The information of the US Securities and Alternate Fee (SEC) submitting in opposition to Binance despatched the market cap of cryptocurrencies down by $53 billion.

On June 5, the SEC charged Binance, its CEO, Changpeng Zhao, and associates with 13 counts of violations, together with wash buying and selling, regulatory evasion, and providing of unregistered securities.

Binance stated it was disenchanted by the criticism and has at all times been cooperative with regulators’ investigations. Nonetheless, the corporate objected to the enforcement motion and meant to:Vigorously” in protection of the costs.

A key factor of Binance’s protection facilities on the SEC’s alleged reluctance to supply regulatory readability. As well as, the corporate claimed to be the sufferer of an ongoing “”.regulatory tug of conflict,the federal government company isDeclare jurisdiction over different regulators”

“Sadly, the SEC’s refusal to interact productively with us is the Fee’s misguided and acutely aware refusal to supply much-needed readability and steerage to the digital asset trade. Simply one other instance of that.“

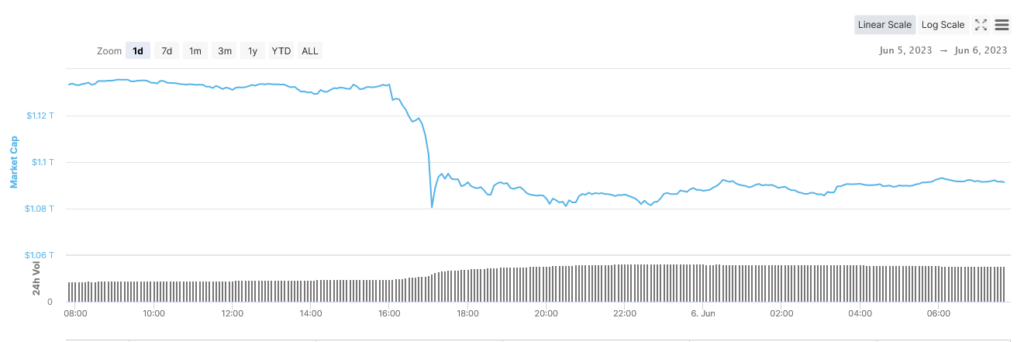

Cryptocurrency market crash

Markets plunged on information that the SEC sued Binance.

As of 16:00 BST on June fifth, simply earlier than this information was introduced, the market capitalization of cryptocurrencies was valued at $1.13 trillion. As rumors unfold, his subsequent dumping bottomed out at $1.8 trillion about an hour later. This equates to a drawdown for him of $52.7 billion (4.7%).

It then rebounded and hit a brand new all-time excessive of $1.1 trillion. Since then, the market has been flat as contributors take into account the gravity of the scenario, significantly the allegations that a number of third-party tokens, together with ADA, SOL and MATIC, have been designated as securities in SEC filings. are traded.

Largest Winners and Losers

Among the many prime 100, Pepe, The Sandbox and Sui suffered probably the most losses within the final 24 hours, down 15.2%, 14.8% and 12.7% respectively. Sandbox was designated as an unregistered safety in its filings with the SEC.

Kava was the one prime 100 token (excluding stablecoins) to stay inexperienced over this era, rising 9.6%.

Market chief Bitcoin suffered a 5% loss from excessive to low and located help at $25,400. It then peaked at $25,890 earlier than retesting the help at $25,600.

Comments are closed.