- There’s a glimmer of hope within the crypto market as stablecoin provide surges to a yearly excessive.

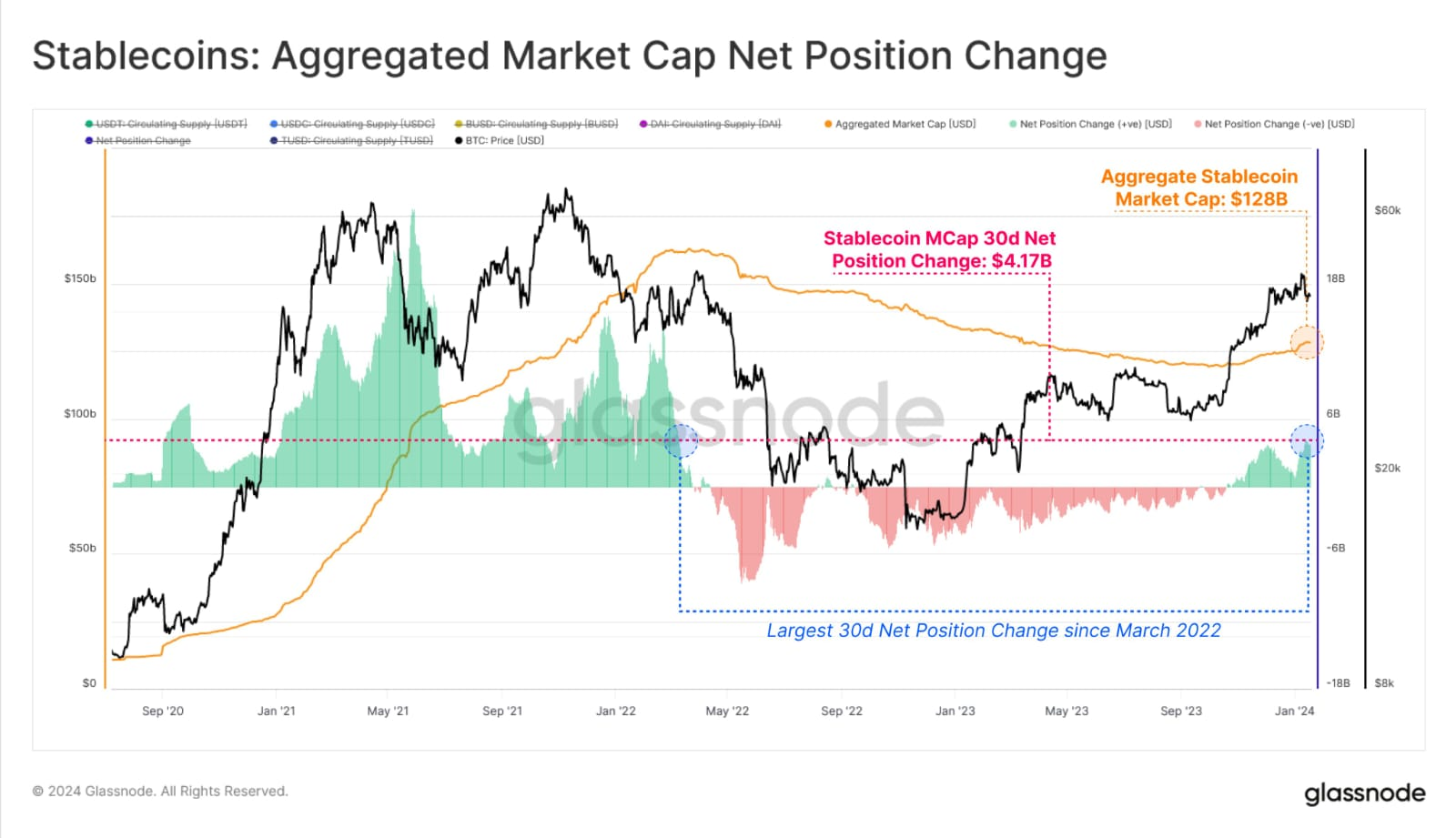

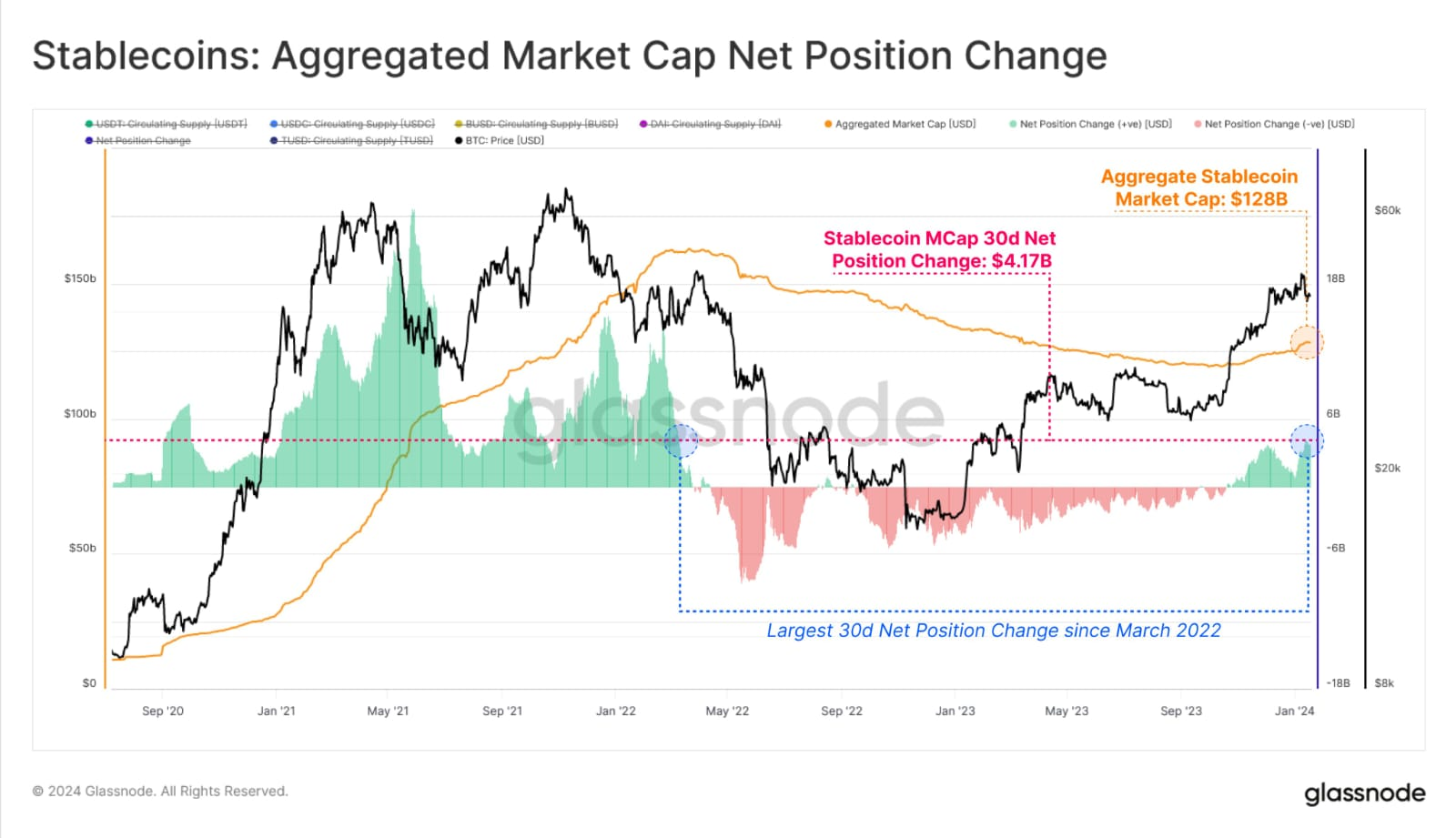

- The stablecoin’s valuation reached $134.3 billion, with a 30-day change of $4.17 billion.

- The $4.17 billion influx is the biggest web influx since March 2022.

Cryptocurrency markets have been in a sustained bearish development because the introduction of crypto ETFs, and market individuals are in search of causes to stay optimistic amidst the pink candlelight.

In a latest submit on the favored YouTube channel Crypto Banter attracted consideration For a brand new growth that has historically been often known as a bullish sign. Particularly, Crypto Banter cited statistics from famend analytics agency Glassnode concerning the evolving traits within the stablecoin panorama.

Stablecoin provide surged to a yearly excessive this month, in response to knowledge from Glassnode. Notably, the report confirmed that the general valuation of stablecoins reached $128 billion on the time of disclosure. Nonetheless, this quantity has since elevated to greater than $134.3 billion, in response to real-time knowledge from CoinMarketCap.

Moreover, Glassnode's report famous that the surge in stablecoin provide adopted a major improve in 30-day web place change in market capitalization of $4.17 billion. In different phrases, over the previous month, greater than $4 billion has entered the crypto market by means of stablecoins.

This 30-day influx represents essentially the most important web place change since March 2022, in response to the evaluation report.

Notably, Crypto Banter is modest {that a} surge in stablecoin provide will instantly result in a major improve in liquidity, or funds available for investing in risky tokens. states. Analysts say this units the stage for a bull market, attracting extra individuals and pushing costs to new highs.

Moreover, earlier than the newly noticed development emerged, web inflows into stablecoins have been destructive, as proven within the graph. Moreover, this chart exhibits that document inflows into stablecoins replicate the height of the crypto market in 2021. It additionally displays a subsequent bearish development.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.