US Treasury yields rose notably this week, fueling market fears. There have been notable beneficial properties on Wednesday and Thursday as debt ceiling considerations and fee hike hypothesis pushed yields to all-time highs.

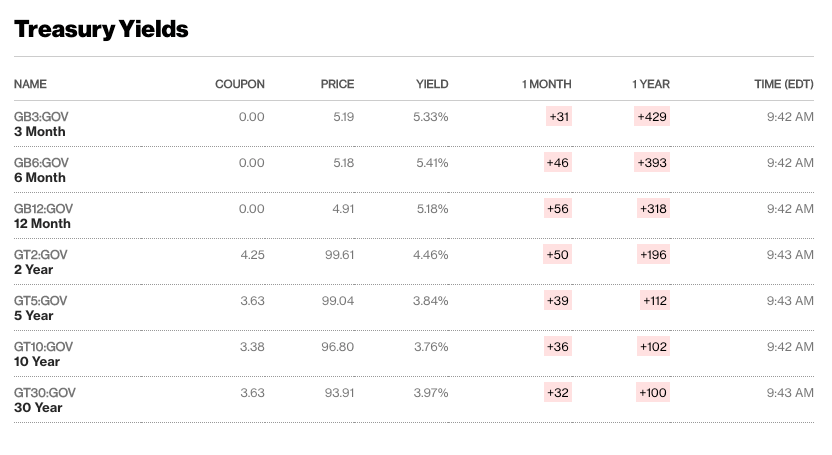

Within the early hours of Thursday, Might 25, 12-month treasury payments yielded 5.18% and six-month treasury payments yielded 5.41%. Three-month yields reached 5.33%. 10-year Treasuries reached 3.76%, whereas 2-year bonds rose 7 foundation factors to 4.46%.

“Treasury Bonds” means U.S. authorities securities that signify the obligations of the U.S. authorities to borrow cash to fund its enterprise. Authorities bond yields are the return on funding that traders get from holding these securities. They’re vital benchmarks in monetary markets and function key indicators of market sentiment, inflation expectations and total financial circumstances throughout the nation.

A number of components contribute to the speed of return on authorities bond yields, however crucial is demand. When traders present larger demand, costs rise and yields fall because of this. Conversely, when demand weakens, costs fall and yields rise.

Moreover, market expectations relating to rates of interest and inflation can have a big influence on US Treasury yields. When traders anticipate rising rates of interest and inflation, yields are likely to rise, reflecting the elevated danger related to holding bonds.

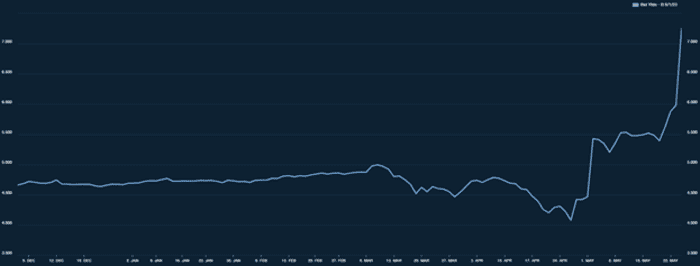

The current decline in demand for Treasuries will be attributed to 2 primary components: considerations over the debt ceiling and hypothesis {that a} fee hike is imminent.

Because the US approaches its debt ceiling, uncertainty grows over whether or not the federal government will be capable of meet its fiscal obligations. This uncertainty drives traders to demand larger yields to compensate for perceived danger. Furthermore, the potential for an rate of interest hike launched by the Federal Reserve is including to market unease, as larger rates of interest will have an effect on the worth of present bond investments.

Market considerations concerning the debt ceiling turn out to be obvious when analyzing one-month Treasury Payments. On Wednesday, Might 24, the one-month rate of interest due June 1 hit a multi-decade excessive of seven.226%. This exhibits traders are dumping short-maturity notes for concern of a doable technical default on June 1 if the debt ceiling negotiations fail.

A pointy rise in authorities bond yields has a big influence on the monetary markets as a complete. It will increase borrowing prices, triggers larger rates of interest on every kind of borrowing, and restrains non-public consumption and enterprise funding. Rising authorities bond yields may create downward stress on fairness markets, as excessive yields on mounted earnings investments are comparatively extra enticing than shares.

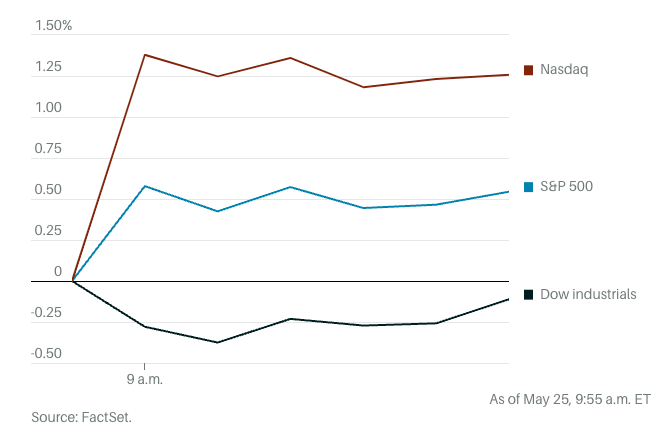

Fairness market volatility has elevated as traders weigh the financial well being of the market amid debt ceiling talks. All three main US indices fell late Wednesday after Fitch Scores put the US AAA long-term score on adverse watch. Dow Jones Industrial Common futures fell 86 factors, or 0.3%, early Thursday. S&P 500 futures had been up 0.6% and Nasdaq 100 futures had been up 1.4%. Nevertheless, the optimistic strikes seen in S&P 500 and Nasdaq 100 futures will be attributed to the extraordinary efficiency of NVDA, which drove tech shares larger.

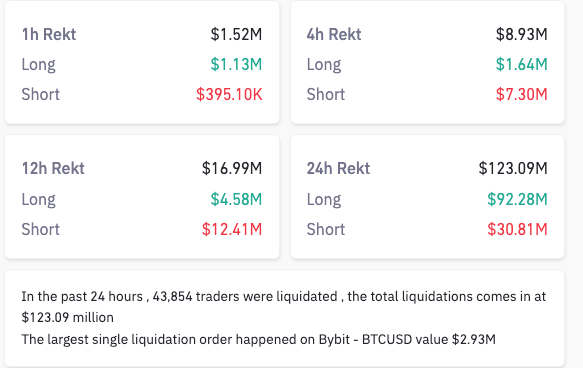

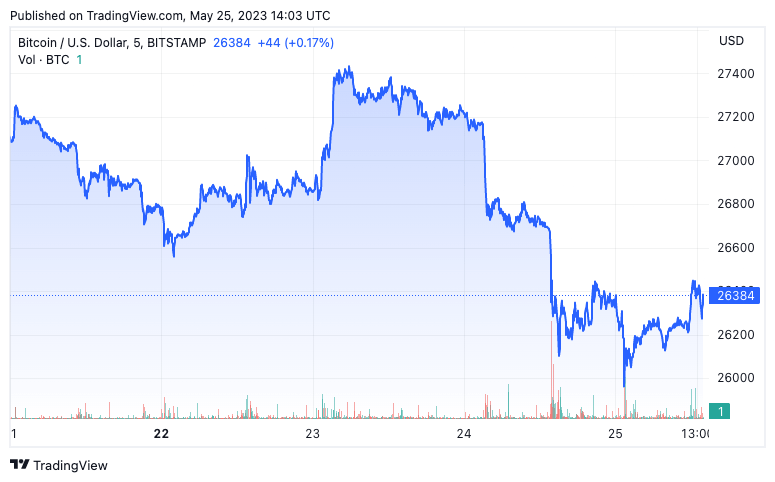

The cryptocurrency market can be affected by rising US Treasury yields. Bitcoin fell under $26,000, triggering a liquidation storm of $120 million, largely lengthy positions.

The surge in liquidations suggests an inverse relationship between authorities bond yields and BTC. When yields rise, investments usually flip away from riskier belongings similar to Bitcoin. And whereas institutional traders could also be shifting their cash to higher-profit bond investments, retail traders could also be involved concerning the worth volatility that additional fee hikes might convey.

Fears of a fee hike first appeared on currencyjournals as US Treasury yields surged and Bitcoin stumbled amid the debt ceiling.

Comments are closed.