A wave of regulatory stress sweeping by the U.S. cryptocurrency market is popping merchants away from Bitcoin (BTC) and Ethereum (ETH) to the seemingly safer stablecoins.

This shift coincides with a burgeoning political motion in the USA geared toward imposing tighter rules on the cryptocurrency and mining sectors. Proponents of the brand new regulation argue that the disruptive nature of cryptocurrencies requires stricter regulation to make sure the soundness and safety of the monetary ecosystem.

Critics, in the meantime, have expressed concern that heavy-handed regulation may stifle innovation and drive the business abroad. This polarizing debate is creating an environment of uncertainty that’s reshaping buying and selling conduct.

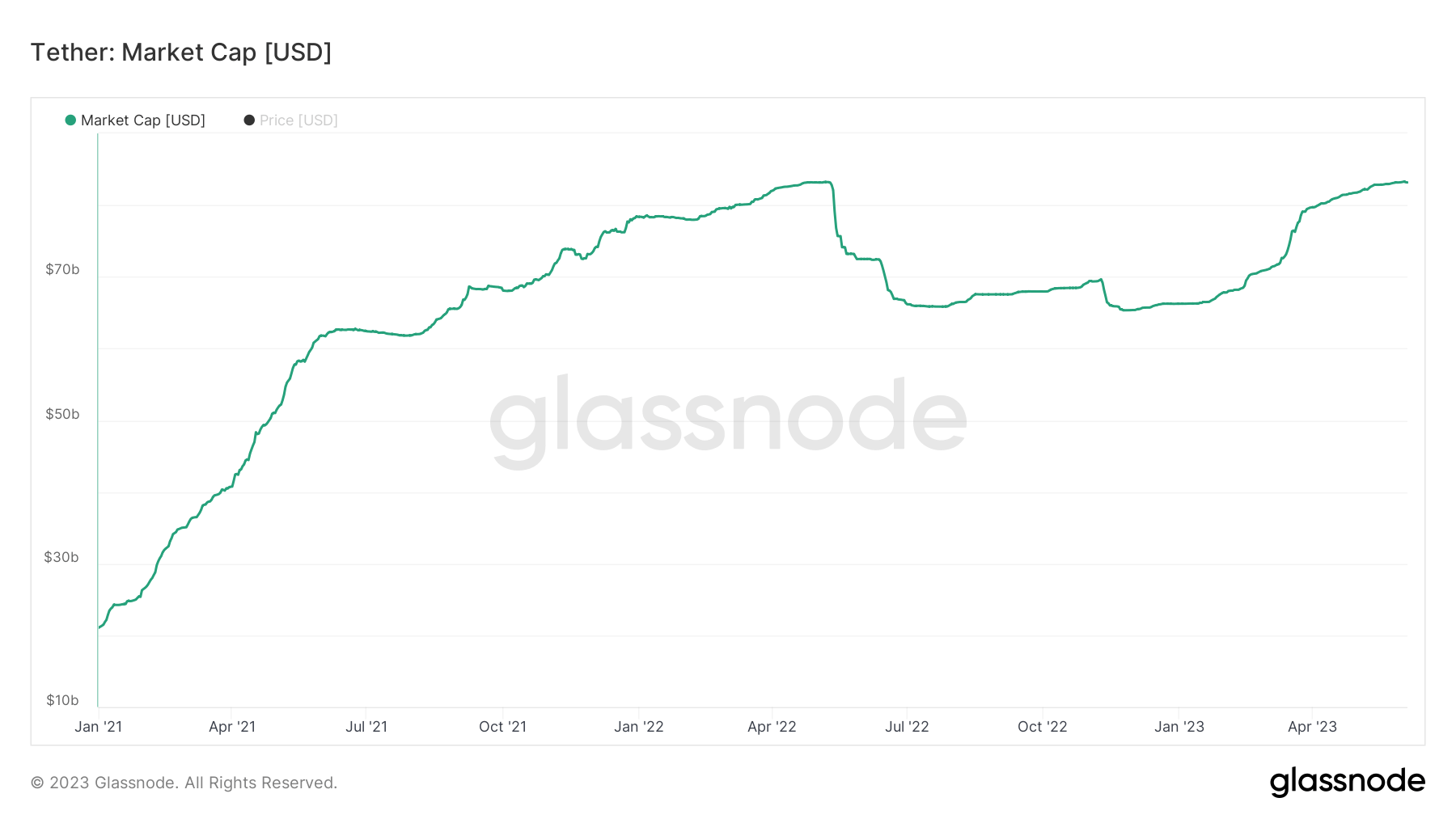

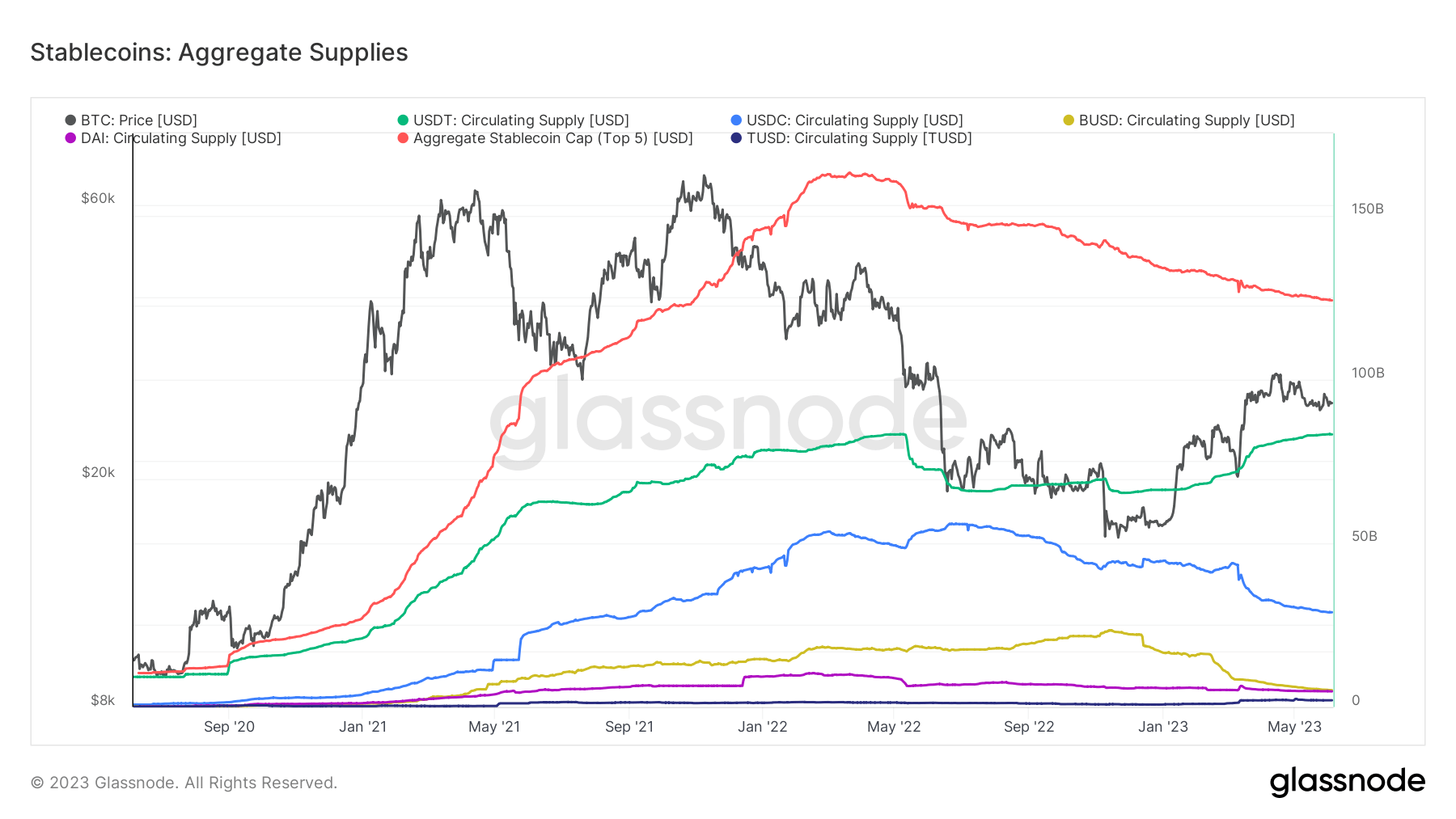

These regulatory pressures look like pushing merchants towards stability in stablecoins. That is clearly noticed within the conduct of USDT on Tether, which reached an all-time excessive of $83.2 billion in provide on June third. About $17 billion of this may add to Tether’s market cap in 2023 alone.

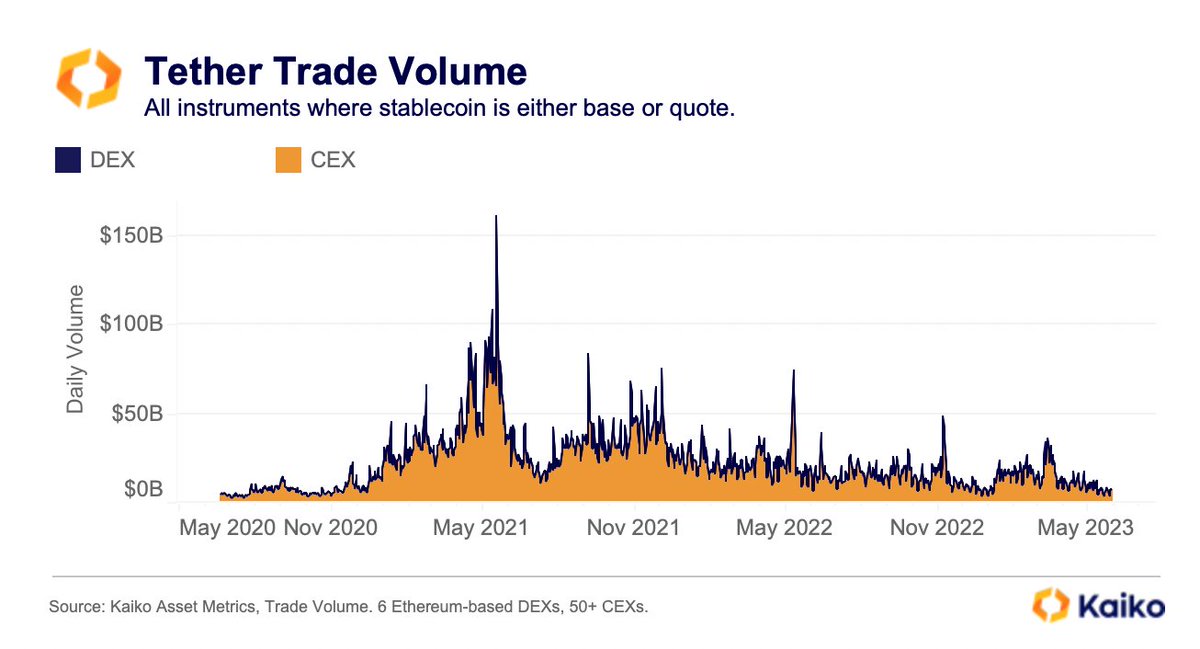

Nevertheless, regardless that Tether’s market capitalization is rising, buying and selling quantity is trending downward. In keeping with Kaiko’s information, each CEX and DEX, his each day USDT buying and selling quantity averaged round $7 billion in Could, hitting a multi-year low. This seeming contradiction means that whereas the general provide is rising, the asset’s lively buying and selling is reducing.

Conversely, different key gamers within the stablecoin market, USDC and BUSD, witnessed provide dwindle to multi-year lows.

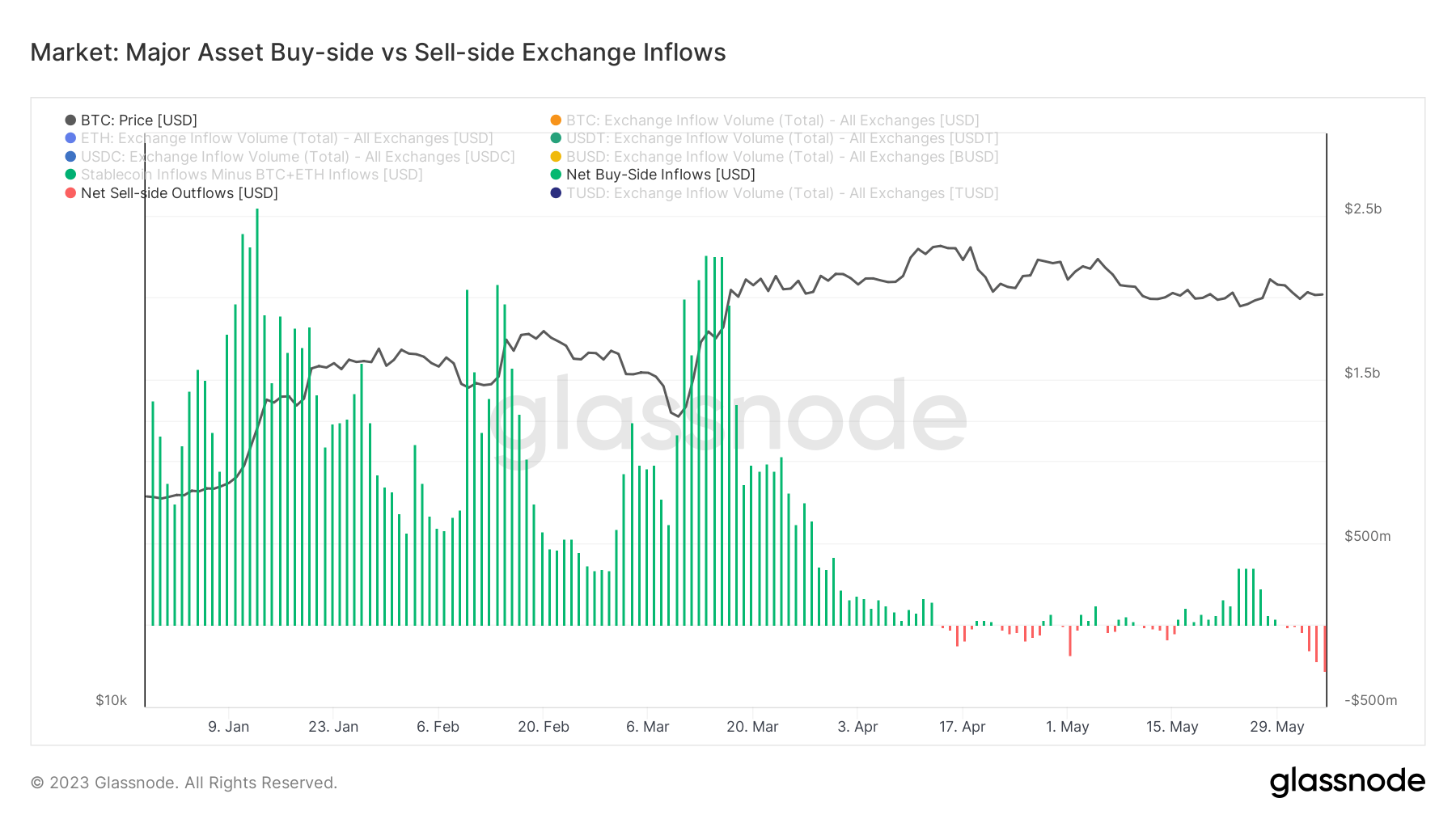

Evaluation of foreign money inflows reveals an attention-grabbing pattern. Demand for stablecoins on exchanges has weakened since April, which is being compensated by the inflow of BTC and ETH. Regardless of sustained inflows, the 2 cryptocurrencies have largely traded flat or skilled unfavorable value actions, indicating that many of the inflows are doubtless sell-side.

Stablecoins are interest-free and exempt from capital good points tax, which makes them enticing to merchants. As a consequence of their nature, there aren’t any taxable occasions which might be important for buying and selling BTC or ETH. That is significantly enticing to US merchants who’re beginning to really feel the stress of elevated regulatory scrutiny and potential enforcement motion.

Our article on stablecoins as merchants flip to stablecoins amid mounting US regulatory stress first appeared on currencyjournals.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

Greetings! Very helpful advice on this article! It is the little changes that make the biggest changes. Thanks a lot for sharing!

Of course, what a splendid website and instructive posts, I definitely will bookmark your blog.Have an awsome day!

I reckon something really special in this web site.

I haven?¦t checked in here for some time since I thought it was getting boring, but the last few posts are great quality so I guess I?¦ll add you back to my daily bloglist. You deserve it my friend 🙂

Whats Going down i’m new to this, I stumbled upon this I’ve found It absolutely helpful and it has aided me out loads. I am hoping to contribute & aid different users like its aided me. Good job.

I just could not go away your website before suggesting that I really loved the standard information an individual supply for your guests? Is gonna be back frequently to investigate cross-check new posts

… [Trackback]

[…] Find More to that Topic: currencyjournals.com/merchants-flip-to-stablecoins-as-regulatory-stress-mounts-within-the-us/ […]

It’s perfect time to make some plans for the future and it is time to be happy. I’ve read this post and if I could I desire to suggest you few interesting things or advice. Perhaps you could write next articles referring to this article. I wish to read even more things about it!

… [Trackback]

[…] Read More Info here on that Topic: currencyjournals.com/merchants-flip-to-stablecoins-as-regulatory-stress-mounts-within-the-us/ […]

… [Trackback]

[…] Here you will find 65818 more Information to that Topic: currencyjournals.com/merchants-flip-to-stablecoins-as-regulatory-stress-mounts-within-the-us/ […]