On what’s undoubtedly a historic day for Bitcoin, I spent the morning trying again at historic information to see simply how influential the primary gold ETF was on the time. We've seen many analysts, together with ourselves, speak about how gold ETFs modified the commodity panorama and delivered enormous earnings over the subsequent twenty years. Nevertheless, what was it really like again then? Did gold explode on day one or did it take time? Let's dig deeper.

First, let's check out the timeline of the associated listed merchandise that we’ll be discussing.

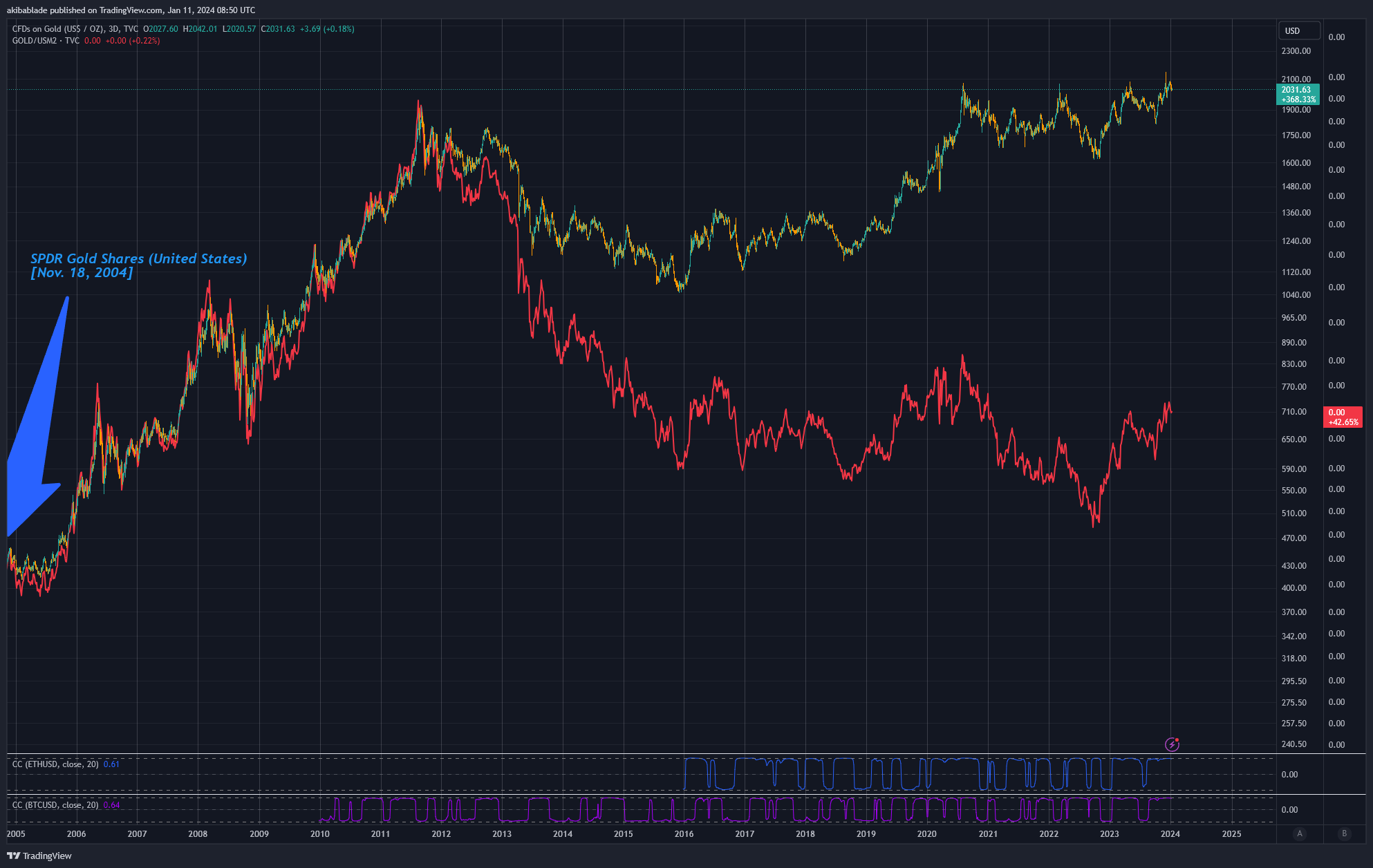

On November 18, 2004, State Avenue Company launched SPDR Gold Shares (GLD) with $114.92 million in property beneath administration at launch and $1.0 billion in its first three enterprise days.

On October 19, 2021, ProShares launched the ProShares Bitcoin Technique ETF (BITO), which obtained $570 million in inflows on the primary day and reached $1 billion in property the subsequent day.

On January 11, 2024, 11 Spot Bitcoin ETFs might be launched within the US with $115.88 million beneath administration by means of sponsored seed funds. Which means as soon as we get $115 million in inflows, issuers like BlackRock, Ark, and VanEck will purchase Bitcoin from the open market through Coinbase and Gemini, identical to we did. Masu.

Subsequently, earlier than buying and selling begins (excluding Grayscale, which has already transformed its belief* into an ETF with $28.58 billion in property beneath administration), the full Spot Bitcoin ETFs will exceed GLD's first buying and selling day. turn out to be. Together with Grayscale, the Spot Bitcoin ETF may have managed extra property than gold in its first 5 years. It was on February 12, 2009 that GLD acquired $29 billion in property beneath administration.

However to be honest, at this level, it was now not the one gold ETF. BlackRock he launched the iShares® COMEX® Gold Belief in 2005. Mixed with GLD, the gold ETF reached comparable AUM round February 10, 2009, and IAU had acquired $2 billion in property by the top of Q1 2009.

By the top of 2009, three gold-backed ETFs traded in the US: ETFS Bodily Swiss Gold Shares, SPDR Gold Shares, and iShares Comex Gold Belief.

| firm | Seed funding ($ million) |

|---|---|

| little by little | 20 |

| Van Eck | 72.50 |

| valkyrie | 0.52 |

| franklin templeton | 2.60 |

| tree of knowledge | 4.95 |

| invesco galaxy | 4.85 |

| black rock | Ten |

| Ark | 0.46 |

| grayscale | 2,858 |

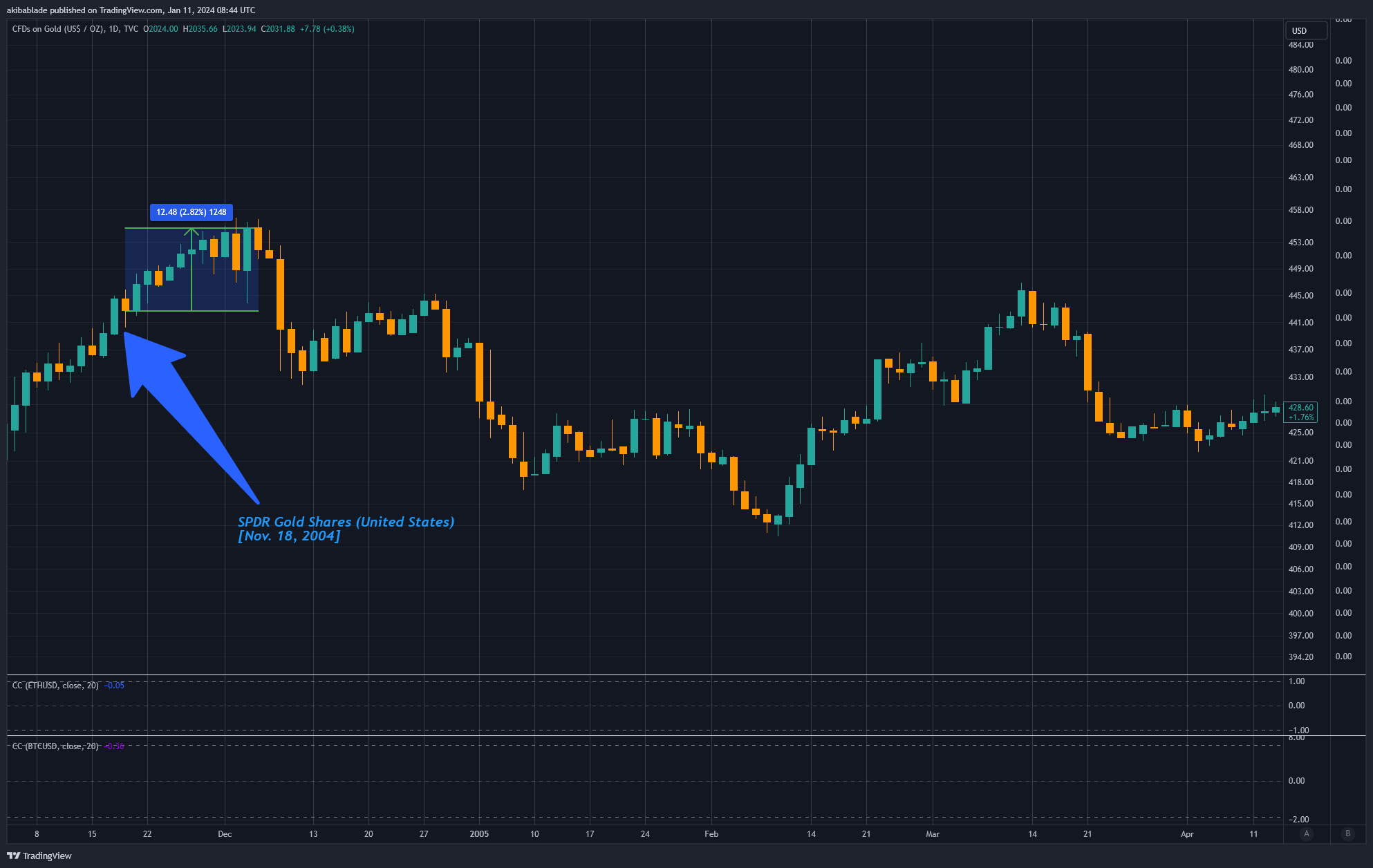

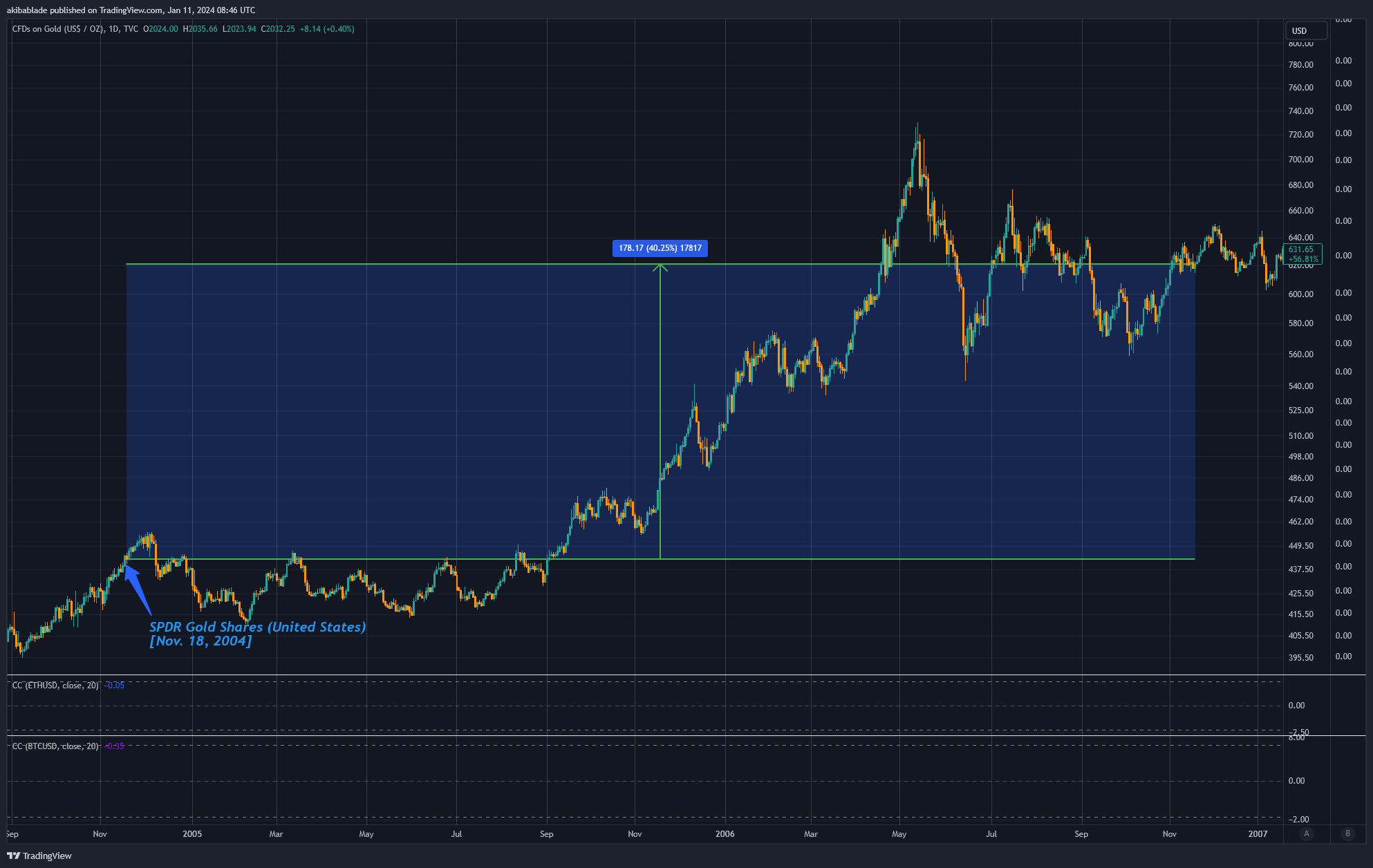

How did GLD commerce at launch?

The primary gold ETF was launched within the US on November 18, 2004, and inside 12 days, gold costs rose by simply 2.82%.

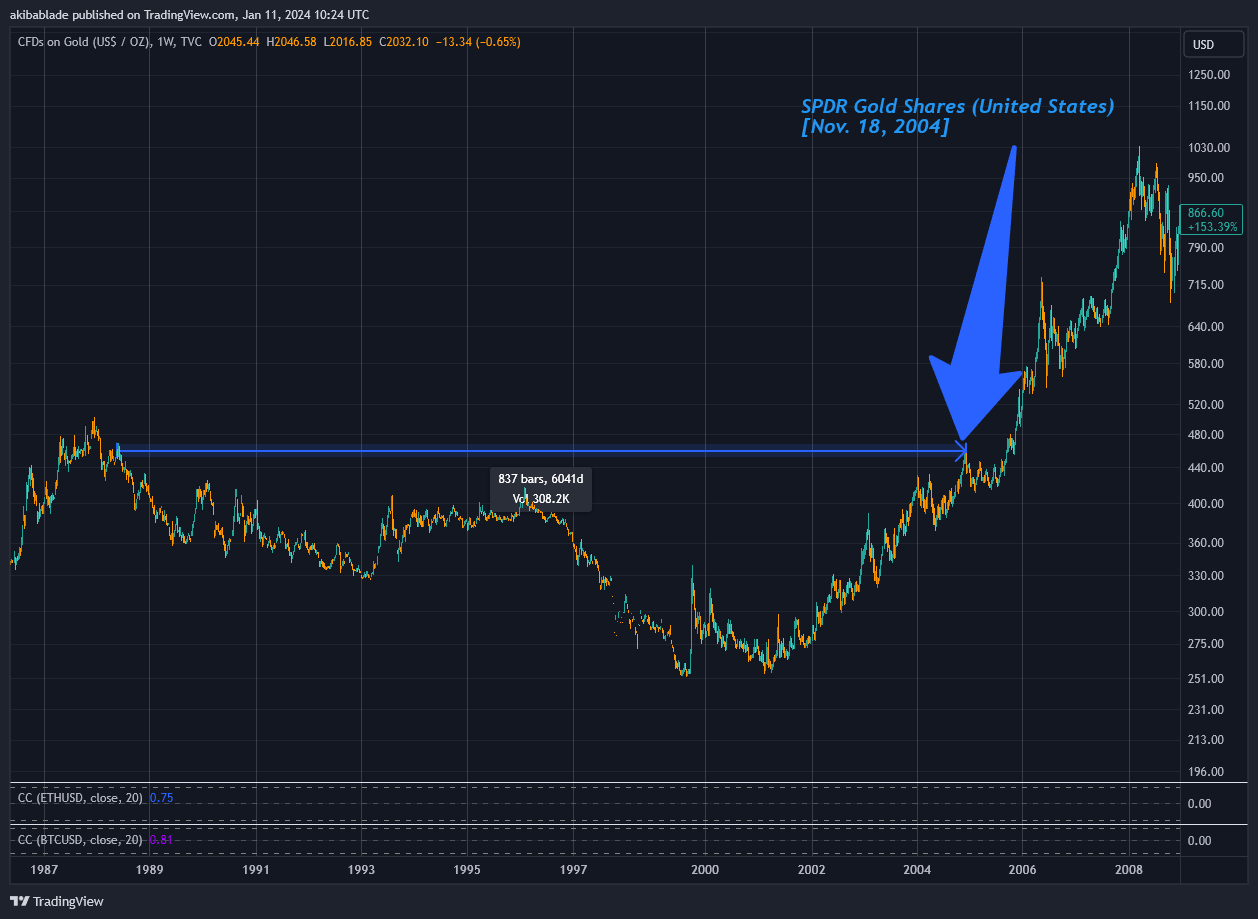

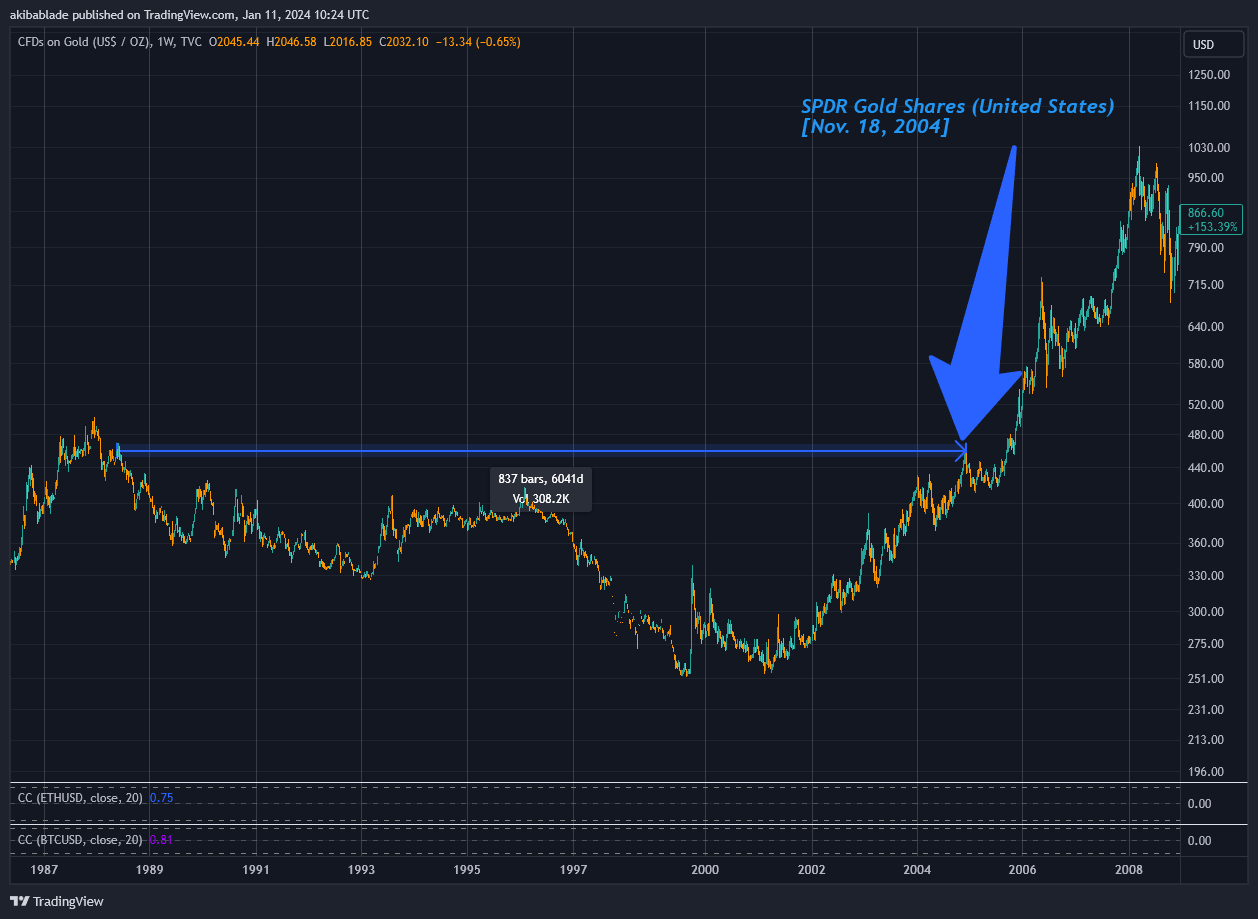

This was a 16-year excessive for gold, which had not touched $453 an oz. since Might 1988, however not an all-time excessive. In actual fact, it’s going to take one other 4 years for that to occur.

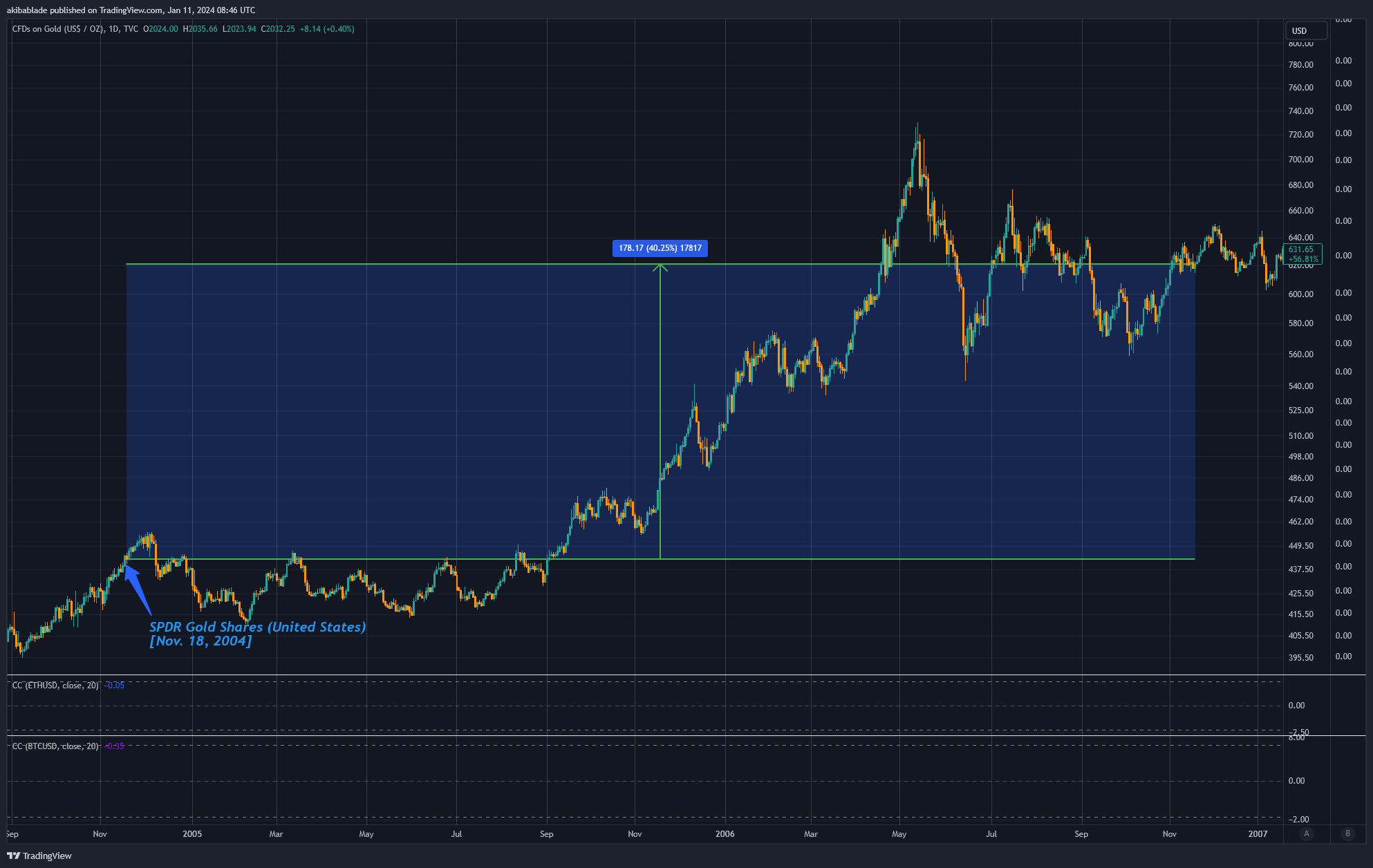

After a neighborhood excessive of $453.40 in December 2004, gold launched into a chronic downward trajectory, with costs declining 4% over the subsequent six months. On its six-month birthday, GLD acquired his $2.4 billion in property beneath administration and the worth of gold was $419.75.

Nevertheless, the scenario for our core merchandise has began to enhance significantly. By the anniversary of its launch in November 2004, gold had risen by 8.15% since its launch to $485,85. Subsequently, gold's upside in a 12 months's time is decrease than Bitcoin's, and will change relying on Gary Gensler's tweets. It's removed from the earth-shaking shock many anticipated based mostly on comparisons with the launch of gold ETFs.

When GLD hit 2 on November 18, 2006, gold appreciated by about 40% to $620.50.

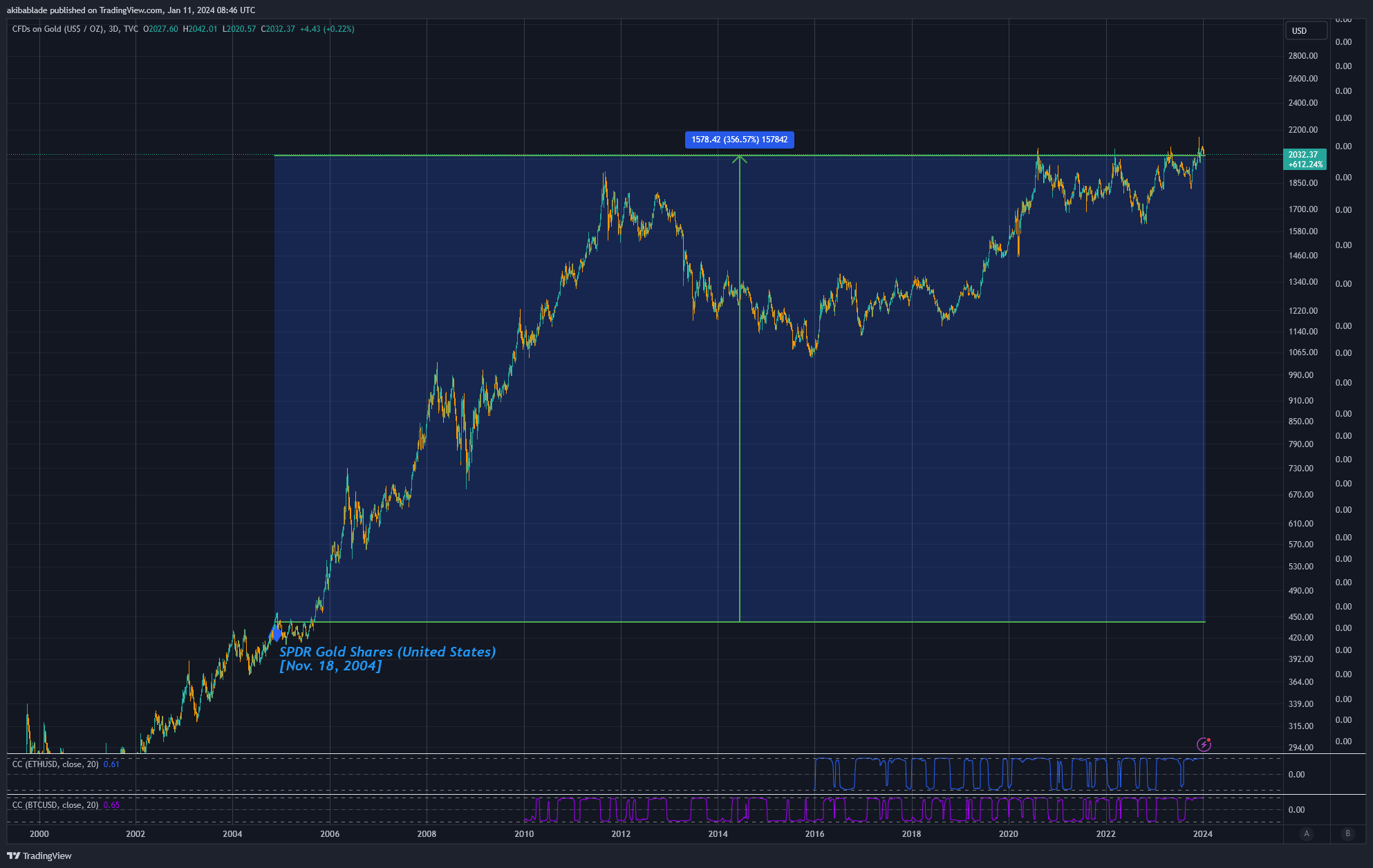

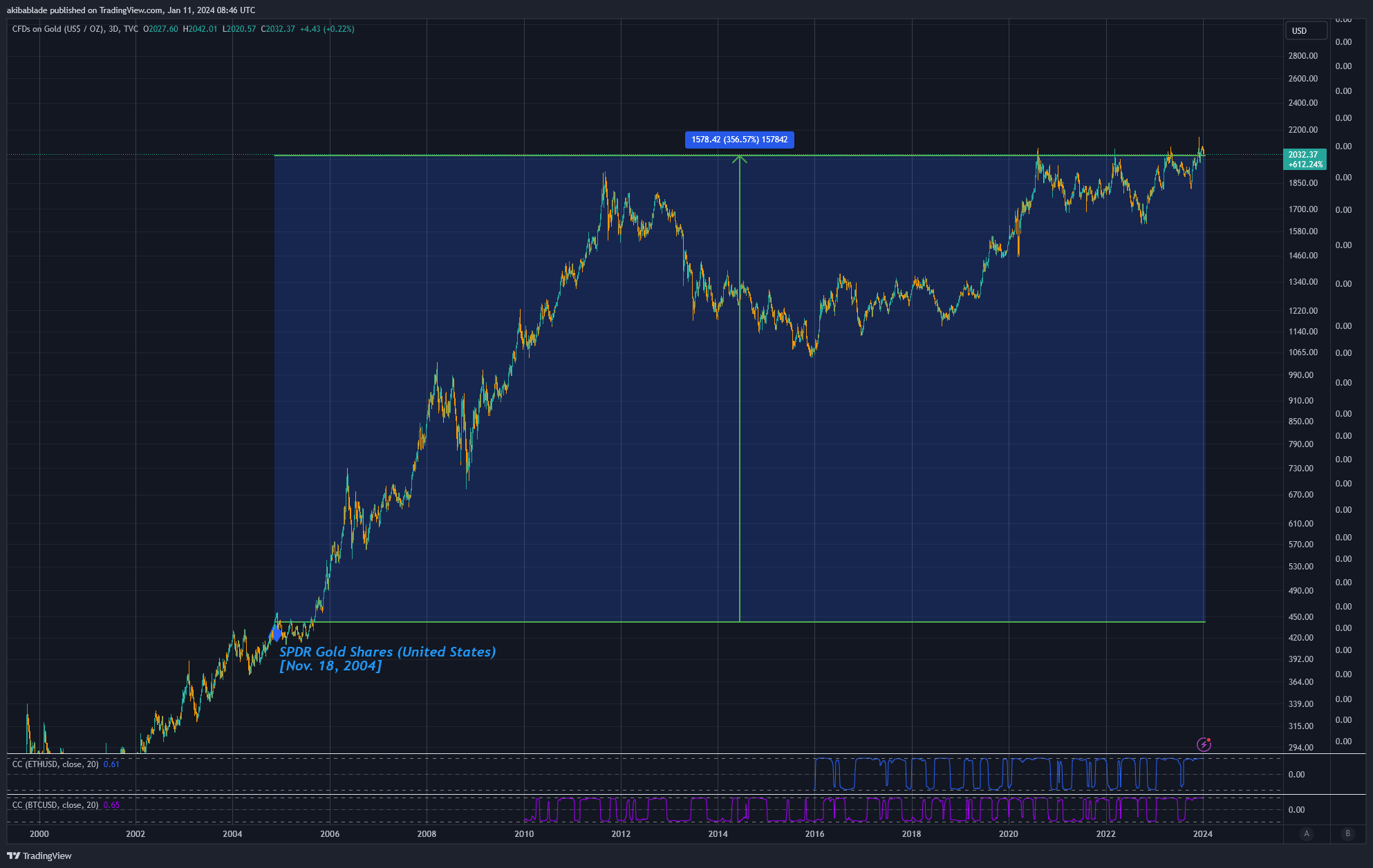

Presently, the worth of gold is round $2,032 on the time of writing, an astounding 356%. Nevertheless, that was over a interval of almost 20 years. As compared, if the worth of Bitcoin was $210,000 on January 11, 2044, what number of buyers can be glad with that return? It is a worth level to concentrate to.

However gold and Bitcoin are like evaluating apples and oranges. We could talk about Bitcoin as digital gold, however it’s undoubtedly way more than that.

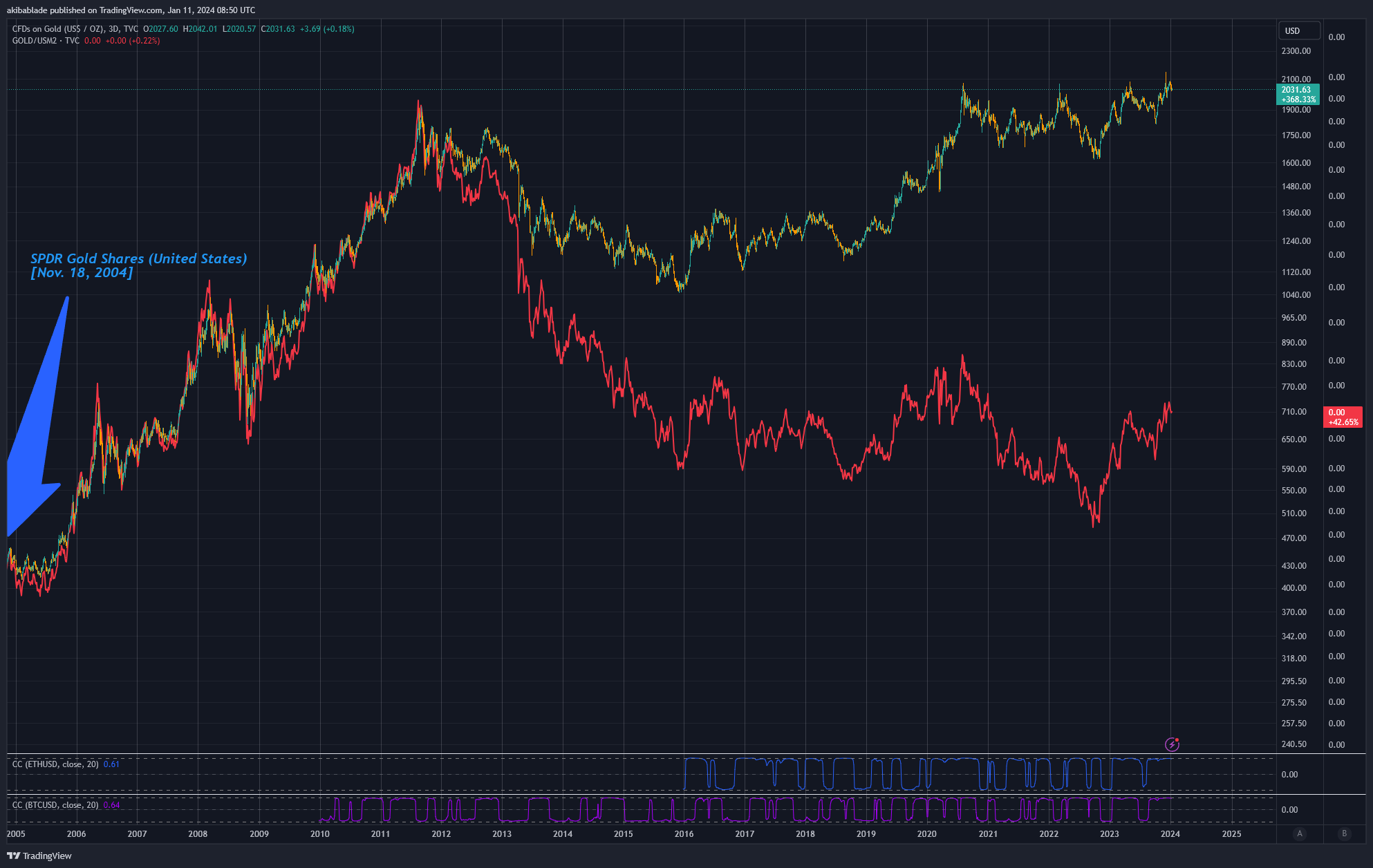

First, let's have a look at gold in relation to the US M2 cash provide. M2 is a broad measure of cash provide. This contains all parts of M1 (notes and cash, checking, different verify deposits, traveler's checks), plus financial savings deposits, small time period deposits (time deposits beneath $100,000), and retail cash market funds. Consists of the steadiness.

M2 excludes solely massive deposits, institutional cash market funds, short-term repurchase contracts, and different extra important liquid property, so the related long-term It is a good indicator.

Adjusting for M2 provide, gold would rise by simply 42%. From 2004 to 2012, gold roughly tracked Gold/M2 and the greenback worth of gold continued to rise, however since then Gold/M2 has been on a downward development.

Comparability with Bitcoin

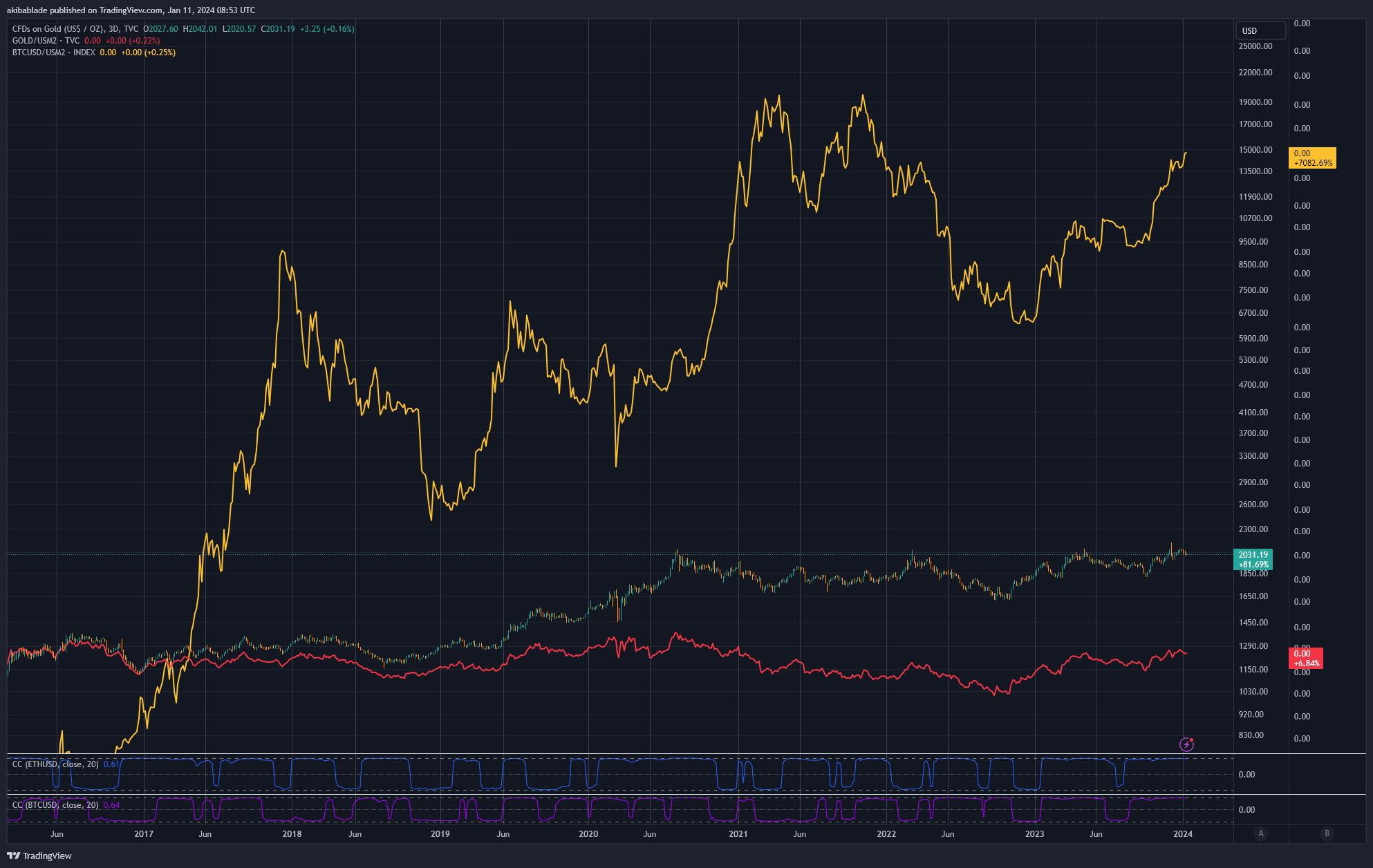

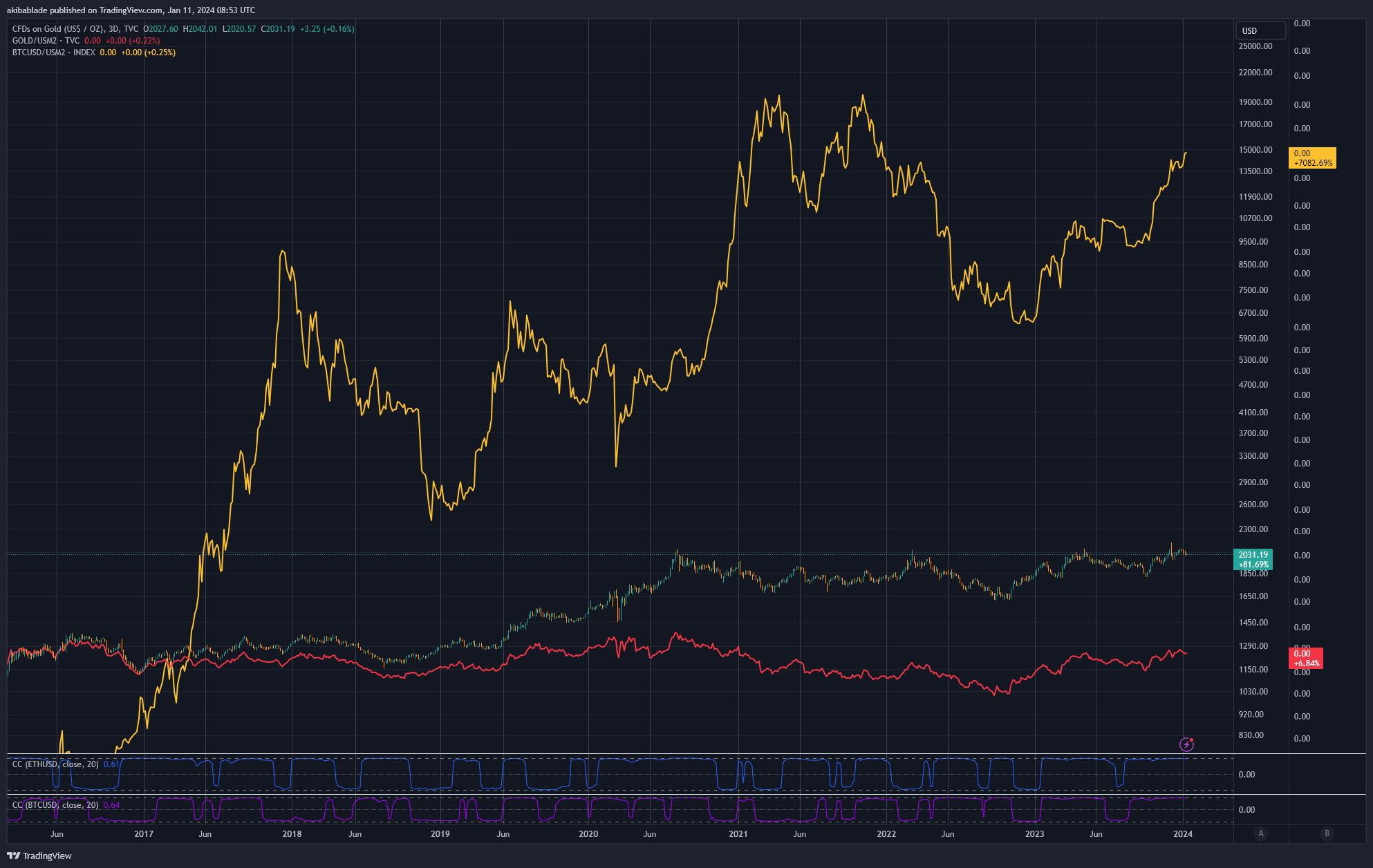

Bitcoin was not launched till 2009, so it can’t be in contrast over the identical interval, and its early worth discovery was very unstable, so the chart beneath makes use of 2015 to 2024 to symbolize Gold/ I in contrast M2 and Bitcoin/. M2.

As you’ll be able to see, Bitcoin has considerably outperformed gold (7,082%) over the previous 10 years, even accounting for the 70% improve within the variety of {dollars} in M2 provide.

Nevertheless, not solely has Bitcoin been proven to understand regardless of greenback dilution, however the provide is mounted and market dynamics are additionally tight. Solely 30% of all Bitcoins in circulation have been traded up to now 12 months.

The provision of Bitcoin is restricted to 21 million cash and is basically in brief provide. This rarity is a vital consider figuring out its worth, much like valuable metals resembling gold. However not like gold, the place new reserves may be found and mined, Bitcoin's provide is predictably finite. With the introduction of spot Bitcoin ETFs, the affect of shortage is more likely to be amplified.

As extra buyers buy ETFs, a portion of the restricted provide of Bitcoin might be locked as much as again these funding merchandise, decreasing the provision obtainable for normal buying and selling on the open market. turn out to be. This discount in provide can result in greater costs, particularly within the face of elevated demand (typically pushed by ease of entry by means of monetary merchandise resembling ETFs). There may be additionally a cyclical impact right here the place ETF issuers must fill their inventory baskets with Bitcoin from the general public market.

Moreover, the truth that 70% of the presently circulating Bitcoin provide has not been migrated in over a 12 months signifies the sturdy holding habits of present Bitcoin holders. This holding sample reduces the efficient quantity of Bitcoin in circulation, additional rising its shortage.

If long-term holders maintain a big portion of the asset, this will have a disproportionate affect on the worth, resembling elevated demand brought on by the launch of recent funding automobiles just like the Spot Bitcoin ETF. There might be much less provide obtainable to fulfill this new demand.

This motion is in distinction to gold. Gold has a extra various possession sample, with extra industrial and jewelery makes use of, which may restrict the scarcity-driven worth will increase seen in property like Bitcoin.

So whereas gold has had a really stable rise over the previous 20 years, whenever you evaluate gold's ETF-powered development to Bitcoin, it could actually really be fairly underwhelming.

You will need to notice that the demand for Bitcoin when it comes to shortage nonetheless must be correlated to the demand on the asking worth. For instance, it’s unlikely that there would be the similar demand for Bitcoin at $1 million per coin as there’s at $1 per coin. In my view, that is the place the rubber meets the highway. At what worth will the demand for Bitcoin change?

Digging into the numbers – Bitcoin and gold property beneath administration

Yesterday, Bitcoin traded at $52 billion throughout all exchanges, or about $45,000 to $47,000.

Roughly 6.2 million BTC is in the marketplace (moved throughout the previous 12 months). Glassnode estimates that roughly 7.9 million cash are both misplaced or unlikely to be moved any time quickly. Provided that the present circulating provide is roughly 19.59 million cash, we will estimate the liquid pool of cash obtainable for buy to be between 6.2 million and 11.6 million cash.

When it comes to present worth, this equates to roughly $291 billion to $545 billion in liquid cash in the marketplace, and roughly 10 occasions the every day buying and selling quantity.

So, hypothetically, every of the 11 Spot Bitcoin ETFs launching at this time would want to accumulate roughly $49 billion in AUM to eat up the entire market's theoretical liquidity.

As of January 10, 2024, GLD, the highest gold ETF, had $56 billion in property beneath administration. Valuing the highest ETFs general, SPY is valued at $483 billion and IVV is valued at $396 billion.

All U.S. gold ETFs have roughly $114 billion in property beneath administration.

So whereas there’s definitely room available in the market for Spot Bitcoin ETFs to accumulate extremely liquid cash proper now, the market remains to be tight and can get even tighter within the subsequent 100 days.

When analysts evaluate the profitable launch of Spot Gold 20 years in the past to the potential of Bitcoin to comply with, they might be considerably underestimating the distinction between gold and “digital gold.” suppose.

To place this into context, if BlackRock had been to accumulate the identical property beneath administration in Bitcoin as in gold (roughly $27 billion), it will symbolize 5% to 9% of all liquid Bitcoins in the marketplace. Moreover, there are presently 2.35 million BTC on the alternate. Which means he would want to purchase 24% of the Bitcoin listed on the alternate on the present worth.

Drawing on the similarities and contrasts between the historic affect of gold ETFs and the potential future affect of spot Bitcoin ETFs, we conclude that whereas the success of gold ETFs has been important, distinctive facets of Bitcoin, resembling mounted provide and pervasiveness, traits have been revealed. Holding the sample may have a extra extreme affect in the marketplace, highlighting the potential for transformative results far past these noticed in gold.

(Tag translation) Bitcoin

Normally I do not read article on blogs however I would like to say that this writeup very forced me to try and do so Your writing style has been amazed me Thanks quite great post