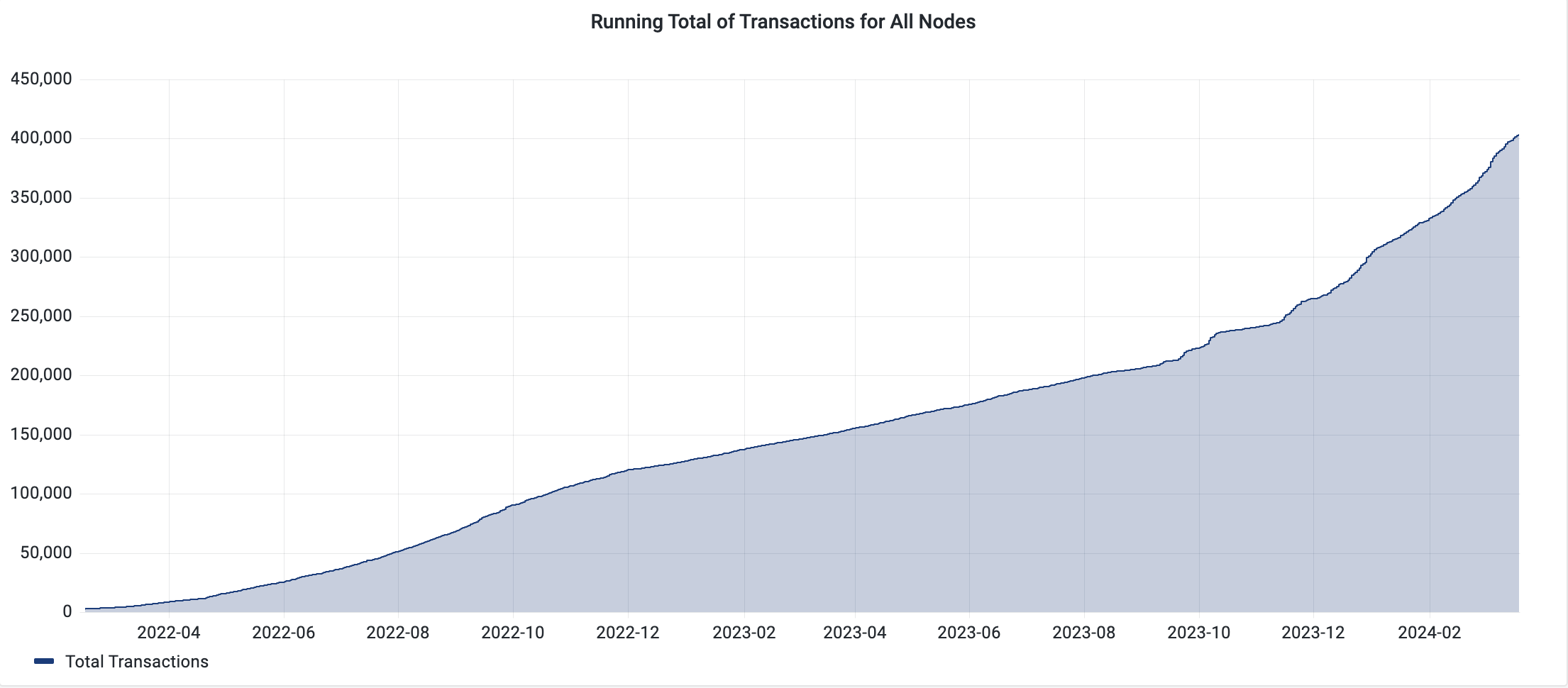

In keeping with self-reported knowledge, LQWD's Lightning Community transactions have been persistently rising since 2022, lately exceeding 400,000 transactions.

Amboss prospects will acquire liquidity from LQWD, permitting LQWD to earn preliminary charges and routing charges for trades by the Lightning Community. Sean Anstey, CEO of LQWD, mentioned: “This strategic partnership marks the collaboration between LQWD and Amboss as we work collectively to enhance liquidity and effectivity inside the Bitcoin Lightning Community ecosystem. “This represents an essential step ahead for either side,” he mentioned, underscoring the significance of the partnership.

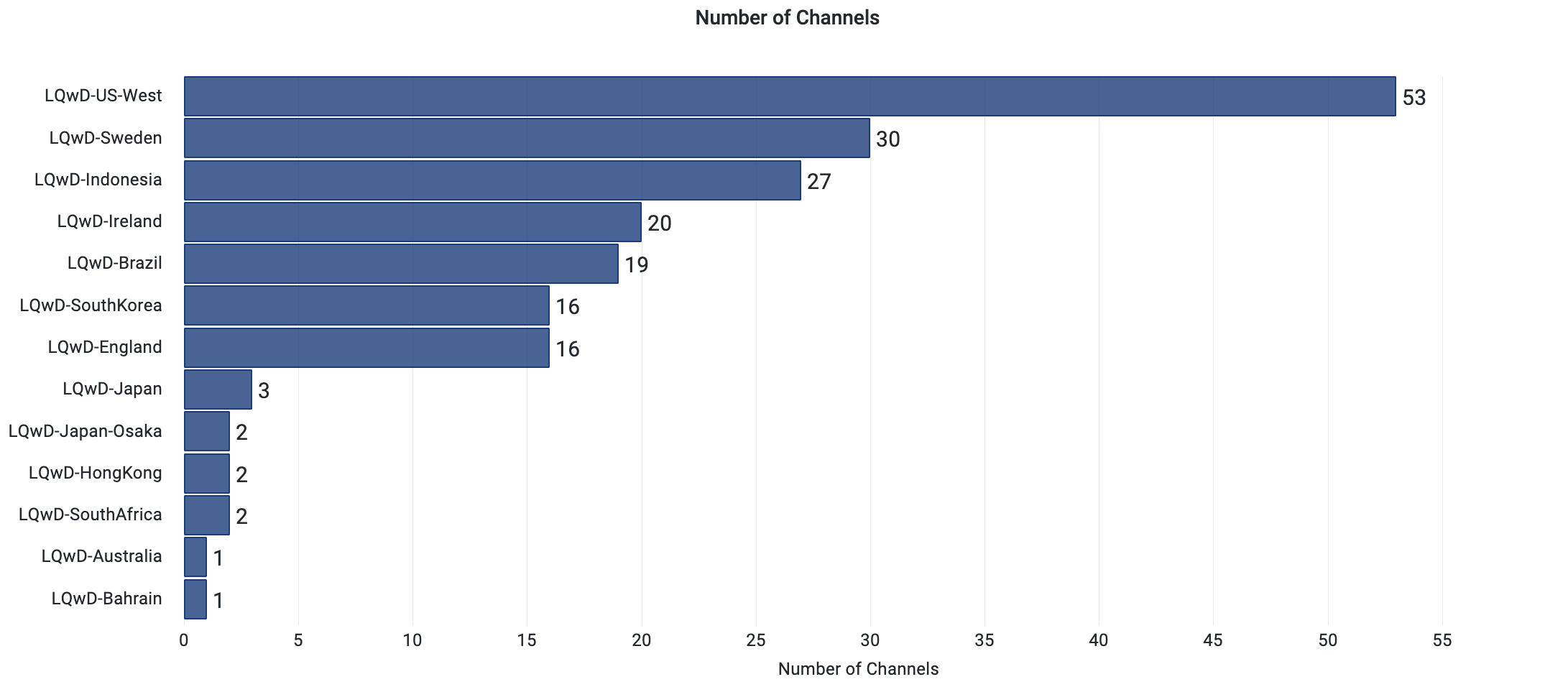

LQWD additionally provides Lightning channels in some areas, totally on the West Coast of america. Curiously, after america, Sweden, Indonesia, Eire, and Brazil have probably the most lively channels.

This partnership will enable LQWD to deploy its personal proprietary Bitcoin, probably permitting it to seize massive buying and selling volumes and generate income from its holdings. Importantly, LQWD maintains full sovereignty and management all through the method and is concentrated on growing fee infrastructure and options that speed up Bitcoin adoption by the Lightning Community.

Amboss' market presently provides a 5.57% APR on Bitcoin deployed by the Lightning Channel, with complete liquidity of 157 BTC, roughly $10 million on the time of writing.

Jesse Shrader, co-founder and CEO of Amboss, highlights the advantages of collaboration:

“The partnership with LQWD will give Amboss prospects world wide direct entry to institutional-grade liquidity for Bitcoin funds and can allow LQWD to generate further income by nodes on the Lightning Community. Moreover, this partnership strengthens Amboss' liquidity market provide facet.”

LQWD additionally makes use of its personal Bitcoin as an operational asset to ascertain nodes and fee channels on the community. Via the partnership between LQWD and Amboss, the businesses purpose to offer enhanced liquidity options for each companies and shoppers, contributing to the expansion and effectivity of the Bitcoin Lightning Community ecosystem.

(Tag translation) Bitcoin