CoinShares' newest weekly report reveals that crypto-related funding merchandise have skilled damaging flows for the fourth consecutive week, with nearly all of the move coming from “seen outflows from newly issued ETFs in america.”

In accordance with the report, the market noticed a complete outflow of $251 million, with the New child 9 Spot Bitcoin ETF accounting for greater than 60% of this outflow, or $156 million.

James Butterfill, Head of Analysis at CoinShares, stated:

“We estimate the common buy value of those ETFs since launch to be $62,200 per Bitcoin. Costs falling 10% under that stage possible triggered an computerized promote order. .”

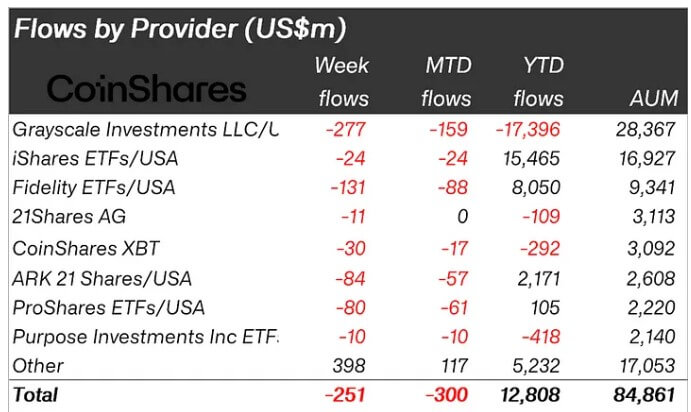

A breakdown of flows reveals that Constancy's FBTC had essentially the most outflows from the fund at $131 million, adopted by Arc21Shares' ARKB with $84 million.

In the meantime, BlackRock's IBIT noticed modest damaging flows of $24 million, whereas Grayscale's Bitcoin ETF continued its development of outflows, with $277 million withdrawn throughout the identical interval.

The efficiency of those ETFs resulted in $504 million in outflows from the US. Notably, Canada, Switzerland, and Germany additionally had outflows totaling $9.6 million, $9.8 million, and $7.3 million, respectively.

Nevertheless, regardless of the efficiency of the US-based spot-based Bitcoin ETF, the newly launched spot-based Bitcoin ETF and Ethereum ETF in Hong Kong obtained $307 million of their first week of buying and selling. There was an inflow of

Ethereum and Polkadot collect influx

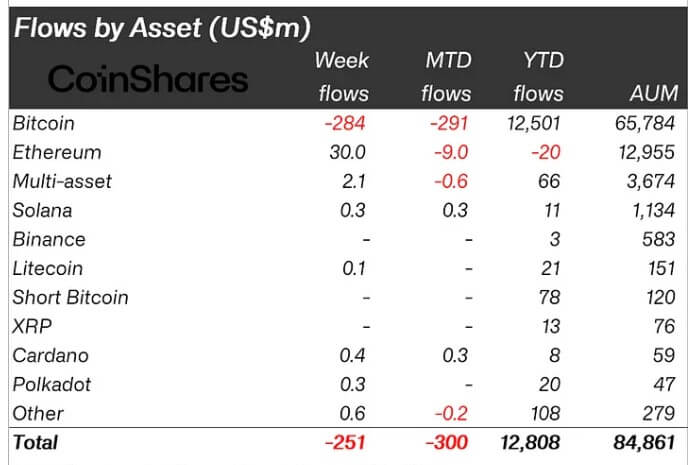

Total Bitcoin property noticed a complete outflow of $284 million, with month-to-date outflows reaching $291 million.

crypto slate A earlier report discovered that crypto buyers are more and more looking for publicity to altcoins whereas lowering their publicity to flagship digital currencies equivalent to Bitcoin.

This development continued this week, with altcoins like Avalanche, Cardano, and Polkadot seeing modest inflows of round $500,000, $400,000, and $300,000, respectively.

Remarkably, Ethereum broke a seven-week interval of damaging flows and recorded $30 million in inflows final week. Because of this, ETH outflows because the starting of the yr have decreased to -$20 million.