- Researchers at Bitcoin Journal examined on-chain knowledge and concluded that BTC is unlikely to crash to $50,000.

- Researchers noticed that new capital inflows are absorbing BTC provide from long-term holders.

- He identified that BTC's MVRV Z-score is 2.68, indicating the market is in the course of a bullish cycle.

Bitcoin is experiencing a full-fledged bull market regardless of the latest retracement, and BTC is unlikely to crash to $50,000, in response to Dylan LeClair, head of analysis at Bitcoin Journal. claims.Mr. LeClair expressed this sentiment in his latest article put up on X updates the group on the present state of the Bitcoin market.

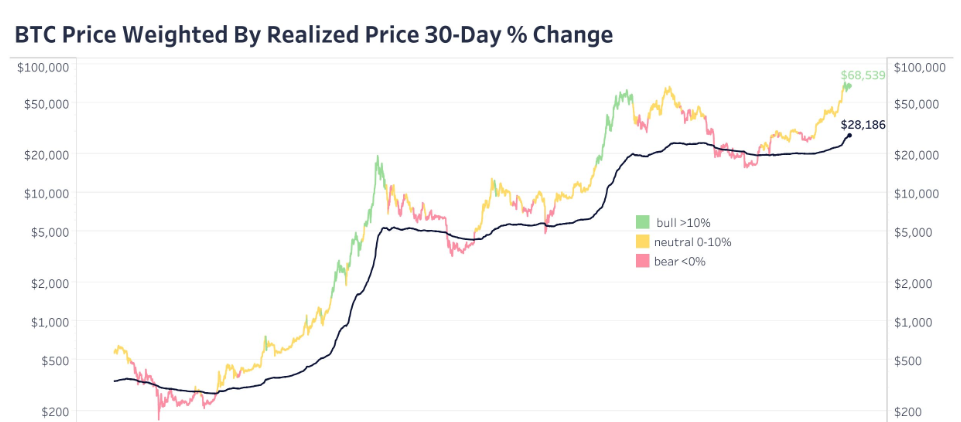

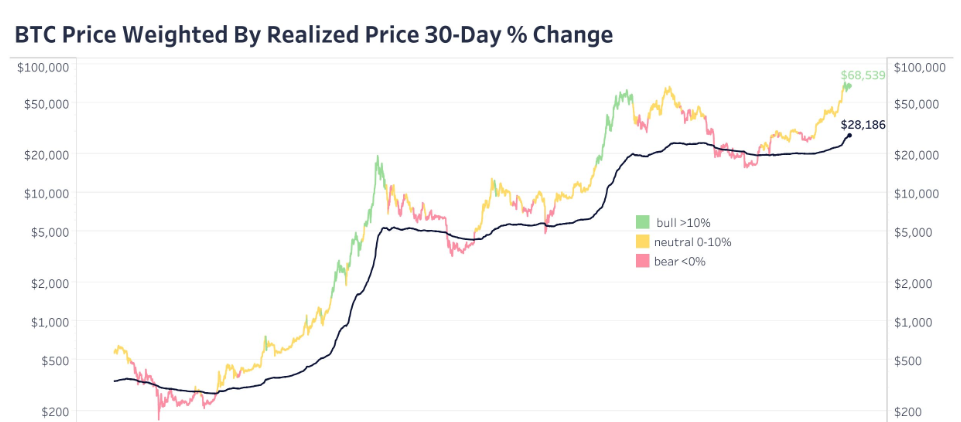

Researchers examined on-chain knowledge to disclose the interplay between the diversification of inventory holdings by long-term holders and the surge in new capital inflows. One of many indicators studied was the availability distribution, particularly from the realized market capitalization angle of Bitcoin.

LeClair identified that Bitcoin's realized market capitalization has proven a excessive constructive charge of change. This indicator displays the worth of every BTC on the final worth it moved on-chain, suggesting that older Bitcoin holders are diversifying their holdings and successfully benefiting from them. Masu.

Curiously, Leclair famous that new capital inflows have been absorbing this provide properly. He stated this phenomenon sometimes happens throughout bull cycles and is occurring once more.

Moreover, Leclair famous that whereas previous efficiency isn’t any assure of future outcomes, traditionally vital Bitcoin worth will increase have occurred in periods of market capitalization progress, notably progress of 10% or extra. .

Moreover, LeClair highlighted that Bitcoin's market value-to-realized worth ratio (MVRV) Z-score is at the moment 2.68. The researchers stated the numbers point out the market is roughly midway by its present bullish cycle.

Analysts consider present ranges, mixed with the continuing realized cap progress, counsel there may be room for additional progress earlier than such a peak is reached.

Leclair additionally analyzed the derivatives market and highlighted that Bitcoin-based perpetual futures open curiosity is at its lowest degree in latest months. He famous that this development means decrease leverage and extra hypothesis, additional supporting a wholesome bull market.

Moreover, analysts referred to as consideration to BlackRock's latest transfer to replace its Bitcoin ETF prospectus to incorporate main monetary establishments akin to Citadel, Goldman Sachs, UBS, and Citigroup. “The large guys desire a piece of the motion,” LeClair stated.

The analyst concluded by drawing parallels between the present stage and the stage noticed in 2020, earlier than costs rose considerably. LeClair stays bullish on Bitcoin over the long run, seeing it as a hedge towards the inevitable decline of conventional currencies.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.