With the arrival of the Ordinals protocol, Bitcoin has gone from being a considerably outdated single-asset chain to one thing extra thrilling.

Nonetheless, this newfound pleasure has sparked a backlash from astute purists who argue that BTC isn’t meant for non-monetary transactions, with some even calling the protocol a spam assault on the community.

Ignoring the protests, Ordinal’s Capitalists argue {that a} permissionless system additionally contains the liberty to make use of Bitcoin in any manner. They accuse purists of making an attempt to spoil their enjoyable.

A disagreement units the stage for a possible chain break up, which is finally not in everybody’s greatest curiosity.

The taproot that opened Pandora’s field

Taproot gentle fork rolled out in November 2021. On the time, this was primarily seen as an improve to enhance community safety, effectivity, and scalability. Nonetheless, it additionally enabled the implementation of executable instructions and particular scripts, laying the muse for Ethereum-like options similar to good contracts and dApps.

With the discharge of Ordinals in January by developer Casey Rodarmor, the affect of this Ethereum-like addition started to take form. This protocol permits every of his 100 million satoshis in Bitcoin to be written with further metadata similar to textual content, pictures, movies and code.

By February, we used the Ordinals protocol to jot down wizard jpegs to the blockchain, opening the door to the Bitcoin NFT market. However as a “sq. peg, spherical gap” utilization of this expertise, buying and buying and selling bitcoin NFTs is a cumbersome and technically difficult job, and data of node synchronization and his launch of NFTs upon fee I needed to belief a 3rd social gathering to try this.

Supporting wallets similar to Ordinals Pockets, Xverse and hiro Pockets have just lately been rolled out to handle these ache factors, bringing the method nearer to the usual expertise NFT consumers are accustomed to.

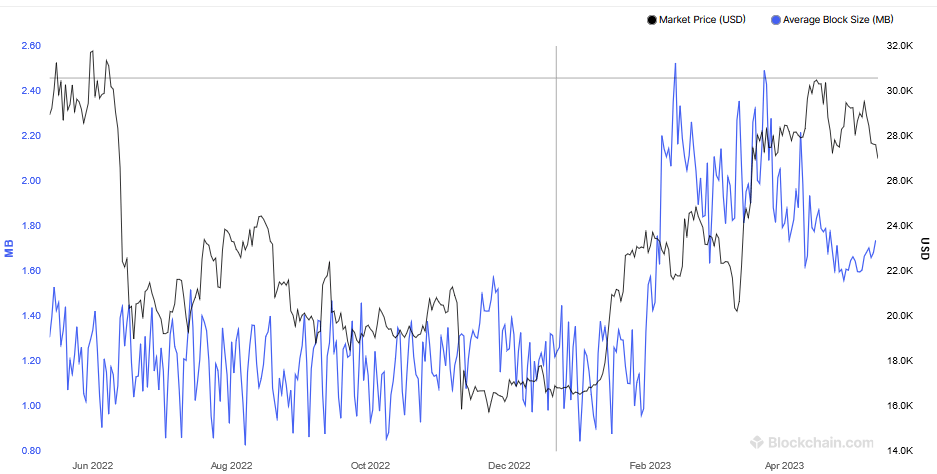

Earlier than Ordinals NFTs went reside, the common block dimension hovered round 1.2MB, however since rollout, subsequent blocks have greater than doubled on common, negatively impacting pace and scalability. As well as, rising transaction charges and chain bloat attributable to backlogs of unconfirmed transactions compound the usability downside.

Introducing the BRC-20 Token

Issues accelerated additional in March when nameless developer “Domo” introduced the BRC-20 token, bringing a fungible token commonplace to Bitcoin. By including JavaScript Object Notation (JSON) Pricey satoshis, BRC-20 token traits particulars (similar to minted and distributed values) are saved within the community.

Stimulated by the memecoin season, the market cap of BRC-20 tokens hit a peak worth of $1 billion on Could eighth. Nonetheless, attributable to rising market uncertainty and the prevalence of memetic coin lag, there was a big drawdown since then, dropping to $574 million as of 2019. press.

In line with KuCoin, the surge in recognition of BRC-20 exacerbated issues seen with NFTs, inflicting important community delays, with some customers reporting that affirmation took 4 hours. Moreover, the BRC-20 token additional contributed to the rise in transaction charges.

Regardless of the usability points, miners revenue from on-chain metrics similar to Minerhash Worth, which measures a miner’s earnings relative to their contributions to the community, and Minerhash Worth, which examines the gross sales price of cash mined by miners. I’m having fun with Revitalization of the Bitcoin mining house.

of crypto slate Our evaluation concludes that if this momentum continues at its present tempo, miners will expertise elevated profitability and elevated confidence within the community, resulting in a propensity to retain mined cash.

Ordinal neighborhood division

Distinguished members of the Bitcoin neighborhood have expressed their assist for Ordinals.For instance, MicroStrategy Chair Michael Thaler He mentioned the protocol was what prompted the sentiment to show bullish, including that if he had been a miner he could be ecstatic.

He additionally identified that the expertise might result in many new functions in the long run, a few of which might remedy critical social issues, citing writing wills on blockchain for example.

“You too can engrave my final will. If my final will transfers $1 billion from me to you, burning it right into a blockchain and cryptographically verifying it would require you to How a lot is it price to

within the meantime, Willie Woo expressed a extra lifelike view, stating that there are professionals and cons to contemplate. Extra transaction charges are a powerful incentive for miners, however will grow to be extra vital sooner or later as they lower every time the block reward is halved, however fewer individuals are prepared to run larger bandwidth nodes. so on the expense of extra centralization.

On condition that decentralization has not but “taken maintain,” Woo mentioned Ordinals and the ensuing advantages to miners are too early for his style.

“I’d have appreciated the affect of the ordinals to come back lengthy after safety budgets had grow to be extra pressing, a time when decentralization had already taken maintain.“

Jan3 co-founder Samson Mow downplayed the significance of the Ordinals. He mentioned paying miners enormous charges is unsustainable in the long term, so there isn’t any want to fret about congestion or excessive charges.

“There are query marks as to how lengthy they’ll do it. Perhaps it takes a number of extra days. Perhaps per week. However losing cash isn’t a sustainable mannequin. It’s clear.”

Mow made his place clear, explaining that Ordinals is a hype-driven market fueled primarily by short-term cash making. Furthermore, he predicts that the sector will disappear as soon as token issuers make sufficient revenue.

“They exist to attract consideration to gullible individuals by doing loopy antics…

Nonetheless, like most tasks within the blockchain house, the relevance fades as soon as the token issuer makes cash. ”

What do you consider Satoshi?

Satoshi Nakamoto can not specific an opinion on whether or not ordinals are good or unhealthy for Bitcoin. However individuals turned to his Bitcointalk discussion board posts to attempt to perceive his views on the matter.

In a December 2010 put up, Nakamoto endorsed the thought of maintaining the blockchain lean and never bloated with the purpose of maximizing scalability.

“Bringing all of the proof-of-work quorum techniques on the earth into one dataset isn’t scalable.”

Nakamoto talked about separating non-monetary transactions right into a separate chain known as BitDNS. BitDNS is considered a sidechain or Layer 2 with the Area Identify System Web Protocol. The venture has since grow to be a completely unbiased various chain and has been rebranded to Namecoin.

“Bitcoin and BitDNS can be utilized individually. Customers do not must obtain each in full to make use of both. Chances are you’ll not wish to obtain all of

Based mostly on this, Nakamoto wished to maintain the mainchain devoted to monetary transactions, whereas permitting the sidechain/layer 2 to deal with large-scale knowledge capabilities.

Bitcoin core builders additionally appear to undertake a purist place: @frankdegodshas introduced plans to develop the Taproot spam filter to take away Ordinals utterly.

Bitcoin civil warfare

Trying again to 2017 and the Bitcoin Money arduous fork, the query of whether or not Bitcoin’s block dimension must be elevated to accommodate ordinals has sparked debate inside the neighborhood.

Additional chain splits are more and more probably given the dearth of consensus on the very best path ahead. Nonetheless, it’s price noting that of the 105 of his BTC forks which have ever existed, all have been forgotten.

Probably the most profitable fork, Bitcoin Money, is down 98.9% towards Bitcoin from its November 2017 peak of 0.43. This means that the Ordinals fork will probably face important challenges and the break up might be wasted.

There is no such thing as a scarcity of different Layer 1s that present tokenization with the additional benefit of extra superior options similar to occasion logic processing. Moreover, these various Layer 1s can function at scale and at a decrease price than Bitcoin, making Ordinals like a dinosaur by comparability.

Sure, Ordinals has breathed new life into Bitcoin, particularly when it comes to novelty and mining sustainability. However different chains are higher on the subject of tokenization.

Furthermore, thus far the first use case for this protocol has been memecoin funding, which lacks utility, lacks collective curiosity, and doesn’t contribute to the purpose of abolishing the corrupt fiat foreign money system.

Ordinal numbers are unhealthy for Bitcoin as a result of they intervene with the purpose of revolutionizing cash.

Posted Editorial: An article on why ordinals, BRC-20, are unhealthy for Bitcoin was first printed on currencyjournals.

Comments are closed.