Analyzing miner-to-exchange flows is necessary for understanding market sentiment, particularly when assessing whether or not miners are liquidating or accumulating. Surges in bitcoin inflows to exchanges have traditionally preceded will increase in promote orders, and elevated promoting strain typically led to cost declines.

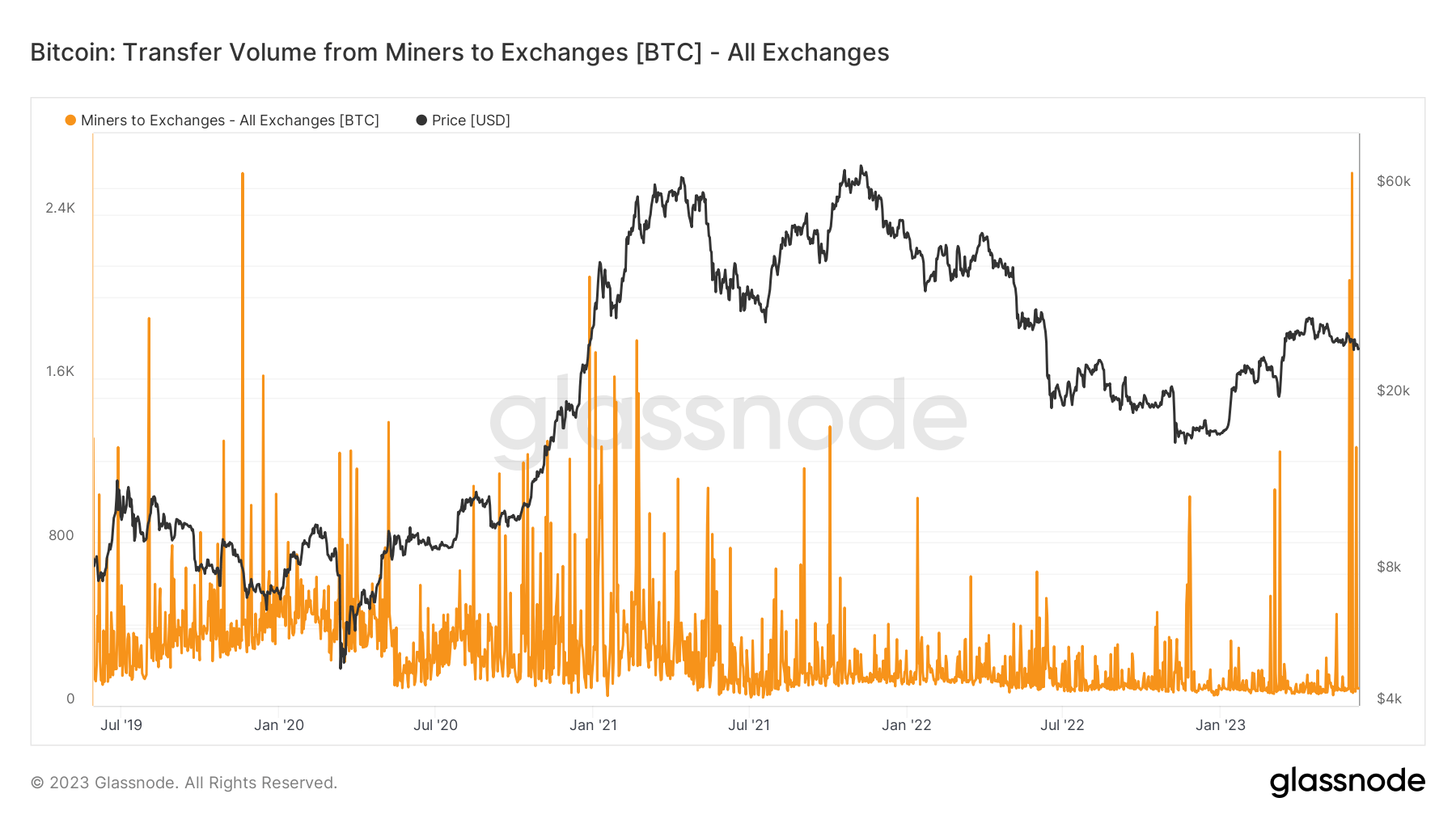

On June 3, miners transferred a big quantity of BTC to exchanges, sparking a market-wide debate in regards to the supply of those inflows and their potential affect available on the market. Based on Glassnode information, simply over 2,606 BTC have been transferred on June third, the very best since March twenty sixth, 2019. At the moment, miners transferred simply over 4,083 BTC to exchanges.

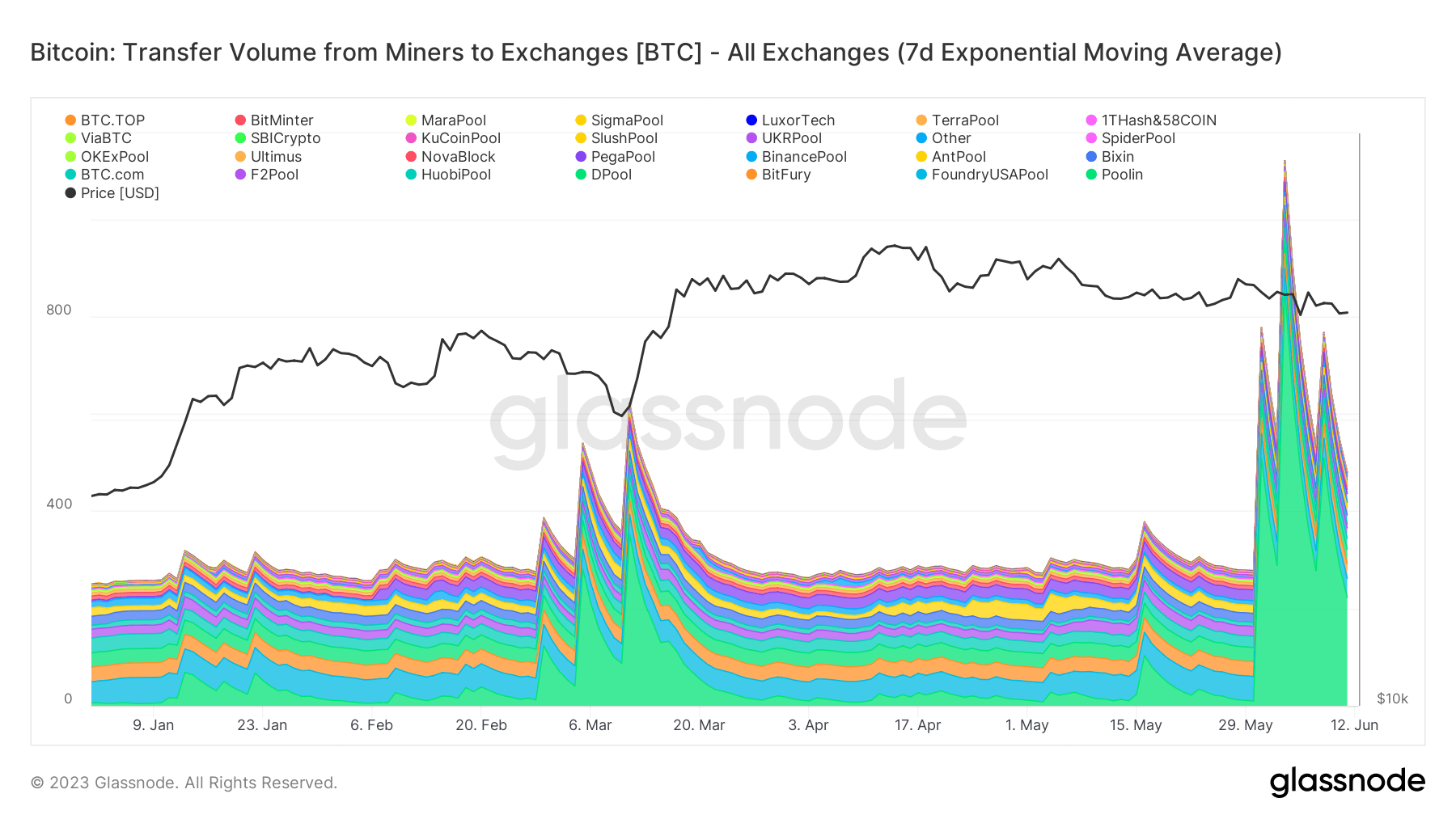

crypto slate Evaluation has revealed that the principle reason behind the huge outflow is without doubt one of the largest mining swimming pools available on the market, Pullin. Pooling despatched 853.4 BTC, suggesting that round a 3rd of all bitcoin transferred from miners to exchanges on June 3 was attributed to Poolin.

The transfer just isn’t an remoted occasion, however a continuation of a pattern that began from Pullin in late Could.

Since Could thirty first, Pullin has despatched a median of 433.5 BTC to exchanges every single day, peaking with an enormous outflow on June third. For comparability, the subsequent largest funder, Foundry USA, transferred 45.5 BTC on the identical day, sustaining its each day switch quantity. Between 40 and 50 BTC for the reason that finish of Could.

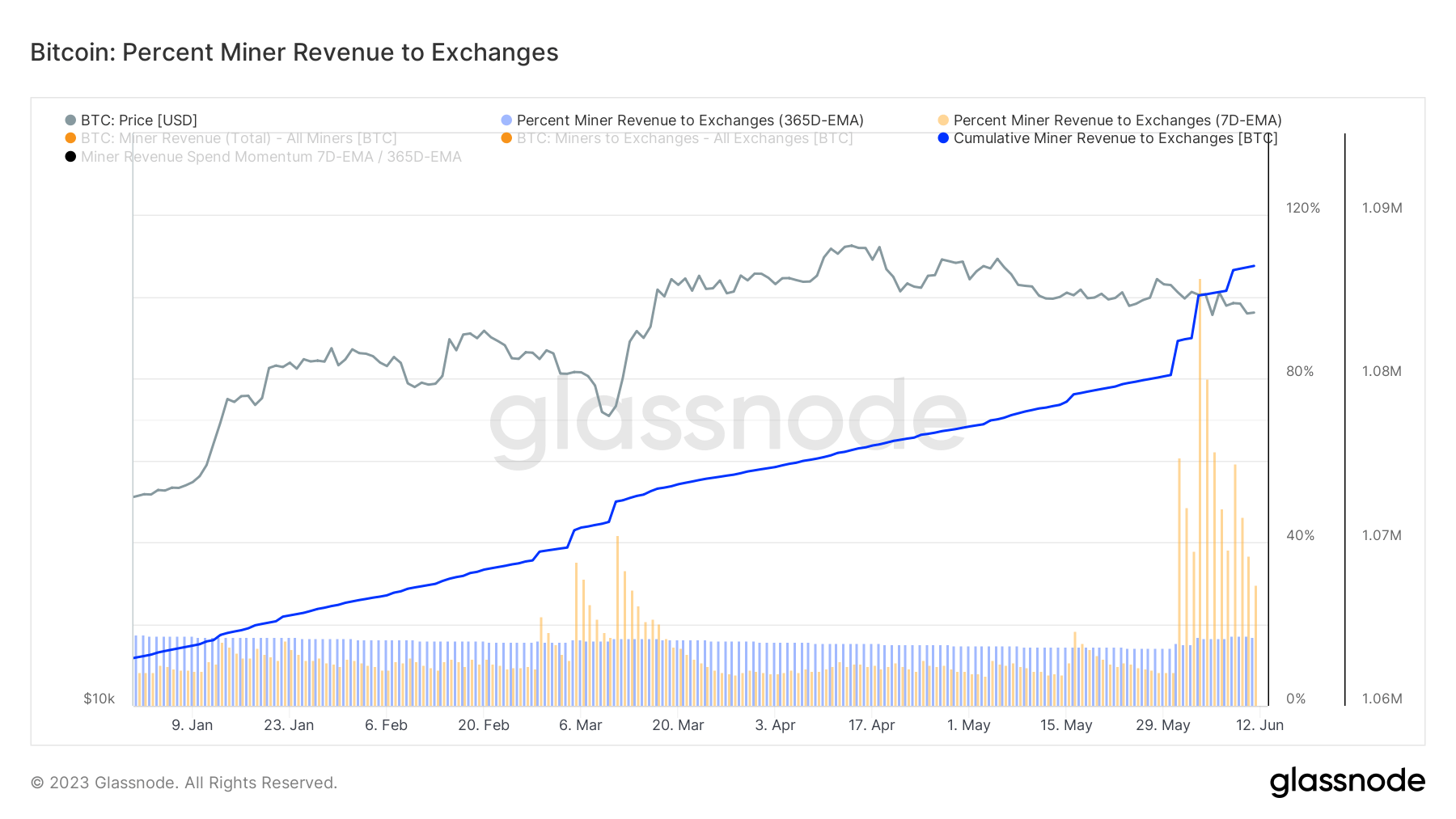

The rise in miner remittances has led to a pointy enhance within the proportion of miner income going to exchanges. crypto slate Our evaluation exhibits that the 7-day exponential shifting common (EMA) of miner earnings to the trade reached 104.5% on June third.

EMA is a crucial monetary indicator that places extra weight on latest information, smoothes information strains, and divulges pattern modifications extra successfully. This EMA worth is the very best since November 17, 2014 when it reached 131.7%.

Bitcoin value is comparatively steady From Could thirty first to June 4th it was $26,800 and $27,300. The sharp drop on June 5 was probably a response to information of the SEC lawsuit in opposition to Binance and Coinbase reasonably than elevated foreign money promoting strain from miners as the value rebounded inside 24 hours. .

This means that miners might select to liquidate their cash through over-the-counter (OTC) strategies or maintain them on exchanges in anticipation of extra favorable market situations.

The publish What is going on on behind the scenes of June’s Minor Mass Exodus? First appeared on currencyjournals.

(tag translation) bitcoin

Comments are closed.