Institutional buyers more and more sought publicity to the cryptocurrency within the first quarter of this 12 months, following the launch of a number of US-based spot Bitcoin exchange-traded funds (ETFs) in January.

A research by CoinShares Digital Fund Supervisor revealed that these institutional buyers have considerably elevated their digital asset allocation, reaching 3% of their portfolios. That is the best degree because the survey started in 2021.

Many of those buyers consider that distributed ledger know-how has elevated their publicity to digital asset investments.

Furthermore, they’re now recognizing that digital belongings provide superior worth and there’s a rising demand for investing in BTC as a method of decentralization.

Bitcoin provides probably the most convincing progress prospects.

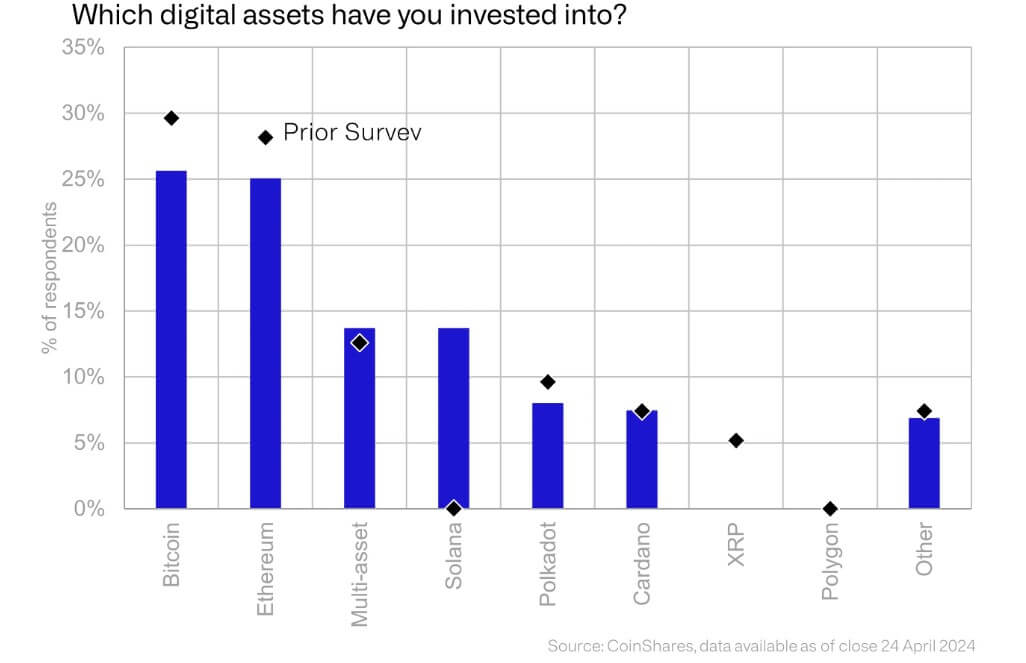

Institutional buyers' portfolios primarily embody Bitcoin, making it probably the most sought-after digital asset amongst this demographic. In line with James Butterfill, head of analysis at CoinShares, greater than 1 / 4 of respondents stated they’d publicity to BTC by way of spot ETFs of their portfolios.

After Bitcoin, Ethereum stays in second place, though investor curiosity has declined because the final survey.

BTC and ETH stay the digital belongings with probably the most engaging progress prospects, buyers say.

Nonetheless, investor enthusiasm for Solana has grown, as evidenced by the rise in its allocation to 14%. This enhance is primarily pushed by a choose group of key buyers who’re increasing their holdings within the fast-growing blockchain community, which has seen speedy progress in worth and adoption over the previous 12 months. .

Whereas different various digital belongings have struggled, XRP stands out for its steep decline. Not one of the buyers surveyed talked about holdings.

limitations to funding

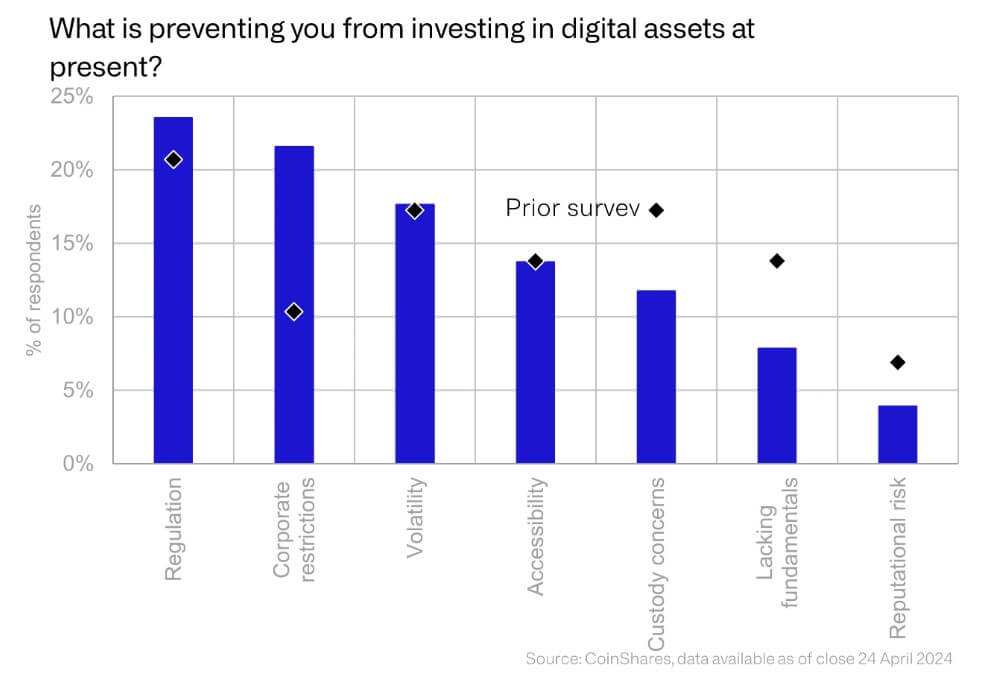

Regardless of growing publicity to digital belongings and the emergence of Bitcoin ETFs, many buyers nonetheless wrestle to entry this asset class.

CoinShares analysis confirmed that regulatory issues stay the largest barrier for many buyers. The rising trade has confronted regulatory scrutiny, significantly within the US, the place monetary regulators such because the SEC have filed a number of lawsuits in opposition to main firms corresponding to Binance and Coinbase.

In the meantime, the inherent volatility of rising sectors stays a major concern for some buyers. Nevertheless, custody points, reputational danger, and lack of elementary funding case have gotten much less of a difficulty.

talked about on this article

(Tag translation) Bitcoin