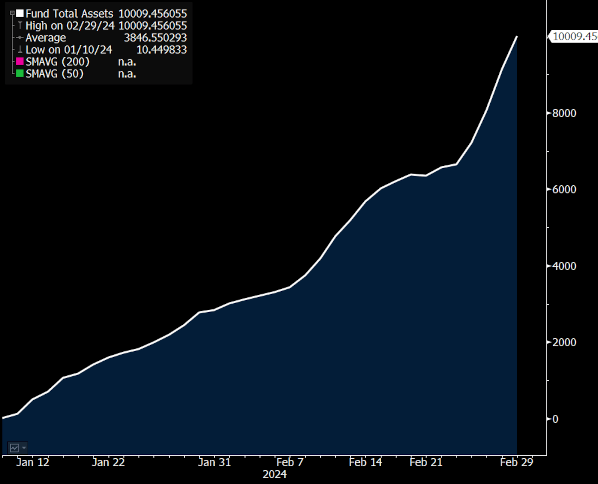

BlackRock’s iShares Bitcoin Belief (IBIT) presently has greater than $10 billion in belongings below administration (AUM), in response to knowledge from CoinGlass.

Eric Balchunas, Bloomberg ETF Analyst level out that IBIT is certainly one of solely 152 exchange-traded funds (ETFs) to succeed in the $10 billion degree. Presently, there are roughly 3,400 ETFs in whole.

He noticed that IBIT was the quickest to succeed in $10 billion in AUM. The fund began buying and selling on January eleventh lower than two months in the past, so it has reached its present degree in lower than two months. Individually, ETF.com famous that the primary gold ETF failed to succeed in $10 billion in belongings below administration in two years.

Competitor Grayscale Bitcoin Belief (GBTC) stories a bigger AUM, with $27 billion in belongings below administration. Nonetheless, though GBTC was born as an funding fund in 2013 and transformed to an ETF this 12 months, not like BlackRock's IBIT, it didn’t begin with zero belongings.

The third largest spot Bitcoin ETF, Constancy Clever Origin Bitcoin Fund (FBTC), presently manages $6.5 billion in belongings. All 10 present Spot Bitcoin ETFs have a complete of $48.2 billion in belongings below administration.

Causes for IBIT's progress

Balchunas hinted that IBIT's AUM enhance was as a consequence of inflows. He mentioned ETFs usually battle to attain the primary $10 billion in belongings below administration, whose worth needs to be generated from inflows, however the second $10 billion is achieved by way of market appreciation. advised that it’s straightforward.

IBIT surpassed the $10 billion mark on March 1st. Round that point, the ETF reported $7.7 billion in inflows since its inception, together with a $603 million influx on Feb. 29. This makes IBIT the third-longest-running ETF, Balciunas mentioned. Influx.

Rising Bitcoin costs can also additional contribute to IBIT's progress. As of March 4th, Bitcoin is value $67,200. Its value has elevated by 25.3% up to now week and 51.0% in two months.

Moreover, some monetary establishments, together with Financial institution of America Merrill Lynch and Wells Fargo, have reportedly begun providing entry to BlackRock's Bitcoin ETF and competing exchange-traded funds. This growth might have contributed to latest progress.

(Tag translation) Bitcoin